How to Turn Your Home Into a Vacation Rental

So, you want to become an AirBnB host. How do go about converting your property into a vacation destination?

The hospitality industry has been hard at work to regain its foothold with stir-crazy consumers who have a whole new set of values post-Covid. The growing popularity of the short-term vacation rental is poised to redefine the nature of vacationing for years to come, thanks to increased space, flexibility, and lower average rates.

The demographic for Airbnb guests is changing as well, as Gen Z and millennials are more inclined to travel with groups of friends rather than just their immediate family. Future Airbnb owners can capitalize on this trends for unique, photogenic accommodations that hotels can’t always provide.

If you are willing to put in the hard work, your vacation rental can turn a good profit, and we’ve got a quick guide to get you started!

Laws & Logistics

Converting your home into a vacation rental isn’t as easy as listing it on a site like AirBnB. There are a lot of hoops to jump through regarding local regulations, insurance policies, market trends and HOA rules. Start your research by looking into the ordinances of the city where you are located, as municipal law can vary even within the same state.

Seattle law, for example, states that property owners are restricted to operating a maximum of 2 dwelling units as short-term rentals, whereas Bellingham only requires that short-term rental operators obtain the appropriate vacation rental permit and pay the associated fee. Paying attention to regional codes is an important first step towards turning your property into a vacation rental.

Looking into the local market is a great way to get a feel for whether or not your vacation rental has a chance to really succeed in that area. “Look for your direct competitors,” advises Alex Haler, a strategic account executive with AirDNA, “What are they doing well? Do any of them have a particular amenity or feature that is helping them outperform the others? Keep track of this group of competitors as they will aid you in setting the right price, benchmarking your performance and staying ahead of the curve.”

Reduce, Repair & Redecorate

The next step is to take care of any necessary repairs, update the furniture and install new tech if need be. Start by depersonalizing the space – as much as you love those family mementos, you are selling a space as a blank canvas for others to create their own memories.

Install smart technology to enhance connectivity for your guests and to keep an eye on your property when you can’t be there in person. Electronic locks that can be managed via the internet are a great addition, as they generate unique codes for each guest stay and make the check-in process quicker and easier.

Now is the time to take care of those pesky quirks that you have grown accustomed to, like squeaky doors or testy faucets. While some guests may not even register these issues, you are investing in your property’s longevity. By being proactive with repairs from the get-go, you save yourself stress and potentially more costly problems down the line.

When decorating, consider the aesthetic of your vacation rental and how it will complement the local vibe. What draws people to the area? Would a coastal motif fit best or would a cozy cabin vibe be more appropriate? “Think about how your guests are going to use the space, rather than simply throwing things together,” advises Nikki Kaestner, a Senior Design Associate with Vacasa.

Good design isn’t about finding matchy-matchy pieces, but creating a space that feels like a home. This can be achieved by layering pieces for a lived-in look that don’t necessarily match but blend cohesively. Make sure you invest in sturdy, quality materials (especially in high touch areas like dining rooms) that can withstand the wear and tear of multiple guests over several seasons – this includes solid wood tables and fabrics that have passed the Martindale test for performance, like Sunbrella.

Stock Up On Supplies

You’re almost ready to welcome your first guests! All that’s left is making sure all the little essentials are well-stocked. Guests are always on the lookout for amenities such as extra towels, sheets and basic toiletries. These are items that are used the most and are almost always left behind in a packing frenzy.

Invest in quality bedding, kitchen supplies and travel-size toiletries to make your vacation rental stand out from the crowd. Being an over-prepared vacation rental host by anticipating these needs can make the difference between a glowing review and an unsatisfied comment that affects future bookings.

Advice From An Agent

Don’t just take our word for it! We sat down with WBC broker, Mylo Adams, one our amazing real estate professionals for her tips on property management. “Vacation rental listing setup is the most important,” Mylo advises, “Be sure to verify your property may legally be used as a vacation rental.” This means understanding tax liability on the city, state and federal level, including excise, Business & Occupation (B&O) and capital gains tax.

Mylo’s Top Tips

– Prepare a Rules & Regulations handbook for your guests, as many condominiums allowing vacation rentals have specific rules.

– Invest in excellent professional photos. Did you know that professional photos can lead up to 20% more bookings?

– Respond to inquiries quickly (within 1 hour).

– Clean, Clean, CLEAN! Hire a professional cleaning service to make sure everything looks its best.

Its no secret that the nature of travel has changed over the last few years, creating new opportunities for homeowners to get involved in the field of hospitality and generate another revenue stream. If you think that converting your property into a short-term or vacation rental sounds like the right move, make sure you are doing as much research as possible. It’s a competitive market but creating an insta-worthy escape can pay significant dividends if done right.

Happy hosting!

Written by Makena Schoene

Featured Image Source: NWMLS Listing Courtesy of Duke Young

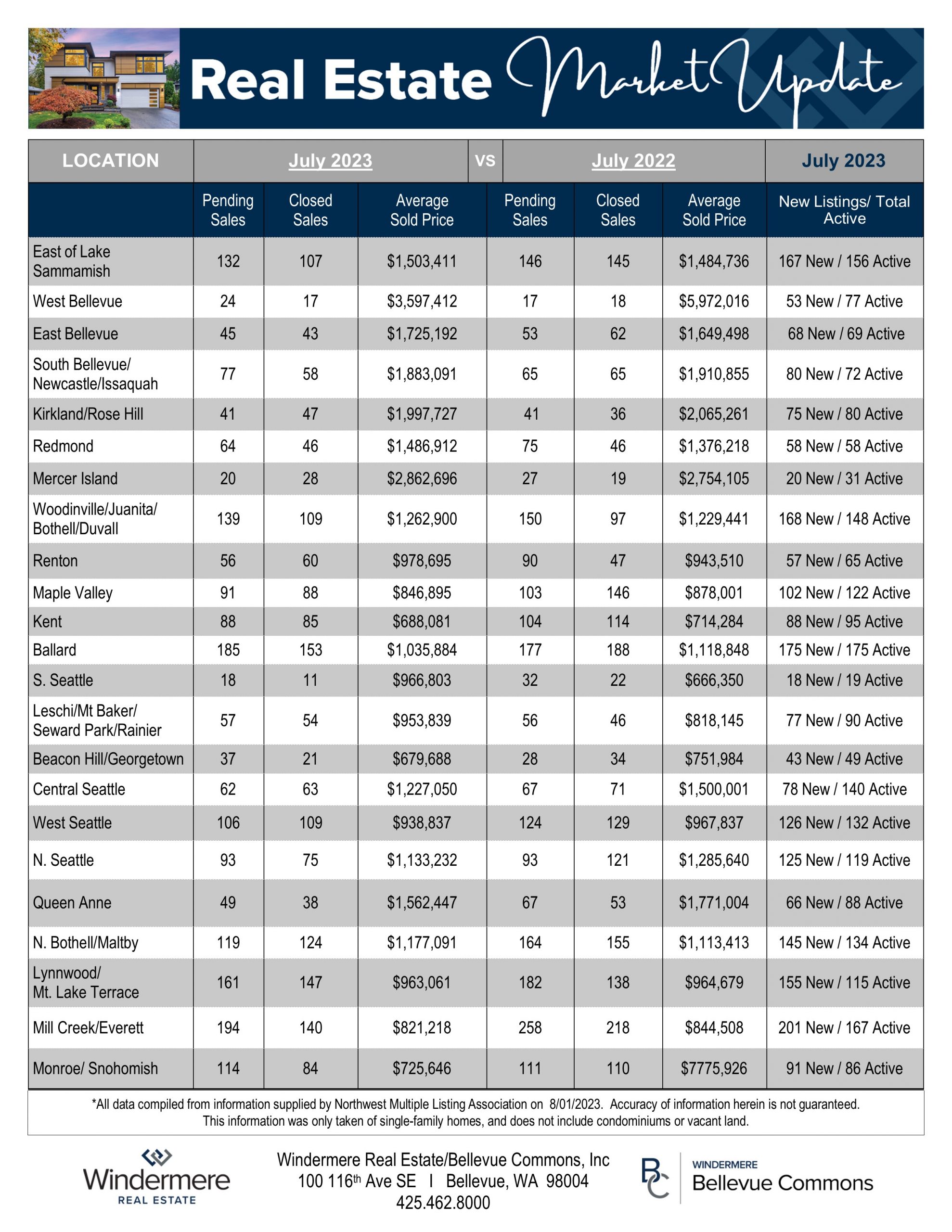

Local Market Update – August 2023

The dog days of summer are upon us, and along with stifling heat comes a sluggish market. High interest rates and a dearth of available inventory are driving prices up and slowing sales across the region.

One major contributor to the low supply of homes is the phenomenon of homeowners protecting their sweet pandemic-era mortgage rates of 3-4%. Rather than selling and having to manage interest rates that are currently in 7% range, they are choosing to stay put. This means homes that otherwise might have been on the market this time of year are also staying put, and would-be buyers are competing for very limited inventory.

According to Windermere Chief Economist Matthew Gardner, July’s active listings in the tri-county market were fewer than in any July on record, excepting the pandemic year of July, 2021.

Gardner also noted that “With mortgage rates unlikely to move tangibly lower during the balance of the summer, I don’t expect the market to move much over the coming months, both in terms of sales and prices.” But he did add that “If the economy starts to soften this fall, rates could start to fall and this could revitalize the market.”

The key now seems to be accurately pricing the listings that are available. While there’s limited inventory, mortgage rates are putting a damper on buying power. Buyers may already be forced to compromise on lifestyle and location for mid-tier properties. They won’t want to compromise on price as well.

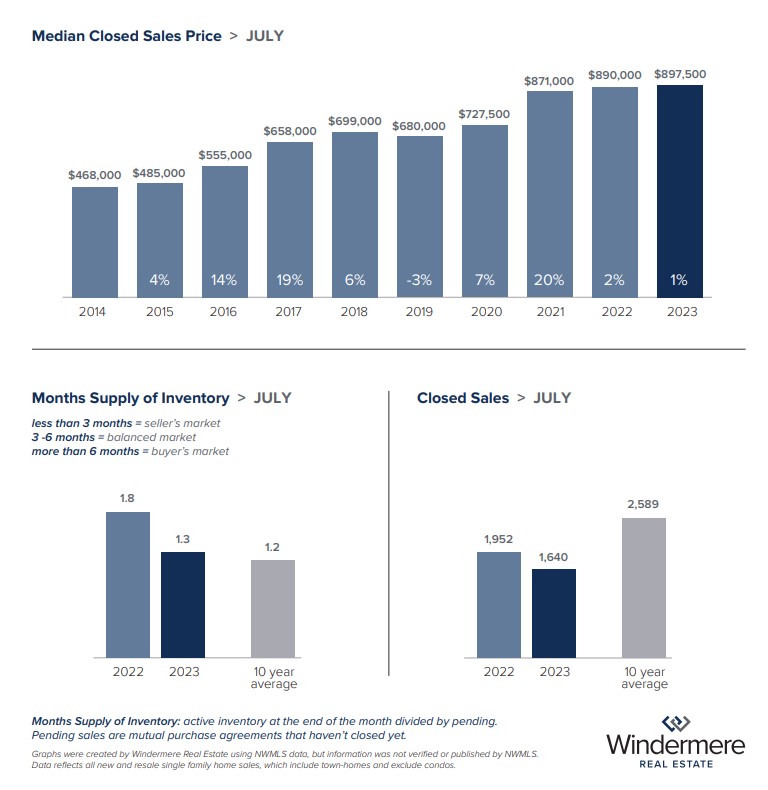

In King County, the median sold price for a single-family home was $897,500 in July, up from $890,000 in July, 2022. Condos also saw a boost, landing at a median of $510,000 last month—up from $490,000 a year ago. This is likely due to high demand and strong competition from buyers in the area.

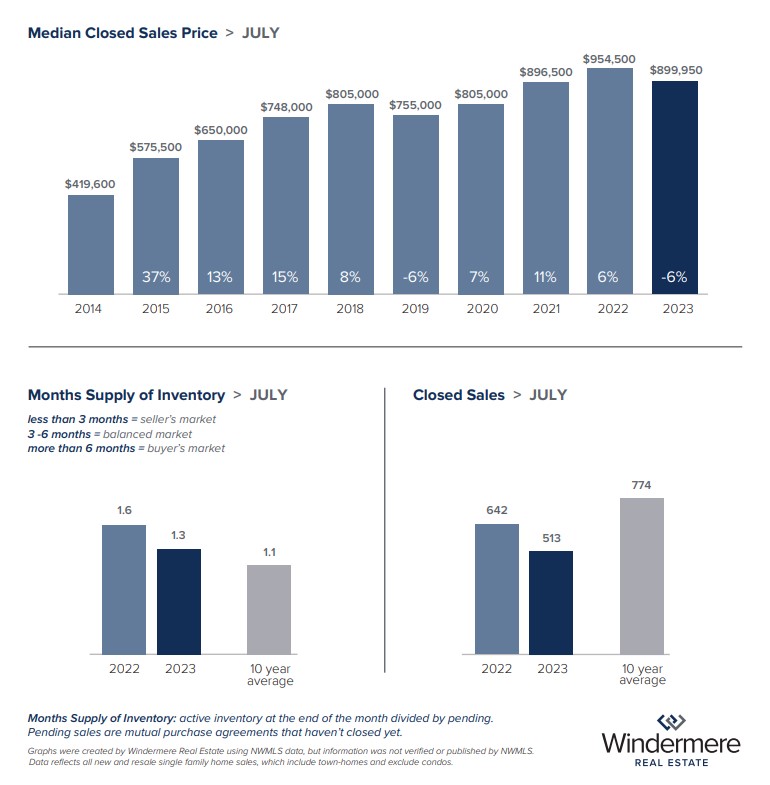

In Seattle, the necessity of pricing homes accurately is clear. As an example, 69% of Seattle single family homes sold in under 15 days in July, and these generated sold prices that were 100.1% of their list price. Those that took longer than two weeks to sell, however, closed at 97.5% of list price.

Seattle sold prices softened a bit in July. The median price for a single-family home in the city was $899,950, down from $954,500 a year ago. On the other hand, condo prices rose to $550,000 last month, up from $537,000 a year ago.

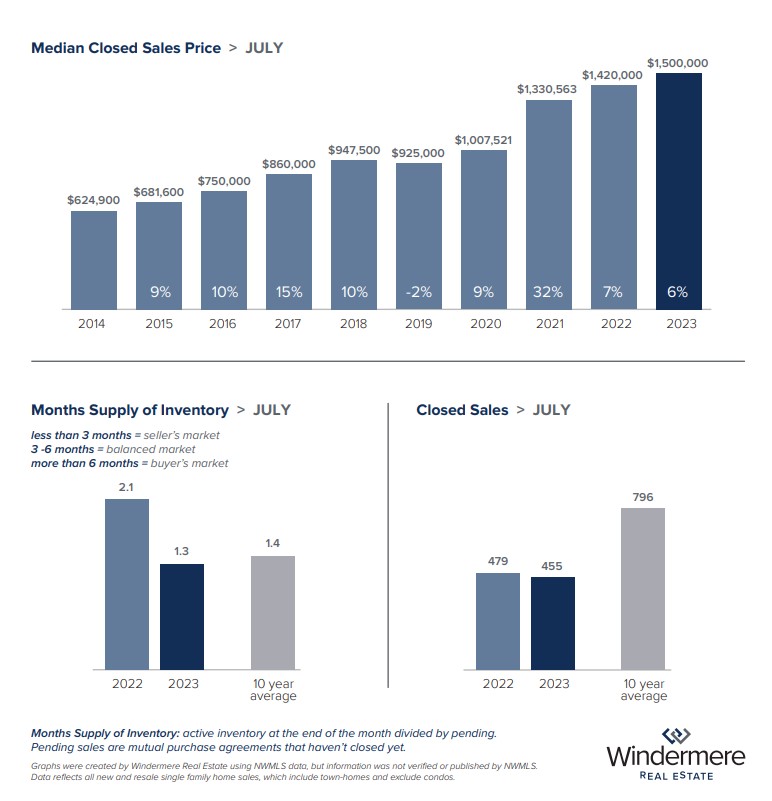

Low inventory on the Eastside had the effect of pushing up home prices in July, when the median sold price of a single-family home was $1,500,000. That’s an increase from $1,420,000 in July 2022. It’s also the first month since September of last year that Eastside median prices have increased from the year prior, so the mid-summer market has shown some heat. Eastside condo prices also increased last month, with a median sold price of $600,000, up from $575,000 a year ago.

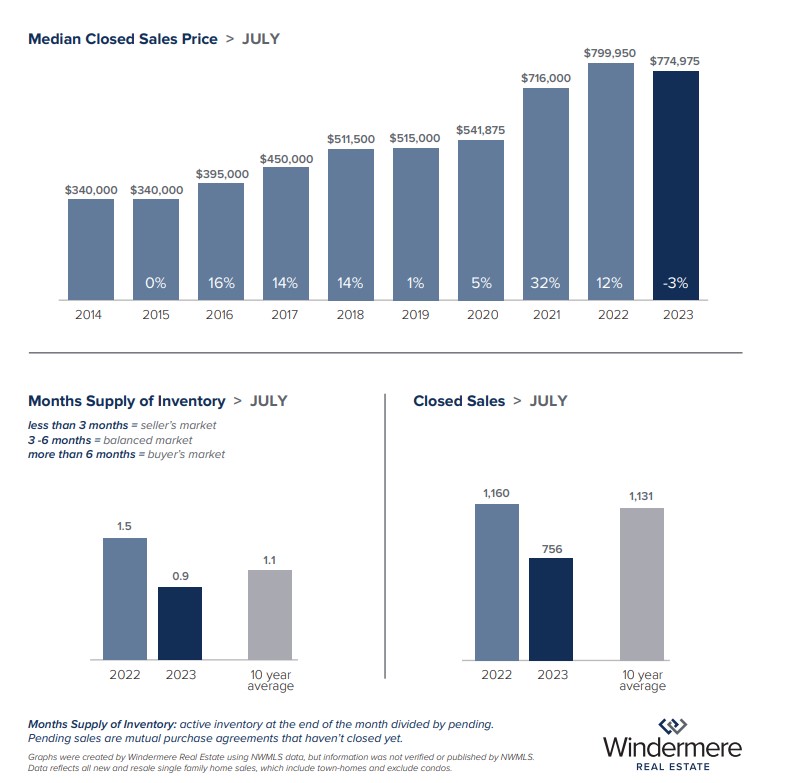

Snohomish County saw prices soften slightly last month. The median sold price for a single-family home dropped from $770,000 last July to $751,250 this July. Even with less than one month’s inventory, interest rates are slowing sales and causing prices to drop. Condo prices also dipped slightly, from $500,000 in July 2022 to $495,000 last month. The county’s condo market had only .7 months of inventory, but this supply squeeze couldn’t completely counter high interest rates when it came to the impact on sold prices.

Looking ahead, it’s clear that now more than ever, sellers and buyers need to tether their real estate interests to a knowledgeable broker who will help them navigate these fluctuating market dynamics. If you have questions about what current market conditions mean for you, reach out to your Windermere broker.

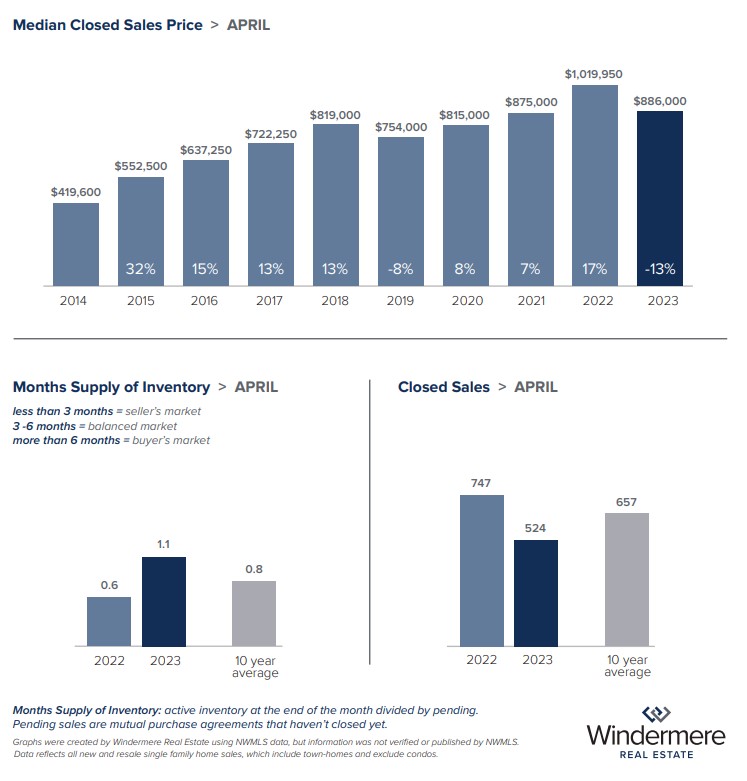

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Hot Summer Reads

Welcome to the WBC Book Club, where your favorite Admins & Agents share our favorite books of the moment! From fictional adventures to inspiring true stories, you can find it all right here on the WBC blog. You may notice that the format of our book recs look a little different than most, but that’s because our team loves to stand out and provide an unparalleled experience in all aspects of our business. We hope you enjoy this summer edition of Literary Listings!

Malibu Rising by Taylor Jenkins Reid

Marketing Remarks: Embrace the easy-going vibe of the Southern California coast without sacrificing ultimate luxury. With a contemporary design and open concept layout, this beach house on the bluff is perfect for entertaining. This property is best known for being the site of the annual Riva Party, hosted by professional surfer, Nina Riva and her famous siblings. Just a few minutes’ walk to the beach, don’t miss the opportunity to call this beautiful Malibu oasis home!

Marketing Remarks: Embrace the easy-going vibe of the Southern California coast without sacrificing ultimate luxury. With a contemporary design and open concept layout, this beach house on the bluff is perfect for entertaining. This property is best known for being the site of the annual Riva Party, hosted by professional surfer, Nina Riva and her famous siblings. Just a few minutes’ walk to the beach, don’t miss the opportunity to call this beautiful Malibu oasis home!

Agent Remarks: Beautifully capturing the intricacies of family relationships and the profound effects of generational trauma, Malibu Rising tells the story of four siblings grappling with the cost of their own fame and the notoriety of their playboy father. The consequences of their choices come to a head on one summer night in 1983, where each must face uncomfortable truths that will alter the course of their lives forever. This book is the ultimate summer read, transporting you to the sunny beaches of California where you can’t help but get swept away by an intriguing cast of flawed, fiery characters.

Directions: Read the synopsis here!

Beautiful Ruins by Jess Walters

Marketing Remarks: Live la dolce vita in this remote and peaceful village on the coast! Nestled among the cliffs of Porto Vergogna, the Hotel Adequate View is an investor’s dream, a historic property that has played host to Hollywood stars and literary scions. Convert into individual units, renovate into a single-family residence or restore this pensione to its former glory – anything is possible for the right buyer.

Marketing Remarks: Live la dolce vita in this remote and peaceful village on the coast! Nestled among the cliffs of Porto Vergogna, the Hotel Adequate View is an investor’s dream, a historic property that has played host to Hollywood stars and literary scions. Convert into individual units, renovate into a single-family residence or restore this pensione to its former glory – anything is possible for the right buyer.

Agents Remarks: While Beautiful Ruins evokes visions of limoncello and vespa rides on a summer day, it shines a harsh light on the perception of women and the toxic nature of the film industry as the golden age of Hollywood begins to crumble like the ruins of Italy. This book is hauntingly beautiful, a love letter to love itself. Within these pages, we encounter love in its varied forms, from the unrequited to the toxic to the complicated, all seen through the eyes of our unlikely hero, Pasquale.

Directions: Read the synopsis here!

Book Lovers by Emily Henry

Marketing Remarks: Looking to escape the hustle and bustle of city life? This quaint little hamlet is home to Goode’s Lily Cottage, a lovely two-bedroom farmhouse with recent updates & classic charm. Just a few miles from Main Street, you can visit all the sites that inspired Dusty Fielding’s bestselling novel, Once in a Lifetime, or sit on the front porch to enjoy the picturesque landscape. This property is perfect for year-round living or for use as a vacation rental – find your happily ever after in Sunshine Falls!

Marketing Remarks: Looking to escape the hustle and bustle of city life? This quaint little hamlet is home to Goode’s Lily Cottage, a lovely two-bedroom farmhouse with recent updates & classic charm. Just a few miles from Main Street, you can visit all the sites that inspired Dusty Fielding’s bestselling novel, Once in a Lifetime, or sit on the front porch to enjoy the picturesque landscape. This property is perfect for year-round living or for use as a vacation rental – find your happily ever after in Sunshine Falls!

Agent Remarks: Book Lovers checks all the boxes for a light, summery beach read. A prickly editor and career-minded publicist butt heads until they inevitably find themselves having to work together on a new project – all while saving a local book store from financial ruin! It has all the makings of a classic Hallmark movie, but it’s intentionally cliché. This satire pokes fun at the rom-com formula without losing the heart that makes these stories so beloved. You can’t help but get drawn in by Nora and Charlie’s intense connection, especially as they both face difficult decisions as their careers and family dramas intersect.

Directions: Read the synopsis here!

We are always on the lookout for new book recommendations and would love to hear from you! Tag us on social media with your favorite beach reads and summer-time stories!

Instagram @windermerebellevuecommons

Twitter @WindermereBelle

Facebook @Bellevue Commons (Windermere)

Written by Makena Schoene

Gardner Report Q2 2023

REGIONAL ECONOMIC OVERVIEW

As discussed in the first quarter Gardner Report, job growth continues to slow. Even though Western Washington added 54,391 new jobs over the past 12 months, which represented a decent growth rate of 2.3%, the slowdown in the creation of new jobs is palpable. The regional unemployment rate in May was 3.7%, which is marginally above the 3.4% of a year ago. As we enter the summer months, I have started to ponder the economic outlook for the balance of this year as well as looking ahead to 2024. Although many are still suggesting a looming recession, I remain unconvinced. However, if enough people expect to see an economic contraction, it can become a self-fulfilling prophecy, which has happened in the past!

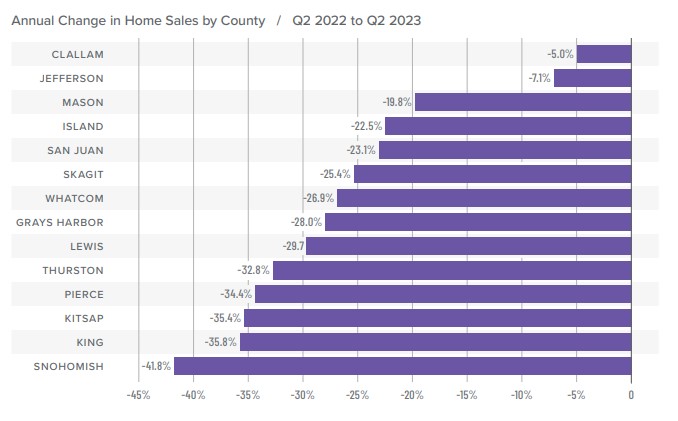

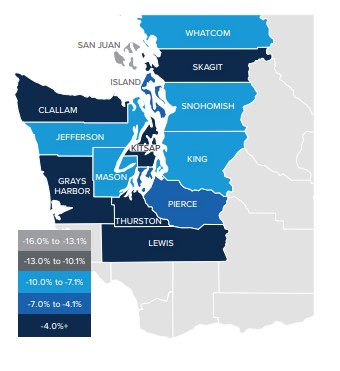

WESTERN WASHINGTON HOME SALES

❱ In the second quarter of 2023, 14,997 homes sold. This was down 34.4% from the second quarter of 2022, but up 43.8% from the first quarter of 2023.

❱ The growth in quarter-over-quarter sales was due to the 21.7% increase in the number of homes for sale. While this is positive, it should be noted that inventory levels in the quarter were still 16% lower than a year ago.

❱ Sales fell across the board compared to the same quarter in 2022 but were up in all markets compared to the first quarter of 2023.

❱ Pending sales rose in all counties compared to the first quarter of this year, suggesting that sales in the upcoming quarter may show further improvement.

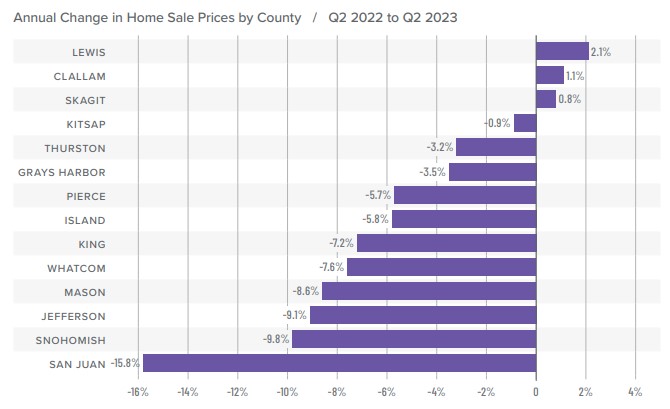

WESTERN WASHINGTON HOME PRICES

❱ Sale prices fell an average of 7.6% compared to the second quarter of 2022 but were 11.7% higher than in the first quarter of this year. The average home sale price was $773,343.

❱ Compared to the first quarter of this year, sale prices were higher in all counties except San Juan, which, as a small island county, is notorious for its extreme price swings.

❱ The year-over-year drop in sale prices was not a surprise given that the market was peaking due to rapidly rising mortgage rates. That said, prices in Lewis, Clallam, and Skagit counties exceeded those of a year ago.

❱ It was interesting to see list prices rising in all markets compared to the first quarter of the year. Even though inventory levels have risen, sellers still believe that they are in the driver’s seat.

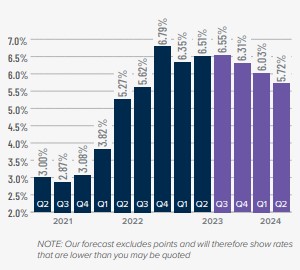

MORTGAGE RATES

Although they were less erratic than the first quarter, mortgage rates unfortunately trended higher and ended the quarter above 7%. This was due to the short debt ceiling impasse, as well as several economic datasets that suggested the U.S. economy was not slowing at the speed required by the Federal Reserve.

While the June employment report showed fewer jobs created than earlier in the year, as well as downward revisions to prior gains, inflation has not sufficiently slowed. Until it does, rates cannot start to trend consistently lower. With the economy not slowing as fast as expected, I have adjusted my forecast: Rates will hold at current levels in third quarter and then start to trend lower through the fall. Although there are sure to be occasional spikes, my model now shows the 30-year fixed rate breaking below 6% next spring.

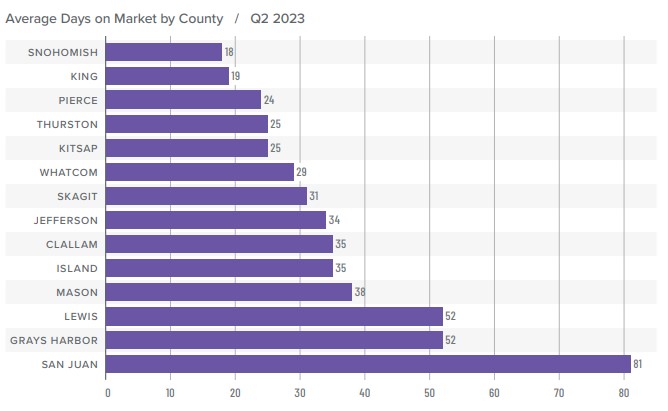

DAYS ON MARKET

❱ It took an average of 35 days for homes to sell in the second quarter. This was 20 more days than in the same quarter of 2022, but 21 fewer days compared to the first quarter of this year.

❱ Snohomish County became the tightest market in Western Washington, with homes taking an average of only 18 days to sell. Homes for sale in San Juan County took the longest time to sell at 81 days.

❱ All counties contained in this report saw average days on market rise from the same period in 2022. Market time fell across the board compared to the prior quarter.

❱ The greatest fall in days on market compared to the first quarter was in Clallam County, where market time fell 31 days. Also of note were Pierce, Thurston, and Whatcom counties, where market time fell 25 days.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The increase in listing activity, while pleasing, still leaves the market short of inventory. Even with mortgage rates well above levels we’ve seen over the past few years, demand for homes still exceeds supply. Given that over 86% of homeowners with mortgages have an interest rate below 5% and more than a quarter have a rate at or below 3%, I see little incentive for them to sell if they don’t have to. This tells me that supply levels are unlikely to improve enough to meet demand until rates drop significantly.

With this supply-demand imbalance, it’s no surprise that prices are rising again following the decline in the second half of 2022. I expect prices to rise modestly as we move through the second half of 2023. Rising list and sale prices, shorter time on market, and higher pending and closed sales all offset higher mortgage rates. Given these factors, I have moved the needle in favor of sellers.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog.

5 Tips For Small Yards

Some of the best memories are the ones created right at home. From deep conversations over yummy meals to evenings spent with loved ones under the stars, the place we choose to call home plays an important role in creating opportunities for deeper connection. With summer now in full swing, you may want to enjoy the warm weather from the comfort of your own backyard, but not every outdoor space is created equal. For some homeowners, it can be quite a challenge to capitalize on a small yard, but luckily, there are plenty of tricks to help you create an enchanting oasis to enjoy all summer long!

Define Separate Zones

Designating areas for lounge or play can go a long way in making a small yard feel larger than it is. According to the Bob Vila blog, the key to a more spacious feeling is all in the organization; by utilizing outdoor rugs, pavers or strategically placed plantings, you can create zones for dining, relaxation, and activities. These little “destinations” give the allusion of endless possibilities, even when the square footage seems constraining.

Pro Tip: Introduce a water feature to help divide zones. If space allows, a fountain or small pond not only provides a lovely visual and auditory element, but the reflection of the sky in the water produces a mirroring effect which can help make a space feel larger.

Elevate Your Space

Depending on the size and layout of your yard, incorporating levels is a great way to add some depth. Elevated decks, sunken firepits, terraced garden beds – these methods can help take advantage of topographical elements that aren’t being utilized to their full advantage, such as hillsides. Elevation changes also work to help define spaces in your small yard. Bonus!

Pro Tip: Make sure there is adequate drainage! For terraced gardens, poor drainage can lead to foundation rot and mold, so be sure to contact a professional to make sure you are using the right materials for your retaining walls and that the drainage is properly diverted.

Form & Function

Picking the right outdoor furniture is about more than just aesthetics. When working in a small yard, it is essential for pieces to pull their weight. This means that versatility is your best friend, where benches can double as storage bins and furniture can be easily folded away when not in use.

Pro Tip: Pick furniture that has a see-through pattern. Open backed chairs and glass tabletops allow the eye to travel further through the furniture, giving the allusion of more space. HGTV recommends investing in a simple bistro set of table and chairs; the slim profile and classic design are a perfect addition to any small garden.

Embrace the Curves

While straight lines and block patterns work for some yards, curves are the perfect way to maximize a small yard. Curved flower beds and winding garden paths lend a sense of movement to a seemingly static environment and can make short distances seem longer.

Pro Tip: Let’s meander! Paths that wind out of sight lend a sense of mystery, like an unexplored destination awaits just around the bend. Bonus points if you include a little visual treat at the end of the path – a little reflection pool or statue are always crowd pleasers.

Vertical Gardening

If you love plants but are short on space, then vertical gardening is the hack for you! Hanging plants draw the eye upwards without taking up valuable yard space, utilizing fences, pergolas, walls – the sky is the limit to where you can show off your plant babies. “Vertical gardening can also save on water usage”, says Carrie Spoonemore of Park Seed, “because water dripping form the top layer will also water plants below”.

Pro Tip: Many plants will thrive in a vertical garden but try to avoid perennials or vegetables with a deep root system, like tomatoes. Herbs and leafy greens, however, are great contenders for a successful vertical garden!

Bonus Tips

Water features don’t have to be big to make a splash! Invest in a small fountain that can be easily tucked away in a secluded corner or act as a centerpiece of your table.

Nothing says summer nights like gathering around a firepit under the stars. If your yard can’t support a full-sized fire pit, don’t despair! There are plenty of tabletop fireplaces alternatives that can create the cozy ambiance on a more manageable scale.

Don’t let square footage keep you from creating a summer destination right in your own backyard! There are so many tips for maximizing space in your small yard, (check out our Home Hacks board on Pinterest for even more inspiration) and we would love to hear some of yours! Just tag us on socials with your favorite #homehack and get started creating the ultimate summer getaway right at home.

Instagram @windermerebellevuecommons

Twitter @WindermereBelle

Facebook @Bellevue Commons (Windermere)

Written by Makena Schoene

Featured Image Source: NWMLS Listing Courtesy of Janine Bolivar

Local Market Update – July 2023

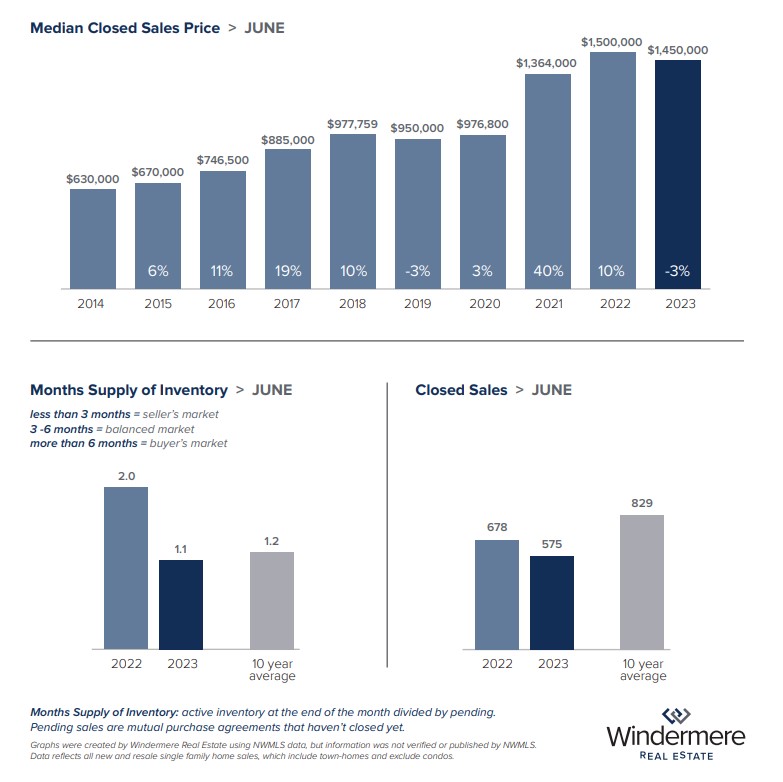

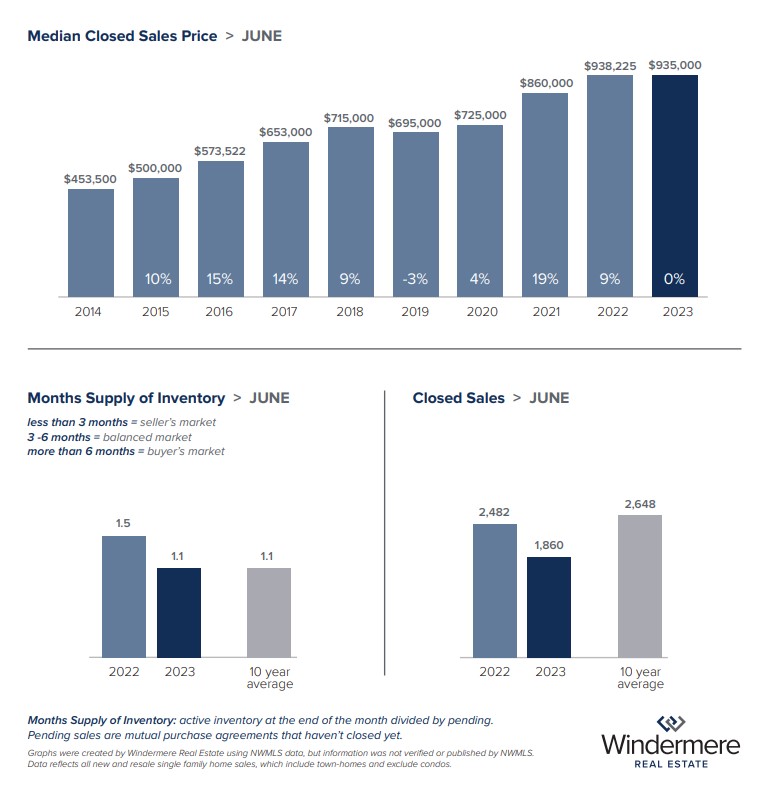

This summer’s local housing market is seeing low inventory feed higher prices, putting the squeeze on would-be buyers. June is typically the month where home prices reach their apex, and last month was no exception as King and Snohomish counties’ prices neared the peaks seen during the sugar high of the pandemic market.

Approximately 80% of recent transactions have been in the more affordable and mid-price ranges, which are nearly sold-out at the moment. Because of this, multiple offers and offers over list price were more prevalent in June’s closed home sales than at any other point this year.

Windermere’s Chief Economist Matthew Gardner addressed the inventory shortfall. “The number of homes for sale in the Central Puget Sound area in June was down 48% from the same month in 2019 (pre-pandemic),” he said. “I believe much of the reason for this is that almost 33% of in-state homeowners have mortgage rates at or below 3%, and 87% of owners have rates below 5%. There is little incentive to list your home for sale if you don’t have to.”

In King County, the median sold price for a single-family home landed at $935,000 in June. This is just a notch below the median price of $938,225 in June 2022. The scarce inventory has caused buyers to compete more aggressively and sellers to list higher, thus leading to comparable peaks as the pandemic market in summer 2022. Likewise, condos were up from $525,000 June 2022 to a median of $529,975 last month.

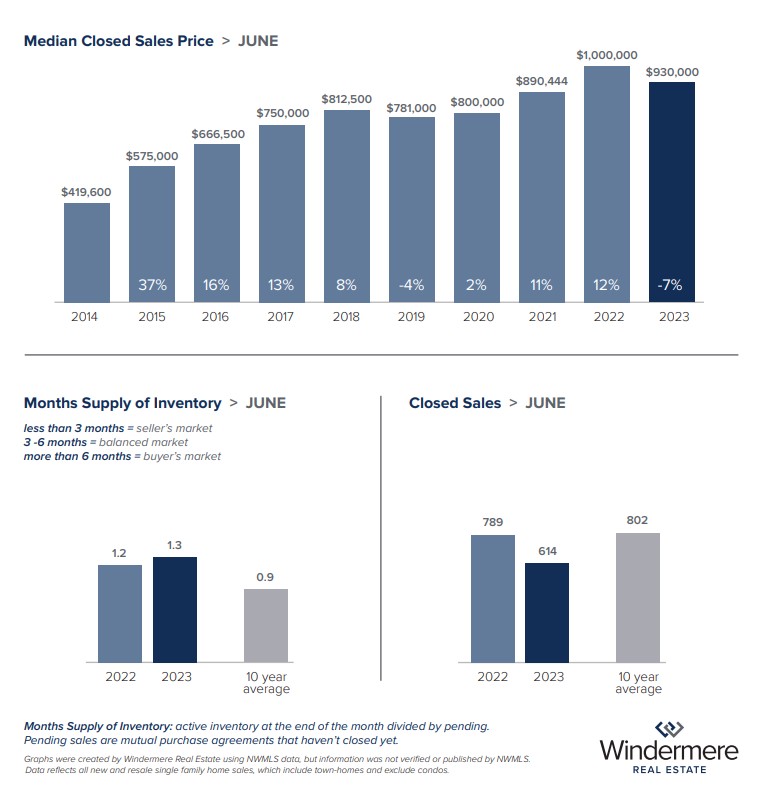

In Seattle, June’s median sold price for a single-family home was $930,000, down 7% from June 2022. Condo prices in the city were up year-over-year, with a median price of $550,000—an increase from $538,700 last June. This jump could be due in part to rising residential prices pushing some buyers into the more affordable condo market.

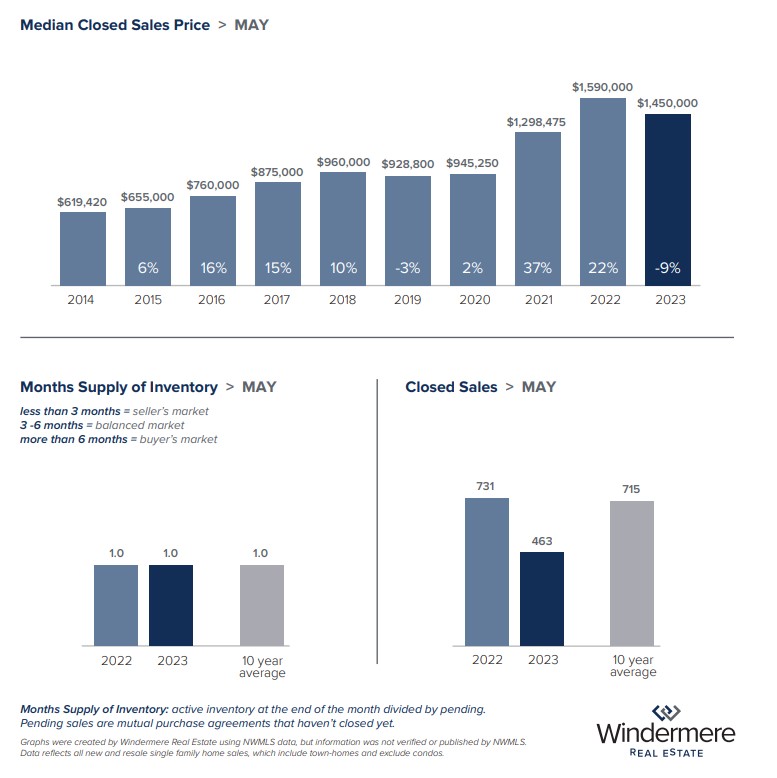

The Eastside, meanwhile, is seeing sales activity slow because of extremely limited supply. The level of new inventory coming onto the market is just 44% of the 10-year average. As a result, median prices have held strong. In June, the median sold price for an Eastside single-family home was $1,450,000, barely off last June’s mark of $1,500,000.

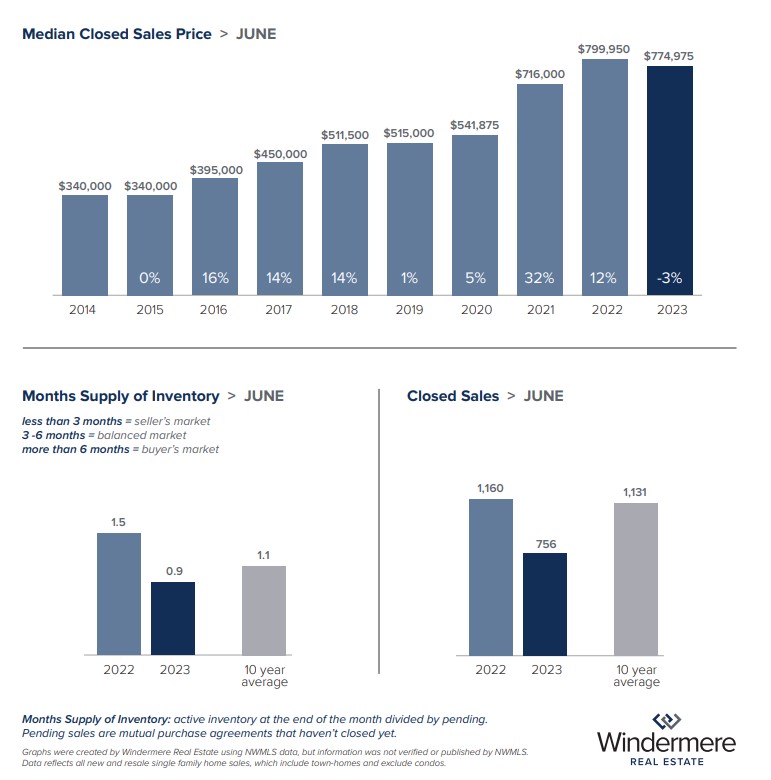

In Snohomish County, the median price for a single-family home last month was $774,975, down from $799,950 in June 2022. Condos actually saw a year-over-year price increase, from $500,000 last June to a median of $506,000 last month. The strength of Snohomish County condo prices is likely tethered to low inventory—there is just over a two week-supply of condo units in the area.

Economist Matthew Gardner notes that “Sale prices in King and Snohomish counties rose for the fifth consecutive month and are only modestly lower than a year ago. It will be interesting to see if this trend can continue given the stubbornly high mortgage rates.”

Despite the high interest rates and scant supply, buyers who are educated on the market and working with a trusted broker should be able to navigate these changing market conditions. For more information on how you can make the most of your real estate endeavors, reach out to your Windermere broker.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – June 2023

The more frenetic activity of a typical spring real estate market has certainly hit our area, with buyers out in droves looking for homes. What they’ve found, however, is high competition and scant listings. The region’s low housing inventory has been a constraint that has resulted in fewer closed sales than we’ve seen in recent spring markets.

According to real estate experts, housing supply and interest rates are the defining obstacles for buyers at the moment. On the Eastside, active inventory is only 32% of the 10-year average, and new listings are off 34% year-to-date. This is driving prices up, while interest rates put a damper on what buyers can afford. While recent demand has been strong, experts expect that demand will taper off as interest rates approach the 7% mark.

Because inventory is so scant, however, sellers who adequately price their homes are seeing success in this market. As an example, around 44% of properties on the Eastside are selling above their asking price, at an average of 5% over list. Anecdotally, the homeowners who are most likely to sell at the moment are those who purchased before the historic low interest rates of the pandemic or have paid off their homes and are thus mortgage-free. Buyers in this market have some negotiating power as well, having successfully negotiated pre-inspections, homeowner warranties and seller-paid closing costs to mitigate the high rates.

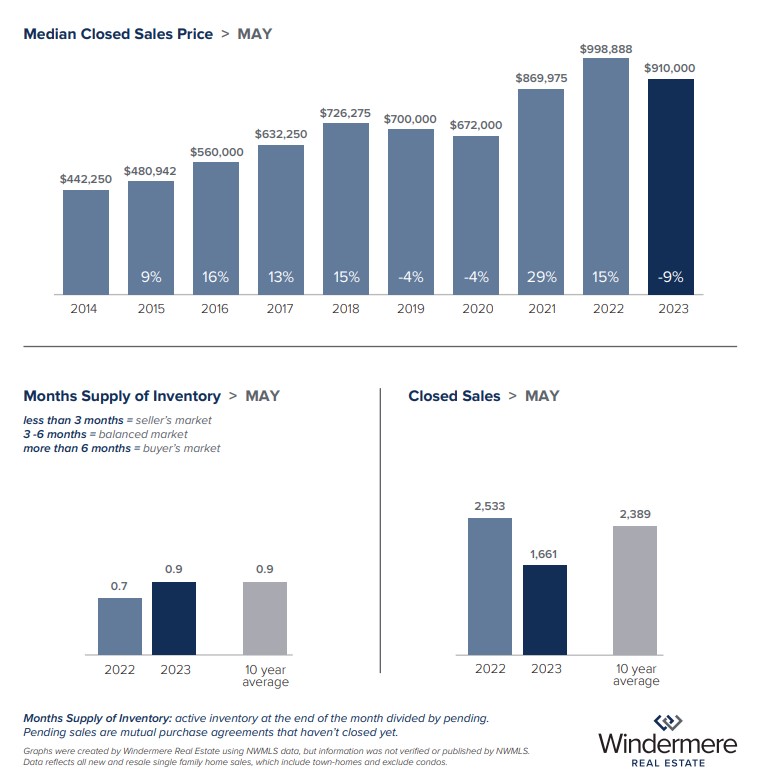

In King County, with just shy of one month’s inventory, competition in the area is fierce and buyers will need to be ready to negotiate when the right listing comes along. The county’s median sold price for a single family home dropped almost 9% year-over-year, from $998,888 in May 2022 to $910,000 this year. However, that’s still an increase from April’s median of $875,000.

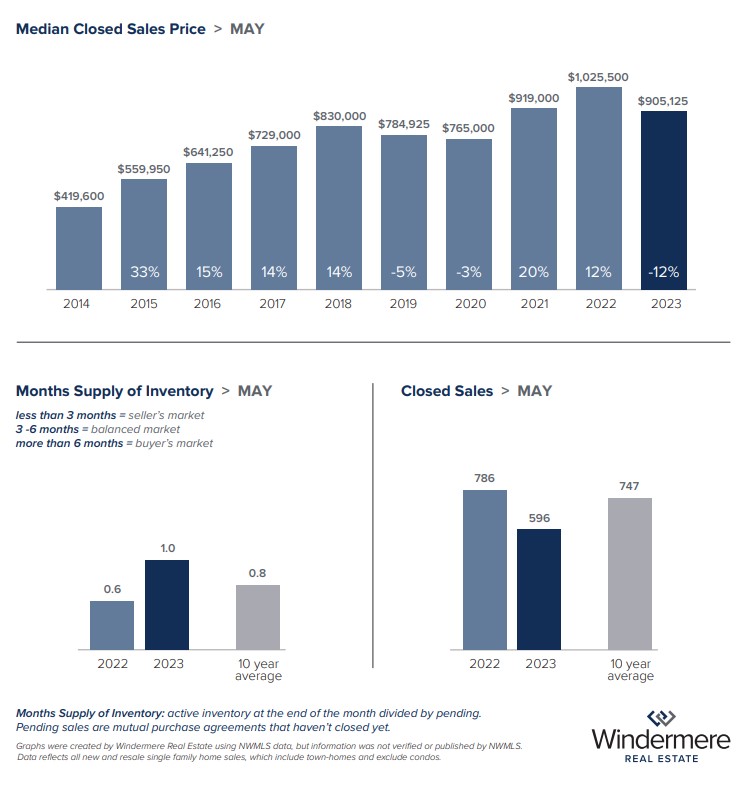

Seattle had similar low inventory, at one month’s supply. The median sold price for single-family homes rose from $886,000 in April to $905,125 last month. While there’s been continued monthly price growth so far this year, May’s median sold price was still down 11.7% from the median of $1,025,500 in May 2022. Although residential inventory is tight, buyers in the city may have more luck with condos, which are both more affordable and more plentiful at the moment. The Seattle condo market currently has almost two months of inventory, and a more reasonable median price of $550,000.

Like Seattle, the Eastside has just one month of inventory at the moment. However, higher interest rates are being felt a little more in this pricier area, as May’s median sold price for a single-family home did not change from April’s median of $1,450,000. This is down 8.8% from the median of $1,590,000 in May 2022. The supply of Eastside condos is lower than the residential supply, with just .8 month’s inventory. At a median sold price of $582,000 last month, condos may be a slightly easier path to homeownership for those searching on the Eastside.

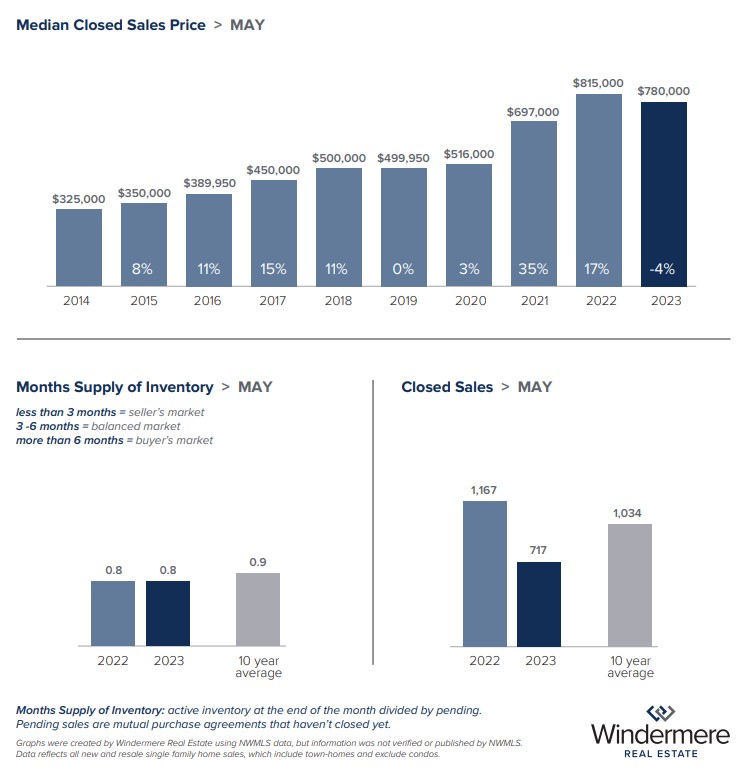

Finally, Snohomish County saw month-over-month price gains in May, landing at a median sold price of $780,000 for a single-family home, up from $767,500 in April. May’s median price was down 8% from $782,000 in May 2022. The county’s more affordable price points may allow for better appreciation in the area, despite the continued higher interest rates that have stifled other local markets. With just two weeks of inventory, the Snohomish County condo market is the tightest regional market at the moment. The median price for condos in the area is $544,900, down less than 1% from $550,000 in May 2022.

As buyers and sellers navigate continued low inventory and high interest rates, they both must be comfortable negotiating terms to achieve the best possible outcome. Buyers should be ready to move fast and bring as much cash to the table as they can, while sellers should be cognizant of the burden higher rates can create and price their listings accordingly.

If you have questions about these housing market trends or real estate in general, please reach out to your Windermere broker.

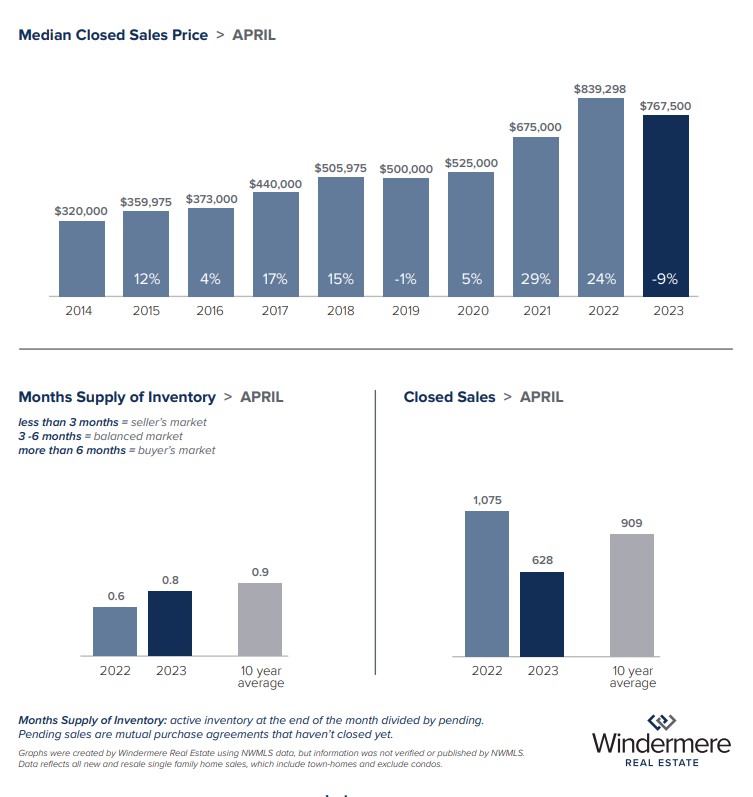

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – May 2023

As the weather warms, so too does our real estate market, it seems. With dwindling inventory and climbing prices, the housing market is on an upswing, even if it’s a small one. This places sellers back in the driver’s seat, with buyers forced to compete against multiple offers and in the face of higher interest rates than last spring.

The evidence for the market’s positive growth can be found in higher median closed sales prices, an increased percentage of multiple offers and a higher median percentage paid above the original asking price. The primary constraint on the market at this point is a lower number of active listings. Many sellers are reluctant to part with their historically low interest rates from the pandemic years, and with volatile interest rates it’s an understandable predicament.

The lower number of available homes on the market has contributed to rising prices as buyers compete for a limited pool of properties. This trend often leads to multiple offers and bidding wars, further driving up prices.

For those buyers who do decide to jump into the fray, interest rates remain a key factor in determining their buying power. For the last few months, activity in the market has ticked up when rates dip, but some buyers are willing to face higher interest rates with the plan of refinancing when rates settle.

Even with that in mind, interest rates can have a huge impact on a buyer’s price bracket. For example, the median Seattle home price has declined by about 13% ($133,950) year-over-year. However, the increase in interest rates has offset this reduction. As a result, the median monthly mortgage payment remains around $5,507, which is comparable to the payment amount from a year ago — despite a lower median sold price.

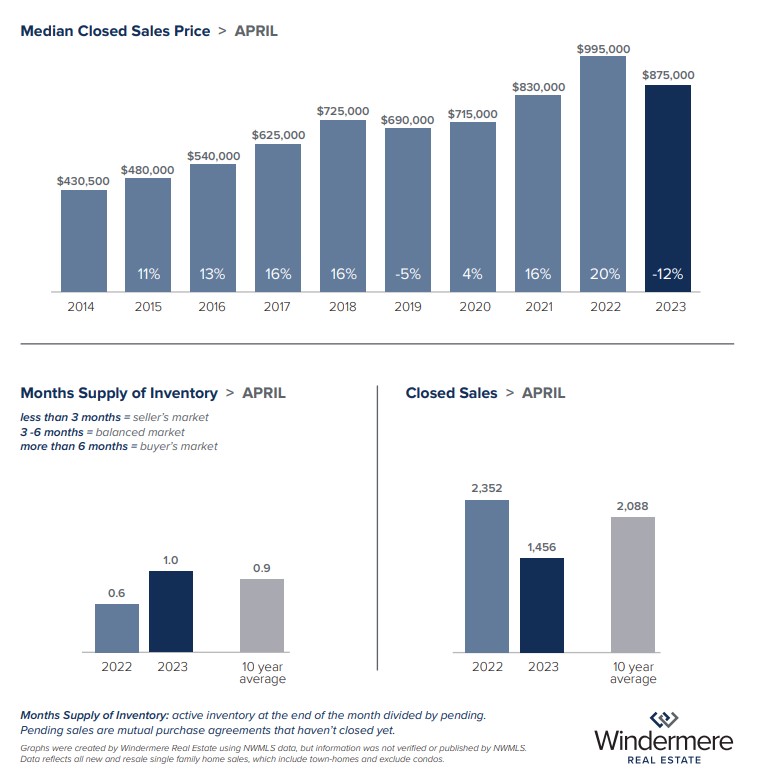

Although home prices in our region may be lower year-over-year, prices have generally been increasing each month this year. In King County, April’s median single-family home price was $875,000. That’s down 12.6% from last April’s $995,000, but up from a median of $840,000 in March. A single month of available inventory means competition for homes is tight throughout the county.

In Seattle, April’s median price for a single family home was $886,000 — down quite a bit from the same month last year, when the median price was $1,019,950. However, prices were up from a median of $869,975 in March, and low inventory of just over a month’s supply means demand is still high and prices are likely to keep inching upward. Condo prices in the city were actually up year-over-year, with a median sold price of $539,000 in April, compared to $512,500 in April 2022.

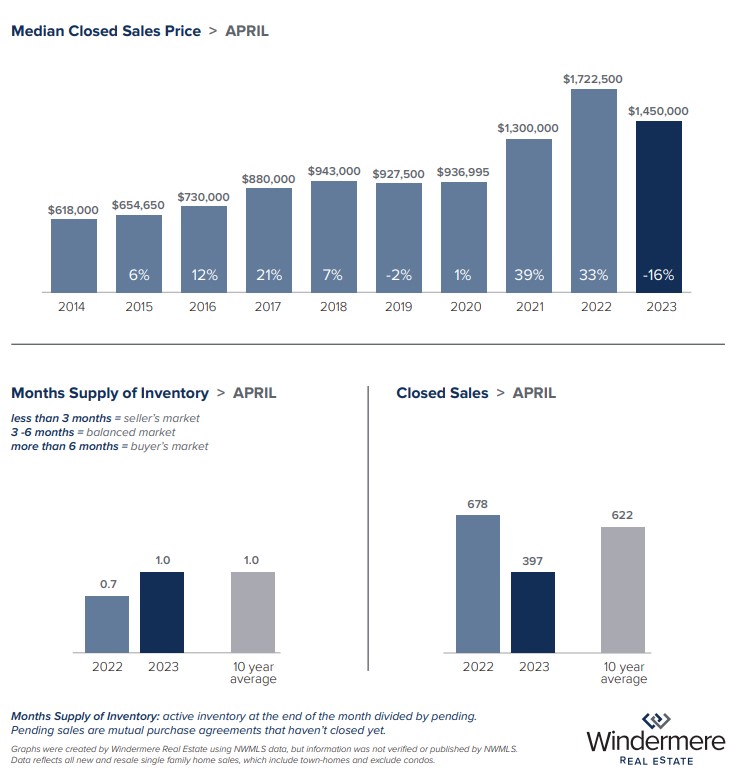

The Eastside also saw month-over-month price growth in April, with the median price for a single-family home landing at $1,450,000. This is up from $1,411,500 in March. Despite a 15% decrease in year-over-year prices, the current monthly price growth trend is notable. It’s likely we will not see the exponential price increases of the pandemic again anytime soon, making slow, steady growth the norm once again. The Eastside also has about one month of inventory for single-family homes, making it once again a competitive market.

Finally, Snohomish County saw month-over-month price growth in April as well. The median price of a single family home was $767,500, up from $724,000 in March. With less than one month of available inventory, the housing market in Snohomish County is trending warm-to-hot. Condos in the county had the tightest inventory of any market, with less than two weeks’ supply. That combined with April’s median sold price of $544,900 makes the Snohomish County condo market a competitive market for buyers to break into.

If you have questions about these housing market trends or real estate in general, please reach out to your Windermere broker.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link