Winter Ready Coat Drive to Benefit Jubilee Reach

WBC Agents Anna Grisham, Joe Dahl, Shani Brummer, Tina Terada, KiamaLise Herres and Allyson Green held a Winter Ready coat drive last weekend. Those who dropped off donations picked up an ice cream treat at drop off. The drive was a success! Donations will benefit Jubilee Reach and local families in need. So great to see these WBC agents taking time out of their busy weekend schedules to help out families in our community!

Local Market Update June 2020

As we move to the next phase of reopening, life feels like it’s slowly inching back towards normal. The same is true in real estate. Statistics on home sales in May provided the first true picture of the effects of COVID-19. Those reports confirmed the incredible strength and stability of the local real estate market.

- The Stay Home order, as expected, continued to impact the number of sales. However, the market is starting to move its way towards more normal activity. Pending sales, a measure of current demand, have risen every week since April.

- The slight drop in median closed sale price is a result of a proportionately larger number of lower priced homes selling than is normal. It should not be interpreted as a decrease in individual home value.

- There were significantly fewer homes for sale in May than the same time last year. With less than a month of available inventory, competition among buyers was intense. Bidding wars and all-cash offers were common.

The monthly statistics below are based on closed sales. Since closing generally takes 30 days, the statistics for May are mostly reflective of sales in April. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here. As we adapt to new phases of reopening, know that the safety of everyone remains our top priority.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

A Guide to Mortgage Assistance During COVID-19

For some homeowners who have been financially impacted by the COVID-19 pandemic, there is a high level of concern about paying their mortgage. Fortunately, there are options to aid struggling homeowners from governments, financial institutions, and loan providers. The following information is intended to provide clarity on which financial relief options are available to you during this time.

What are my mortgage relief options?

Newly placed into law, the Coronavirus Aid, Relief and Economic Security (CARES) Act, provides two protections for homeowners with federally backed mortgages:

Your lender or loan servicer may not foreclose on you for 60 days following March 18, 2020. The CARES Act prohibits lenders and/or servicers from beginning a non-judicial foreclosure, or finalizing a foreclosure sale, against you within this time period. While 60 days has passed since this was put into place, it is still important to be aware of in the event that any of these actions were taken against you.

You have a right to request a forbearance for up to 180 days if you experience financial hardship due to the COVID-19 pandemic. You can also apply for a 180-day extension beyond the forbearance period. This does not require submitting additional documentation beyond your claim, nor will you incur additional fees, penalties or interest beyond what has already been scheduled.

Forbearance is…

With forbearance, mortgage servicers and lenders allow you to pause or reduce your mortgage payments for a period of time while you get back on your feet financially.

Different types of loans beget different forbearance options, understanding the differences and which options apply to your loan is key to navigating the forbearance landscape.

Once your income is back to a normal level, contact your loan servicer and resume your payments.

Forbearance is not…

Forbearance is not a means to forgive or erase your payments. Any missed or reduced payments still require payment in the future.

Which relief options do I qualify for?

The first step in discovering your mortgage assistance qualifications is to contact your mortgage provider. If you are unsure of how to get in touch with them, look at your mortgage statement for contact information or see what contact options are available online.

After you have successfully made contact, find out if your mortgage is federally backed. To be eligible for assistance under the CARES act, your mortgage must either be backed federally, or by one of the entities in the list below. These links show the agencies’ current advise and related loan information:

U.S. Department of Housing and Urban Development (HUD)

U.S. Department of Agriculture (USDA)

Federal Housing Administration (FHA)

U.S. Department of Veteran Affairs (VA)

Fannie Mae – Loan Lookup

Freddie Mac – Loan Lookup

For non-federally backed loans, contact your lender or servicer to learn more about their forbearance repayment options.

Today’s financial landscape can be stressful for homeowners, especially those that are struggling to keep up financially. Fortunately, these entities, institutions, and servicers have provided options to help lessen the burden. Knowing which options apply to you and your household will help you navigate through hardship as your finances recover.

Originally published on the Windermere Blog by Sandy Dodge

Saving in the Laundry Room

Image Source: Shutterstock

When it comes to household expenses, staying at home has brought about savings in some areas, while increasing expenses in others. The laundry room has likely seen an uptick in usage, with its associated costs following suit. Save your energy and money by keeping these tips in mind as we continue to adapt to being home more often.

Master your machine settings

Review the owner’s manuals for your washer and dryer. There may very well be energy-saving settings you’re not using. For example, your washer’s “high-speed” or “extended wash” cycles will remove more moisture, which can help reduce drying time. A dryer’s “cool down cycle” allows clothes to finish drying using only residual heat.

Think twice before washing

Once you’re aware of the costs associated with washing and drying, and the natural resources this consumes, you may decide you don’t need to launder certain clothes as often – which can also extend the life of these garments. Some clothing, like jeans, sweatshirts, and sweatpants, can be worn a few times without a cleaning. Washing these items only when necessary will help you cut down. Another tip – keep another laundry basket in your room for those lightly worn clothes that you could wear again, so they keep separate from your clean clothes.

Use hot water only when necessary

Using warm water instead of hot can significantly cut down your washer’s energy expense. Using cold water puts less pressure on electricity grids, saving your household even more money and energy. Cold water washes are less likely to shrink or fade your clothing as well. To ensure your clothes still get clean, try using a cold-water detergent.

Right-size your loads

For both washing and drying, taking into consideration the size of your load can factor greatly into your savings. No matter the size of the load you wash, it costs the same amount to run a cycle. So instead of doing two small loads, wait until you have one large load. When drying, keep in mind that an overly full dryer will take longer to dry the clothes. A dryer with too few items inside costs more to operate.

Clean the dryer vent and filter

When the lint filter in your dryer gets clogged, airflow is reduced, and the dryer can’t operate effectively. Make a point to clean the filter after every use. If you use dryer sheets, scrub the filter every month to remove any film buildup. The venting that attaches to the back of your dryer also needs to be kept clean and clear.

Air dry

When the weather is sunny and warm, consider putting your clothes out to hang-dry. Doing so will keep your drying expenses to a minimum. It can also be a better drying method for clothing with delicate tailoring.

With staying at home being the new status quo, taking a look at the ways our homes use energy and incur expenses is more relevant than ever. These small changes in the laundry room are just some of the minor adjustments you can make in your household during these unique times.

Originally published on Windermere.com

Local Market Update April 2020

Windermere is focused on keeping our clients and our community safe and connected. We’re all in this together. Since the early days of COVID-19, our philosophy has been “Go slow and do no harm.” While real estate has been deemed an “essential” business, we have adopted guidelines that prioritize everyone’s safety and wellness.

Like everything else in our world, real estate is not business as usual. While market statistics certainly aren’t our focus at this time, we’ve opted to include our usual monthly report for those who may be interested. A few key points:

- The monthly statistics are based on closed sales. Since closing generally takes 30 days, the statistics for March are mostly reflective of contracts signed in February, a time period largely untouched by COVID-19. The market is different today.

- We expect that inventory and sales will decline in April and May as a result of the governor’s Stay Home order.

- Despite the effects of COVID-19, the market in March was hot through mid-month. It remains to be seen if that indicates the strong market will return once the Stay Home order is lifted, or if economic changes will soften demand.

Every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

Stay healthy and be safe. We’ll get through this together.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

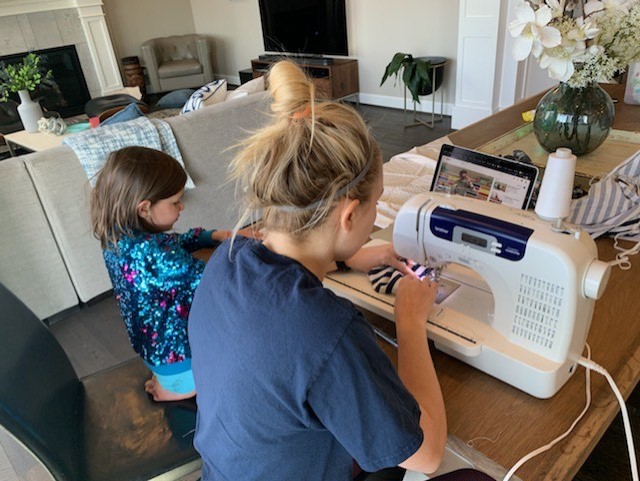

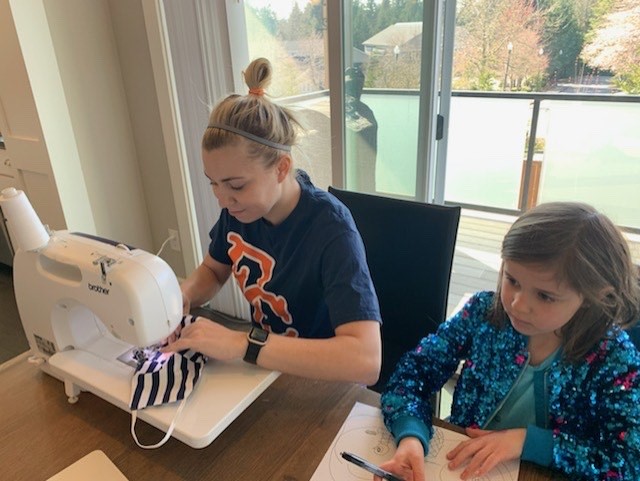

The Costello Team is Making Masks for Health Care Workers

WBC agents, The Costello Team and little Costellos have been making masks for healthcare workers at Evergreen Health. They are being donated during the COVID-19 outbreak to protect, doctors, nursers and other essential staff at Evergreen Health. Thanks for your time and contributions, Costellos. Every little bit helps in fighting this coronavirus.

Supporting Local Businesses During the COVID-19 Outbreak

Many small businesses have been impacted by COVID-19 due to mandated closures and customers staying at home. We can help them by doing things like:

- Order take-out from restaurants that offer it, and pick up directly if possible rather than 3 rd-party delivery to avoid fees charged back to the restaurant.

- Buy gift cards from service providers like hair salons (gift them or use them later).

- Buy locally whenever possible, and look for online stores from local providers.

- If you can afford to continue paying service providers who can’t work but depend on your income, do.

- Check into online services and classes offered by local fitness studios, tutors, financial planners and more.

- Tip delivery people generously if you can. They’re on the front lines of exposure. (And of course if you feel sick, avoid direct contact with them.)

Local Market Update November 2019

A steady influx of buyers continued to strain already tight inventory throughout the area in October. Home sales were up, as were prices in much of the region. With our thriving economy and highly desirable quality of life drawing ever more people here, the supply of homes isn’t close to meeting demand. Homeowners thinking about putting their property on the market can expect strong buyer interest.

EASTSIDE

As the Eastside continues to rack up “best places” awards, it’s no surprise that the area is booming. Development is on the rise, fueled primarily by the tech sector. The appeal of the Eastside has kept home prices here the highest of any segment of King County. The median single-family home price in October was stable as compared to the same time last year, rising 1% to $900,000.

KING COUNTY

King County’s 1.74 months of available inventory is far below the national average of four months. Despite the slim selection, demand in October was strong. The number of closed sales was up 5% and the number of pending sales (offers accepted but not yet closed) was up 11%. The median price of a single-family home was down 2% over a year ago to $660,000. However, some areas around the more reasonably-priced south end of the county saw double-digit price increases.

SEATTLE

Seattle home prices took their largest year-over-year jump in 12 months. The median price of a single-family home sold in October was up 3% from a year ago to $775,000, a $25,000 increase from September of this year. Seattle was recently named the third fastest-growing city in America. Real estate investment is surging. A growing population and booming economy continue to keep demand for housing –and home prices—strong.

SNOHOMISH COUNTY

Both the number of home sales and home prices were on the rise in Snohomish County in October. Overall homes sales increased 7%, and the median price of a single-family home rose 5% over a year ago to $495,000. Supply remains very low, with just six weeks of available inventory.

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link