First Time Buyers, Millennials, and What to Expect in 2017

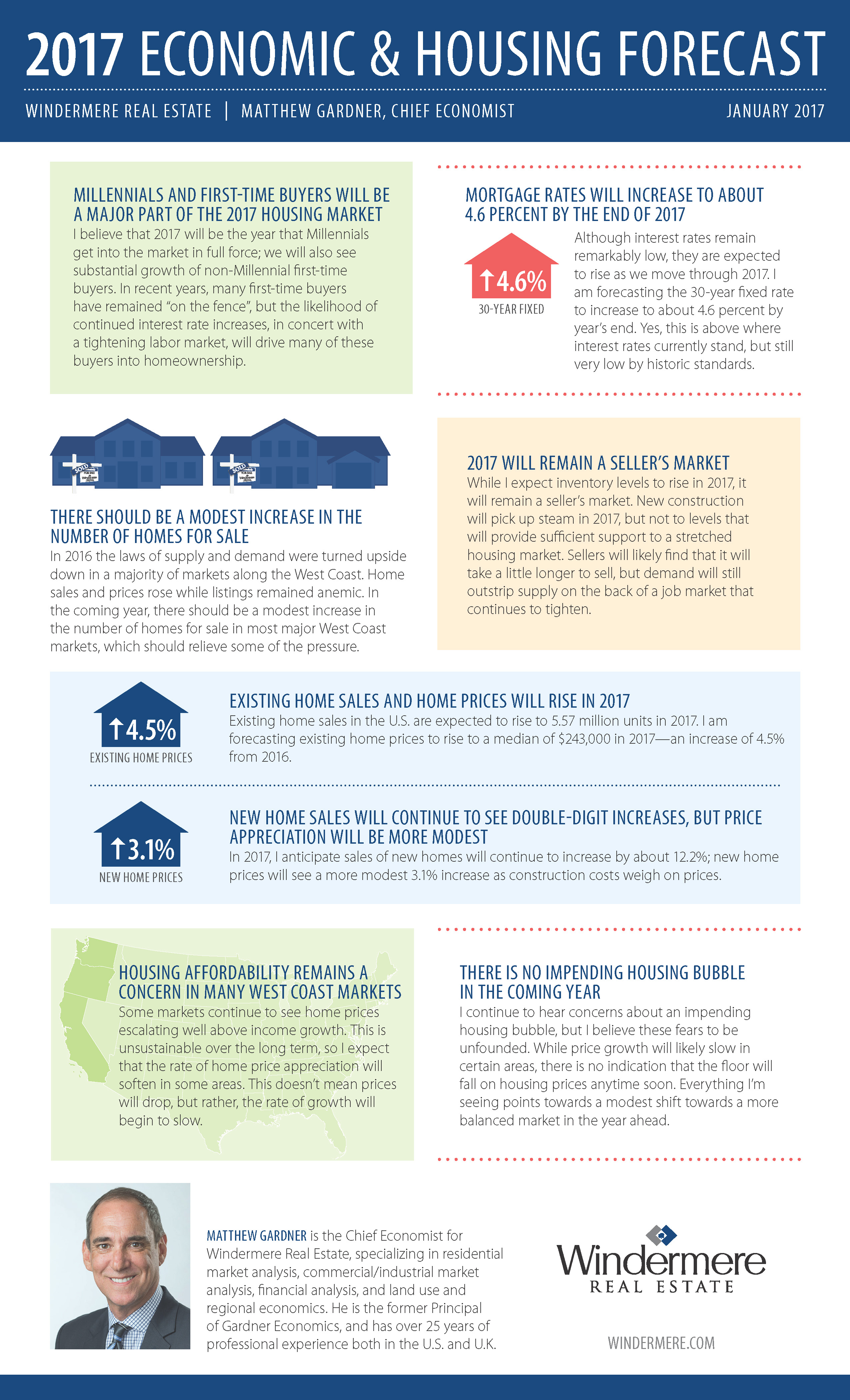

2017 Economic and Housing Forecast

I believe that the big story for the coming year will be first-time home buyers. Since they don’t need to sell before purchasing, their reemergence into the market ensures that sales will continue to increase, even while inventory is limited. Thirty-one percent of buyers currently in the real estate market are first-time buyers, but it would be more ideal if that figure was closer to 40 percent.

Why don’t we have enough first-time buyers in the market? With Baby Boomers working and living longer, we aren’t making much room for Millennials to start their careers. Plus, the major debt that the younger generation owes on student loans ($1.3 trillion today) hugely impacts the housing market. But the bigger issue is lack of down payments. Before the recession, many Millennials could look to their parents for help with down payments; however, these days that is not as much the case.

I would also contend that the notion of Millennials being a “renter generation” is nonsense. In a National Association of Realtors survey, 75 percent of them said that buying a home would be the most astute financial decision they’d ever make; however, 80 percent said they don’t think they could qualify for a mortgage. I do believe that Millennials will eventually buy, but they’re delaying their purchasing decisions by about three years when compared to previous generations, which is about the same amount of time they’re waiting to start families as well.

Mortgage rates have risen rapidly since the election, and unfortunately, I do not see a turnaround in this trend. That said, they will remain cheap when compared to historic averages. Expect to see the yield on 30-year mortgages rise to around 4.7% by the end of 2017. For those who have grown accustomed to interest rates being at historic lows, this might seem high, but it’s all relative.

If I were to gaze all the way into 2018, my crystal ball takes me to the dreaded “R” word. Like taxes and death, recessions are another one of those unwanted realities that inevitably comes to visit every so often. Irrespective of who was voted into the White House, my view remains the same: prepare to see a business cycle recession by the end of 2018, but, rest assured, it will not be driven by real estate, nor will it resemble the Great Recession in any way.

This article was first posted in Windermere.com by Matthew Gardner, Chief Economist, Windermere Real Estate

Western Washington Real Estate Market Update

OVERVIEW of Western Washington Real Estate Market

Here is a detailed overview of Western Washington Real Estate Market. Washington State finished the year on a high with jobs continuing to be added across the market. Additionally, we are seeing decent growth in the area’s smaller markets, which have not benefited from the same robust growth as the larger metropolitan markets.

Unemployment rates throughout the region continue to drop and the levels in the central Puget Sound region suggest that we are at full employment. In the coming year, I anticipate that we will see substantial income growth as companies look to recruit new talent and keep existing employees happy.

HOME SALES ACTIVITY

- There were 19,745 home sales during the fourth quarter of 2016—up by a very impressive 13.4% from the same period in 2015, but 18.7% below the total number of sales seen in the third quarter of the year. (This is a function of seasonality and no cause for concern.)

- Sales in Clallam County grew at the fastest rate over the past 12 months, with home sales up by 47%. There were also impressive sales increases in Grays Harbor and Thurston Counties. Jefferson County had a fairly modest decrease in sales.

- The number of available listings continues to remain well below historic averages. The total number of homes for sale in the fourth quarter was down by 13.7% compared to the same period a year ago.

- The key takeaway from this data is that 2017 will continue to be a seller’s market. We should see some improvement in listing activity, but it is highly likely that demand will exceed supply for another year.

HOME PRICES

- Demand continued to exceed supply in the final three months of 2016 and this caused home prices to continue to rise. In the fourth quarter, average prices rose by 7.1% but were 0.4% higher than the third quarter of the year. The region’s average sales price is now $414,110.

- In most parts of the region, home prices are well above historic highs and continue to trend upward.

- When compared to the fourth quarter of 2015, price growth was most pronounced in Kittitas County. In total, there were eight counties where annual price growth exceeded 10%. We saw a drop in sales prices in the notoriously volatile San Juan County.

- The aggressive home price growth that we’ve experienced in recent years should start to taper in 2017, but prices will continue to increase at rates that are higher than historic averages.

DAYS ON MARKET

- The average number of days it took to sell a home in the fourth quarter dropped by 15 days when compared to the fourth quarter of 2015.

- King County was the only area where it took less than a month to sell a home, but all markets saw decent improvement in the time it took to sell a home when compared to a year ago.

- In the final quarter of the year, it took an average of 64 days to sell a home. This is down from the 78 days it took in the third quarter of 2015, but up from the 52 days it took in the third quarter of 2016. (This is due to seasonality and not a cause for concern.)

- We may experience a modest increase in the time it takes to sell a home in 2017, but only if there is a rapid increase in listings, which is certainly not a given.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economic factors. For the fourth quarter of 2016, I actually moved the needle a little more in favor of buyers, but this is purely a function of the increase in interest rates that was seen after the election. Higher borrowing costs mean that buyers can afford less, which could ultimately put some modest downward pressure on home prices in 2017. That said, the region will still strongly favor sellers in the coming year.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economic factors. For the fourth quarter of 2016, I actually moved the needle a little more in favor of buyers, but this is purely a function of the increase in interest rates that was seen after the election. Higher borrowing costs mean that buyers can afford less, which could ultimately put some modest downward pressure on home prices in 2017. That said, the region will still strongly favor sellers in the coming year.

This article were first Posted on windermere.com by Matthew Gardner, Chief Economist, Windermere Real Estate

Our Brokers Care!

We have the best real estate agents in our office! Thanks to our generous agents, we collected $3,700 to buy new toys and clothes for kids supported by Hopelink.

Each holiday season, Hopelink, the largest non-profit organization in Washington State, transforms its food banks into holiday gift rooms, offering new toys and new clothing to children in need.

Hopelink serves more than 64,000 homeless and low-income families, children, seniors and people with disabilities in north and east King County; providing stability and helping people gain the skills and knowledge they need to exit poverty for good.

Hopelink also provides transportation services throughout King and Snohomish Counties. With service centers in Redmond, Bellevue, Kirkland, Shoreline and Sno-Valley.

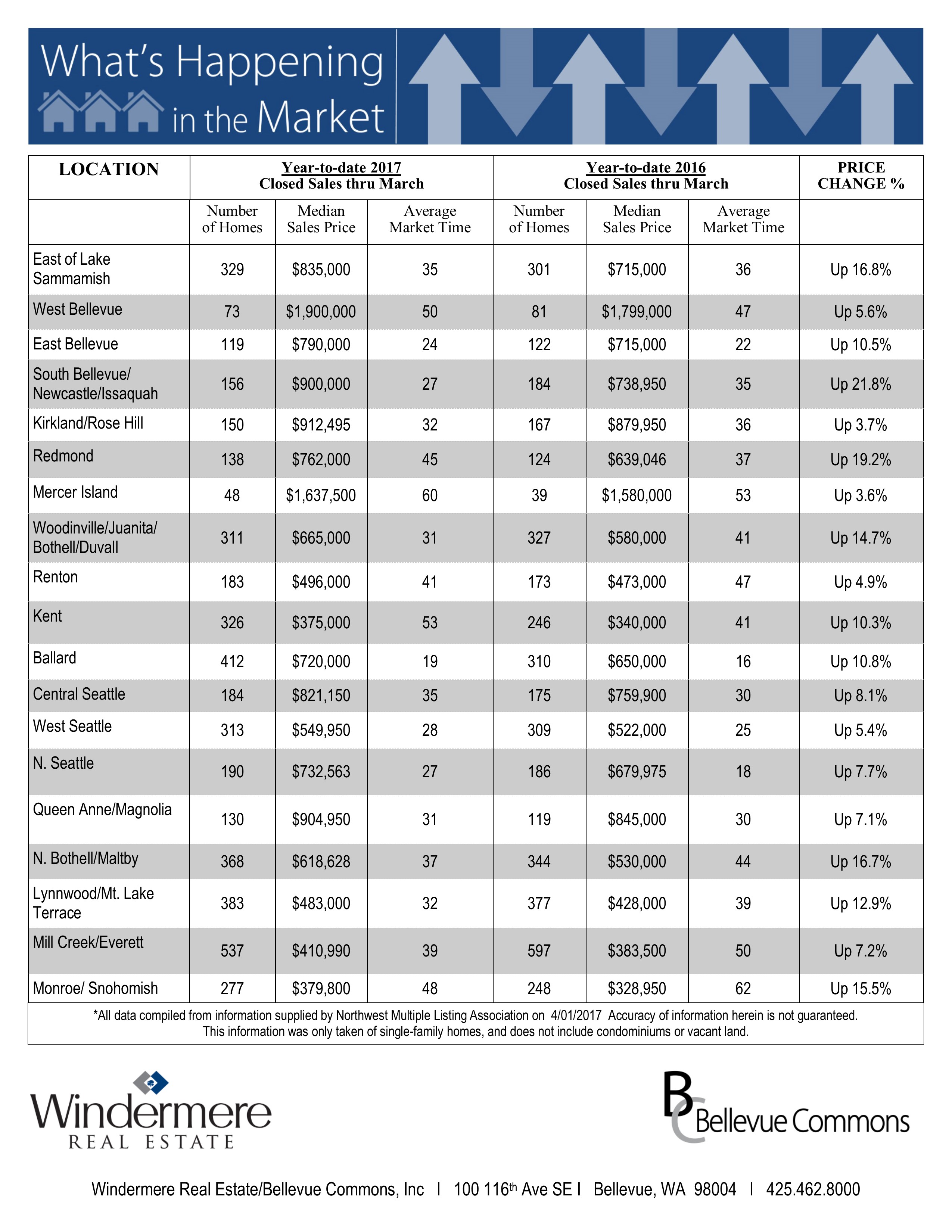

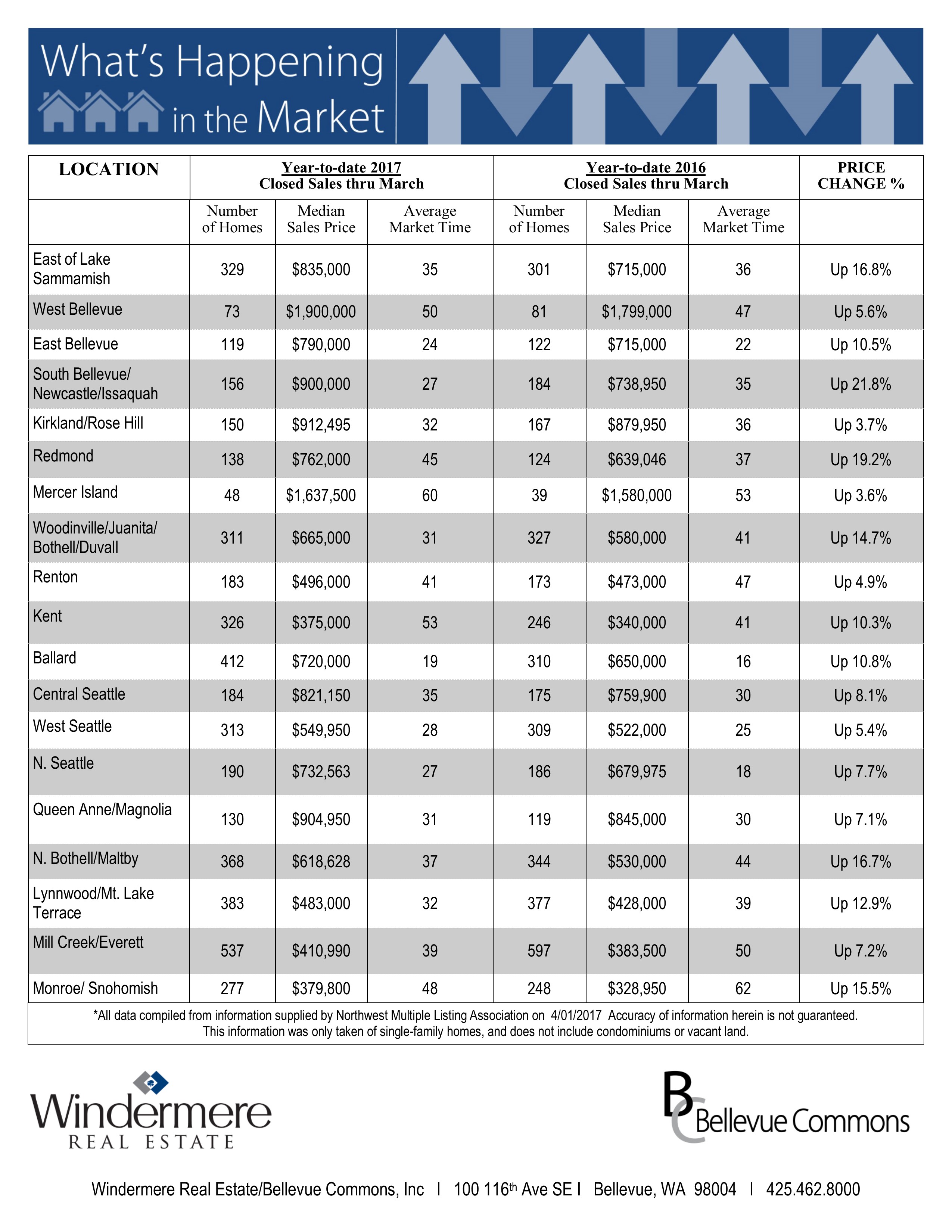

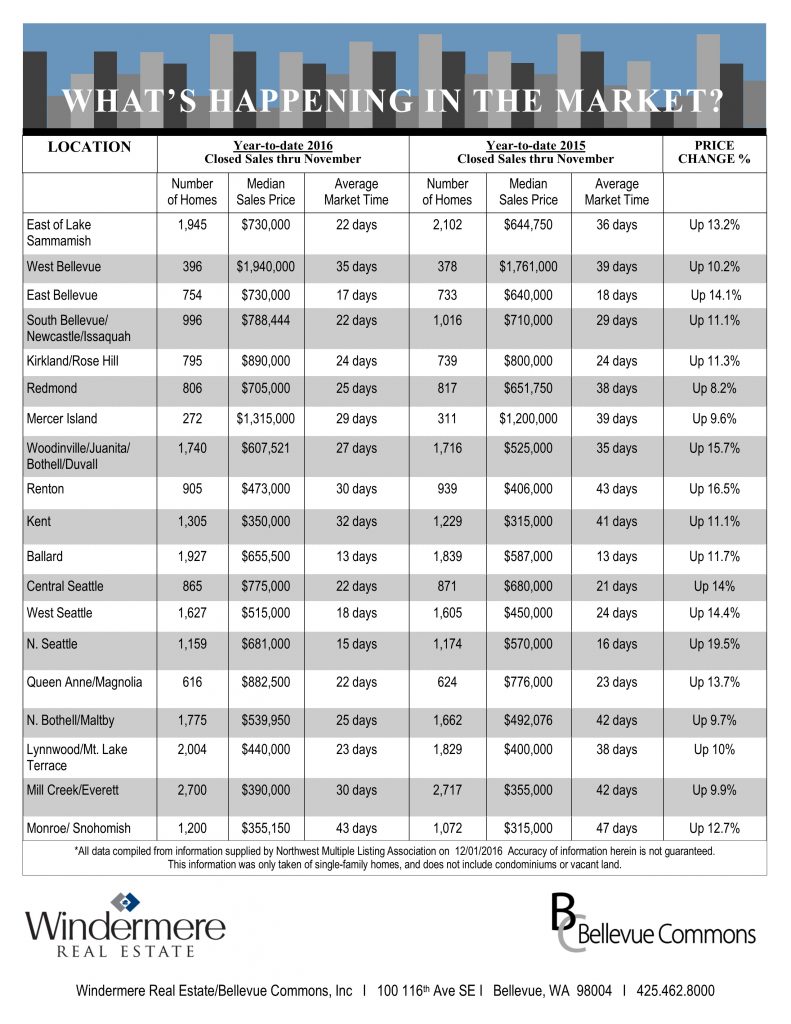

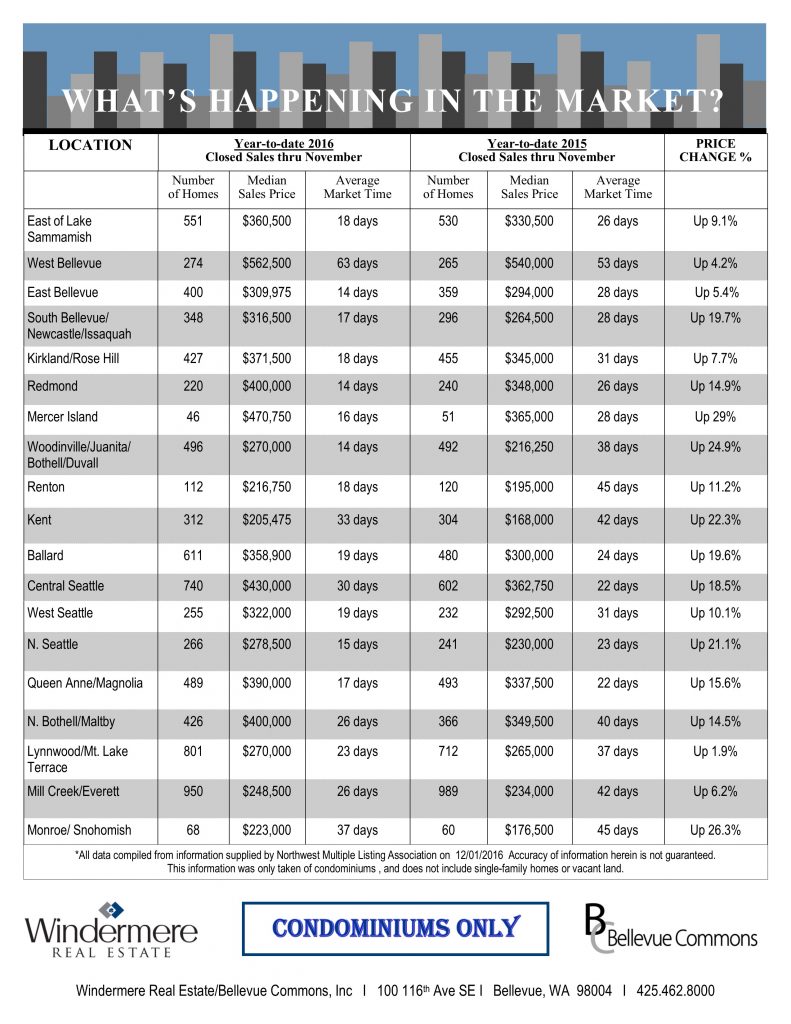

King & Snohomish County Market Stats – November 2016

What’s Happening In The Market

While we have seen a typical slowdown in transaction side during the holiday’s it is still very active and pricing seems to be holding steady during this last quarter. While the political landscape has caused some uncertainty in many markets around the country it does not appear to have affected ours up to this point. Interest rates having risen ½ point over the past couple weeks have caused some to start thinking about making a move now vs. later. Buyers having lost more than 5% of their buying power due to the rate hike rightfully have concerns about them continuing to rise.

Single Family Homes Market Stats

Condominiums Market Stats

How to get your real estate license in Washington State

The real estate profession has expanded and offers one of the widest career selections in the business world today. A career in real estate provides flexibility and freedom to set your own pace. Income directly reflects your efforts, with no limits on what astute, hard-working men and women can earn. Successful people in real estate are goal-oriented, persevering, self-motivated, ambitious and people-oriented. The rewards of a real estate career are a potential for high earnings, status in the community, autonomy, time freedom, helping people, the intellectual challenge and the satisfaction from those accomplishments.

If you think real estate is right for you, here is the requirements and steps you need to take to get your real estate license in Washington State.

Requirements

To qualify for a broker’s license, you must:

- Be at least 18 years old.

- Have a high school diploma or equivalent.

- Successfully complete 90 hours of approved real estate education within 2 years before applying for the exam. This education must include:

- A 60-hour course in Real Estate Fundamentals.

- A 30-hour course in Real Estate Practices.

- Pass the broker’s exam.

Study for broker’s exam

You need to complete 90 hours of real estate education before taking your broker’s exam. Included in this 90 hours is a 60-hour course in Real Estate Fundamentals which provides an overview of the theoretical and practical aspects of real estate. Another included course is Real Estate Practices which is 30 hours and provides an overview of the practical, day-to-day aspects of the real estate business. It teaches the essential skills that Washington real estate agents must master, including: working with clients, pricing property, complying with fair housing laws, filling out necessary agreements, handling offers and counteroffers, prequalifying buyers, and guiding transactions through the closing process.

You need to complete 90 hours of real estate education before taking your broker’s exam. Included in this 90 hours is a 60-hour course in Real Estate Fundamentals which provides an overview of the theoretical and practical aspects of real estate. Another included course is Real Estate Practices which is 30 hours and provides an overview of the practical, day-to-day aspects of the real estate business. It teaches the essential skills that Washington real estate agents must master, including: working with clients, pricing property, complying with fair housing laws, filling out necessary agreements, handling offers and counteroffers, prequalifying buyers, and guiding transactions through the closing process.

To complete your education, you can choose from a variety of online and class based schools. Here is our recommendations in the state of Washington.

| 1- Windermere Professional Development | Cost: $399 | windermereu.com |

| 2- Rockwell Institute | Cost: $489 | rockwellinstitute.com |

Schedule your broker’s exam

Before you complete your course, you must register as a student with DOL testing vendor, Applied Measurements Professionals, Inc. (AMP), so your school can submit your course completion information electronically. To register as a student with AMP click here and follow the instructions.

- Your school must submit your course completions to AMP electronically to complete the examination registration process.

- After your school submits your education information to AMP, schedule your exam online, by phone, or by mail. To schedule online: Go to www.goAMP.com.

For more information visit dol.wa.gov.

Apply for your Washington Real Estate Broker License

- Complete the Real Estate License Application form.

- Submit your completed application with a check or money order for the fee ($138.25 as of Nov. 2016), payable to the Department of Licensing, to:

Real Estate Licensing

Department of Licensing

PO Box 3917

Seattle, WA 98124-3917 - Submit fingerprints for state and national background checks.

- Inside Washington:

- Go to www.identogo.com to schedule an appointment through MorphoTrust, DOL’s electronic fingerprinting vendor. You will pay IdentoGO for taking your fingerprints and for the background checks required for your license type.

- Outside Washington:

- Call Real Estate Regulatory at 360.664.6484 for fingerprint card submission instructions.

- For more details, see Fingerprinting and background checks.

- Inside Washington:

We wish you good luck in the process. Please don’t hesitate to contact us, should you have any questions or need any further information.

Sources: dol.wa.gov, realtor.org, rockwellinstitute.com, amazon.com

Top 5 Tips for Selling Your Home During the Holidays

Posted in hgtv.com.

Attract homebuyers even during the holidays with these useful tips.

The holiday season from November through January is often considered the worst time to put a home on the market. While the thought of selling your home during the winter months may dampen your holiday spirit, the season does have its advantages: holiday buyers tend to be more serious and competition is less fierce with fewer homes being actively marketed. First, decide if you really need to sell. Really. Once you’ve committed to the challenge, don your gay apparel and follow these tips from Front Door.

Original Photo on melaniekramerrealtor.com

1. Deck the halls, but don’t go overboard.

Homes often look their best during the holidays, but sellers should be careful not to overdo it on the decor. Adornments that are too large or too many can crowd your home and distract buyers. Also, avoid offending buyers by opting for general fall and winter decorations rather than items with religious themes.

Original Photo on 2ladiesandachair.com

2. Hire a reliable real estate agent.

That means someone who will work hard for you and won’t disappear during Thanksgiving, Christmas or New Year’s. Our agents in Windermere Bellevue Commons are committed to you 100%, no matter which season we’re in.

3. Make curb appeal a top priority.

When autumn rolls around and the trees start to lose their leaves, maintaining the exterior of your home becomes even more important. Bare trees equal a more exposed home, so touch up the paint, clean the gutters and spruce up the yard. Keep buyers’ safety in mind as well by making sure stairs and walkways are free of snow, ice and leaves.

Original Photo on burchetthomes.com

4. Give house hunters a place to escape from the cold.

Make your home feel cozy and inviting during showings by cranking up the heat, playing soft classical music and offering homemade holiday treats. When you encourage buyers to spend more time in your home, you also give them more time to admire its best features.

5. Relax — the new year is just around the corner.

The holidays are stressful enough with gifts to buy, dinners to prepare and relatives to entertain. Take a moment to remind yourself that if you don’t sell now, there’s always next year, which, luckily, is only a few days away.

Windermere Launches New Ultra-Luxury Brand: W Collection

Anyone who has spent time in the Seattle area in recent years has likely seen for themselves how much the city has changed. Thanks in large part to the booming economy, growing tech sector, and increasing international appeal, Seattle is no longer a sleepy little city tucked away in the far corner of the United States. With this changing landscape has come an infusion of wealth that has seen the area’s high-net-worth population explode. And with it, so too has the ultra-high-end real estate market.

In order to meet the specialized needs of this burgeoning market, Windermere has launched W Collection, a new ultra-luxury brand specifically designed for homes priced at $3 million and above in Western Washington. OB Jacobi, President of Windermere Real Estate, says that Seattle’s population of “global affluent” is on the rise and they greatly value real estate. The proof is in the numbers.

Over the past five years there has been a significant increase in the number of home sales in the $3 million+ market. In 2011 there were only 45 such sales in King County, while in 2015 there were 131. “Windermere agents represent anywhere from 40-60 percent of the $3 million+ sales in the Seattle area, so we felt we were in the ideal position to build a brand that could provide enhanced marketing support to the growing number of ultra-luxury homes,” said Jacobi.

W Collection is its own standalone brand with a separate website, WByWindermere.com, signage, presentation materials, and specialized advertising opportunities. When developing W Collection, Jacobi said that the goal was to create a sophisticated, yet humble, brand that evokes the understated expression of wealth that is unique to the Pacific Northwest. “Our clients are not largely drawn to the shows of excessive wealth that you see at other companies and in other parts of the country. This is reflected in the W Collection brand,” said Jacobi.

The development of W Collection began a little over a year ago, and according to Jacobi, was a highly collaborative process with Windermere agents playing an integral role in every step, “Over the past 44 years some of Windermere’s best ideas have come from our agents who are totally in tune with the needs of their clients and the shifting demands of the market; W Collection was born from this same agent ingenuity.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link