Local Market Update – July 2025

Housing inventory across the Puget Sound climbed again in June, marking another month of double-digit year-over-year growth in active listings. While more homes on the market offer buyers greater selection, the uptick in demand hasn’t yet caught up to the surge in supply. In all four of our local markets, conditions continue to shift in buyers’ favor. Compared to May, signs of buyer movement improved slightly – but overall, many remain hesitant, especially as interest rates hover near 7%.

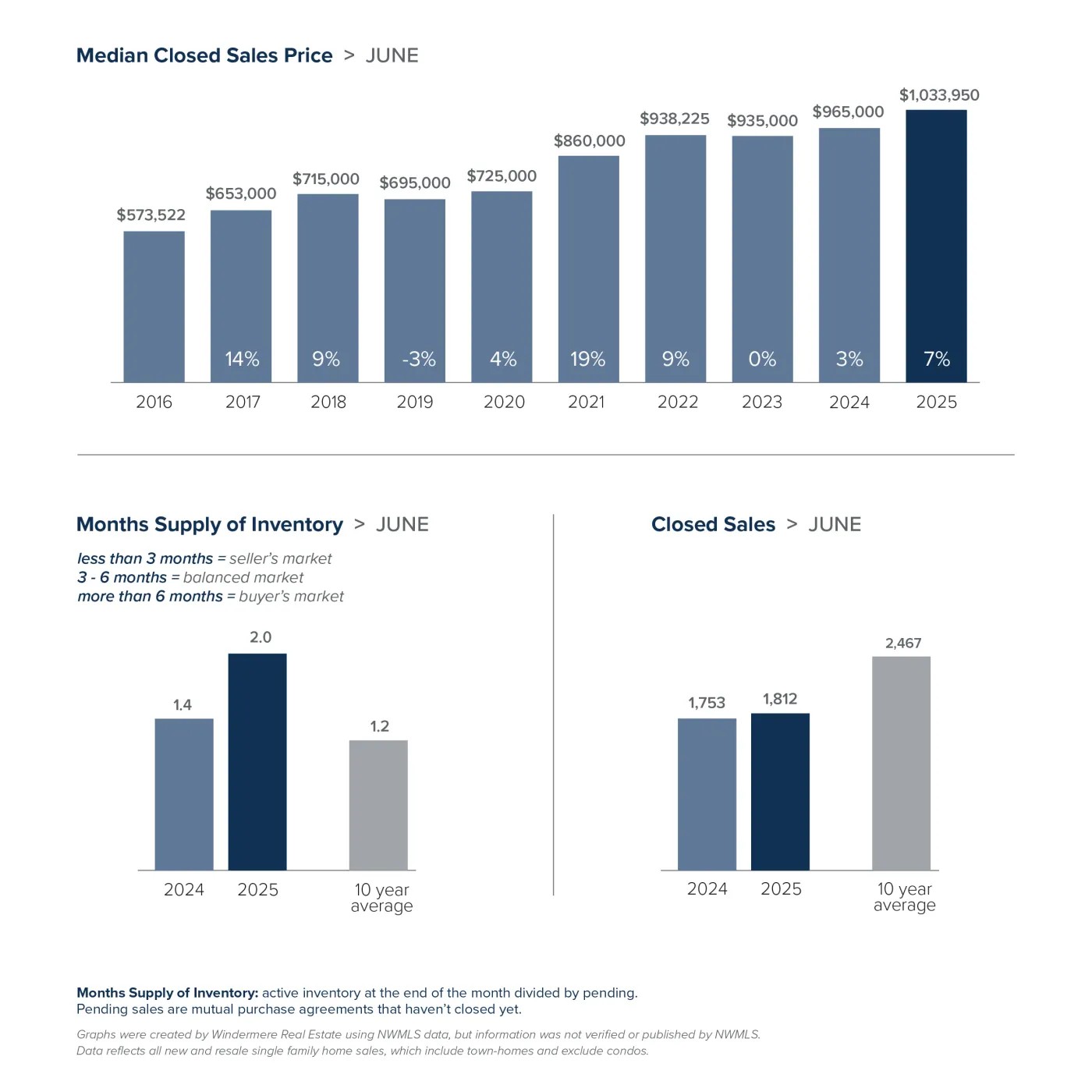

In King County, the median sold price for residential homes rose 7% in June, reaching $1,033,950. Buyer activity gained modest ground, with pending sales up 4% and closed sales rising 3%. Even so, inventory continued its upward climb – active listings increased 50% compared to last year. The condo market showed similar momentum, with a 4% bump in the median price to $576,000 and a 41% gain in active listings.

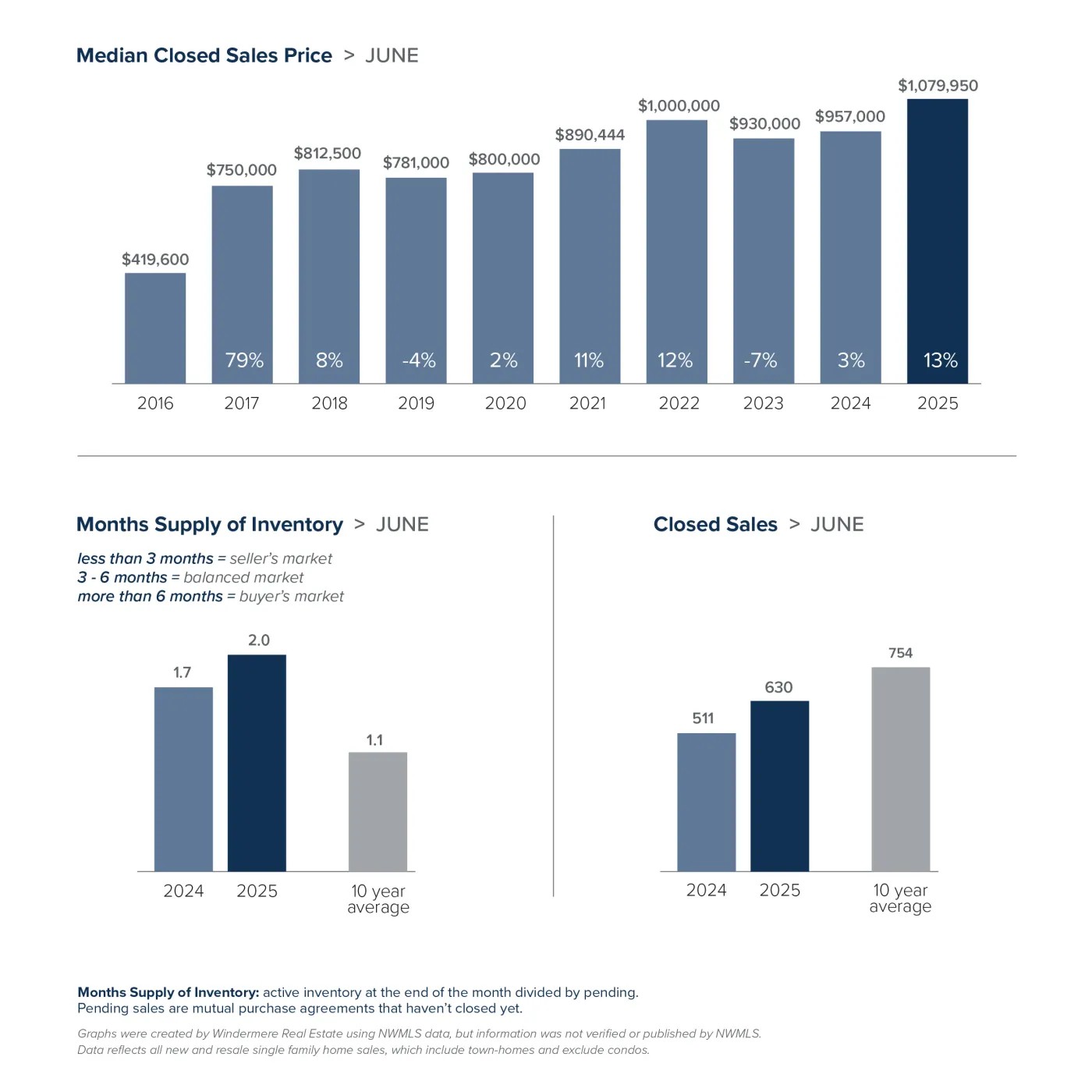

Seattle’s housing market was the most active last month. The median residential sold price jumped 13% year over year to $1,079,950, as demand remained strong despite a 35% increase in listings. Homes moved quickly – 86% sold within 30 days – and competition stayed high, with 39% of properties selling above asking. Pending sales climbed 16%, and closed sales were up 23%. The city’s condo market also gained ground, with median prices up 7% to $589,000 and listings increasing 26%.

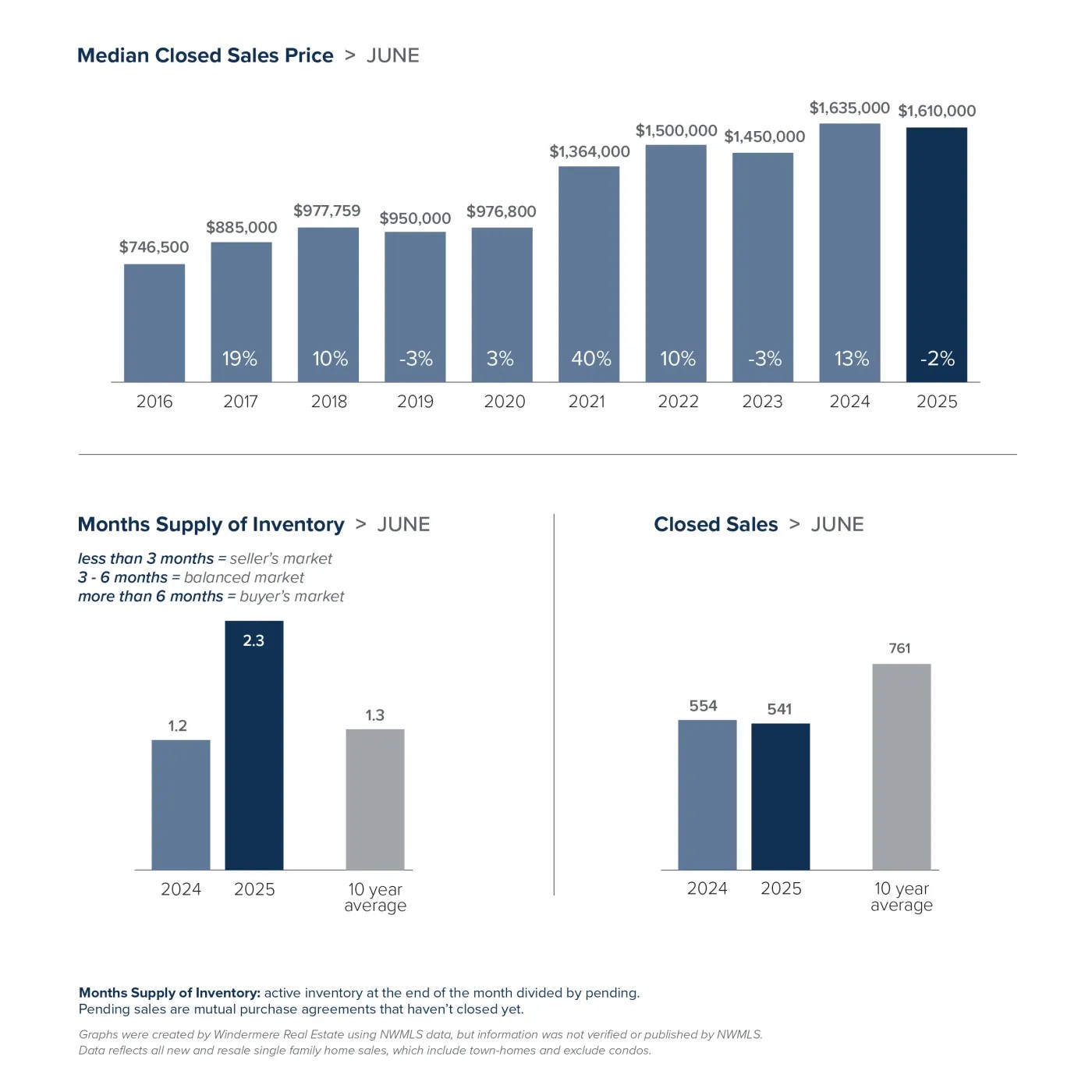

The Eastside continues to feel the weight of rising inventory. Active listings jumped 92% compared to last June, giving buyers more leverage. As a result, the median price for a single-family home dipped 2% to $1,610,000. Closed sales also slipped 2%. Notably, over half of June’s homes sold below list price or after a price reduction – an indication that negotiations are playing a bigger role. However, the condo market told a different story: prices rose 22% to $780,000, while listings increased 91%.

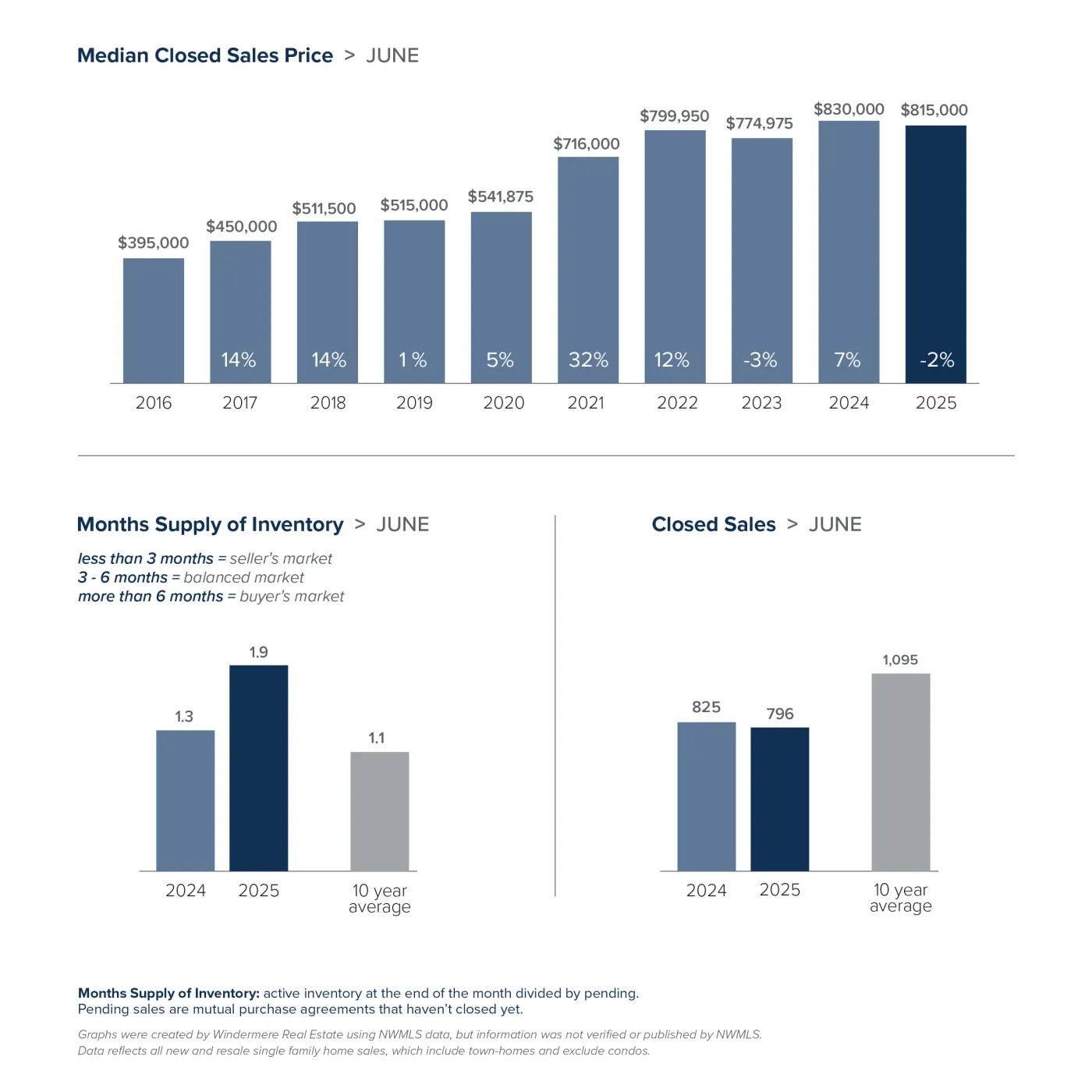

In Snohomish County, a more balanced market began to take shape. Inventory rose 45% from June 2024, while the median single-family home price declined 2% to $815,000 – the first year-over-year price dip of 2025. Increased competition among sellers likely contributed to nearly half of homes selling below list price or after a price adjustment. Closed sales rose 5%. Meanwhile, the condo segment surged: median prices climbed 13% to $600,000, and active listings soared 81%.

Across the region, inventory continues to build as buyers weigh their options amid affordability concerns and high mortgage rates. Whether these dynamics persist – or give way to renewed buyer confidence – remains to be seen. In a shifting real estate environment like this, having an experienced Windermere advisor by your side can make all the difference.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – June 2025

May brought a continued surge in housing inventory across the Puget Sound, with active listings reaching their highest levels since 2018. While buyer activity showed some seasonal momentum, it continued to lag behind the influx of new listings, suggesting that many buyers are staying on the sidelines as interest rates hover near 7%. Still, early signs of price stabilization and greater selection suggest new opportunities could be emerging. Whether the market continues this trajectory remains an open question in the months ahead.

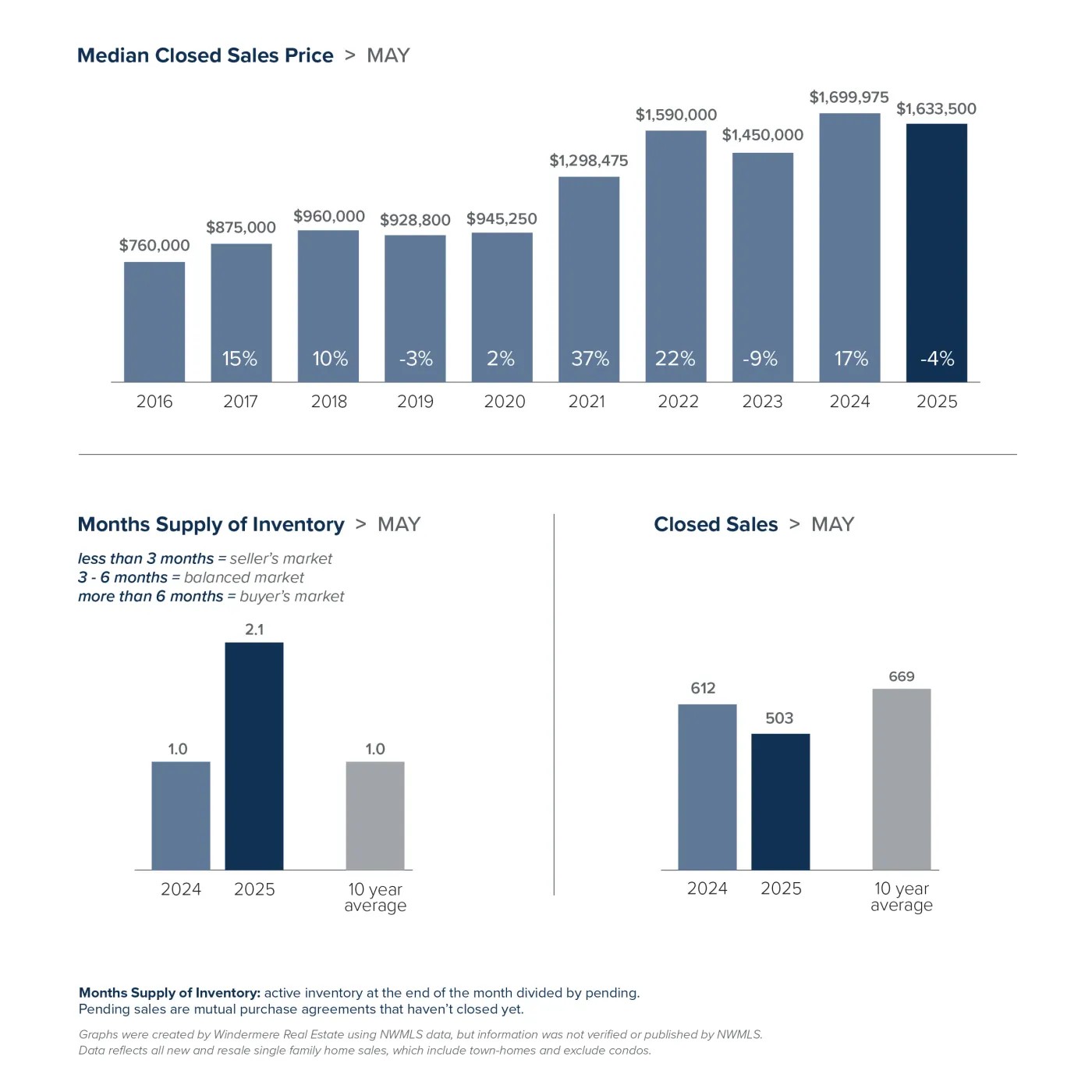

Last month, the Eastside saw a year-over-year drop of 4% in the median residential sold price, settling at $1,633,500. Inventory more than doubled, rising 103%, but demand didn’t keep pace. Pending sales dipped 4%, and closed sales fell 18%. Still, homes moved quickly – 88% sold within 30 days or less. The area’s median condo price declined 3% to $728,400, and active listings jumped 129%.

King County home prices dipped 1% compared to last May, falling to a median of $989,000. Active listings surged 58%, continuing several months of strong inventory growth. But buyers remained cautious – pending sales declined 1%, and closed sales fell 14%. In King County’s condo market, the median price dropped 4% to $569,900, while active condo listings rose 57%.

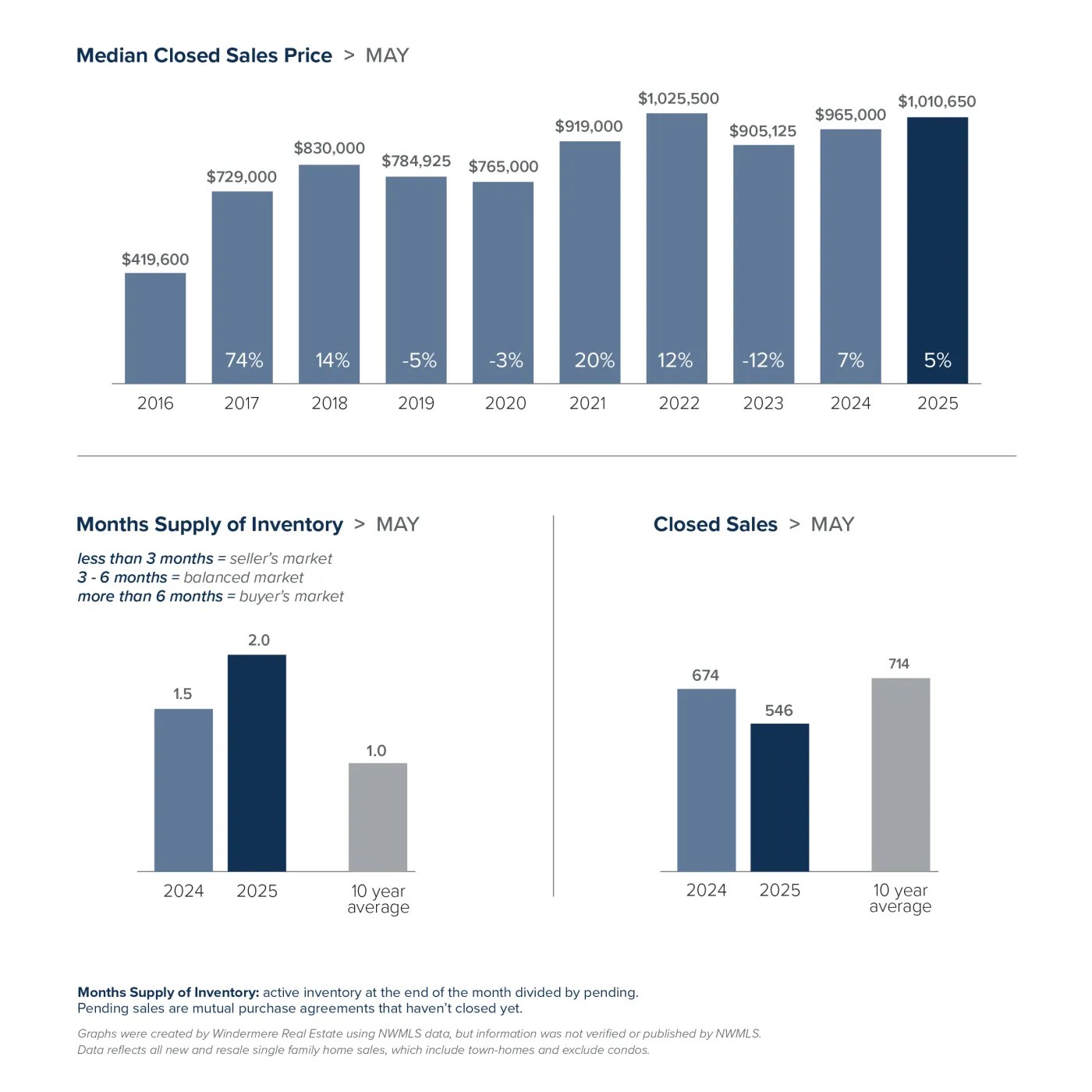

May’s median sold price for a single-family home in Seattle rose 5% year over year to $1,010,650. Active listings climbed 44%, reflecting increased seller activity. Pending residential sales increased 8%, but closed sales dropped 19%, underscoring buyer hesitancy. For the city’s condos, the median price fell 4% to $573,250, while active listings increased 37%.

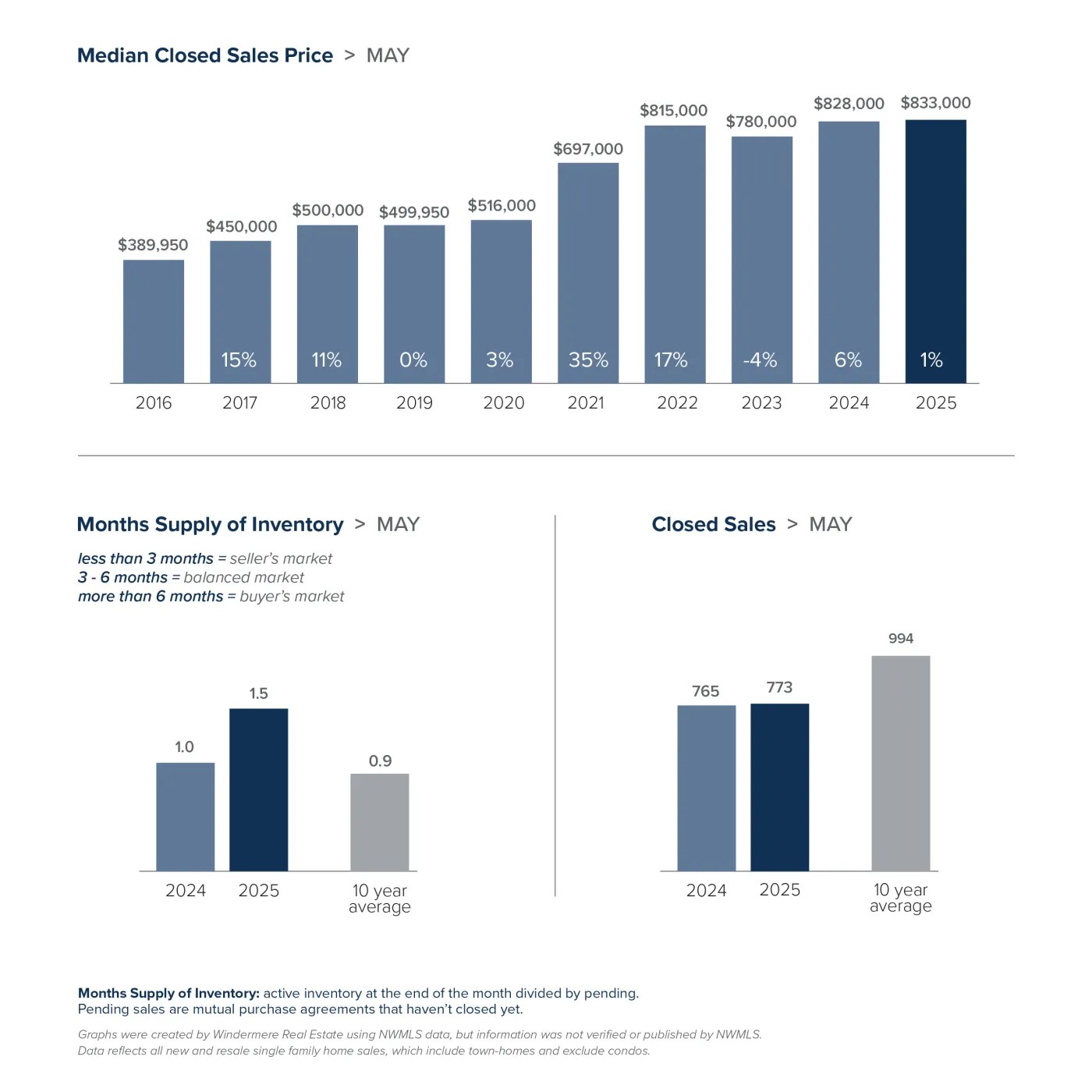

Snohomish County was the only region to post gains in both pending and closed residential sales last month, each up 1% year over year. The median residential sold price inched up 1% to $833,000. Active listings rose 54%, offering buyers more choices in a relatively affordable market – possibly a factor in the modest increase in sales activity. In the county’s condo segment, the median price fell 12% to $489,975, while active listings soared 118%.

As we head into summer, the gap between rising inventory and measured buyer demand will be a key trend to watch. Whether increased supply leads to further price softening may depend on how buyers respond to ongoing economic pressures. In a fast-moving market like this, having the right guidance is essential. Connect with a Windermere advisor today for expert insights tailored to your real estate goals.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – May 2025

Our local real estate market is seeing sellers flood the landscape with listings, but buyers aren’t diving in. Despite double-digit increases in active listings across the board, sales declined in all four regions—possibly signaling buyer caution amid ongoing national economic uncertainty. This complete 180 in supply and demand compared to last year’s intensely competitive market is already impacting price growth—but by how much, and for how long, remain key questions in the months ahead.

King County home prices rose 5% year over year, bringing the median to $1,030,000 in April. Active listings surged 70%, significantly boosting inventory. Buyer activity, however, slowed: pending sales dropped 9% and closed sales fell 2%. Still, 67% of homes sold at or above list price, showing that well-priced listings continue to attract competition. King County condo prices held steady at a median of $579,950, while active condo listings rose 74%.

Seattle homebuyers remained competitive last month, with 65% of residential sales closing at or above list price—even as active listings climbed 47% from a year prior. However, pending sales fell 7%, suggesting increased caution from buyers. The median sold price for single-family homes reached $1,025,000, up 3% from 2024. Seattle condo prices were flat at $598,000, while active condo listings also rose 47%.

The median sold price for Eastside homes edged up 1% compared to last April, to $1,697,500. Even with a staggering 125% increase in active listings, demand remained strong: 92% of homes sold within 30 days, and nearly 75% closed at or above asking price. Still, pending sales dropped 15% and closed sales dipped 3%. Eastside condo prices rose 4% to a median of $754,500, while active condo listings skyrocketed by 165%.

In Snohomish County, April’s median residential sold price held steady at $799,950, virtually unchanged from last year. The share of homes selling at or above listing price fell to 65%, down from 76% last year – likely a response to the 79% jump in active listings. As inventory rose and prices plateaued, 84% of homes sold within 30 days, but the county saw a 4% drop in pending sales compared to 2024. In the condo market, the median price declined 2% and active listings soared 113%.

As we move deeper into the traditionally busy real estate season, the disconnect between supply and demand will be a key trend to watch. Buyers may remain hesitant until broader economic signals stabilize, while motivated sellers continue to drive up inventory. Whether prices hold, soften, or climb will likely depend on which side makes the next move. In a market this fluid, having a trusted real estate expert on your side makes all the difference. For guidance tailored to your goals this season, connect with your Windermere advisor today.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – April 2025

Tulips are blooming, the days are growing longer, and the housing market is showing clear signs of seasonal momentum. Inventory continued its steady rise in March, with all four markets posting double-digit year-over-year gains in new listings. Condo inventory saw especially sharp increases — a continuing trend partly driven by the growing appeal of non-traditional “condo” alternatives like townhomes, ADUs, and backyard cottages. Whether these inventory gains will ease affordability remains to be seen as interest rates, trade dynamics, and broader economic forces continue to shape the path ahead.

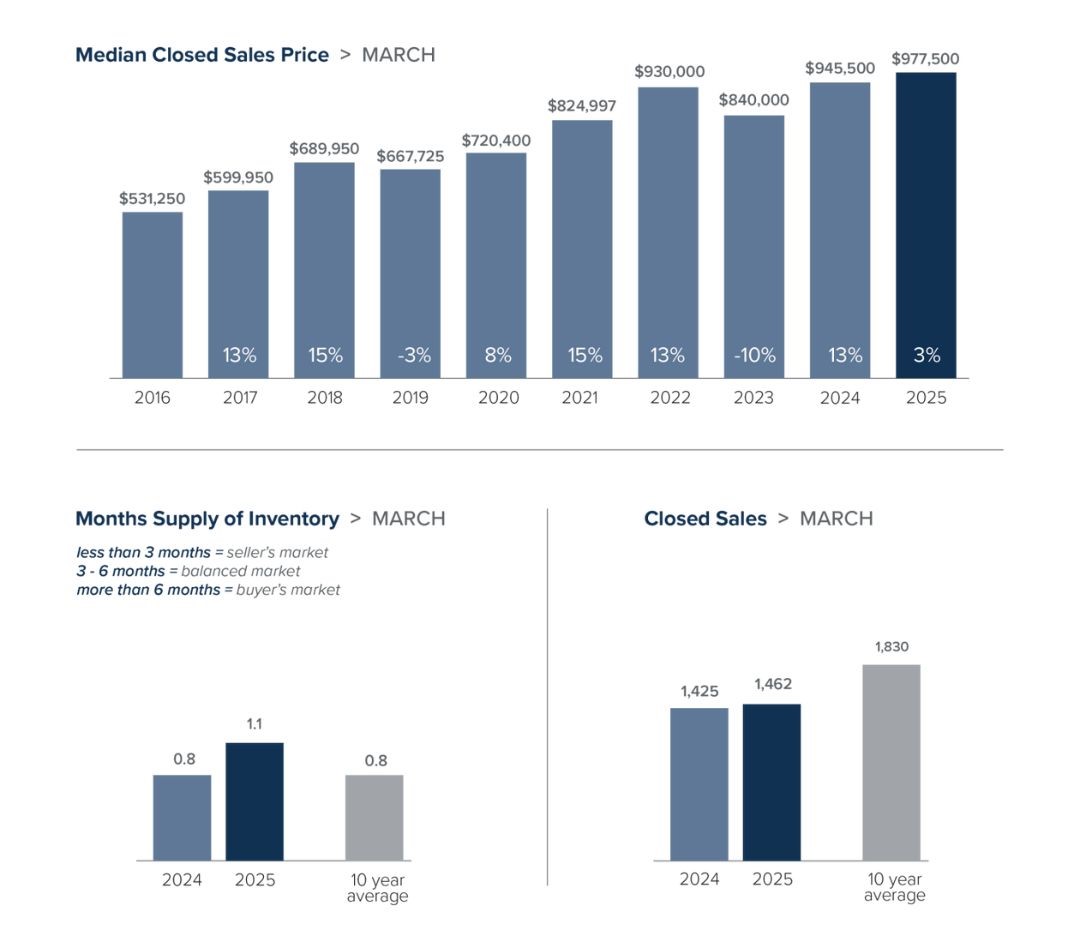

In March, King County’s median residential sold price rose 3% year over year, increasing from $945,500 to $977,500. Active residential listings jumped 50%, giving buyers a wider range of options. However, closed residential sales only grew by 3%, potentially reflecting ongoing economic uncertainties in the market. In the condo segment, the median sold price increased 9% from $540,000 to $590,000, while active listings surged 77% — signaling a notable shift in supply and buyer opportunity.

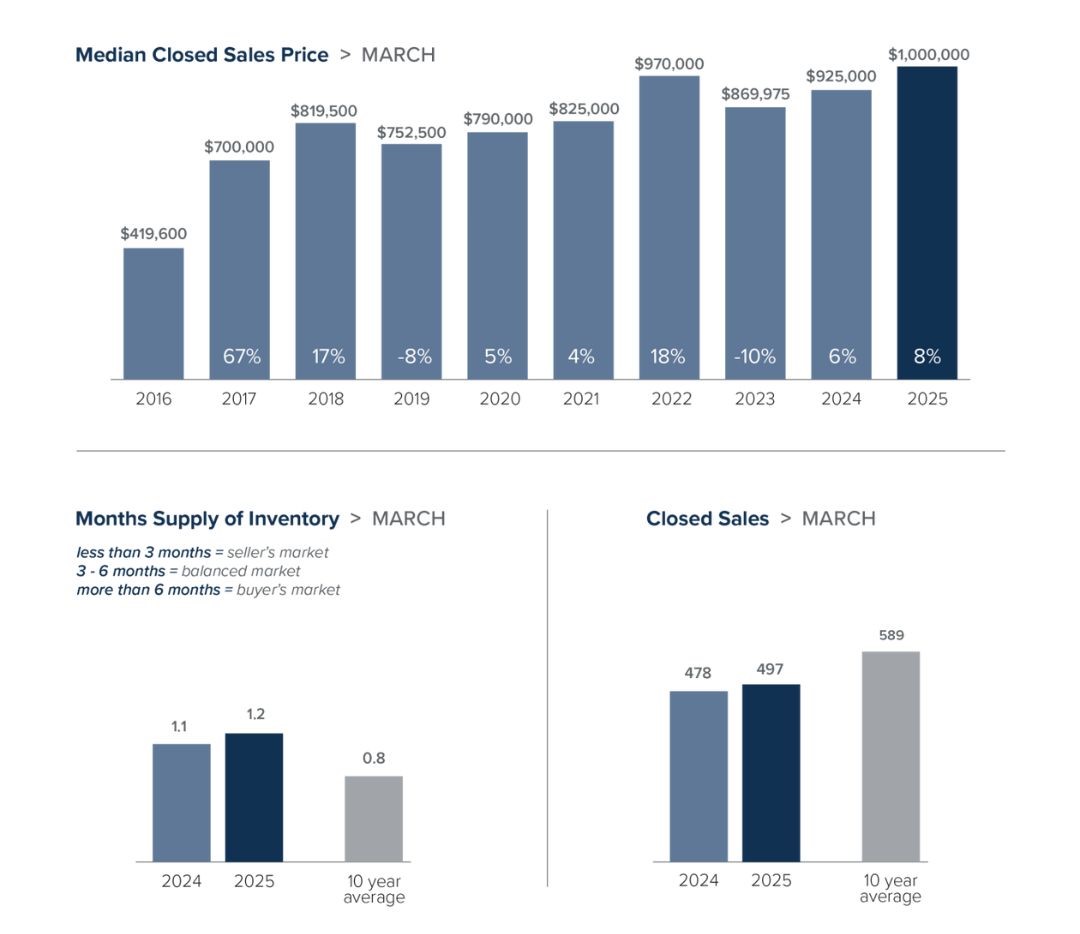

Seattle’s median residential sold price reached $1 million in March — an 8% increase from $925,000 in March of last year. Despite the rise in prices, market activity accelerated: pending sales were up 12% compared to a year prior, while active listings climbed 31%. Seattle’s condo market also gained momentum, with the median sold price increasing 7% to $627,650, up from $587,500. Active condo listings grew 55%, helping supply the high demand for more affordable options.

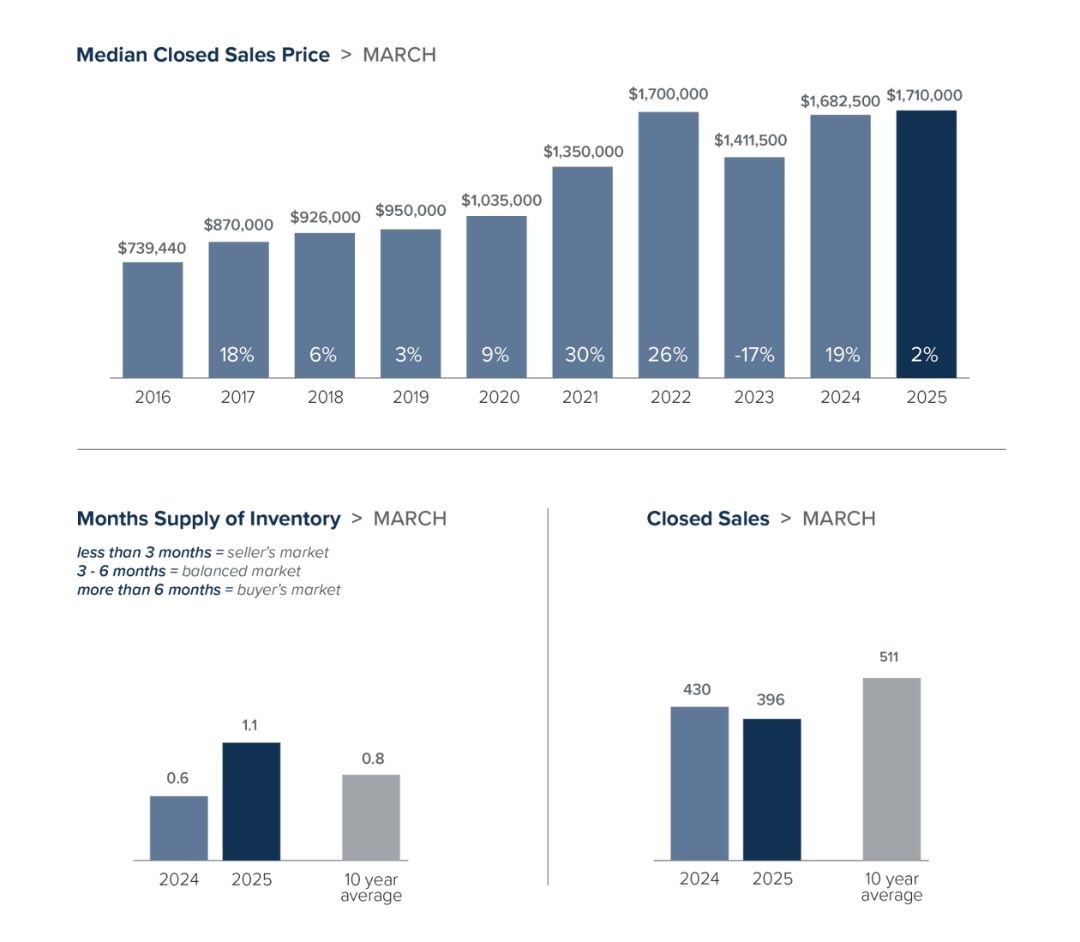

On the Eastside, the median residential sold price in March rose just 2% year over year – from $1,682,500 to $1,710,000 – a modest gain by Eastside standards. After months of steady price appreciation, affordability may be emerging as a limiting factor, with closed sales down 8% compared to March of last year. Inventory, however, continues to rise: active listings were up 86%, giving buyers more choices and potentially more negotiating power. Meanwhile, the Eastside condo market remained a standout — the median sold price rose 16% annually, and active listings were up 119%, perhaps giving buyers some relief in segment that has grown increasingly competitive.

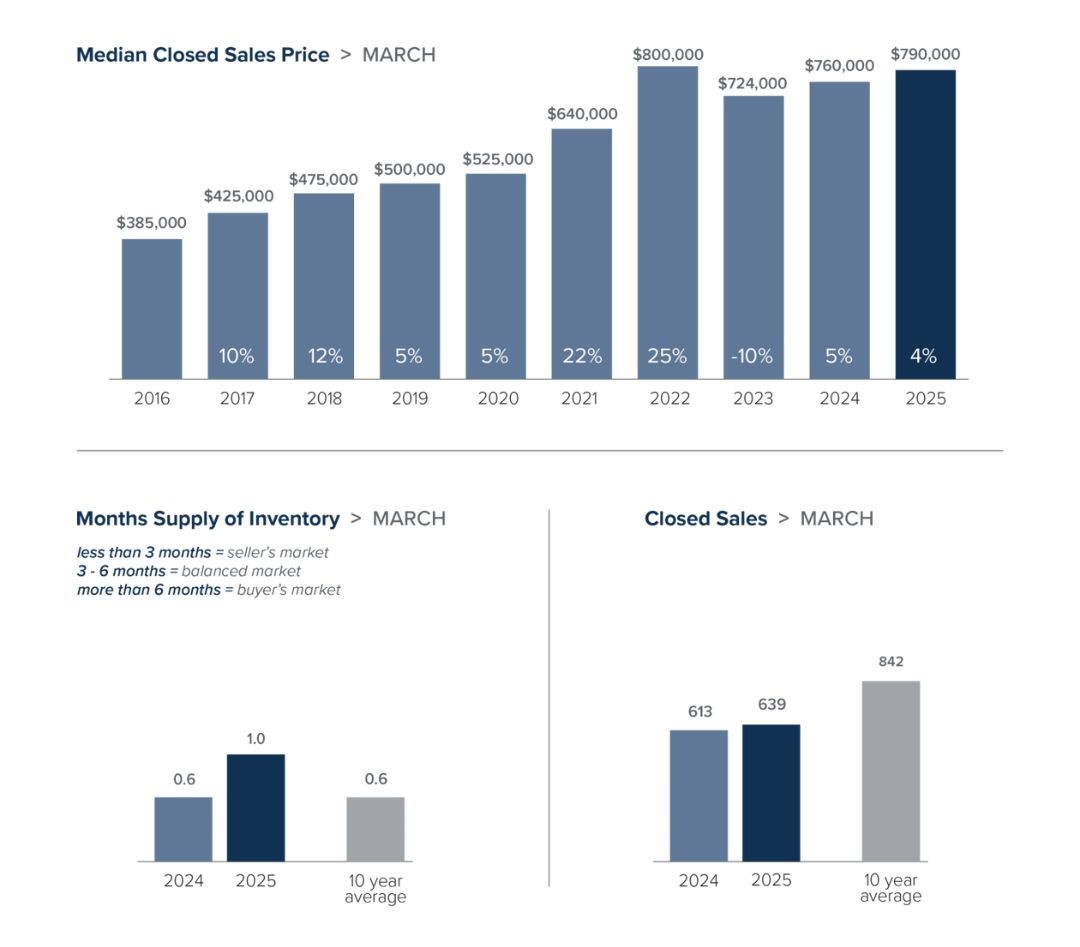

In Snohomish County, the median residential sold price rose 4% in March compared to last year, from $760,000 to $790,000. Active residential listings surged 79% year over year, offering buyers more selection in a market that is increasingly popular for its relative affordability. Closed and pending residential sales inched upwards, growing 4% and 1%, respectively. In the condo market, the median sold price rose 3%, from $515,000 to $529,994, while active listings more than doubled, jumping 104%. This influx of inventory provides welcome opportunities for first-time buyers and downsizers alike.

As the region moves deeper into spring, all eyes are on how rising inventory and renewed buyer interest will influence competition and pricing. While more listings bring opportunity, the pace of the market remains brisk — and navigating it with confidence takes up-to-the-minute insights. For expert guidance tailored to your goals, connect with your Windermere agent today.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – March 2025

February typically brings a quiet real estate market, though this year, the balance between affordability and inventory shaped activity across the Puget Sound. While 30-year mortgage rates dipped slightly from January, rising home prices remained a challenge for buyers, potentially tempering demand. Despite a significant increase in active listings compared to last year, closed sales have not kept pace – and in some areas, they’ve declined year over year. As spring approaches, the interaction between inventory and pricing will be crucial in determining market momentum.

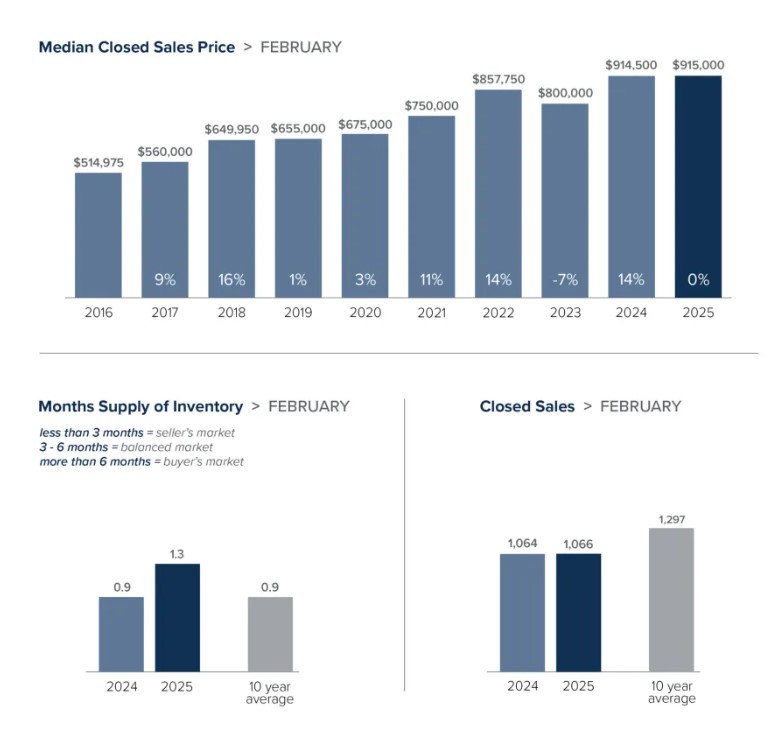

In February, King County’s median residential sold price remained relatively flat year over year, inching up from $914,500 to $915,000. However, prices rose 7% from January, indicating sustained short-term growth. Sellers seem to be preparing for the busier spring season, with active residential listings up 37% compared to last year and 9% from last month. Despite the increase in inventory, closed sales remained flat year over year – suggesting that affordability challenges may still be limiting buyer activity. In King County’s condo market, the median price rose 11% year over year to $612,500 from $550,000. Active condo listings surged 81% compared to the same time last year, following a similar trend as the residential market.

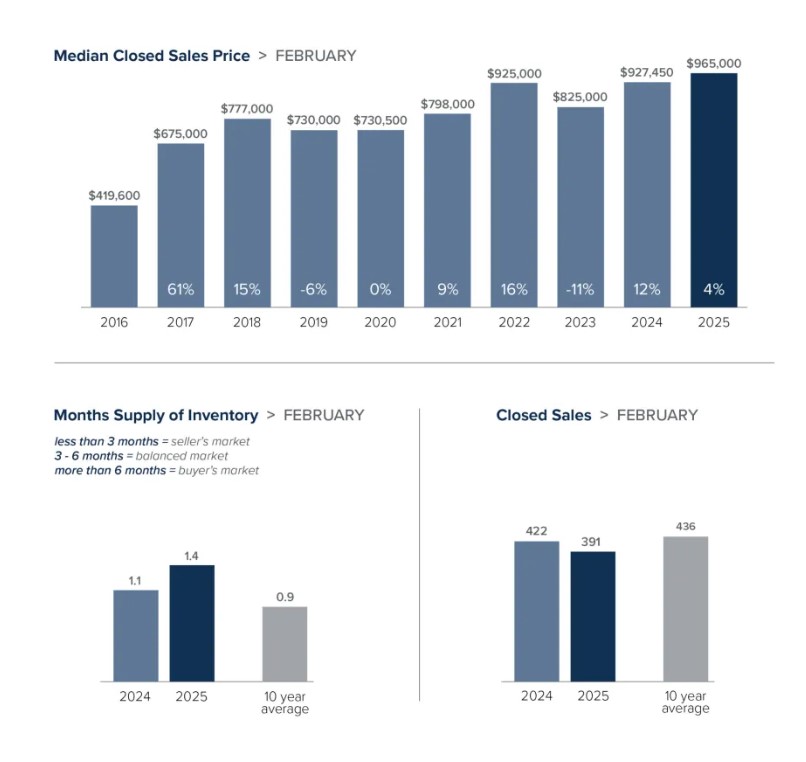

Seattle’s market showed solid price growth in February, with the median residential sold price reaching $965,000 – a 4% increase from last year and a 13% jump from January’s $927,450. Inventory grew as well, with active residential listings climbing 28% year over year and nearly 9% month over month, further boosting buyer choice. However, closed sales declined 7% from last year, hinting that rising prices may be impacting demand despite more inventory. Seattle’s condo market reflected the same trends, with the median sold price rising 12% year over year to $625,000, while active condo listings increased 55% from a year ago.

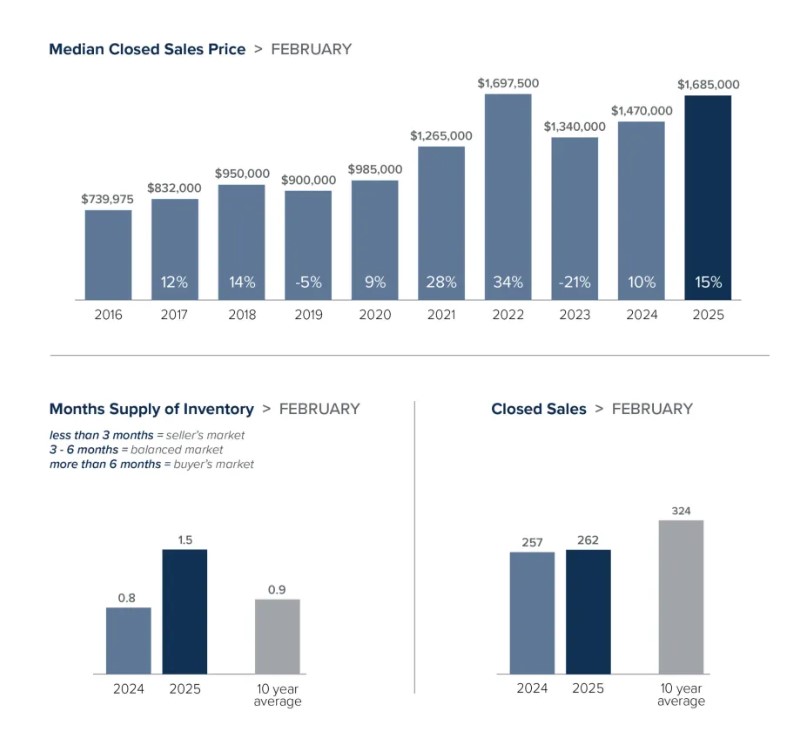

Across the Eastside, home prices continued their upward trajectory, with February’s median residential sold price hitting $1,685,000 – a 15% increase from $1,470,000 last year. Inventory levels expanded as active residential listings rose 62% year over year and 23% from January, likely due to sellers returning after the winter market slowdown. While closed sales remained essentially flat compared to last year, pending sales dropped 15%, suggesting that affordability may be hindering buyer activity. Eastside condos also saw notable growth, with the median sold price rising 18% from a year prior to $787,475, and active condo listings skyrocketing by 142%, dramatically increasing available options for buyers.

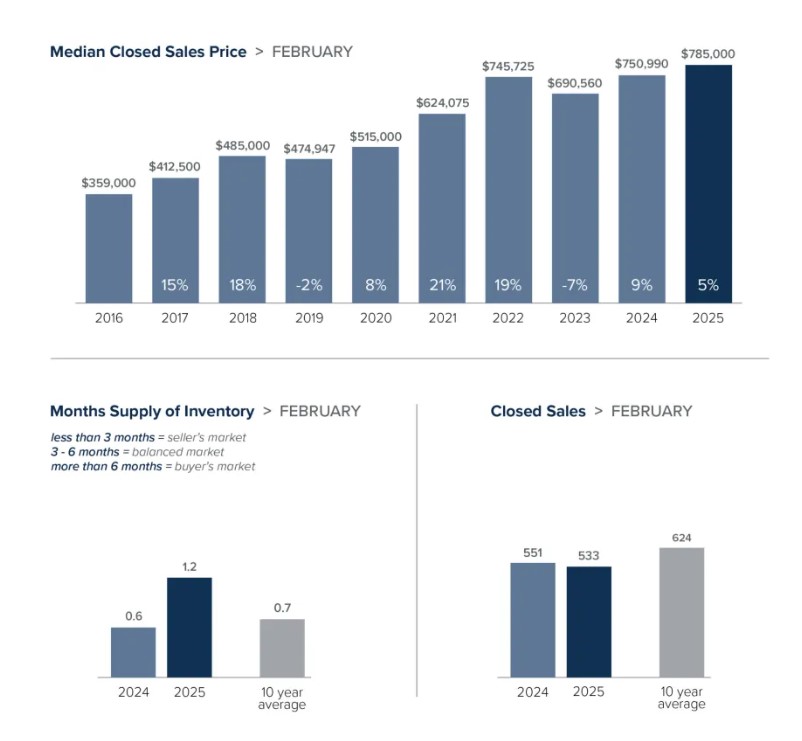

Snohomish County’s median residential sold price rose 5% year over year in February, reaching $785,000, up from $750,990 a year ago. Inventory growth was strong, with active residential listings climbing 66% compared to last year and growing nearly 7% from January, adding more options to the market. However, both pending and closed residential sales declined from 2024, down 10% and 3%, respectively. This suggests that rising prices and persistently high interest rates may be softening demand. Snohomish County’s condo market showed similar patterns, with median sold price increasing 5% from last year to $525,000, while active condo listings grew 64% during the same period.

With inventory continuing to build, competition among sellers is increasing, which could lead to price adjustments that stimulate buyer activity in the months ahead. However, inventory remains below balanced-market levels. Across our four Puget Sound regions, the average months of inventory sits at just 1.3 – still well below the 2 months considered balanced, suggesting that additional opportunities may emerge for buyers facing affordability concerns. Whether that inventory will materialize remains to be seen. In a fast-moving market, having an experienced real estate professional by your side is essential. Connect with a Windermere agent for personalized guidance and real-time market insights.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – February 2025

The start of the year is typically a quieter time for the housing market, but this year continued the trend of year-over-year growth. Across all of our Puget Sound area markets, active residential listings increased significantly – both month over month and year over year – bringing much-needed inventory to buyers. While rising supply often improves affordability, home prices and interest rates remain elevated. Additionally, upcoming immigration policies and tariffs could drive up construction costs, further influencing pricing. How these factors interact will be key as we approach the spring market.

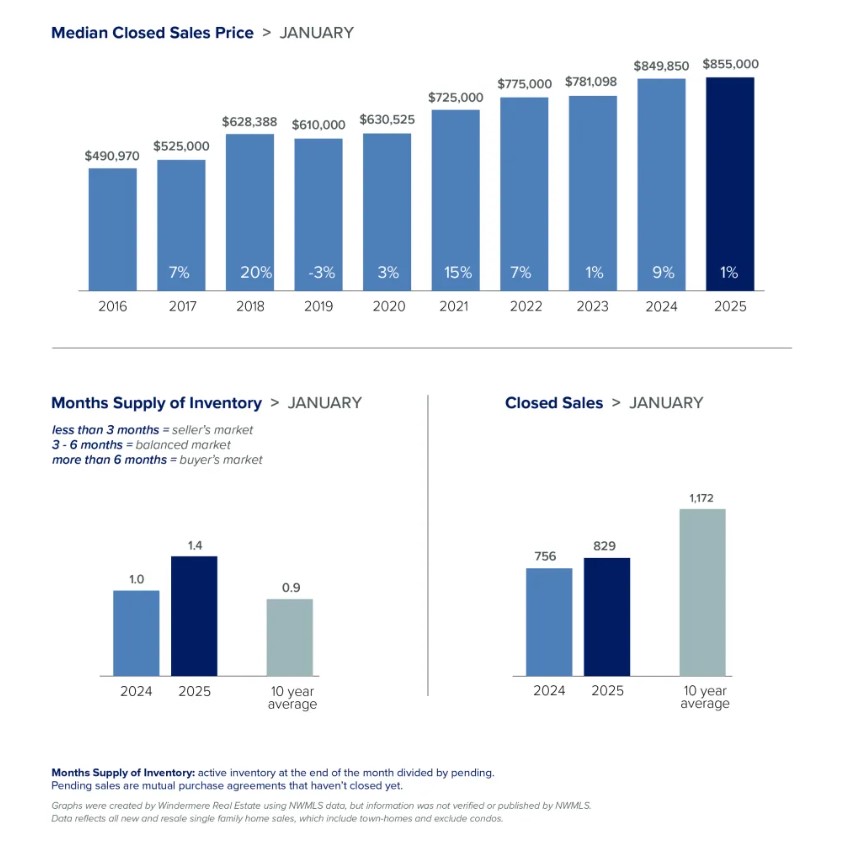

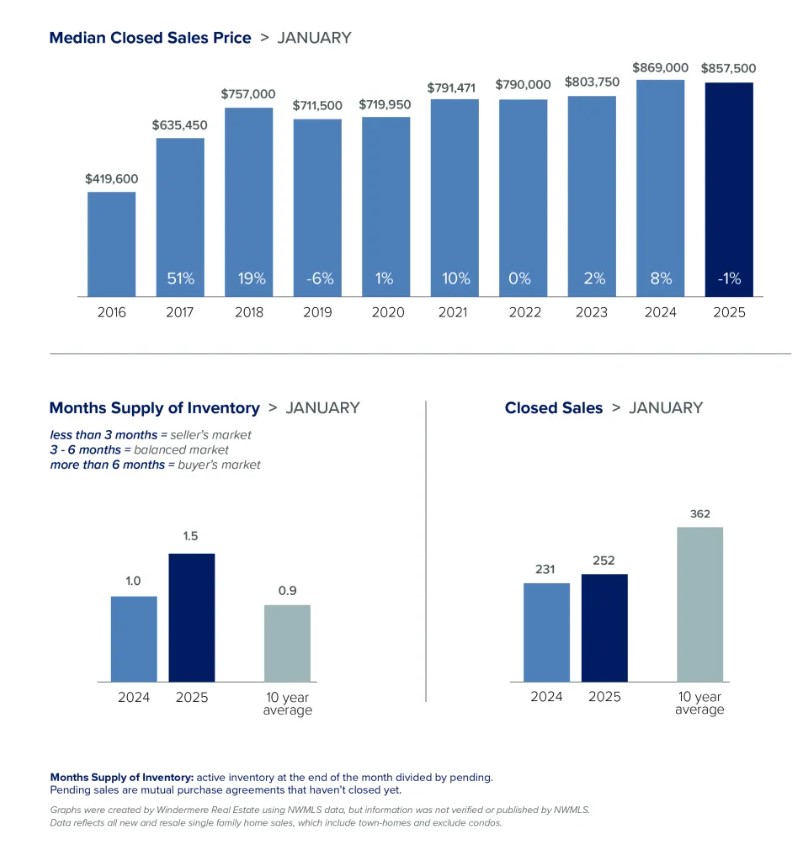

In King County, the median residential sold price in January edged up 1% year over year, from $849,850 to $855,000. The number of active listings surged 50% compared to last January and rose 20% from December, offering buyers more choices. Closed residential sales increased 10% year over year but declined 28% from the previous month. The condo market in King County saw more dramatic shifts, with the median sold price rising 21% from $495,000 to $600,000. Meanwhile, active condo listings soared 85% year over year, significantly expanding buyer options.

Seattle’s median residential sold price in January remained stable at $857,500, reflecting a slight 1% year-over-year dip from $869,000. More single-family homes entered the market, with active residential listings up 36% from a year ago. Closed residential sales rose 9% in the same timeframe, while pending sales jumped 50% between December and January – good news for sellers as it indicates strong buyer activity in the new year. Seattle condos saw price growth, with the median sold price climbing 28% year over year from $537,500 to $689,975. Active condo listings increased 52%, giving buyers more options in this segment of the market.

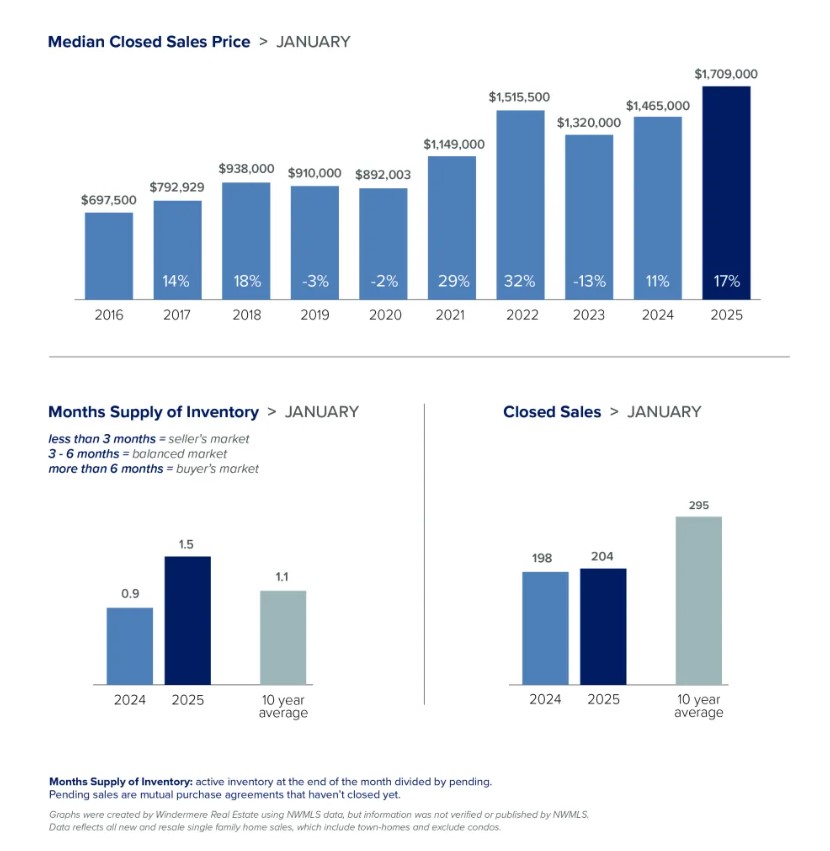

The Eastside saw an impressive 17% year over year increase in the median residential sold price, rising from $1,465,000 in January 2024 to $1,709,000 in January 2025. Prices were also up 11% from last month. Despite this appreciation, buyers gained more opportunities as active residential listings grew 61% year over year and 32% month over month. Meanwhile, closed residential sales rose 3% from last year. With more options available, some price stabilization may be on the horizon. Eastside condos saw even greater growth, with the median sold price increasing 29% year over year from $570,000 to $724,000. Active condo listings skyrocketed 128% compared to last January, and closed sales increased 77% in the same period.

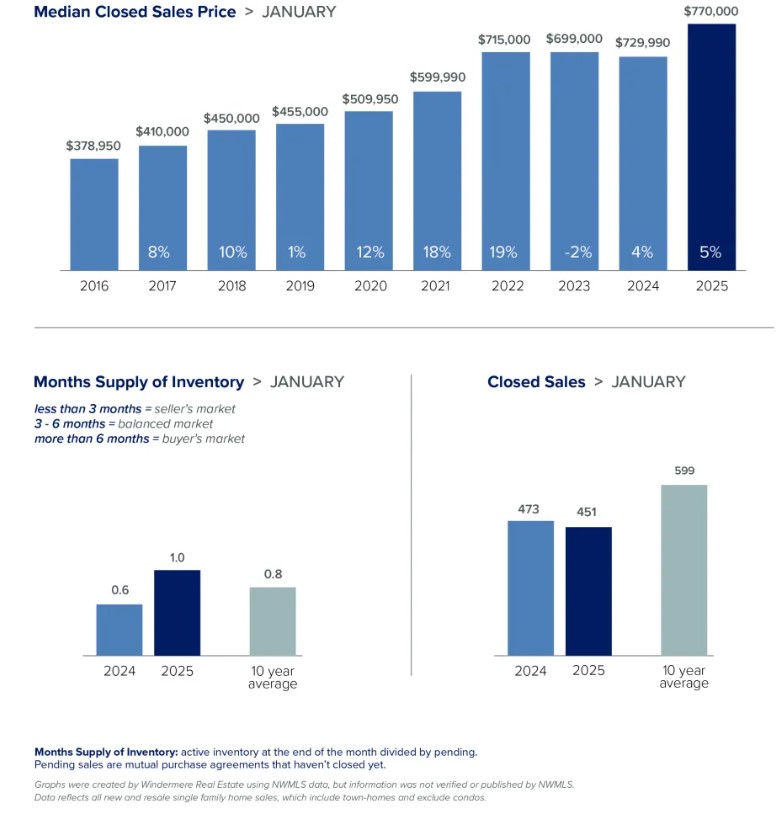

Snohomish County saw the highest increase in active residential listings, jumping 78% year over year. Meanwhile, closed residential sales declined 5% from last January and dropped 26% from December – a potential benefit for buyers as they face less competition. The median residential sold price in January rose 5% from $729,990 a year prior to $770,000, indicating that demand remains strong. Condos in Snohomish County also saw notable gains, with the median sold price increasing 15% year over year to $570,000. Meanwhile, active condo listings surged 189%, dramatically raising inventory for prospective buyers.

As more sellers enter the market ahead of spring, active listings will likely continue to rise, providing buyers with additional opportunities. At the same time, shifting economic conditions in the upcoming months may create new challenges and amplify existing ones. Whether you’re looking to buy or sell, connect with a Windermere advisor for expert guidance and real-time strategies in today’s evolving real estate market.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – January 2025

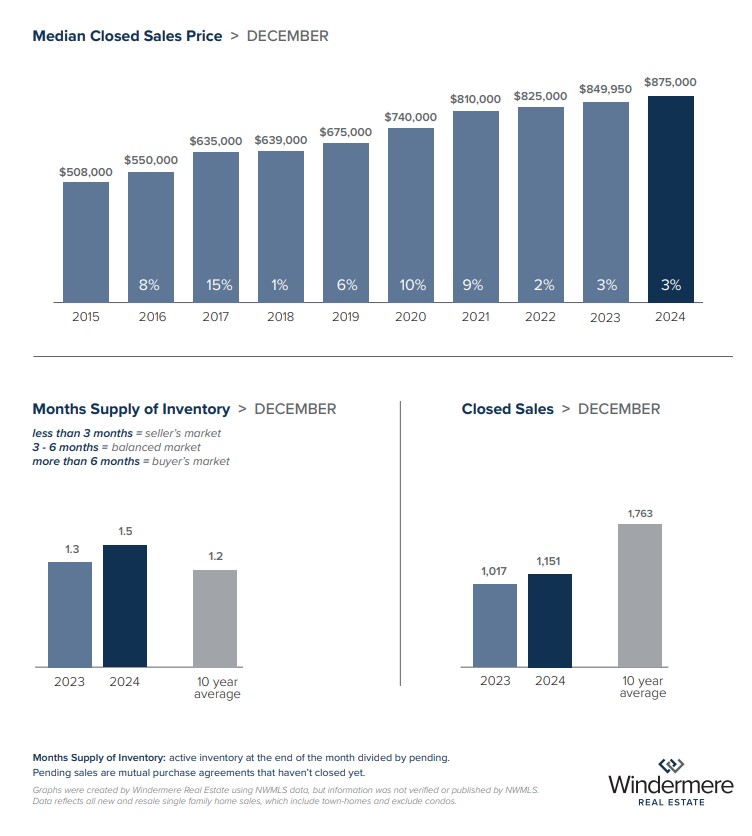

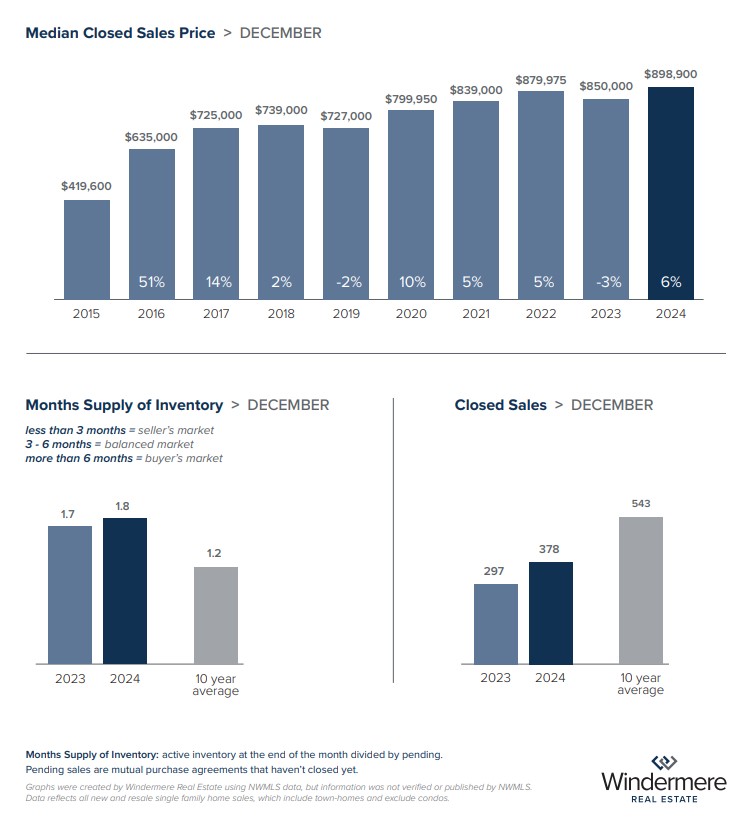

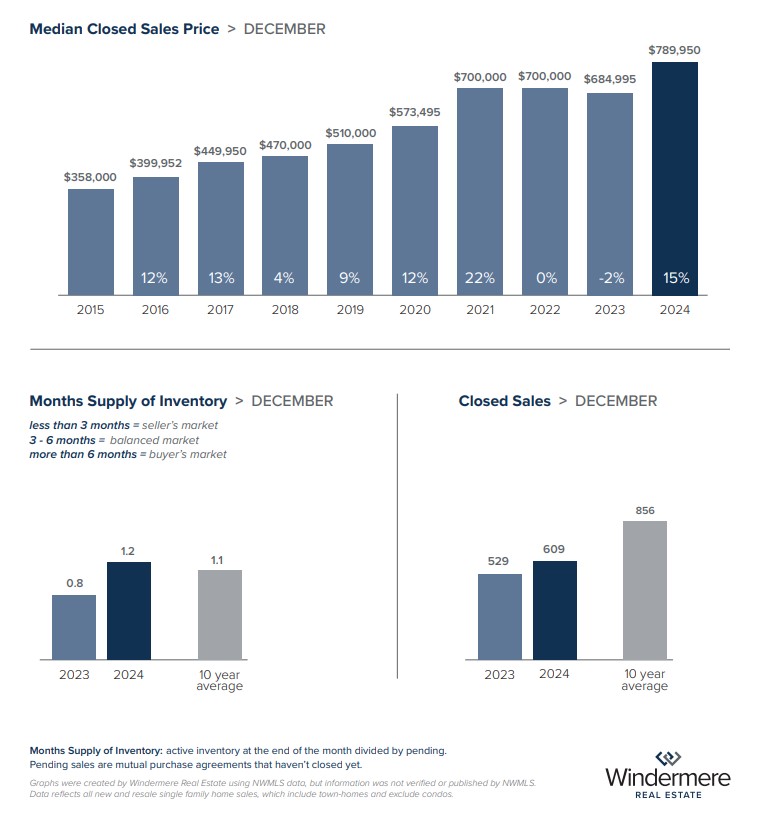

Despite a wet and windy holiday season, buyers remained active in December. According to NWMLS data, showings and keybox usage increased by 3% and 6% year over year, respectively. Active listings saw double-digit percentage increases across all four markets compared to the previous year, providing buyers with more options. As is typical, there was a seasonal decline in active sales from November, likely as sellers delayed listing their homes until spring in anticipation of a busier market. With the new year underway, new listings are expected to ramp up as we approach spring selling season.

King County’s median residential sold price rose 3% year over year to $875,000 in December but dropped 5% from November’s $925,000, reflecting seasonal softening in competition and creating opportunities for buyers. Active residential sales increased 21% year over year, while closed residential sales climbed 13%. Meanwhile, December’s median sold price for King County condos fell 2% from the previous year, declining from $537,000 to $525,000. A 31% surge in closed condo sales compared to a year earlier points to strong buyer activity in this segment, likely driven by affordability concerns amid high interest rates.

In Seattle, single-family homes saw the median sold price rise 6% year over year to $898,900 in December, highlighting continued demand in the region. However, a 7% price drop from November suggests the typical winter slowdown influenced the market. Following the same trend, active and pending residential sales both fell 33% month over month. Still, active residential listings rose 12% compared to the year prior, signaling overall healthier inventories. Seattle’s condo market also saw notable shifts, with active listings jumping 41% year over year, though they decreased 28% between November and December. Median condo prices dropped 6% from the year prior to $550,000, likely due to higher inventory levels and increased buyer choice.

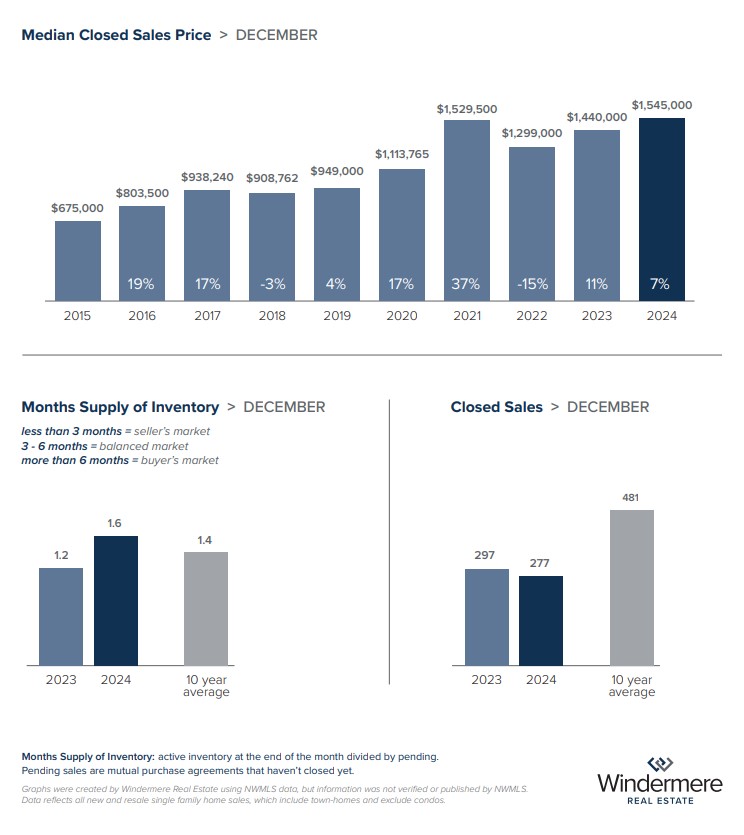

The Eastside continues to see robust real estate prices, with December’s median residential sold price climbing 7% year over year to $1,545,000. Active residential listings rose 22% from the previous year, offering buyers more selection, though closed and pending sales both dropped 7%. This decline in sales activity could reflect affordability challenges and the seasonal slowdown. The Eastside condo market performed particularly well, with the median sold price increasing 10% year over year to $695,000. Closed condo sales surged 54% compared to December 2023, underscoring strong demand in this segment. However, a 69% increase in active condo listings from the prior year suggests that supply is catching up to demand, potentially leading to more balanced market conditions as the year progresses.

Snohomish County’s residential market saw impressive growth in December, with the median sold price rising 15% year over year to $789,950. Active home listings climbed 34% from a year earlier, giving buyers broader options. While pending sales dropped 10% compared to December 2023, closed residential sales increased by 10%, showing that buyers remained engaged despite high interest rates and rising prices. The county’s condo market experienced a dramatic 108% year-over-year increase in active listings. However, closed and pending sales struggled to keep pace, pointing to increased competition among sellers for buyer attention. Even so, the median sold price for condos rose 5% year-over-year to $549,975, indicating continued demand for well-priced properties.

As buyers and sellers adapt to the ongoing impact of higher interest rates, the spring market is likely to bring both opportunities and challenges. Rising inventory levels may influence buyer demand and pricing strategies in the months ahead. To understand the forces at play in today’s real estate landscape, reach out to a Windermere advisor for real-time advice and tailored strategies.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

WBC Book Club 2024 Wrapped

Welcome to the WBC Book Club, where your favorite Admins & Agents share our favorite books of the moment! From fictional adventures to inspiring true stories, you can find it all right here on the WBC blog. You may notice that the format of our book recs look a little different than most, but that’s because our team loves to stand out and provide an unparalleled experience in all aspects of our business.

Happy New Year! Before we jump into 2025, let’s reminisce on some of the great books we read in 2024. From Japanese coffeeshops to Swedish HOAs and a mystery in the Blue Ridge Mountains, we traveled the world through the written word, experiencing heartache and joy and love through the eyes of memorable characters. We are grateful for all the awesome books we had the chance to read in 2024 and look forward to all the #LiteraryListings to come in this brand new year!

Before the Coffee Gets Cold by Toshikazu Kawaguchi

Unique commercial space waiting for the right buyer. Currently a charming coffee shop made famous by urban legends, this subterranean space located in the heart of Tokyo marries convenience with comfort. Close to local amenities yet intimate enough to make this hole in the wall the perfect location for cafes, speakeasies and more! Frequented by a host of colorful patrons, the knowledgeable staff is ready to answer your questions on anything, from obscure coffee beans to time travel. Don’t let this opportunity pass you by!

Agent Remarks: A poignant and moving portrait of humanity, oscillating between love and loss in the time it takes to drink a cup of coffee. Before the Coffee Gets Cold explores the nature of time travel but with certain concrete rules, the most important of which is that no matter what you do in the past, the present will not change. Split into four parts and charting the travels of several individuals who are all searching for hope or absolution or peace. Equal parts heartbreaking and humorous, Before the Coffee Gets Cold is a short book that leaves a huge impression on the reader, reminding us to treasure every moment, every relationship, and hope for a better future even if we regret actions of our past.

Directions: Read the full synopsis here!

A Man Called Ove by Frederick Backman

Marketing Remarks: Find peace and quiet in this quaint row house. Located in a quiet community on a dead-end street, this property offers the clean, Scandi style that Sweden is famous for. Please note: very active HOA with strict parking rules. Conveniently located near local cafes and hospitals with plenty of storage for vehicles and tools. Radiators will be replaced by seller prior to closing. This is a great place for families with young children and curmudgeonly older folks alike!

Marketing Remarks: Find peace and quiet in this quaint row house. Located in a quiet community on a dead-end street, this property offers the clean, Scandi style that Sweden is famous for. Please note: very active HOA with strict parking rules. Conveniently located near local cafes and hospitals with plenty of storage for vehicles and tools. Radiators will be replaced by seller prior to closing. This is a great place for families with young children and curmudgeonly older folks alike!

Agents Remarks: Frederick Backman has a talent for writing exceptionally witty novels that are incredibly moving at the same time. It’s hard not to have soft spot for the grumpy, misanthropic Ove who is grieving his wife’s recent death. After being forced into retirement, Ove contemplates suicide but is continuously prevented by a cast of colorful neighbors who call on him at just the right time. This is a heartwarming story about love, community and found family that will have you laughing out loud as often as you tear up.

Directions: Read the full synopsis here!

The Unmaking of June Farrow by Adrienne Young

Marketing Remarks: Historic Victorian-style home in need of a little TLC from the right buyer. This well-loved property has been in the same family for generations and features lovely historic details including a stained glass window and claw foot tub in the upstairs bathroom. Located in the secluded mountain town of Jasper, North Carolina, this home has seen its fair share of love and family intrigue, but don’t let the local gossip mill keep you from writing your own chapter in this Bishop Street gem!

Marketing Remarks: Historic Victorian-style home in need of a little TLC from the right buyer. This well-loved property has been in the same family for generations and features lovely historic details including a stained glass window and claw foot tub in the upstairs bathroom. Located in the secluded mountain town of Jasper, North Carolina, this home has seen its fair share of love and family intrigue, but don’t let the local gossip mill keep you from writing your own chapter in this Bishop Street gem!

Agent Remarks: The Unmaking of June Farrow is a heartbreaking and romantic work of magical realism, like a perfect blend of Outlander meets Where the Crawdads Sing. With parallel timelines and a dash of time travel, there are several plot lines to keep straight over the course of the book, but Adrienne Young does a masterful job of making sure nothing gets lost in the shuffle. This book has it all; a curse, betrayal, murder and the quintessential quest to choose one’s own destiny. The characters are incredibly dynamic and fleshed out, the story well-paced and beautifully written and you are truly left guessing up until the last moment what path June will choose for herself.

Directions: Read the full synopsis here!

What should we read next? We are always on the lookout for new book recommendations and would love to hear from you – tag us on social media with your favorite stories!

Instagram @windermerebellevuecommons

Twitter @WindermereBelle

Facebook @Bellevue Commons (Windermere)

Written by Makena Schoene

Local Market Update – December 2024

As the holidays approach, we’re in a season known for a natural slowdown in real estate market activity. While month-to-month declines in active listings and closed sales are expected at this time of year, these fluctuations don’t suggest a downturn. In fact, last month saw an increase in year-over-year closed sales, signaling a healthy market with sustained demand. Looking ahead to the winter months, many homeowners will begin preparing their properties for spring listings, and with interest rates remaining lower than a year ago, demand from buyers should remain strong.

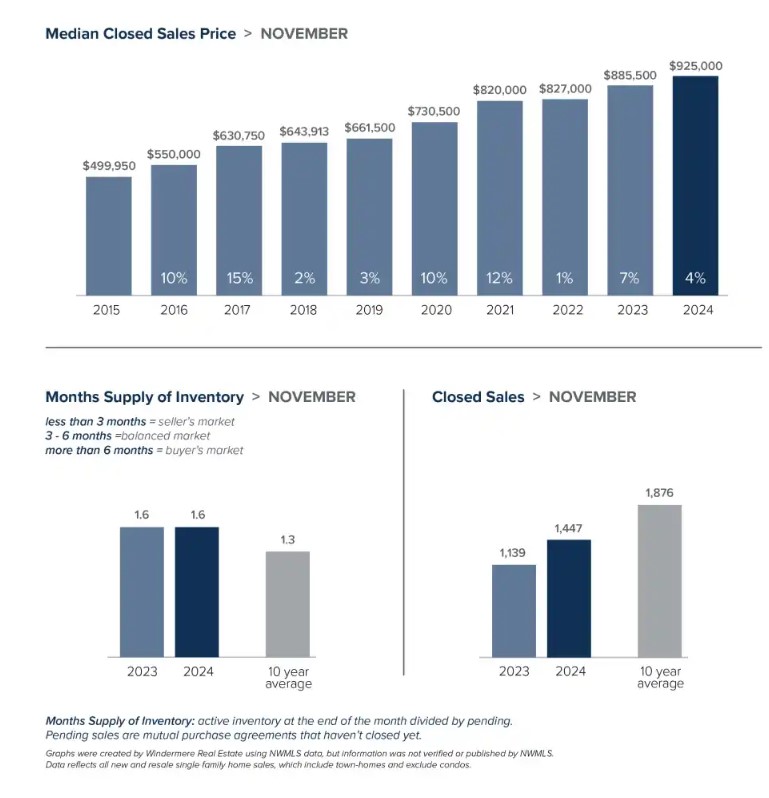

In November, King County’s median residential sold price rose 4% year over year, climbing from $885,500 to $925,000. While the number of active residential listings was 14% higher than at the same time last year, it fell by 25% from October’s level, largely due to seasonal market shifts. Pending residential sales dropped 31% from the previous month but remained 15% higher than a year prior. King County condos saw a year-over-year price increase of 17%, with a median sold of $565,467. The number of active condo listings was also 49% higher than last year, giving first-time homebuyers new opportunities in this segment of the market.

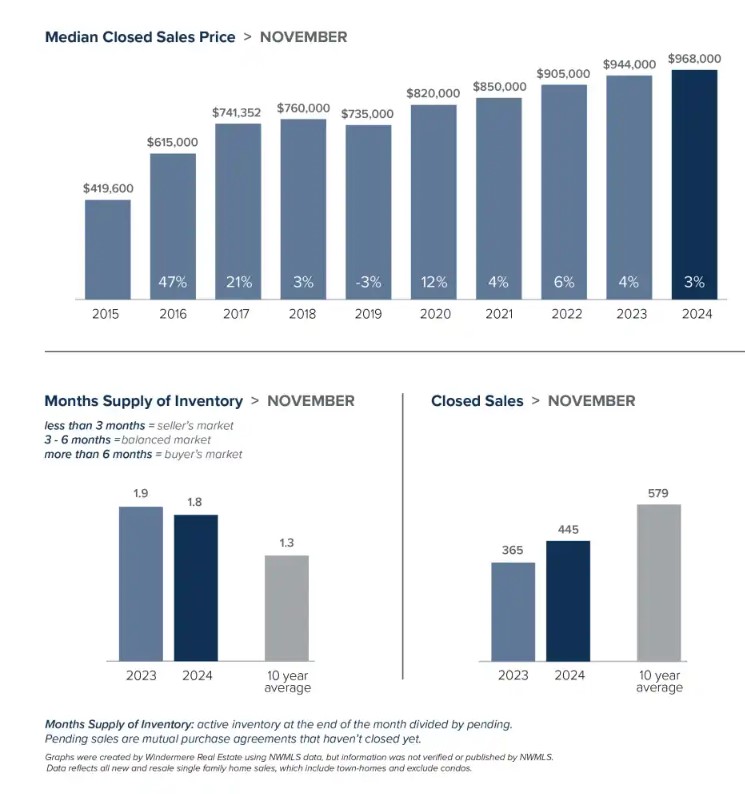

Seattle’s November median residential sold price inched up 3% year over year, reaching $968,000. However, this level remained roughly flat compared to last month. The number of closed residential sales jumped 22% from the same time last year, demonstrating a notable increase in buyer activity. Active residential listings rose 13% from a year prior, but dropped 26% from October, aligning with expected seasonal trends. Meanwhile, Seattle’s condo market experienced a significant boost in inventory this November, with 32% more active listings than at the same time last year. Perhaps due to buyers having more choices this year, the median sold price for condos slipped 1%, down to $574,950.

On the Eastside, the number of active residential listings dropped by 27% month over month but finished November 1% higher than a year ago. Single-family homes sold for a median price of $1,537,312, reflecting a 10% year-over-year increase. The number of closed residential sales jumped 23% compared to the same time last year but decreased 20% from October. Eastside condos also saw a 10% year-over-year price increase, with the median sold price reaching $685,000, though this was down from $740,000 in October. The month-over-month decline may reflect the significant 77% increase in the number of active condo listings compared to last year, giving buyers more options.

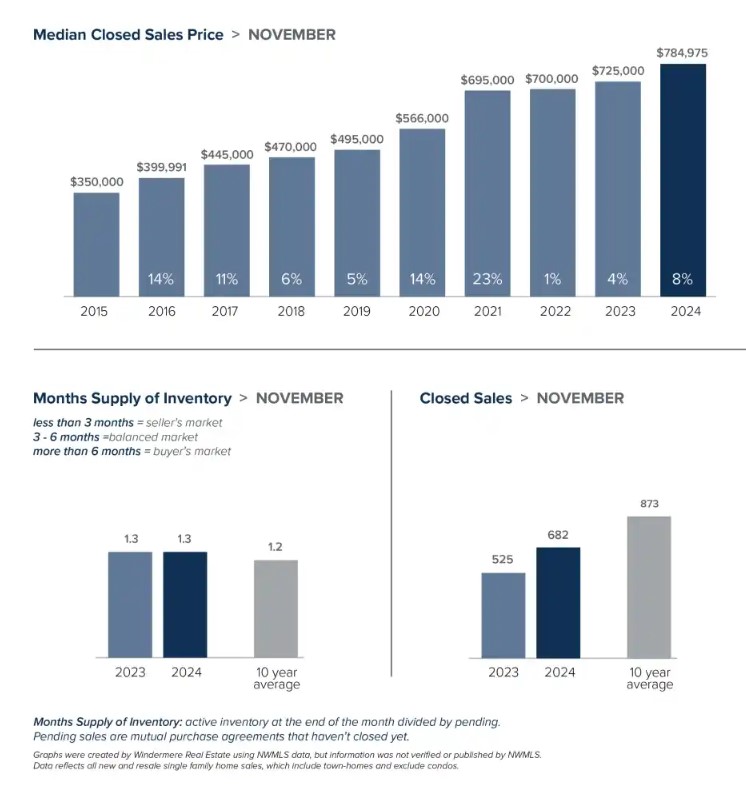

Snohomish County experienced an 8% year-over-year increase in the median sold price of a single-family home in November, rising from $725,000 to $784,976. The number of active residential listings declined 22% month over month, likely due to seasonal changes, but still finished the month 12% higher than a year ago. Closed residential sales surged 30% year over year, while pending sales climbed 16%, signaling increased buyer demand and a robust market. Snohomish County condos also posted gains, with the median sold price rising to $535,000, up 3% from last year. At the same time, active condo listings jumped 51% compared to a year prior, providing buyers with more opportunities.

November’s hot/cold market trends mirror patterns we saw a year ago, suggesting that Q1 of 2025 could once again bring rising prices. As we look ahead, it will be interesting to see how higher asking prices and shifting interest rates shape opportunities for buyers and sellers in the coming months. For help navigating these market fluctuations, connect with your Windermere broker for expert insights and up-to-the-minute advice.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link