How to Turn Your Home Into a Vacation Rental

So, you want to become an AirBnB host. How do go about converting your property into a vacation destination?

The hospitality industry has been hard at work to regain its foothold with stir-crazy consumers who have a whole new set of values post-Covid. The growing popularity of the short-term vacation rental is poised to redefine the nature of vacationing for years to come, thanks to increased space, flexibility, and lower average rates.

The demographic for Airbnb guests is changing as well, as Gen Z and millennials are more inclined to travel with groups of friends rather than just their immediate family. Future Airbnb owners can capitalize on this trends for unique, photogenic accommodations that hotels can’t always provide.

If you are willing to put in the hard work, your vacation rental can turn a good profit, and we’ve got a quick guide to get you started!

Laws & Logistics

Converting your home into a vacation rental isn’t as easy as listing it on a site like AirBnB. There are a lot of hoops to jump through regarding local regulations, insurance policies, market trends and HOA rules. Start your research by looking into the ordinances of the city where you are located, as municipal law can vary even within the same state.

Seattle law, for example, states that property owners are restricted to operating a maximum of 2 dwelling units as short-term rentals, whereas Bellingham only requires that short-term rental operators obtain the appropriate vacation rental permit and pay the associated fee. Paying attention to regional codes is an important first step towards turning your property into a vacation rental.

Looking into the local market is a great way to get a feel for whether or not your vacation rental has a chance to really succeed in that area. “Look for your direct competitors,” advises Alex Haler, a strategic account executive with AirDNA, “What are they doing well? Do any of them have a particular amenity or feature that is helping them outperform the others? Keep track of this group of competitors as they will aid you in setting the right price, benchmarking your performance and staying ahead of the curve.”

Reduce, Repair & Redecorate

The next step is to take care of any necessary repairs, update the furniture and install new tech if need be. Start by depersonalizing the space – as much as you love those family mementos, you are selling a space as a blank canvas for others to create their own memories.

Install smart technology to enhance connectivity for your guests and to keep an eye on your property when you can’t be there in person. Electronic locks that can be managed via the internet are a great addition, as they generate unique codes for each guest stay and make the check-in process quicker and easier.

Now is the time to take care of those pesky quirks that you have grown accustomed to, like squeaky doors or testy faucets. While some guests may not even register these issues, you are investing in your property’s longevity. By being proactive with repairs from the get-go, you save yourself stress and potentially more costly problems down the line.

When decorating, consider the aesthetic of your vacation rental and how it will complement the local vibe. What draws people to the area? Would a coastal motif fit best or would a cozy cabin vibe be more appropriate? “Think about how your guests are going to use the space, rather than simply throwing things together,” advises Nikki Kaestner, a Senior Design Associate with Vacasa.

Good design isn’t about finding matchy-matchy pieces, but creating a space that feels like a home. This can be achieved by layering pieces for a lived-in look that don’t necessarily match but blend cohesively. Make sure you invest in sturdy, quality materials (especially in high touch areas like dining rooms) that can withstand the wear and tear of multiple guests over several seasons – this includes solid wood tables and fabrics that have passed the Martindale test for performance, like Sunbrella.

Stock Up On Supplies

You’re almost ready to welcome your first guests! All that’s left is making sure all the little essentials are well-stocked. Guests are always on the lookout for amenities such as extra towels, sheets and basic toiletries. These are items that are used the most and are almost always left behind in a packing frenzy.

Invest in quality bedding, kitchen supplies and travel-size toiletries to make your vacation rental stand out from the crowd. Being an over-prepared vacation rental host by anticipating these needs can make the difference between a glowing review and an unsatisfied comment that affects future bookings.

Advice From An Agent

Don’t just take our word for it! We sat down with WBC broker, Mylo Adams, one our amazing real estate professionals for her tips on property management. “Vacation rental listing setup is the most important,” Mylo advises, “Be sure to verify your property may legally be used as a vacation rental.” This means understanding tax liability on the city, state and federal level, including excise, Business & Occupation (B&O) and capital gains tax.

Mylo’s Top Tips

– Prepare a Rules & Regulations handbook for your guests, as many condominiums allowing vacation rentals have specific rules.

– Invest in excellent professional photos. Did you know that professional photos can lead up to 20% more bookings?

– Respond to inquiries quickly (within 1 hour).

– Clean, Clean, CLEAN! Hire a professional cleaning service to make sure everything looks its best.

Its no secret that the nature of travel has changed over the last few years, creating new opportunities for homeowners to get involved in the field of hospitality and generate another revenue stream. If you think that converting your property into a short-term or vacation rental sounds like the right move, make sure you are doing as much research as possible. It’s a competitive market but creating an insta-worthy escape can pay significant dividends if done right.

Happy hosting!

Written by Makena Schoene

Featured Image Source: NWMLS Listing Courtesy of Duke Young

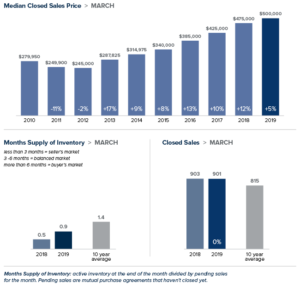

Local Market Update August 2019

The real estate market continued to moderate in July. Inventory rose and home values softened, providing buyers with increased selection and more favorable pricing. With strong job growth and interest rates holding at below 4 percent, brokers expect the market to remain solid through fall.

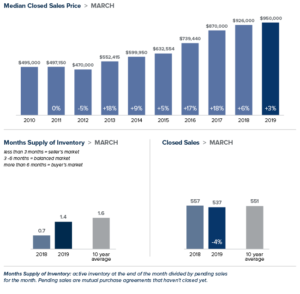

EASTSIDE

The market remains strong on the Eastside. The current tech boom continues to fuel demand, buoyed by Google’s recent plans to build out another office in Kirkland. An increase in inventory gives buyers more time to find the right home for their budget. The median price of a single-family home on the Eastside was $925,000 in July, down 2 percent from the same time last year.

KING COUNTY

Home prices in King County continued to ease. Buyers took advantage of lower prices and new inventory to boost home sales in July. The median price of a single-family home was $680,000, a 3 percent decline from the same time last year. More moderately-priced areas in the south end of the county saw continued price growth.

SEATTLE

It’s no surprise that Seattle is the top city in the country where millennials are moving. Apple plans to add 2,000 jobs in Seattle. The first of 4,500 Expedia employees will start moving into Interbay soon. While demand here is expected to stay strong, prices continue to cool. The median price of a single-family home was $755,000, down 6 percent from a year ago and a decrease of 3 percent from June. Southeast Seattle, which generally has more affordable homes, saw the median home price rise 9 percent over the same time last year.

SNOHOMISH COUNTY

Inventory remains very tight in Snohomish County. The number of listings on the market were up 6 percent over last year, and the county has only six weeks of available supply – far short of the four to six months that is considered balanced. The median price of a single-family home in July was $502,000 – up slightly from the median of $495,000 a year ago.

VIEW FULL SNOHOMISH COUNTY REPORT

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

2019 Home Buyers and Sellers Multi-Generational Trends Report

tap or click image above to read the full report

In July 2018, NAR mailed out a 129-question survey using a random sample weighted to be representative of sales on a geographic basis to 155,250 recent home buyers. The recent home buyers had to have purchased a primary residence home between July of 2017 and June of 2018. A total of 7,191 responses were received from primary residence buyers. After accounting for undeliverable questionnaires, the survey had an adjusted response rate of 4.6 percent.

According to the NAR 2019 Buyers and Sellers Multi-Generational Trends Report 56% of surveyed home buyers say the most difficult part of the home buying process was finding the right home to buy. Read the full report.

Extend the Life of Your Roof

Your roof is one of the most important and expensive assets of your home, but no other element is quite as valuable. While the average lifespan of a roof is about 15 years, careful homeowners can extend the life of their homes without enduring too many hardships. Take a look at these three quick maintenance tips to help your roof last.

Keep Your Gutters Clear

Debris that accumulates and clogs your gutters adds extra weight and pulls at your roof’s fascia, which can be a costly fix. Look down the length of your roof for any signs of sagging or bending – that’s a sure sign your gutters are carrying too much weight and pulling at your roof.

Don’t forget the downspouts either, and don’t be fooled by easy-flowing water. Moss and algae buildup on and around your roof can slowly eat away at your roofing material and severely compromise its integrity.

Focus On The Attic

The exterior of your roof isn’t the only area you should focus on as your attic is your roof’s first line of defense against damage with a two-pronged approach: insulation and ventilation.

Insulating your attic has the double benefit of keeping your home’s internal temperature consistent while also preventing vapor and moisture buildup on the underside of your roof. When combined with proper ventilation your attic can stay dry and keep your roof’s rafters safe from moisture damage.

A great way to keep properly ventilate is to add a fan or dehumidifier to the attic.

Catch Problems Early

Check on your roof regularly, an easy time to remember to check is with every change of the season, or after a significant storm. Catching small issues early on will save you money in the long run, so utilizing the services of a reliable, professional roofer is an invaluable asset. As with any working professional, it’s a good idea to establish a working relationship with a roofer and even consider scheduling a yearly checkup for your roof just to make sure there aren’t any problems sneaking up on you. After all, spending a little each year to maintain your roof is a lot better than dropping $15,000-$50,000 on a new one, right?

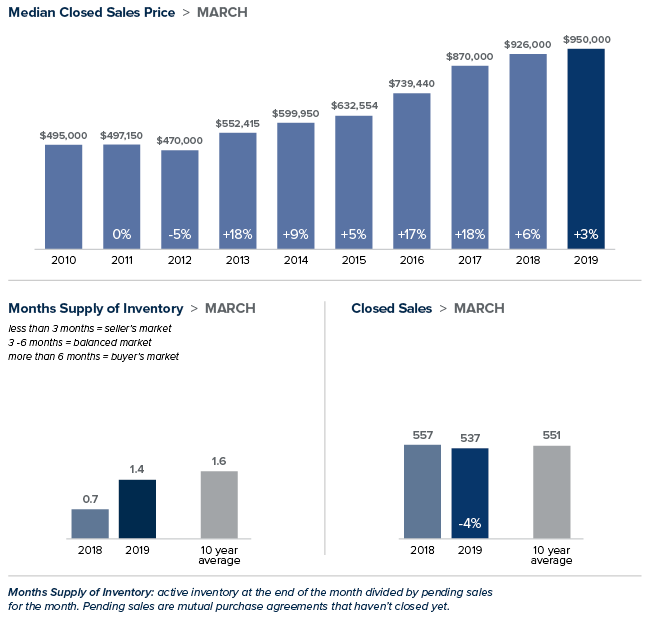

Market Update April 2019 Full Report

After months of softening, home prices began to rise in February. That trend continued in March. While prices in most areas were down from the same time last year, they increased over the prior month. New listings rose as well, offering buyers more options and more time to make the right choice. Despite the uptick in listings, inventory is still under two months of supply, far short of the three to six months that is considered balanced.

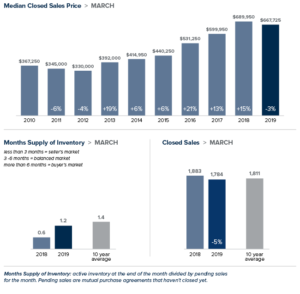

Eastside

Unlike most of King County, home prices on the Eastside grew over the prior year. The median price of a single-family home on the Eastside rose 3% to $950,000. That represents an increase of $50,000 over February. Amazon’s plans to relocate its worldwide operations team to Bellevue is expected to add thousands of employees to their Eastside campus and put even more demand on what is already tight inventory.

King County

The median price of single-family home in King County in March was $667,725. That figure was down 3% from the same time last year, but up from the $655,000 median price in February. The two areas that showed price increases year-over-year were the most expensive area in the county – the Eastside – and the least expensive – Southeast King County. The number of homes for sale was more than double that of a year ago, but still far short of enough to meet demand.

Seattle

The median price of a single-family home in Seattle hit $752,500 in March, down 8% from a year ago, but up $22,500 from February. Inventory rose 136% over last year. Despite the increase, new listings that were competitively priced saw many multiple and contingency-stripped offers.

Snohomish County

In Snohomish County, the median price of a single-family home grew 5.3% over last year to $500,000. That was an increase of $25,000 over February. A new passenger terminal at Paine Field is expected to provide a boost to the local economy and also lift demand for housing.

This post originally appeared on GetTheWReport.com.

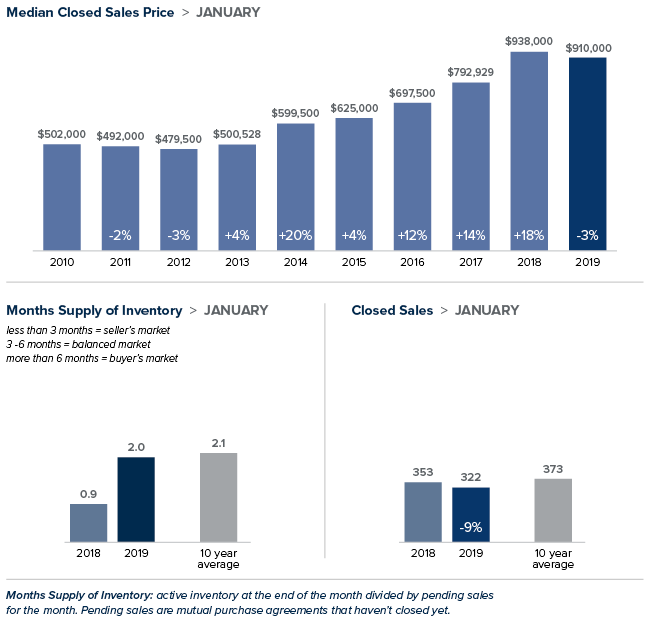

Eastside Market Update February 2019

January brought more good news for homebuyers. Prices were down, inventory was up and interest rates hovered near a nine-month low. Those factors drove more buyers into the market and resulted in an uptick in sales for the month. We’ll see how this transitioning market evolves as we head into the prime Spring home buying season.

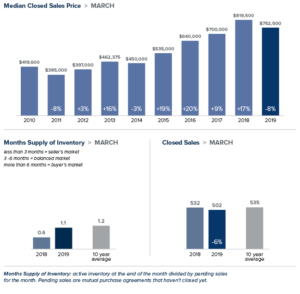

Eastside

>>>Click image to view full report.

>>>Click image to view full report.

The most expensive region in King County saw prices soften in January. The median price of a single-family home on the Eastside dropped 3 percent over last January to $910,000. It’s an excellent time for buyers to leverage the cooling market and negotiate terms that work best for their needs. Last January, 39 percent of the homes in this area sold for over asking price. This January, that figure dropped to 12 percent. With its favorable business climate and high rankings for both economic growth and technology capabilities, demand on the Eastside is projected to remain strong.

King County

>>>Click image to view full report.

>>>Click image to view full report.

January marked the first time home prices in King County decreased year-over-year in seven years. The median price of a single-family home was $610,0000, a drop of 3 percent over the prior year. Inventory more than doubled. Unlike recent months, this was due primarily to more people putting their homes on the market, as opposed to homes taking longer to sell. Despite the surge in listings there is just two months of available inventory, far short of what is needed to meet demand.

Seattle

>>>Click image to view full report.

>>>Click image to view full report.

The median price of a single-family home in the city was $711,500 in January, a decrease of 6 percent year-over-year. Despite a 107 percent increase in homes for sale compared to a year ago, Seattle continues to have the tightest inventory in King County with less than two months of supply. A booming economy that shows no signs of slowing continues to draw more people to the city. The area will have to significantly add more inventory to meet that growing demand.

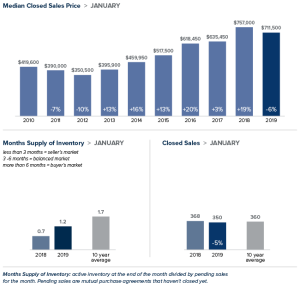

Snohomish County

>>>Click image to view full report.

>>>Click image to view full report.

The median price of a single-family home in January inched up 1 percent from last year to $455,000. That price is down from the median of $470,000 recorded in December. Snohomish County also saw a surge in inventory with the number of homes on the market double of what it was last year at this time.

This post originally appeared on the WindermereEastside.com Blog.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link