The Gardner Report – First Quarter 2018

Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

ECONOMIC OVERVIEW

The Washington State economy added 96,900 new jobs over the past 12 months, representing an annual growth rate of 2.9%—still solidly above the national rate of 1.5%. Most of the employment gains were in the private sector, which rose by 3.4%. The public sector saw a more modest increase of 1.6%.

The strongest growth was in the Education & Health Services and Retail sectors, which added 17,300 and 16,700 jobs, respectively. The Construction sector added 10,900 new positions over the past 12 months.

Even with solid increases in jobs, the state unemployment rate held steady at 4.7%—a figure that has not moved since September of last year.

I expect the Washington State economy to continue adding jobs in 2018, but not at the same rate as last year given that we are nearing full employment. That said, we will still outperform the nation as a whole when it comes to job creation.

HOME SALES ACTIVITY

- There were 14,961 home sales during the first quarter of 2018. This is a drop of 5.4% over the same period in 2017.

- Clallam County saw sales rise the fastest relative to the first quarter of 2017, with an increase of 16.5%. In most of the other markets, the lack of available homes for sale slowed the number of closings during this period.

- Listing inventory in the quarter was down by 17.6% when compared to the first quarter of 2017, but pending home sales rose by 2.6% over the same period, suggesting that closings in the second quarter should be fairly robust.

- The takeaway from this data is that the lack of supply continues to put a damper on sales. I also believe that the rise in interest rates in the finalquarter of 2017 likely pulled sales forward, leading to a drop in sales in the first quarter of 2018.

HOME PRICES

- With ongoing limited inventory, it’s not surprising that the growth in home prices continues to trend well above the long-term average. Year-over-year, average prices rose 14.4% to $468,312.

- Economic vitality in the region is leading to robust housing demand that far exceeds supply. Given the relative lack of new construction homes— something that is unlikely to change any time soon—there will continue to be pressure on the resale market. As a result, home prices will continue to rise at above-average rates in the coming year.

- When compared to the same period a year ago, price growth was strongest in Grays Harbor County at 27.5%. Ten additional counties experienced double-digit price growth.

- Mortgage rates continued to rise during first quarter, and are expected to increase modestly in the coming months. By the end of the year, interest rates will likely land around 4.9%, which should take some of the steam out of price growth. This is actually a good thing and should help address the challenges we face with housing affordability—especially in markets near the major job centers.

DAYS ON MARKET

- The average number of days it took to sell a home dropped by seven days when compared to the same quarter of 2017.

- King County continues to be the tightest market in Western Washington, with homes taking an average of 24 days to sell. Every county in the region saw the length of time it took to sell a home either drop or remain essentially static relative to the same period a year ago.

- In looking at the entire region, it took an average of 61 days to sell a home in the first quarter of this year. This is down from 68 days in the firstquarter of 2017 but up by eleven days when compared to the fourth quarter of 2017.

- Anyone expecting to see a rapid rise in the number of homes for sale in 2018 will likely be disappointed. New construction permit activity—a leading indicator—remains well below historic levels and this will continue to put increasing pressure on the resale home market.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the first quarter of 2018, I have left the needle at the same point as fourth quarter of last year. Price growth remains strong even as sales activity slowed. All things being equal, 2018 is setting itself up to be another very good year for sellers but, unfortunately, not for buyers who will still see stiff competition for the limited number of available homes for sale.

Mr. Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Spring Home Maintenance Checklist

It’s time to check for damage and prepare for hot weather ahead.

Original photo on Houzz

Tasks to Check Off Your List in an Hour or Less

Inspect driveways and paths. Freezing and thawing are rough on concrete, asphalt and other hardscape materials. Take a walk around your property to look for damage to walkways, paths and driveways, then schedule repairs as needed. Asphalt can often be patched, but damaged concrete may need to be replaced entirely.

Keep an eye out for termites. Beginning in March and going through May or June, be on the lookout for these winged insects. “Termites swarm in the spring,” says Victor Sedinger, certified home inspector and owner of House Exam Inspection and Consulting. “If there’s a bunch of winged insects flying out of a hole in the woodwork, that’s probably termites. Call a licensed professional pest-control company. You’ll save money and trouble in the long run.”

Original photo on Houzz

Prevent mosquitoes. In recent years, we’ve become more aware of the potential danger mosquitos can pose to our health. “West Nile virus and Zika virus are just the latest diseases caused by these winged pests,” Sedinger says.

The best way to prevent mosquitoes around your home is simply to get rid of any standing water. “Walk around your property [and peek at your neighbors’]. If you see anything or any area where water stands, fix it, tip it, get rid of it or maintain it regularly,” Sedinger says.

Original photo on Houzz

Tackle These To-Dos Over a Weekend

Wash windows. Clean the grime off glass inside and out for a lighter, brighter home indoors and increased curb appeal outdoors. Wash the exterior windows yourself by using a hose attachment, or hire a pro to get the job done.

Clean gutters and downspouts. After the last frost has passed, it’s important to have your gutters and downspouts cleaned and repaired. “Clogged gutters and downspouts can cause the wood trim at the eaves to rot, and that can invite all kinds of critters into your attic space,” Sedinger says.Having your gutters and downspouts cleaned early in the season can also help prevent damage from spring rains. “Gutters and downspouts should be clean and running free,” Sedinger says. “If your downspouts are installed properly, water is diverted away from the house so that no water collects around your foundation.”

Original photo on Houzz

Clean your fireplace. If your home has a working wood-burning fireplace, the end of winter is a good time to give it a fresh start. Protect your hands with gloves and cover the area around the fireplace with a tarp. Carefully remove the (completely cool) remains of any charred logs and ash using fireplace tools. Then gently clean the fireplace surround. Do not attempt to clean inside the chimney — that job should be left to a professional chimney sweep.

Original photo on Houzz

Check sprinkler and irrigation systems. Checking your sprinklers or irrigation systems in the spring can save water — and your plants. Sedinger shares these tips for checking your watering system:

- Run the system through all the zones manually and walk the property.

- Make sure none of the sprinkler heads are broken or damaged.

- Adjust any heads that are spraying the house, especially windows, as this can cause moisture problems.

- Adjust heads that are spraying the street, sidewalk or porches to avoid wasting water.

- If you don’t know how to maintain your system, call a professional. You’ll save money on your water bill and protect one of our most valuable natural resources.

Original photo on Houzz

Check screen doors and windows. Screens are designed to let the breeze flow in and keep the bugs out, but they can only do their job if they’re free from holes and tears.

Before setting up your screens for the warm months ahead, be sure to carefully check each one and repair any holes or tears, no matter how small. You can find repair kits at most hardware and home-improvement stores.

Original photo on Houzz

Maintenance and Extras to Budget for This Season

Inspect the roof. Winter storms can take quite a toll on a roof. When spring arrives, start by making a simple visual inspection of yours. “It doesn’t require a ladder, and you certainly don’t have to get on a roof to look,” Sedinger says. “Use binoculars or a camera or smartphone with a telephoto feature if you need to.” Look for missing shingles, metal pipes that are damaged or missing or anything that simply doesn’t look right. If you notice anything that needs closer inspection or repair, call a roofer.

Paint exterior. If you’re planning to repaint your home’s exterior this year, spring is a good time to set it up. Want to paint but can’t decide on a color? Explore your town and snap pictures of house colors you like, browse photos on Houzz or work with a color consultant to get that just-right hue.

Original photo on Houzz

Reseal exterior woodwork. Wood decks, fences, railings, trellises, pergolas and other outdoor structures will last longer if they’re stained or resealed every year or two.

Take this opportunity to make any needed repairs to woodwork as well.

Original photo on Houzz

How Tax Reform Affects Homeowners

How the new tax reform may affect you as a homeowner

New tax legislation was signed into law at the end of 2017, and it included some significant changes for homeowners. These changes took effect in 2018 and do not influence your 2017 taxes. Here’s a brief overview of this year’s tax changes and how they may affect you*.

The amount of mortgage interest you can deduct has decreased.

Under the old law, taxpayers could deduct the interest they paid on a mortgage of up to $1 million. The new law reduces the mortgage interest deduction from $1 million to $750,000. These changes do not affect mortgages taken out before December 15, 2017.

The home equity loan deduction has changed.

The IRS states that, despite newly-enacted restrictions on home mortgages, taxpayers can often still deduct interest on a home equity loan, home equity line of credit (HELOC) or second mortgage, regardless of how the loan is labeled. The Tax Cuts and Jobs Act of 2017, enacted December 22, suspends from 2018 until 2026 the deduction for interest paid on home equity loans and lines of credit, unless they are used to buy, build or substantially improve the taxpayer’s home that secures the loan.

The property tax deduction is capped at $10,000.

Previously taxpayers could deduct all the state, local and foreign real estate taxes they paid with no cap on the amount. The new law limits the deduction for all state and local taxes – including income, sales, real estate, and personal property taxes – to $10,000.

The casualty loss deduction has been repealed.

Homeowners previously could deduct unreimbursed casualty, disaster and theft losses on their property. That deduction has been repealed, with an exception for losses on property located in a federally declared disaster area.

The capital gains exclusion remains unchanged.

Homeowners can continue to exclude up to $500,000 for joint filers or $250,000 for single filers for capital gains when selling their primary residence as long as they have lived in the home for two of the past five years. An earlier proposal would have increased that requirement to five out of the last eight years and phase out the exclusion for high-income households, but it was struck down. Find out more about 2018 tax reform.

How does tax reform affect your plans for buying or selling a home?

The changes in real estate related taxes may change your strategy. Contact one of our real estate professionals at Windemere Bellevue Commons.

*Please consult your tax advisor if you have any questions about how the new tax reform impacts you

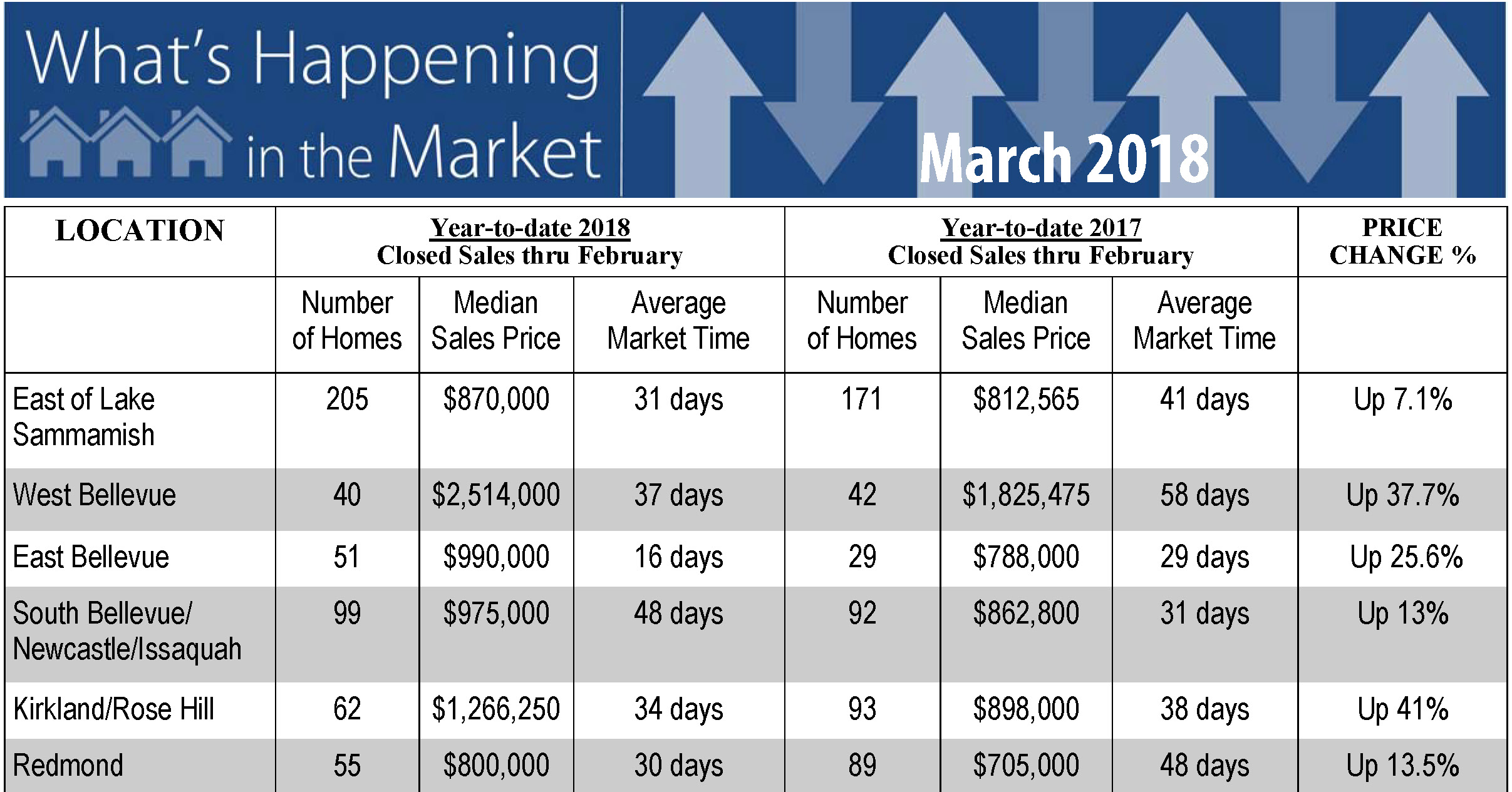

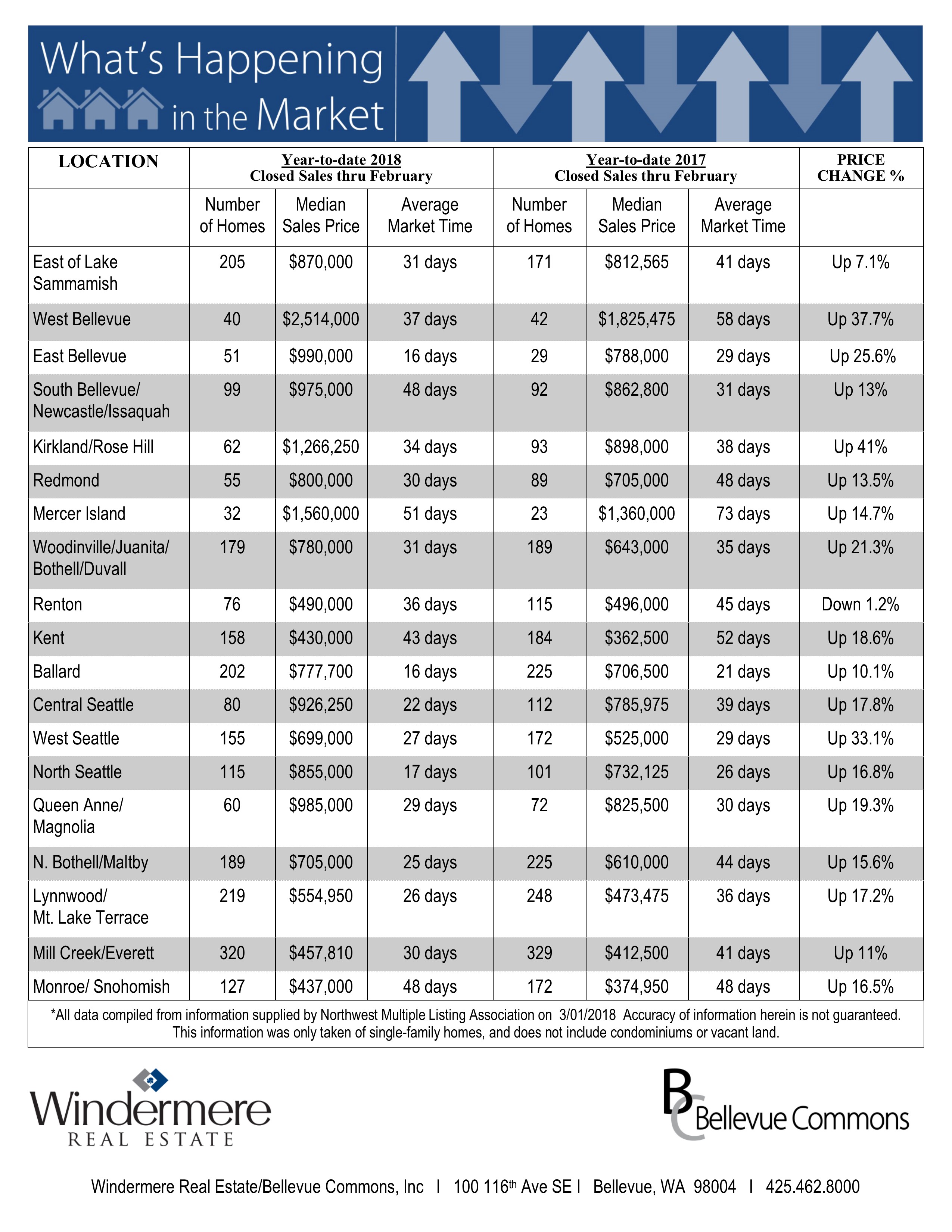

King & Snohomish County Market Stats – February 2018

Median Home prices increased 22% from February 2017 to February 2018

- Active inventory rose 3.3% to 780 properties, but buyers experienced no relief with the median price increasing a staggering 22% from February 2017 to February 2018 ($845,319 from $692,500).

- Over half (52%) of the 529 properties that closed in February sold for over asking price. The median amount above list price was 8%.

- 68% of the closings were on the market for less than 15 days before being Sold!

- Interest rates are a half a point higher at 4.33% than the low of 3.81% in September of 2017.

- We don’t expect to see anything change and if the trend stays the same then we should see the majority of equity gained for 2018 realized over the next 3 months.

The Gardner Report – Fourth Quarter 2017

Western Washington Real Estate Market Update

ECONOMIC OVERVIEW

The Washington State economy added 104,600 new jobs over the past 12 months. This impressive growth rate of 3.1% is well above the national rate of 1.4%. Interestingly, the slowdown we saw through most of the second half of the year reversed in the fall, and we actually saw more robust employment growth.

Growth continues to be broad-based, with expansion in all major job sectors other than aerospace due to a slowdown at Boeing.

With job creation, the state unemployment rate stands at 4.5%, essentially indicating that the state is close to full employment. Additionally, all counties contained within this report show unemployment rates below where they were a year ago.

I expect continued economic expansion in Washington State in 2018; however, we are likely to see a modest slowdown, which is to be expected at this stage in the business cycle.

HOME SALES ACTIVITY

- There were 22,325 home sales during the final quarter of 2017. This is an increase of 3.7% over the same period in 2016.

- Jefferson County saw sales rise the fastest relative to fourth quarter of 2016, with an impressive increase of 22.8%. Six other counties saw double-digit gains in sales. A lack of listings impacted King and Skagit Counties, where sales fell.

- Housing inventory was down by 16.2% when compared to the fourth quarter of 2016, and down by 17.3% from last quarter. This isn’t terribly surprising since we typically see a slowdown as we enter the winter months. Pending home sales rose by 4.1% over the third quarter of 2017, suggesting that closings in the first quarter of 2018 should be robust.

- The takeaway from this data is that listings remain at very low levels and, unfortunately, I don’t expect to see substantial increases in 2018. The region is likely to remain somewhat starved for inventory for the foreseeable future.

HOME PRICES

- Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.

- Economic vitality in the region is leading to a demand for housing that far exceeds supply. Given the relative lack of newly constructed homes—something that is unlikely to change any time soon—there will continue to be pressure on the resale market. This means home prices will rise at above-average rates in 2018.

- Compared to the same period a year ago, price growth was most pronounced in Lewis County, where home prices were 18.8% higher than a year ago. Eleven additional counties experienced double-digit price growth as well.

- Mortgage rates in the fourth quarter rose very modestly, but remained below the four percent barrier. Although I anticipate rates will rise in 2018, the pace will be modest. My current forecast predicts an average 30-year rate of 4.4% in 2018—still remarkably low when compared to historic averages.

DAYS ON MARKET

- The average number of days it took to sell a home in the fourth quarter dropped by eight days, compared to the same quarter of 2016.

- King County continues to be the tightest market in Western Washington, with homes taking an average of 21 days to sell. Every county in the region saw the length of time it took to sell a home either drop or remain static relative to the same period a year ago.

- Last quarter, it took an average of 50 days to sell a home. This is down from 58 days in the fourth quarter of 2016, but up by 7 days from the third quarter of 2017.

- As mentioned earlier in this report, I expect inventory levels to rise modestly, which should lead to an increase in the average time it takes to sell a house. That said, with homes selling in less than two months on average, the market is nowhere near balanced.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I have left the needle at the same point as third quarter. Price growth remains robust even as sales activity slowed. 2018 is setting itself up to be another very good year for housing.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I have left the needle at the same point as third quarter. Price growth remains robust even as sales activity slowed. 2018 is setting itself up to be another very good year for housing.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

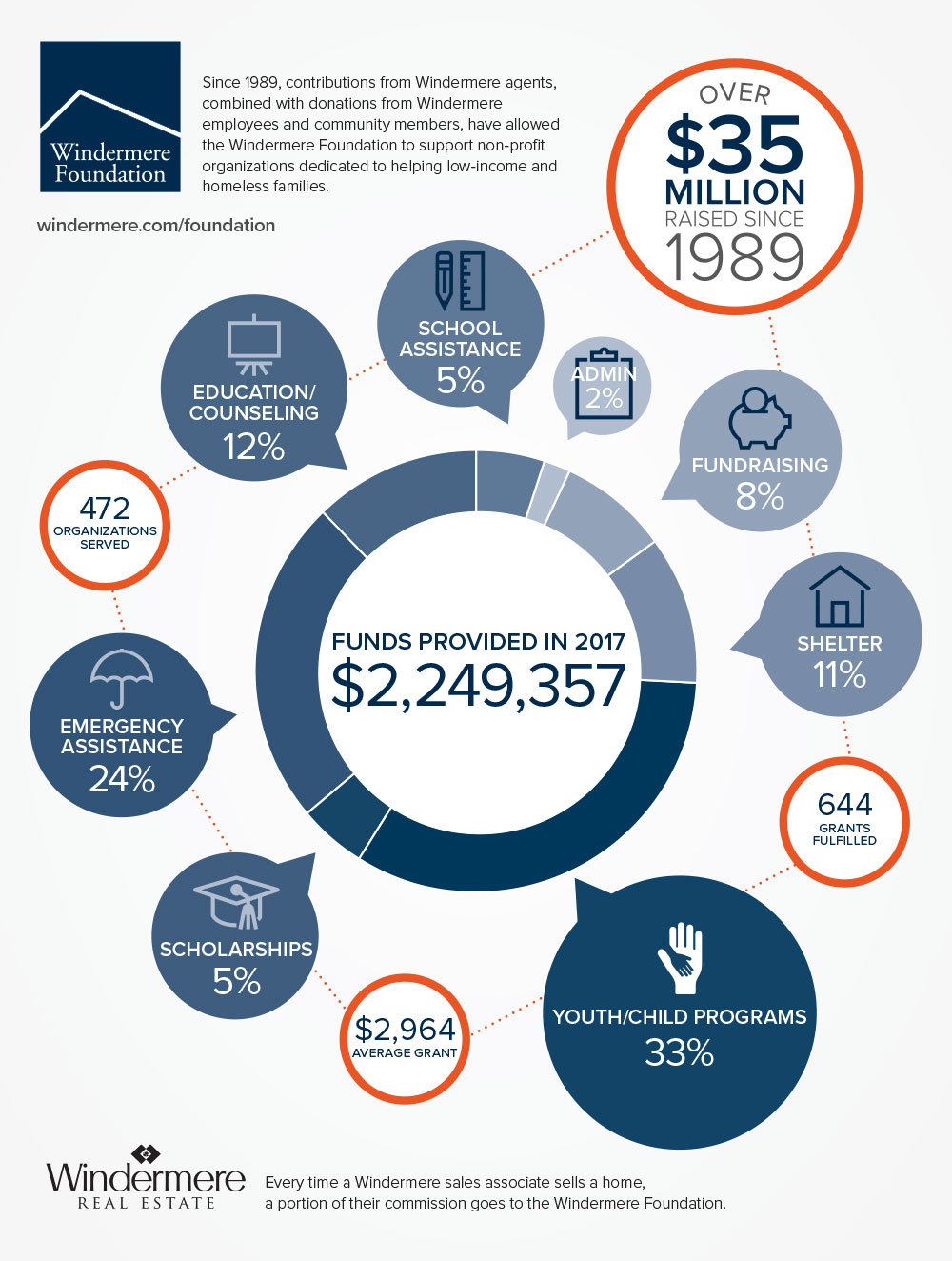

Windermere Foundation Surpasses $35 Million In Giving

Proud to be Windermere…

We are very proud of our brokers to support the Windermere Foundation which has raised over $35 million since 1989. In 2017, Eastside offices alone, raised up to $225,000 to help 22 organizations on the Eastside.

The Windermere Foundation had another banner year in 2017, raising even more than it did the prior year thanks to the continued support of Windermere franchise owners, agents, staff, and the community. Over $2.4 million was raised in 2017, which is an increase of eight percent over the previous year. This brings our total to over $35.5 million raised since the start of the Windermere Foundation in 1989.

A portion of the money raised last year is thanks to our agents who each make a donation to the Windermere Foundation from every commission they earn. Additional donations from Windermere agents, the community, and fundraisers made up 66% of the money collected in 2017. These funds enable our offices to support local non-profits that provide much-needed services to low-income and homeless families in their communities.

SUMMARY OF FUNDS, GRANTS & DONATIONS IN 2017

- Organizations served: 472

- Number of individual grants fulfilled: 644

- Average grant amount: $2,964.04

- Average donation to the Windermere Foundation: $116.08

FUNDING BREAKDOWN

- Total amount disbursed in 2017: $2,249,357.14

- Total disbursed through grants: $1,908,843.54

- Scholarships: 5%

- Youth/Child Programs: 33%

- Emergency Assistance: 24%

- Shelter: 11%

- School Assistance: 5%

- Education/Counseling: 12%

- Administrative Expenses: 2%

- Fundraising Expenses: 8%

So how are Windermere Foundation funds used? Windermere offices decide for themselves how to distribute the money in their local community. Our offices have helped support school lunch and afterschool programs, housing assistance for homeless families, food banks, homeless shelters, and non-profits that provide basic necessities, such as shoes, clothing, toiletries, and blankets to families in need.

A very notable day in 2017 for the Windermere Foundation was November 15, when a record-breaking $253,782 was given in a single day. A total of 35 non-profit organizations benefitted from that day’s donations, including Attain Housing in Kirkland, WA, which received $56,000 from the Windermere Eastside offices. Other organizations that received donations were Boys and Girls Club of Contra Costa in Walnut Creek, CA, and the Shady Cove School in Shady Cove, Oregon.

2017 also marked the second year of our #tacklehomelessness campaign with the Seattle Seahawks, in which Windermere committed to donating $100 for every Seahawks home game defensive tackle to YouthCare, a non-profit organization that provides critical services to homeless youth. While the Seahawks didn’t make it to the playoffs this year, they did help us raise $31,800. When added to last year’s $35,000, that’s a total donation of $66,800. We are grateful for the opportunity to provide additional support to homeless youth thanks to the Seahawks, YouthCare, and the #tacklehomelessness campaign.

2017 also marked the second year of our #tacklehomelessness campaign with the Seattle Seahawks, in which Windermere committed to donating $100 for every Seahawks home game defensive tackle to YouthCare, a non-profit organization that provides critical services to homeless youth. While the Seahawks didn’t make it to the playoffs this year, they did help us raise $31,800. When added to last year’s $35,000, that’s a total donation of $66,800. We are grateful for the opportunity to provide additional support to homeless youth thanks to the Seahawks, YouthCare, and the #tacklehomelessness campaign.

Thanks to our agents and everyone who supports the Windermere Foundation, we are able to continue to make a difference in the lives of many families in our local communities. If you’d like to help support programs in your community, please click the Donate button.

Thanks to our agents and everyone who supports the Windermere Foundation, we are able to continue to make a difference in the lives of many families in our local communities. If you’d like to help support programs in your community, please click the Donate button.

Empty Nesters: Remodel or Sell?

Your kids have moved out and now you’re living in a big house with way more space than you need. You have two choices – remodel your existing home or move. Here are some things to consider about each option.

Choice No. 1: Remodel your existing home to better fit your current needs.

- Remodeling gives you lots of options, but some choices can reduce the value of your home. You can combine two bedrooms into a master suite or change another bedroom into a spa area. But reducing the number of bedrooms can dramatically decrease the value of your house when you go to sell, making it much less desirable to a typical buyer with a family.

- The ROI on remodeling is generally poor. You should remodel because it’s something that makes your home more appealing for you, not because you want to increase the value of your home. According to a recent study, on average you’ll recoup just 64 percent of a remodeling project’s investment when you go to sell.

- Remodeling is stressful. Living in a construction zone is no fun, and an extensive remodel may mean that you have to move out of your home for a while. Staying on budget is also challenging. Remodels often end up taking much more time and much more money than homeowners expect.

Choice No. 2: Sell your existing home and buy your empty nest dream home.

- You can downsize to a single-level residence and upsize your lifestyle. Many people planning for their later years prefer a home that is all on one level and has less square footage. But downsizing doesn’t mean scrimping. You may be able to funnel the proceeds of the sale of your existing home into a great view or high-end amenities.

- A “lock-and-leave” home offers more freedom. As your time becomes more flexible, you may want to travel more. Or maybe you’d like to spend winters in a sunnier climate. You may want to trade your existing home for the security and low maintenance of condominium living.

- There has never been a better time to sell. Our area is one of the top in the country for sellers to get the greatest return on investment. Real estate is cyclical, so the current boom is bound to moderate at some point. If you’re thinking about selling, take advantage of this strong seller’s market and do it now.

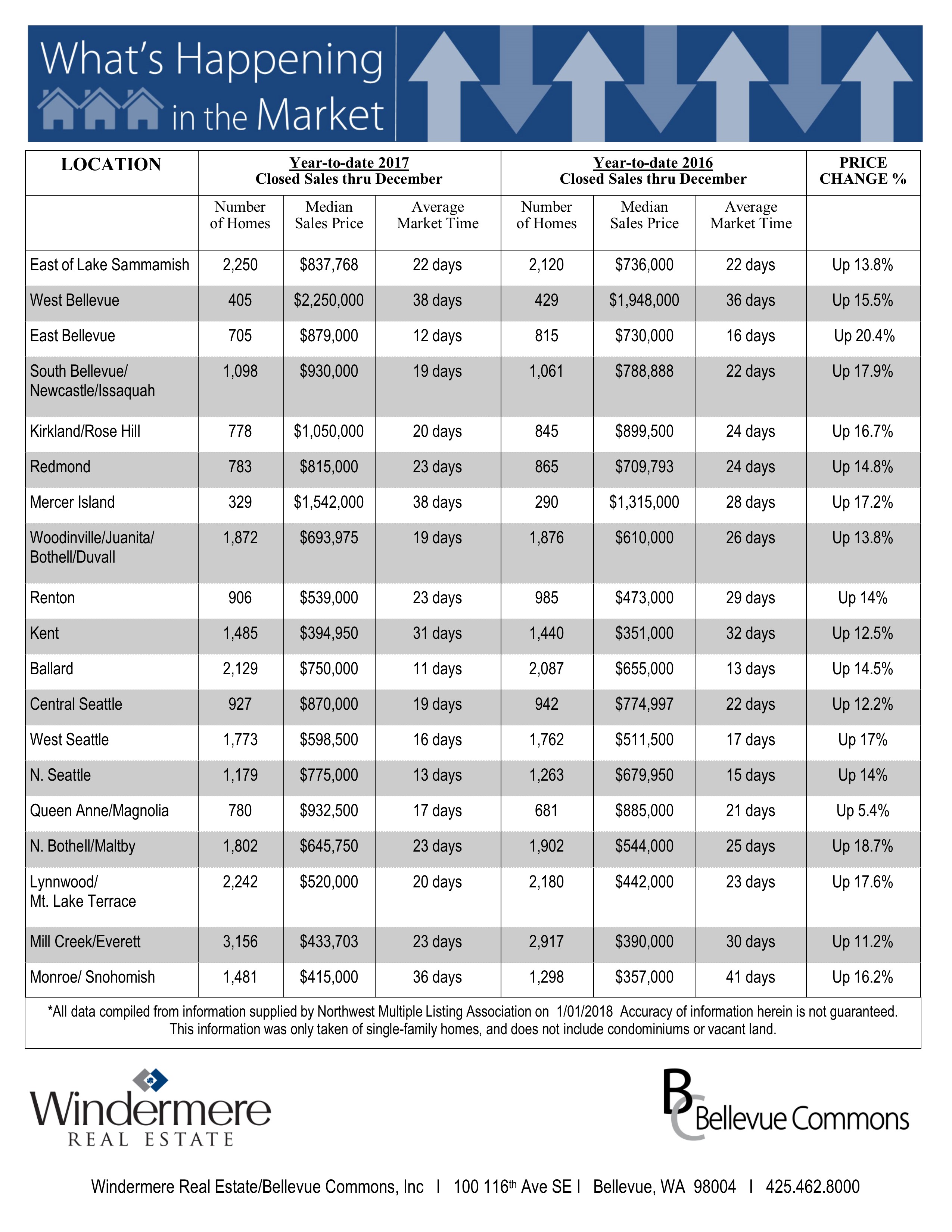

King & Snohomish County Market Stats – December 2017

Home prices nearly double in six years going from $407,000 in December 2011 to $810,000 in December 2017.

The year is over and 2017 has shown to be one of the best years in recent memory for equity gain while creating more and more competition due to dwindling availability of homes. Pricing has recently reached all time highs with the median prices doubling over the past 6 years. That being said we don’t see it changing anytime soon with Consumer and Builder confidence on an all-time high. Those looking to Sell in 2018 will need to position their homes in the best possible light to receive top dollar and Buyers will need to be truly prepared to Buy in order to be awarded a New home in 2018!

Some Highlights

Eastside (based on Residential and Condominium report):

- Home prices nearly double in six years going from $407,000 in December 2011 to $810,000 in December 2017.

- The number of homes sold in December is virtually unchanged from a year ago (538 vs 541) even though there are 22% fewer houses for sale (451 vs 530).

It feels like 2018 will be similar to the past few years. A total frenzy until summer and then a flattening in price for the second half of the year. Interesting consistency in the past three years:

- Big jump in median closed price in December.

- By April or May the closed Median Price has reached the level it will remain close to, until the big jump in December.

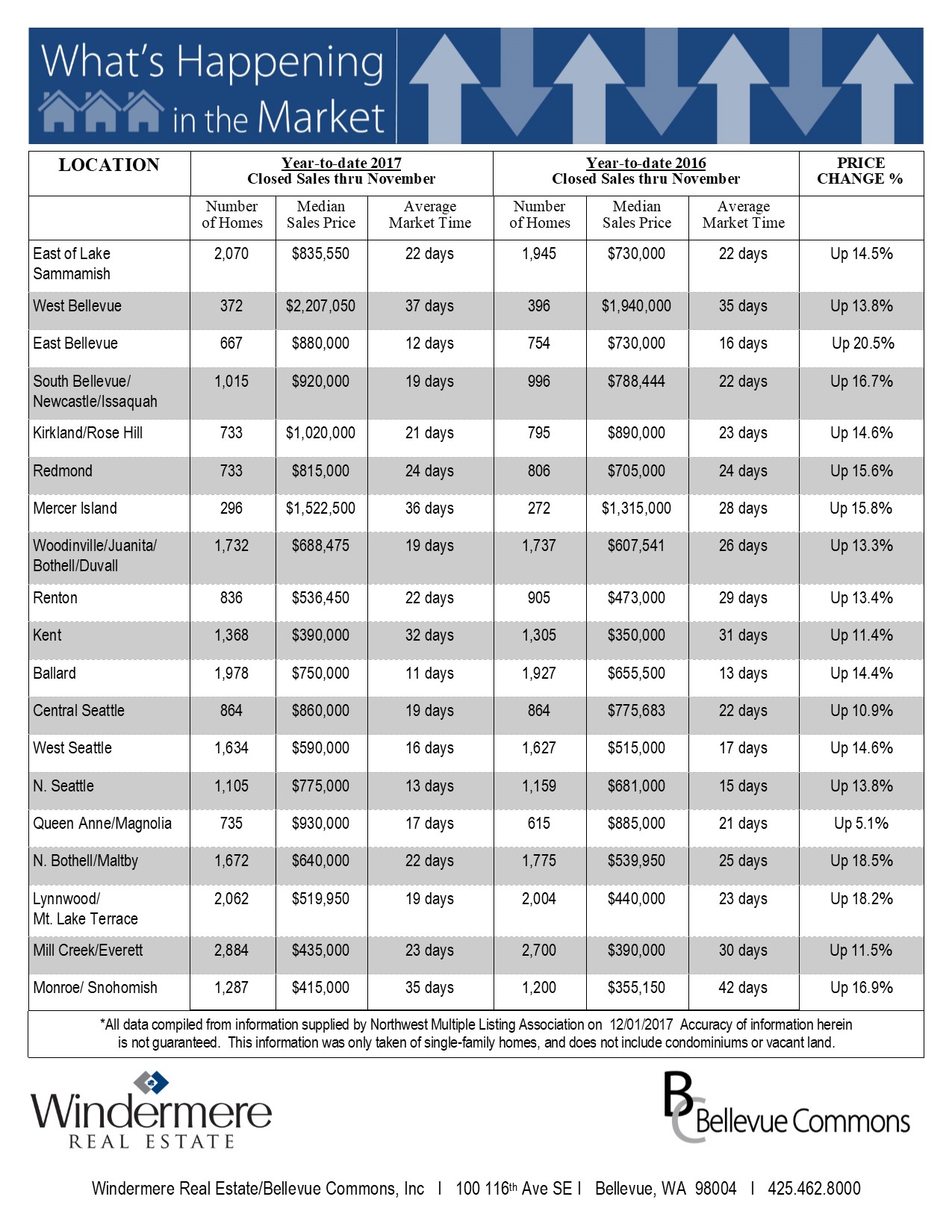

King & Snohomish County Market Stats – November 2017

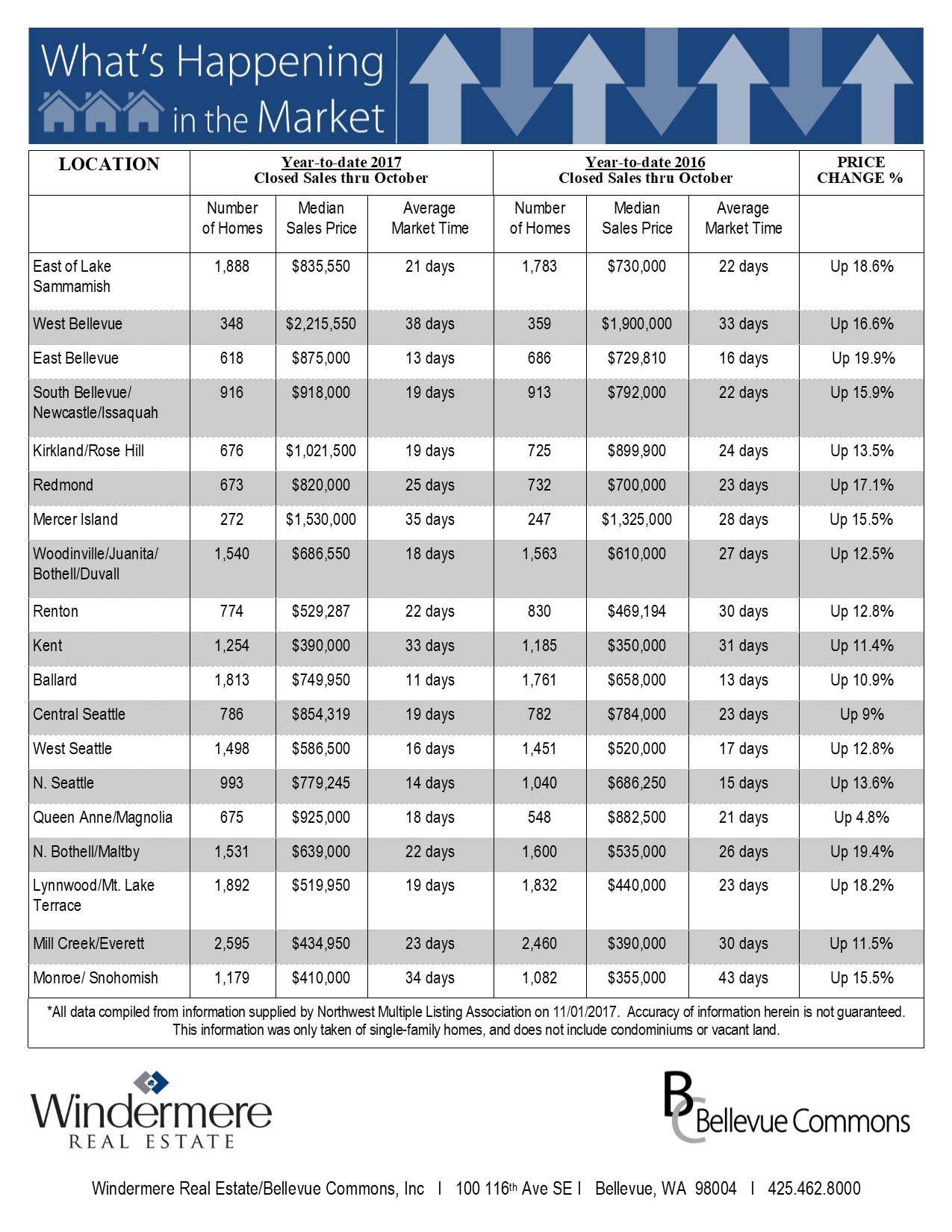

What’s Happening in the Market – November 2017

While the market seems to relaxing for the moment, it appears that the supply is still holding steady below 1 months of inventory. Days on market have been creeping up nominally while the prices seem to have leveled for the moment. This time of year is a nice break from the hectic pace we have been experiencing, but never a better time to list as the competition is at its lowest during the November-December months. Plenty of motivated Buyers out there waiting for homes to become available as there are positive number coming from lenders for Pre-Approvals heading into 2018!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link