How to Price a Home Right?

Six Factors That Affect the Sales Price of Your Home

Pricing a home for sale is not nearly as simple as most people think. You can’t base the price on what the house down the street sold for. You can’t depend on tax assessments. Even automatic valuation methods (AVMs), while useful for a rough estimate of value, are unreliable for purposes of pricing a home for sale.

AVMs, like those used by Zillow and Eppraisal, have been used for many years by banks for appraisal purposes. They are derived from algorithms based on past sales. But producers of AVMs agree that they are not accurate indicators of home value. For example, Zillow.com states, “Our data sources may be incomplete or incorrect; also, we have not physically inspected a specific home. Remember, the Zestimate is a starting point and does not consider all the market intricacies that can determine the actual price a house will sell for. It is not an appraisal.”

So what does Zillow recommend sellers do instead? The same thing the real estate industry has been advising for decades: Ask a real estate agent who knows your neighborhood to provide you with a comparative market analysis. To accomplish that, I typically consider the following factors—plus others, depending on the house:

Location

The location of your home will have the biggest impact on how much it can sell for. Identical homes located just blocks apart can fetch significantly different prices based on location-specific conditions unique to each, including: traffic, freeway-access, noise, crime, sun exposure, views, parking, neighboring homes, vacant lots, foreclosures, the number of surrounding rentals, access to quality schools, parks, shops, restaurants and more.

Recommendation: Be willing to price your house for less if it’s located in a less desirable area or near a neighborhood nuisance.

Market

Another major factor that also can’t be controlled is your local housing market (which could be quite different from the national, state or city housing markets). If there are few other homes on the market in your local area (a situation known as a “sellers market”), you may be able to set a higher price. However, if there’s a surplus of homes like yours for sale (a “buyer’s market”), your pricing will also reflect that.

Recommendation: If it’s a buyer’s market and you can delay selling your home until things change, you should consider doing so. If you can’t wait, be willing to price your home extremely competitively, especially if you are in a hurry to sell.

Condition

The majority of buyers are not looking to purchase fixer-uppers, which is why any deferred maintenance and repair issues can also significantly impact the selling price of your home. When your home’s condition is different than the average condition of homes in your location, AVMs tend to produce the widest range of error.

Recommendation: Hire a professional home inspector to provide you with a full, written report of everything that needs upgrading, maintenance or repair, then work with your real estate agent to prioritize the list and decide what items are worth completing before the property is listed for sale, and what should be addressed through a lower list price. Also, some defects are best addressed during negotiations with buyers.

If you want to sell your home quickly and for the most money, you have to make it as appealing as possible to the largest pool of prospective buyers. The more universally attractive it is, the greater the interest and the faster competing offers will come.

Recommendation:

Hire a professional home stager (not a decorator) to temporarily stage the interior of your home. Also spend time making the exterior look its best: address any peeling paint, make sure the front door/ door hardware is attractive, prune bushes and trees, remove old play equipment and outdoor structures, etc.

Compare homes

The only neighboring homes that should be used to estimate the value of your home are those that have been carefully selected by a real estate professional with special training, access to all sales records, and in-depth knowledge of the neighborhood.

Recommendation: If you’re considering selling your home, ask your real estate agent to recommend a professional appraiser.

Searchability

When working with a prospective buyer, most real estate agents will search the available inventory only for the homes priced at (or less than) their client’s maximum, which is typically a round number. If you home is priced slightly above or below that amount (e.g., $510,000 or $495,000), it will appear in fewer buyer searches.

Recommendation: Be willing to adjust your selling price to maximize visibility.

Periodic price adjustments

Pricing a home isn’t a set-it-and-forget-it proposal. As with any strategy, you need to be prepared to adapt to fast-changing market conditions, new competition, a lack of offers and other outside factors.

Recommendation: After listing your house, be ready to adjust your asking price, if necessary.

Posted in Windermere Blog by Tara Sharp

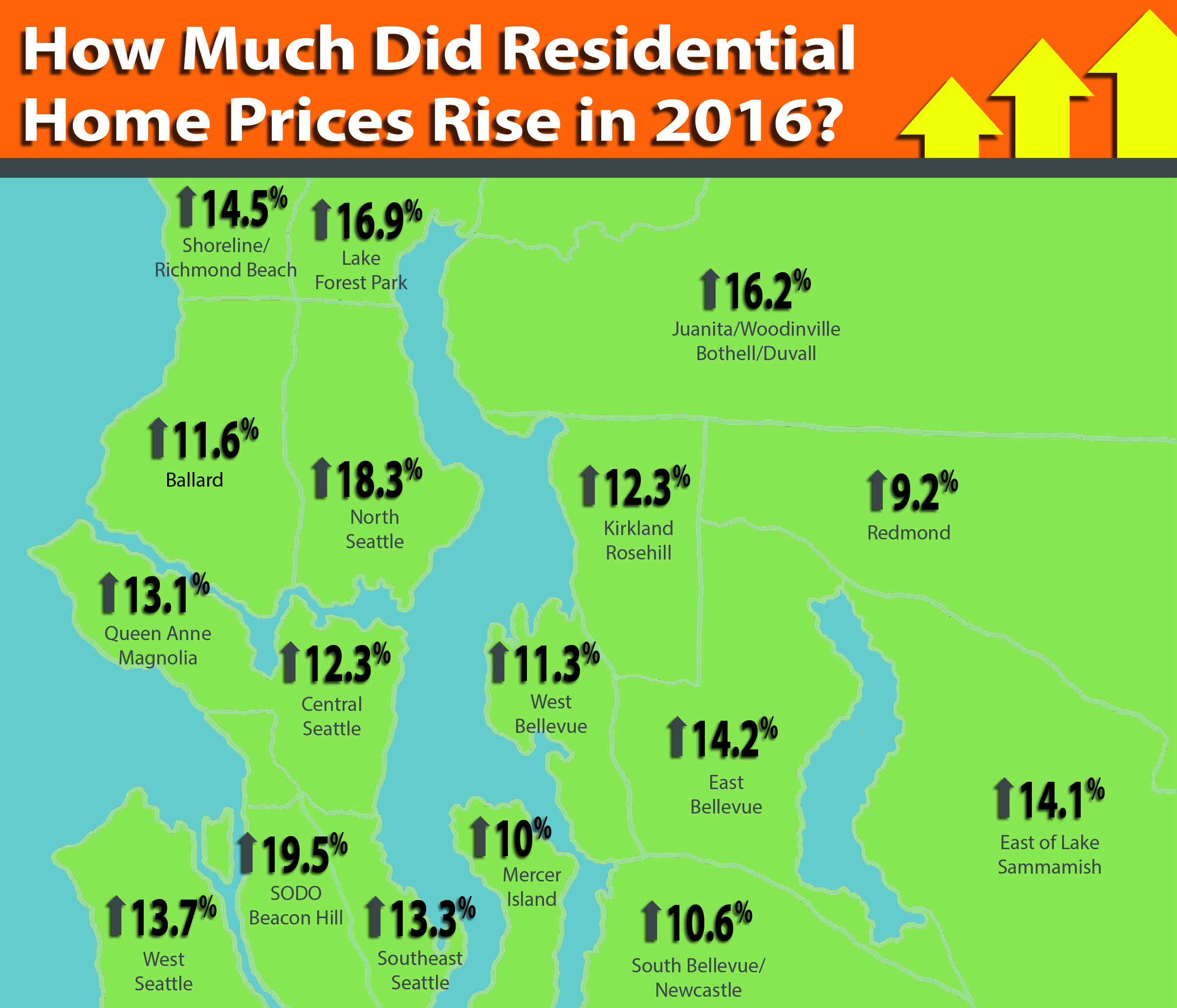

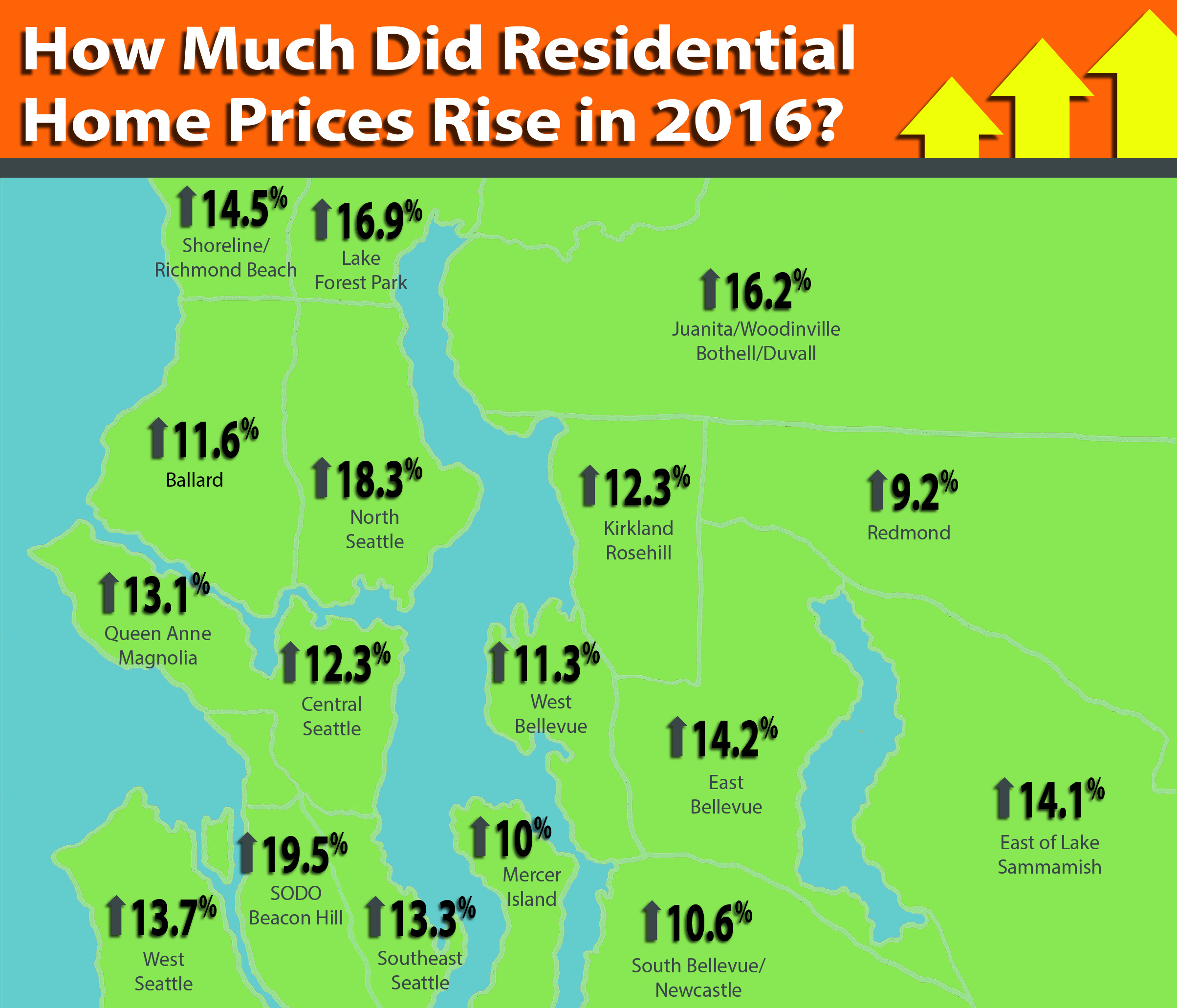

How Much Did Residential Home Prices Rise in 2016?

King County Residential Home Price-Increase in 2016

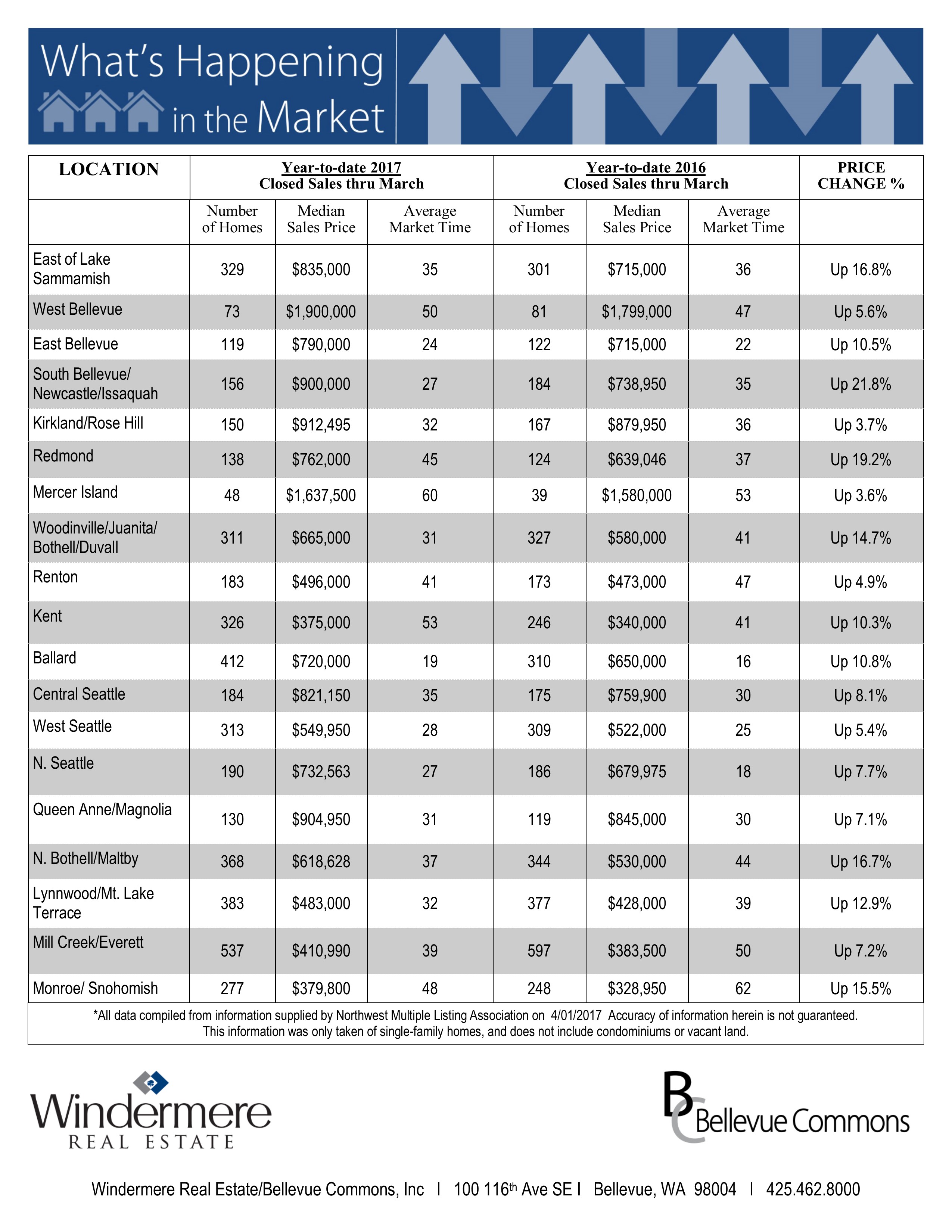

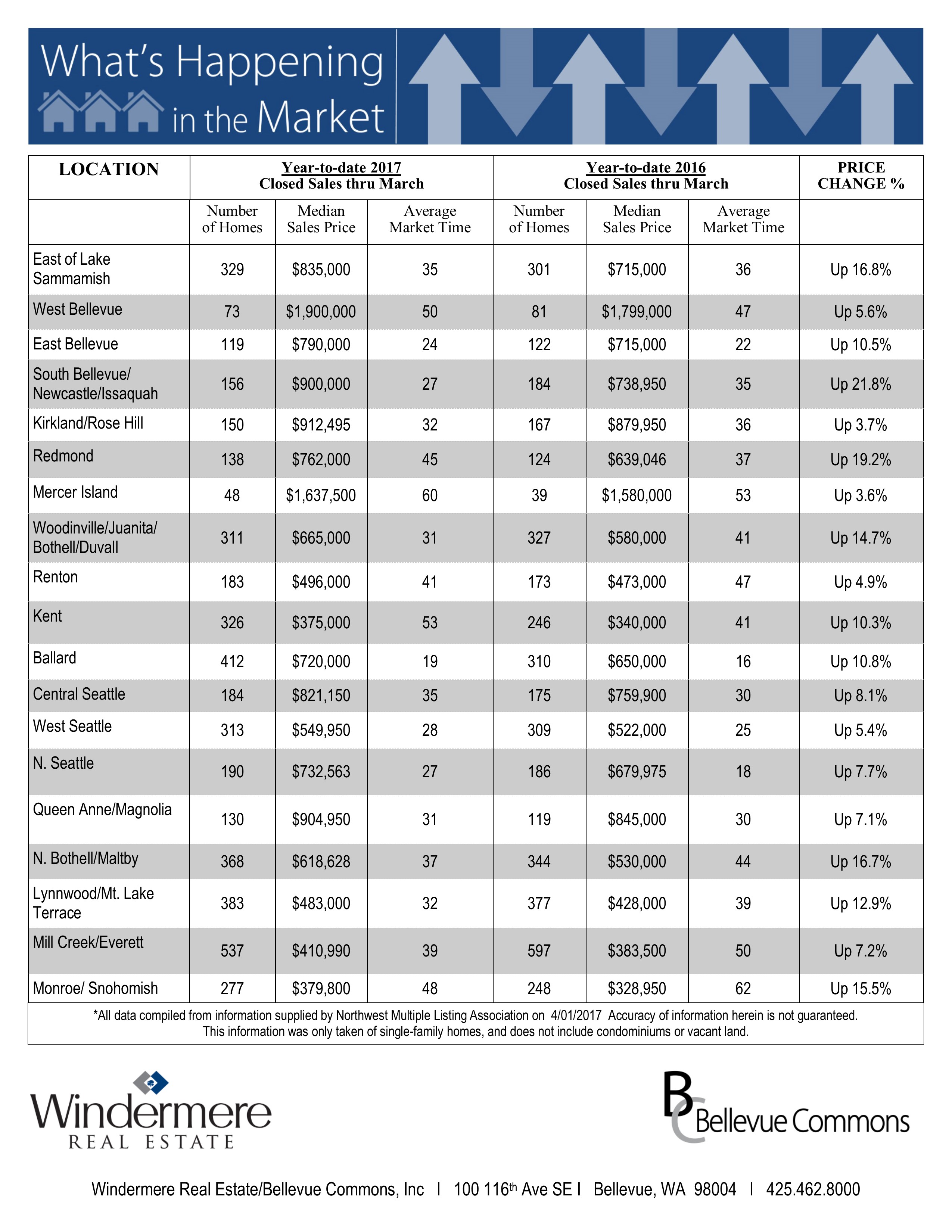

King County Residential home prices increased an average of 12.7%. Here is the list of median home price-increase in different areas.

King County Residential home prices increased an average of 12.7%. Here is the list of median home price-increase in different areas.

| Shoreline/Richmond Beach | $439,725–> $503,393 |

| Lake Forest Park | $432,250–> $505,350 |

| Ballard | $587,000–> $655,000 |

| North Seattle | $575,000–> $679,950 |

| Queen Anne/Magnolia | $780,500–> $882,500 |

| Central Seattle | $689,999–> $774,995 |

| SODO/Beacon Hill | $420,000–> $501,975 |

| West Seattle | $450,000–> $511,500 |

| Southeast Seattle | $441,500–> $500,000 |

| Kirkland/Rosehill | $801,000–> $899,500 |

| Redmond | $650,000–> $709,793 |

| West Bellevue | $1,751,000–> $1,948,000 |

| East Bellevue | $638,950–> $730,000 |

| East Lake Sammamish | $645,000–> $736,001 |

| South Bellevue/Newcastle | $713,000–> $788,888 |

| Mercer Island | $1,195,000–> $1,315,000 |

| Juanita/Woodinville/Bothell/Duvall | $525,000–> $610,000 |

All data compiled from information supplied by Northwest Multiple Listing Association on 1/01/2017 Accuracy of information herein is not guaranteed.

This information was only taken of single-family homes, and does not include condominiums or vacant land.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link