Local Market Update – April 2025

Tulips are blooming, the days are growing longer, and the housing market is showing clear signs of seasonal momentum. Inventory continued its steady rise in March, with all four markets posting double-digit year-over-year gains in new listings. Condo inventory saw especially sharp increases — a continuing trend partly driven by the growing appeal of non-traditional “condo” alternatives like townhomes, ADUs, and backyard cottages. Whether these inventory gains will ease affordability remains to be seen as interest rates, trade dynamics, and broader economic forces continue to shape the path ahead.

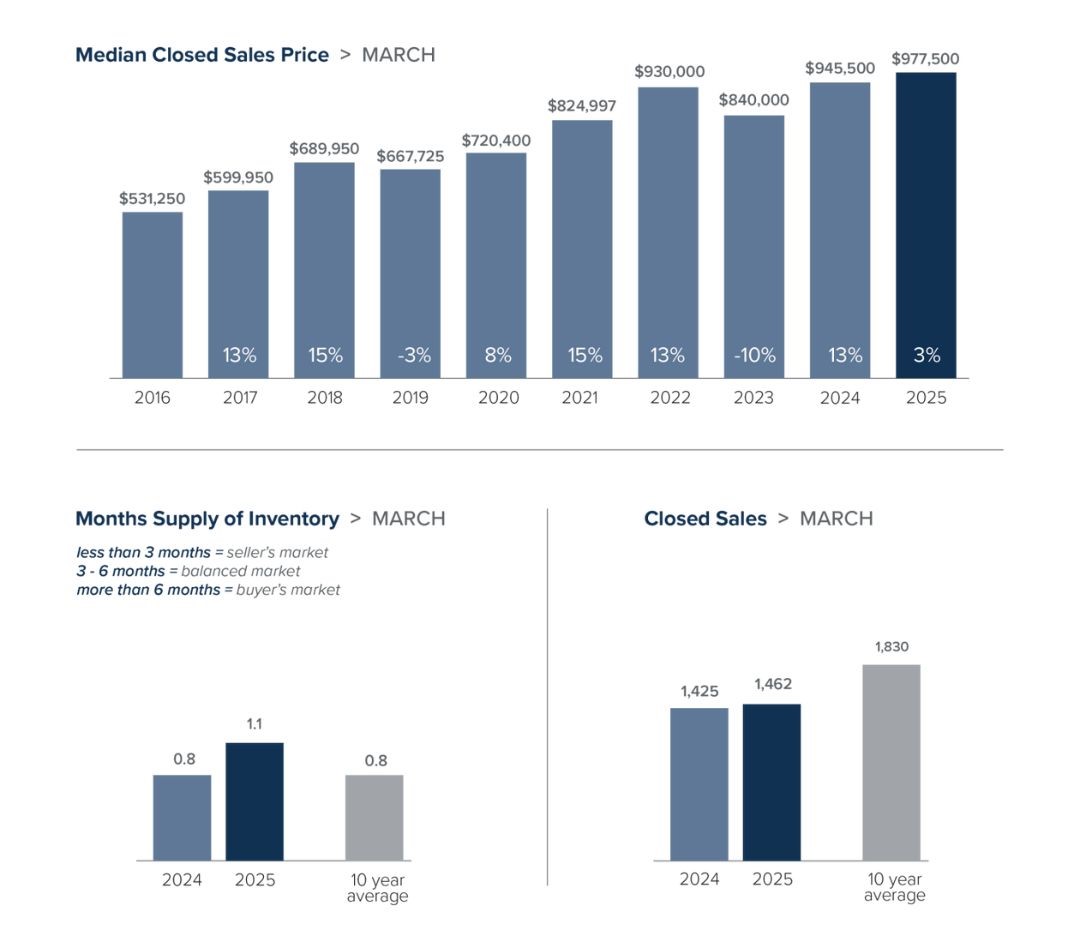

In March, King County’s median residential sold price rose 3% year over year, increasing from $945,500 to $977,500. Active residential listings jumped 50%, giving buyers a wider range of options. However, closed residential sales only grew by 3%, potentially reflecting ongoing economic uncertainties in the market. In the condo segment, the median sold price increased 9% from $540,000 to $590,000, while active listings surged 77% — signaling a notable shift in supply and buyer opportunity.

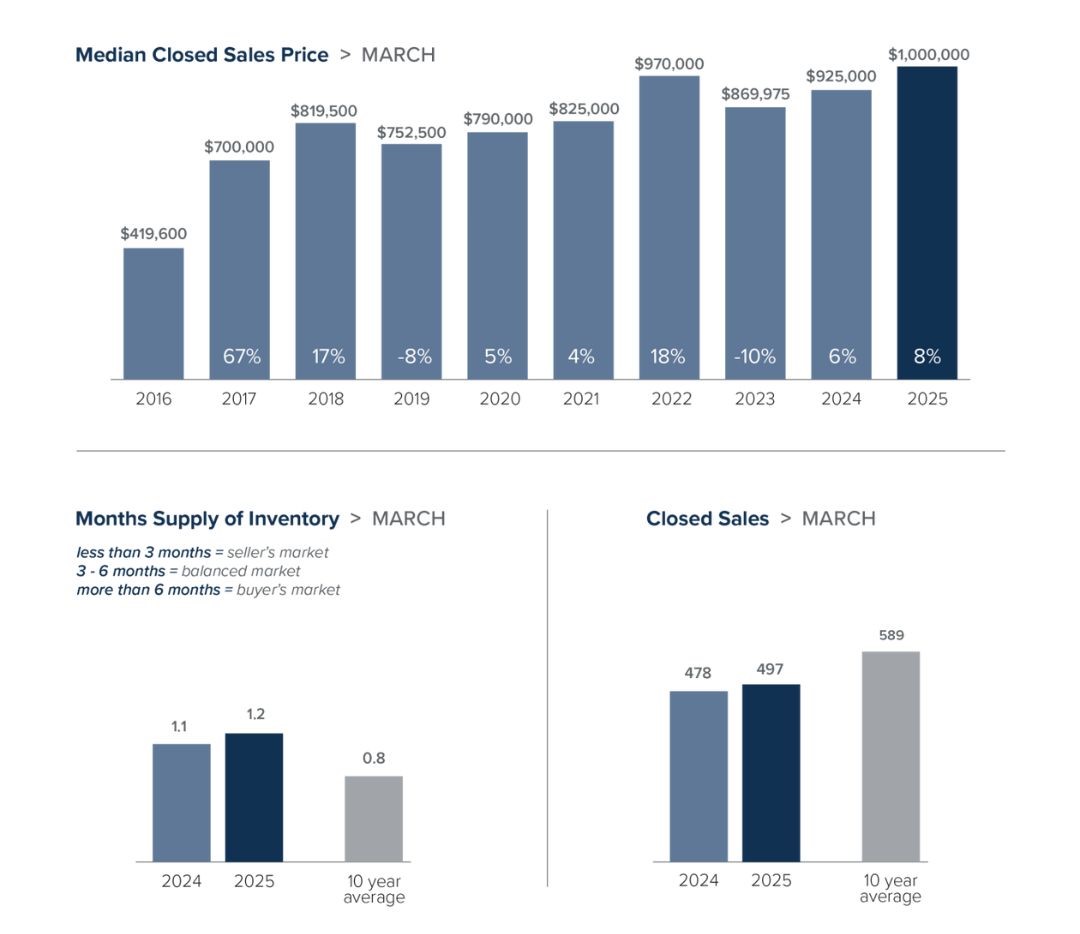

Seattle’s median residential sold price reached $1 million in March — an 8% increase from $925,000 in March of last year. Despite the rise in prices, market activity accelerated: pending sales were up 12% compared to a year prior, while active listings climbed 31%. Seattle’s condo market also gained momentum, with the median sold price increasing 7% to $627,650, up from $587,500. Active condo listings grew 55%, helping supply the high demand for more affordable options.

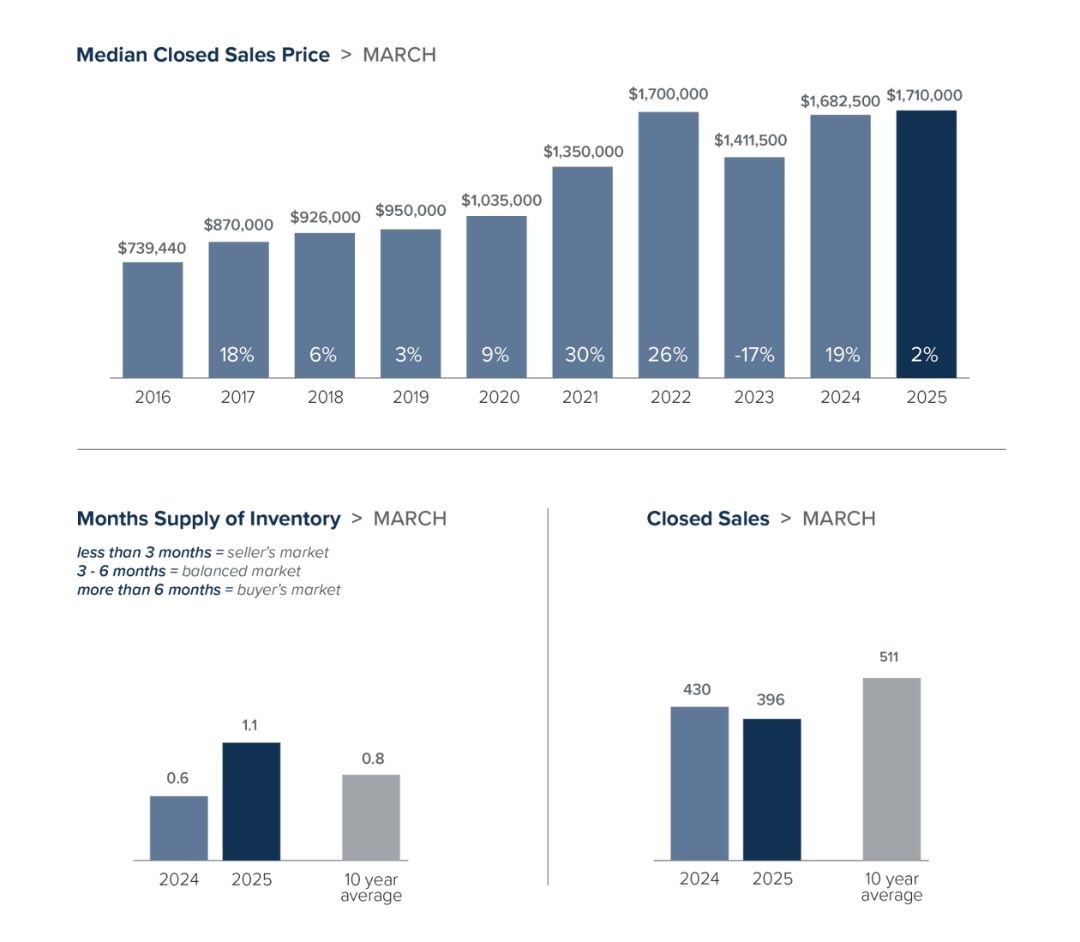

On the Eastside, the median residential sold price in March rose just 2% year over year – from $1,682,500 to $1,710,000 – a modest gain by Eastside standards. After months of steady price appreciation, affordability may be emerging as a limiting factor, with closed sales down 8% compared to March of last year. Inventory, however, continues to rise: active listings were up 86%, giving buyers more choices and potentially more negotiating power. Meanwhile, the Eastside condo market remained a standout — the median sold price rose 16% annually, and active listings were up 119%, perhaps giving buyers some relief in segment that has grown increasingly competitive.

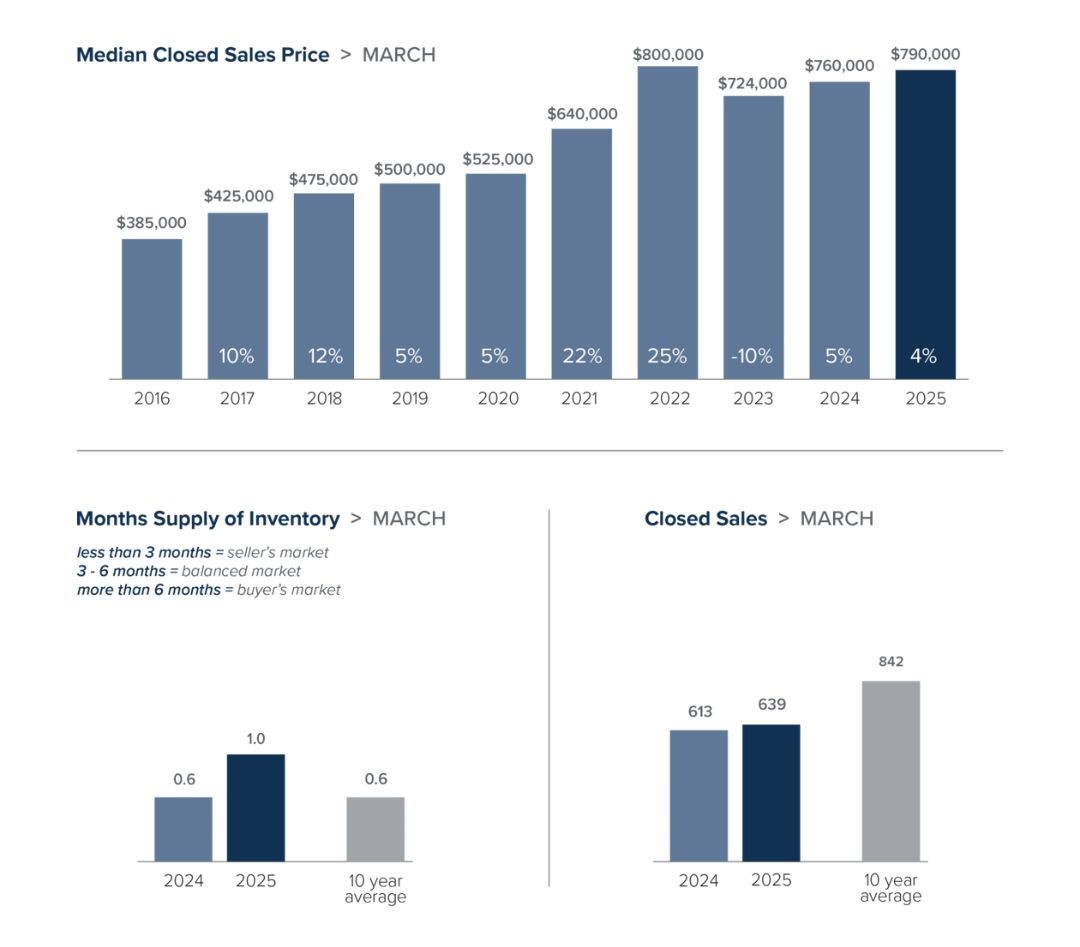

In Snohomish County, the median residential sold price rose 4% in March compared to last year, from $760,000 to $790,000. Active residential listings surged 79% year over year, offering buyers more selection in a market that is increasingly popular for its relative affordability. Closed and pending residential sales inched upwards, growing 4% and 1%, respectively. In the condo market, the median sold price rose 3%, from $515,000 to $529,994, while active listings more than doubled, jumping 104%. This influx of inventory provides welcome opportunities for first-time buyers and downsizers alike.

As the region moves deeper into spring, all eyes are on how rising inventory and renewed buyer interest will influence competition and pricing. While more listings bring opportunity, the pace of the market remains brisk — and navigating it with confidence takes up-to-the-minute insights. For expert guidance tailored to your goals, connect with your Windermere agent today.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – March 2025

February typically brings a quiet real estate market, though this year, the balance between affordability and inventory shaped activity across the Puget Sound. While 30-year mortgage rates dipped slightly from January, rising home prices remained a challenge for buyers, potentially tempering demand. Despite a significant increase in active listings compared to last year, closed sales have not kept pace – and in some areas, they’ve declined year over year. As spring approaches, the interaction between inventory and pricing will be crucial in determining market momentum.

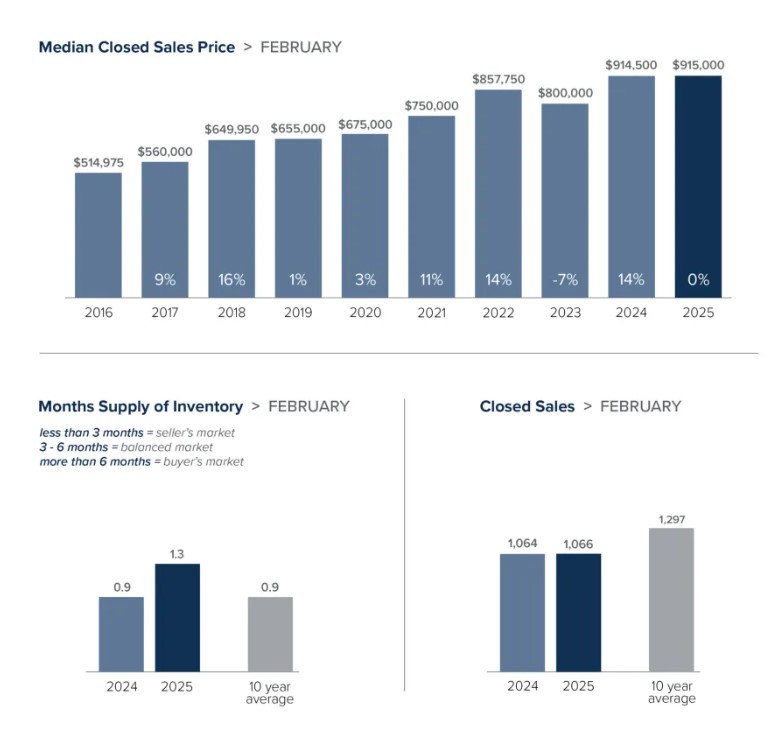

In February, King County’s median residential sold price remained relatively flat year over year, inching up from $914,500 to $915,000. However, prices rose 7% from January, indicating sustained short-term growth. Sellers seem to be preparing for the busier spring season, with active residential listings up 37% compared to last year and 9% from last month. Despite the increase in inventory, closed sales remained flat year over year – suggesting that affordability challenges may still be limiting buyer activity. In King County’s condo market, the median price rose 11% year over year to $612,500 from $550,000. Active condo listings surged 81% compared to the same time last year, following a similar trend as the residential market.

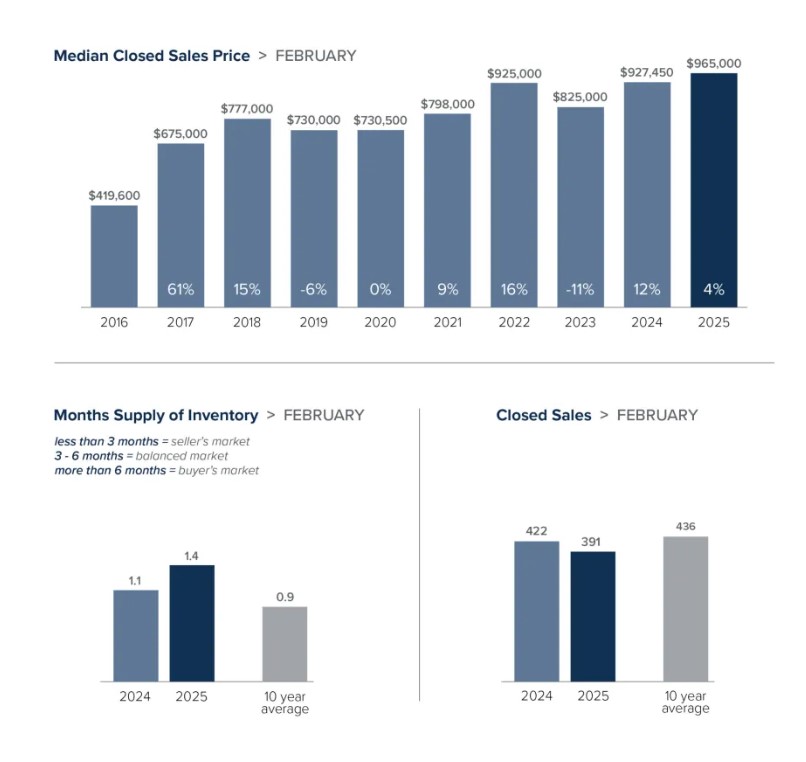

Seattle’s market showed solid price growth in February, with the median residential sold price reaching $965,000 – a 4% increase from last year and a 13% jump from January’s $927,450. Inventory grew as well, with active residential listings climbing 28% year over year and nearly 9% month over month, further boosting buyer choice. However, closed sales declined 7% from last year, hinting that rising prices may be impacting demand despite more inventory. Seattle’s condo market reflected the same trends, with the median sold price rising 12% year over year to $625,000, while active condo listings increased 55% from a year ago.

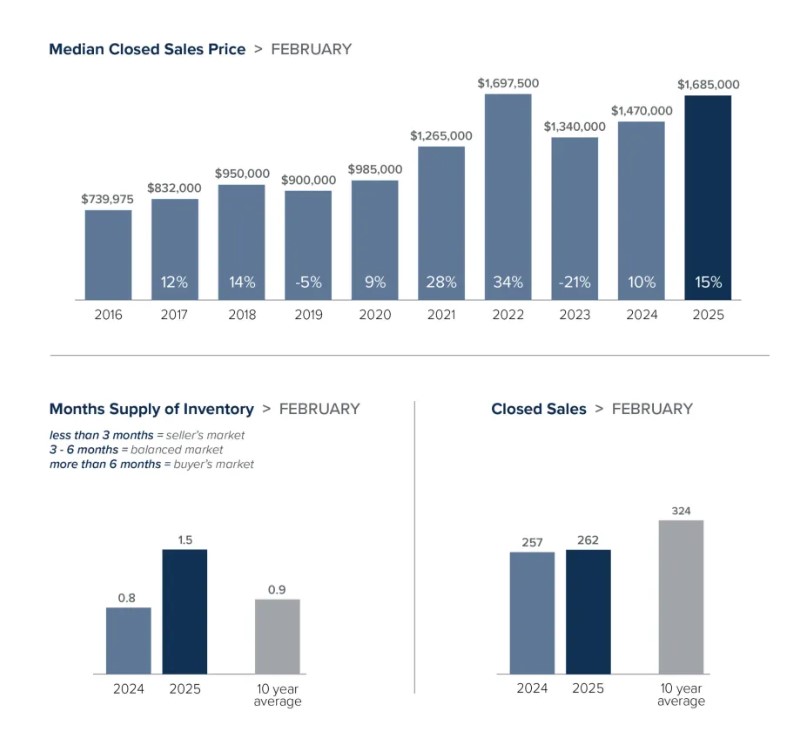

Across the Eastside, home prices continued their upward trajectory, with February’s median residential sold price hitting $1,685,000 – a 15% increase from $1,470,000 last year. Inventory levels expanded as active residential listings rose 62% year over year and 23% from January, likely due to sellers returning after the winter market slowdown. While closed sales remained essentially flat compared to last year, pending sales dropped 15%, suggesting that affordability may be hindering buyer activity. Eastside condos also saw notable growth, with the median sold price rising 18% from a year prior to $787,475, and active condo listings skyrocketing by 142%, dramatically increasing available options for buyers.

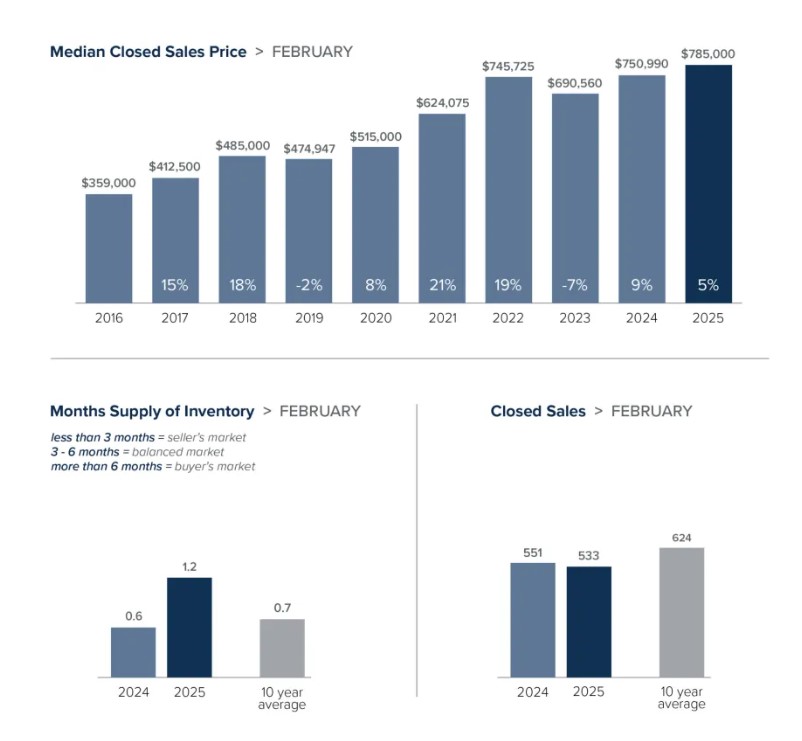

Snohomish County’s median residential sold price rose 5% year over year in February, reaching $785,000, up from $750,990 a year ago. Inventory growth was strong, with active residential listings climbing 66% compared to last year and growing nearly 7% from January, adding more options to the market. However, both pending and closed residential sales declined from 2024, down 10% and 3%, respectively. This suggests that rising prices and persistently high interest rates may be softening demand. Snohomish County’s condo market showed similar patterns, with median sold price increasing 5% from last year to $525,000, while active condo listings grew 64% during the same period.

With inventory continuing to build, competition among sellers is increasing, which could lead to price adjustments that stimulate buyer activity in the months ahead. However, inventory remains below balanced-market levels. Across our four Puget Sound regions, the average months of inventory sits at just 1.3 – still well below the 2 months considered balanced, suggesting that additional opportunities may emerge for buyers facing affordability concerns. Whether that inventory will materialize remains to be seen. In a fast-moving market, having an experienced real estate professional by your side is essential. Connect with a Windermere agent for personalized guidance and real-time market insights.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – February 2025

The start of the year is typically a quieter time for the housing market, but this year continued the trend of year-over-year growth. Across all of our Puget Sound area markets, active residential listings increased significantly – both month over month and year over year – bringing much-needed inventory to buyers. While rising supply often improves affordability, home prices and interest rates remain elevated. Additionally, upcoming immigration policies and tariffs could drive up construction costs, further influencing pricing. How these factors interact will be key as we approach the spring market.

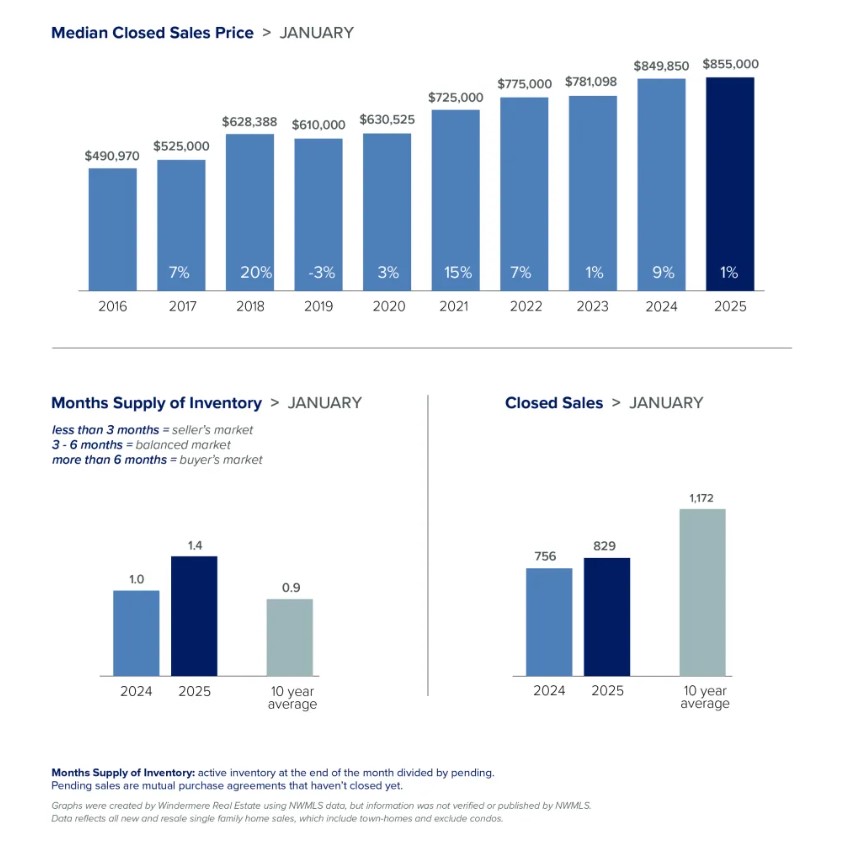

In King County, the median residential sold price in January edged up 1% year over year, from $849,850 to $855,000. The number of active listings surged 50% compared to last January and rose 20% from December, offering buyers more choices. Closed residential sales increased 10% year over year but declined 28% from the previous month. The condo market in King County saw more dramatic shifts, with the median sold price rising 21% from $495,000 to $600,000. Meanwhile, active condo listings soared 85% year over year, significantly expanding buyer options.

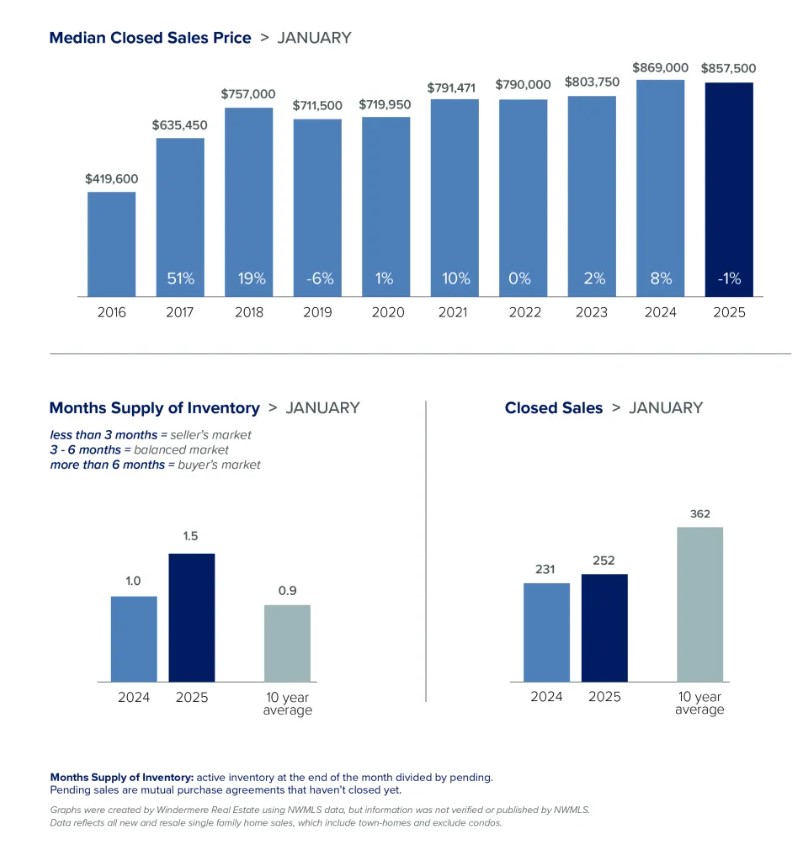

Seattle’s median residential sold price in January remained stable at $857,500, reflecting a slight 1% year-over-year dip from $869,000. More single-family homes entered the market, with active residential listings up 36% from a year ago. Closed residential sales rose 9% in the same timeframe, while pending sales jumped 50% between December and January – good news for sellers as it indicates strong buyer activity in the new year. Seattle condos saw price growth, with the median sold price climbing 28% year over year from $537,500 to $689,975. Active condo listings increased 52%, giving buyers more options in this segment of the market.

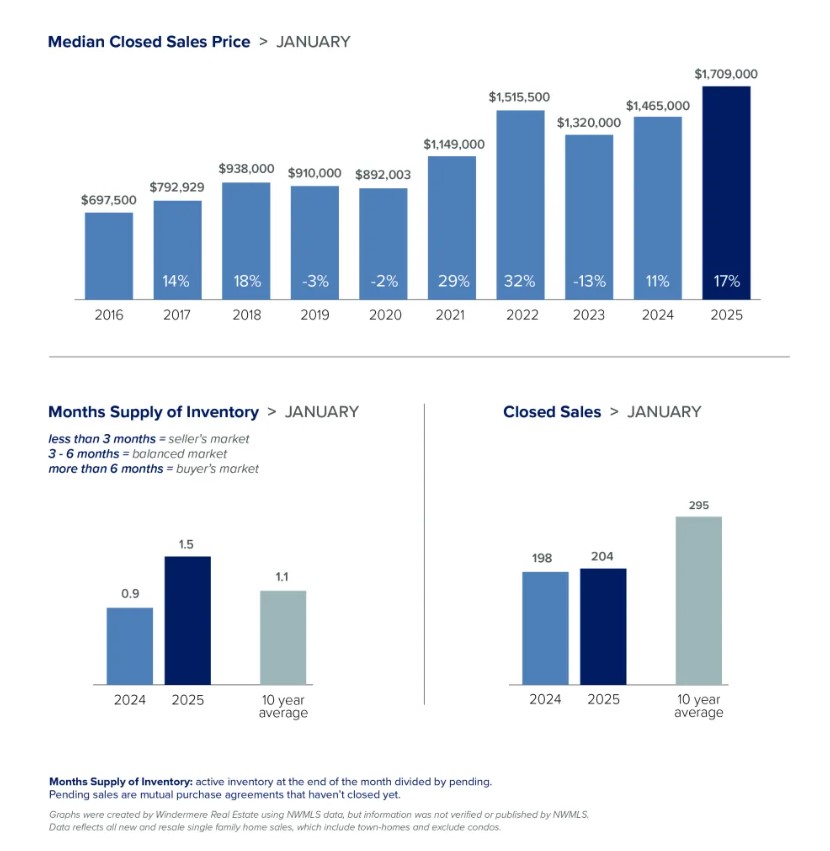

The Eastside saw an impressive 17% year over year increase in the median residential sold price, rising from $1,465,000 in January 2024 to $1,709,000 in January 2025. Prices were also up 11% from last month. Despite this appreciation, buyers gained more opportunities as active residential listings grew 61% year over year and 32% month over month. Meanwhile, closed residential sales rose 3% from last year. With more options available, some price stabilization may be on the horizon. Eastside condos saw even greater growth, with the median sold price increasing 29% year over year from $570,000 to $724,000. Active condo listings skyrocketed 128% compared to last January, and closed sales increased 77% in the same period.

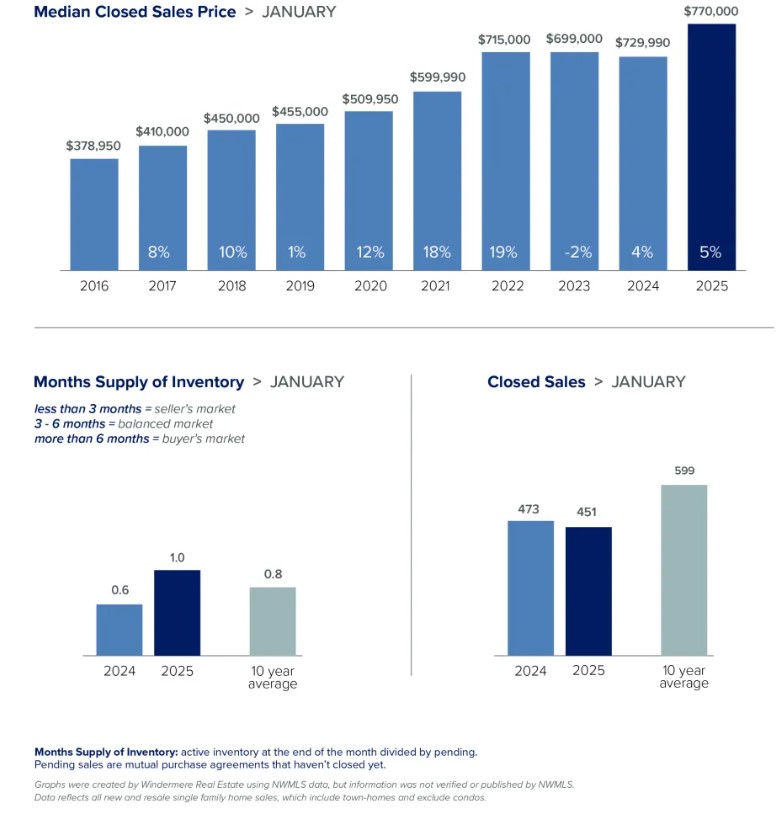

Snohomish County saw the highest increase in active residential listings, jumping 78% year over year. Meanwhile, closed residential sales declined 5% from last January and dropped 26% from December – a potential benefit for buyers as they face less competition. The median residential sold price in January rose 5% from $729,990 a year prior to $770,000, indicating that demand remains strong. Condos in Snohomish County also saw notable gains, with the median sold price increasing 15% year over year to $570,000. Meanwhile, active condo listings surged 189%, dramatically raising inventory for prospective buyers.

As more sellers enter the market ahead of spring, active listings will likely continue to rise, providing buyers with additional opportunities. At the same time, shifting economic conditions in the upcoming months may create new challenges and amplify existing ones. Whether you’re looking to buy or sell, connect with a Windermere advisor for expert guidance and real-time strategies in today’s evolving real estate market.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – January 2025

Despite a wet and windy holiday season, buyers remained active in December. According to NWMLS data, showings and keybox usage increased by 3% and 6% year over year, respectively. Active listings saw double-digit percentage increases across all four markets compared to the previous year, providing buyers with more options. As is typical, there was a seasonal decline in active sales from November, likely as sellers delayed listing their homes until spring in anticipation of a busier market. With the new year underway, new listings are expected to ramp up as we approach spring selling season.

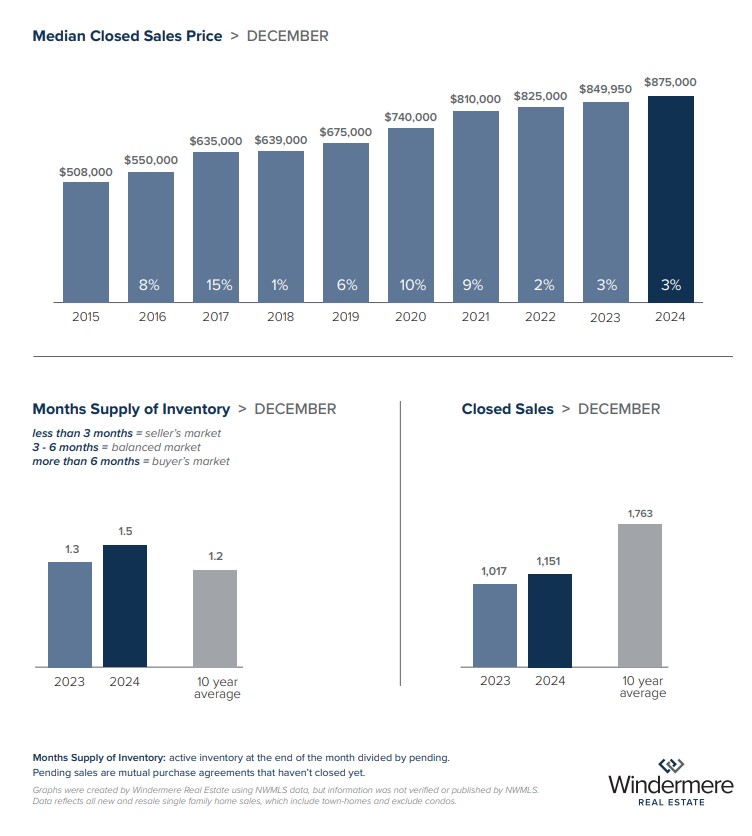

King County’s median residential sold price rose 3% year over year to $875,000 in December but dropped 5% from November’s $925,000, reflecting seasonal softening in competition and creating opportunities for buyers. Active residential sales increased 21% year over year, while closed residential sales climbed 13%. Meanwhile, December’s median sold price for King County condos fell 2% from the previous year, declining from $537,000 to $525,000. A 31% surge in closed condo sales compared to a year earlier points to strong buyer activity in this segment, likely driven by affordability concerns amid high interest rates.

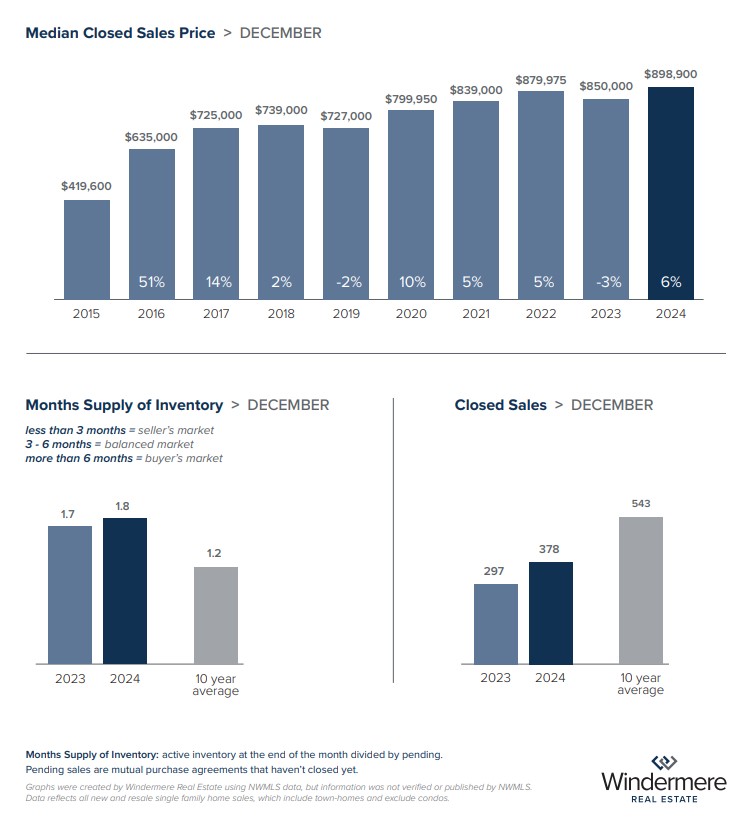

In Seattle, single-family homes saw the median sold price rise 6% year over year to $898,900 in December, highlighting continued demand in the region. However, a 7% price drop from November suggests the typical winter slowdown influenced the market. Following the same trend, active and pending residential sales both fell 33% month over month. Still, active residential listings rose 12% compared to the year prior, signaling overall healthier inventories. Seattle’s condo market also saw notable shifts, with active listings jumping 41% year over year, though they decreased 28% between November and December. Median condo prices dropped 6% from the year prior to $550,000, likely due to higher inventory levels and increased buyer choice.

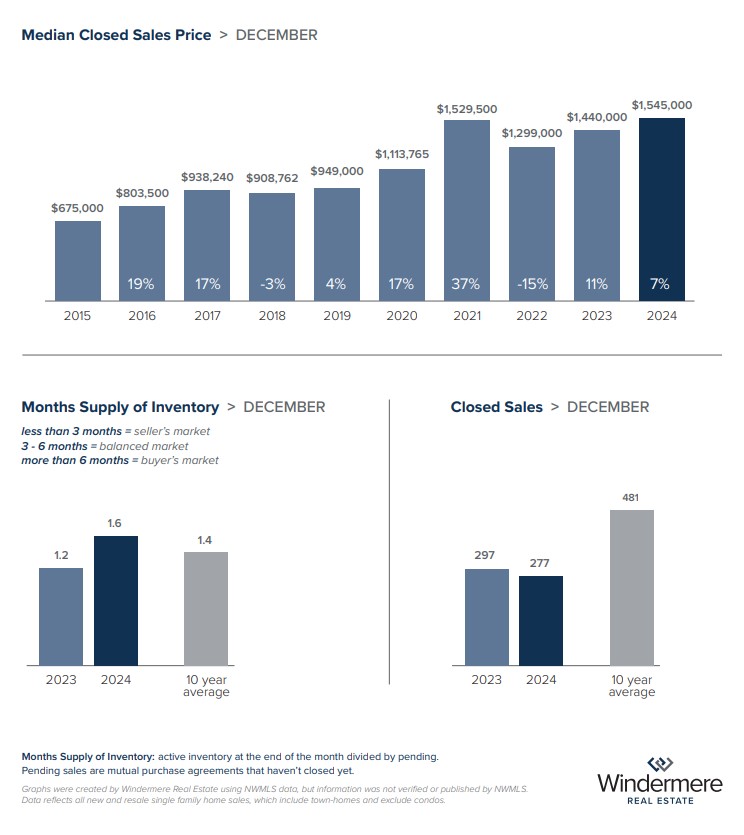

The Eastside continues to see robust real estate prices, with December’s median residential sold price climbing 7% year over year to $1,545,000. Active residential listings rose 22% from the previous year, offering buyers more selection, though closed and pending sales both dropped 7%. This decline in sales activity could reflect affordability challenges and the seasonal slowdown. The Eastside condo market performed particularly well, with the median sold price increasing 10% year over year to $695,000. Closed condo sales surged 54% compared to December 2023, underscoring strong demand in this segment. However, a 69% increase in active condo listings from the prior year suggests that supply is catching up to demand, potentially leading to more balanced market conditions as the year progresses.

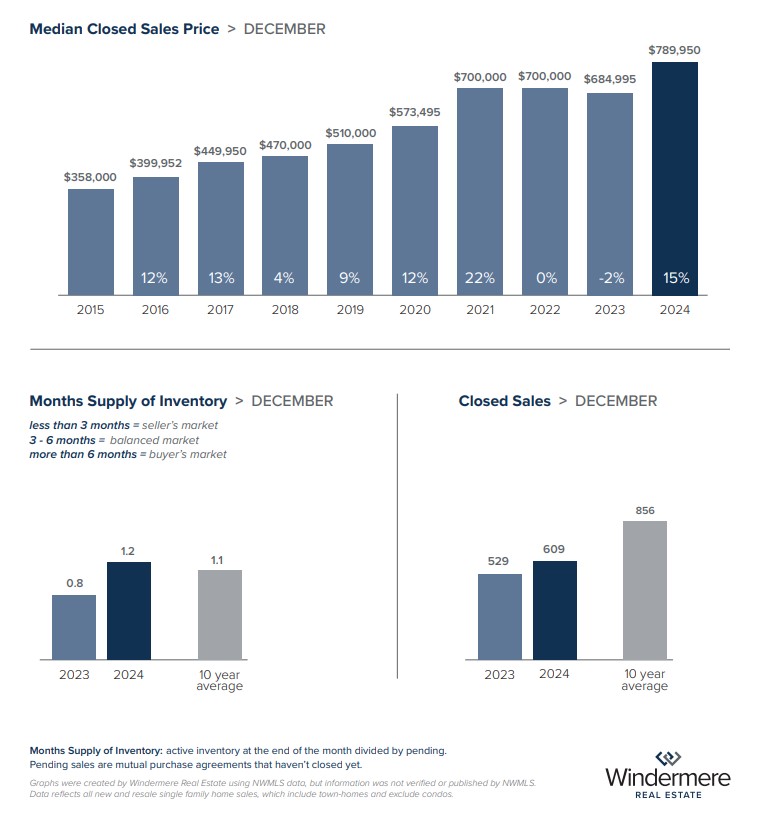

Snohomish County’s residential market saw impressive growth in December, with the median sold price rising 15% year over year to $789,950. Active home listings climbed 34% from a year earlier, giving buyers broader options. While pending sales dropped 10% compared to December 2023, closed residential sales increased by 10%, showing that buyers remained engaged despite high interest rates and rising prices. The county’s condo market experienced a dramatic 108% year-over-year increase in active listings. However, closed and pending sales struggled to keep pace, pointing to increased competition among sellers for buyer attention. Even so, the median sold price for condos rose 5% year-over-year to $549,975, indicating continued demand for well-priced properties.

As buyers and sellers adapt to the ongoing impact of higher interest rates, the spring market is likely to bring both opportunities and challenges. Rising inventory levels may influence buyer demand and pricing strategies in the months ahead. To understand the forces at play in today’s real estate landscape, reach out to a Windermere advisor for real-time advice and tailored strategies.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – December 2024

As the holidays approach, we’re in a season known for a natural slowdown in real estate market activity. While month-to-month declines in active listings and closed sales are expected at this time of year, these fluctuations don’t suggest a downturn. In fact, last month saw an increase in year-over-year closed sales, signaling a healthy market with sustained demand. Looking ahead to the winter months, many homeowners will begin preparing their properties for spring listings, and with interest rates remaining lower than a year ago, demand from buyers should remain strong.

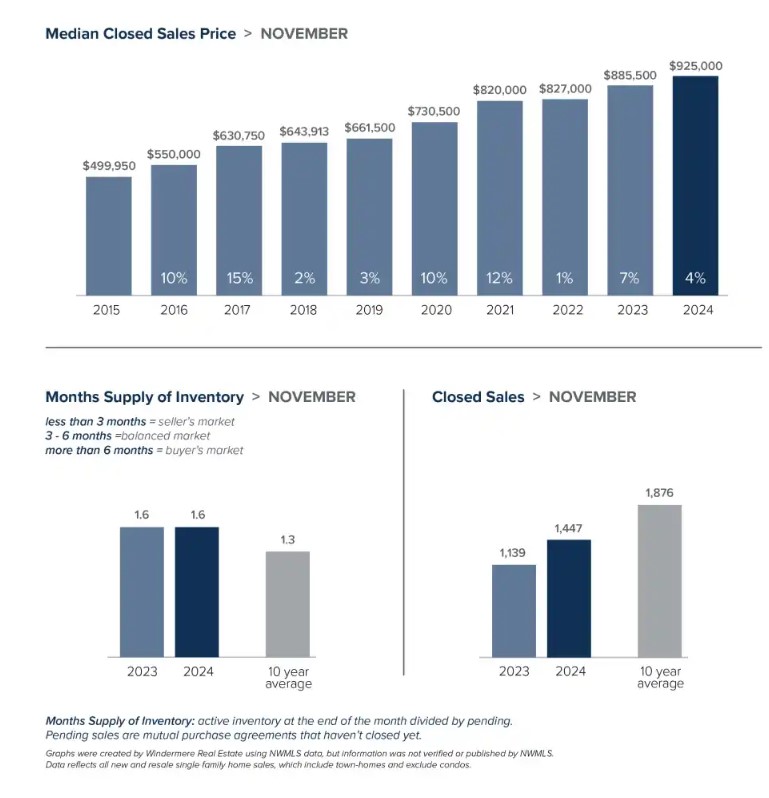

In November, King County’s median residential sold price rose 4% year over year, climbing from $885,500 to $925,000. While the number of active residential listings was 14% higher than at the same time last year, it fell by 25% from October’s level, largely due to seasonal market shifts. Pending residential sales dropped 31% from the previous month but remained 15% higher than a year prior. King County condos saw a year-over-year price increase of 17%, with a median sold of $565,467. The number of active condo listings was also 49% higher than last year, giving first-time homebuyers new opportunities in this segment of the market.

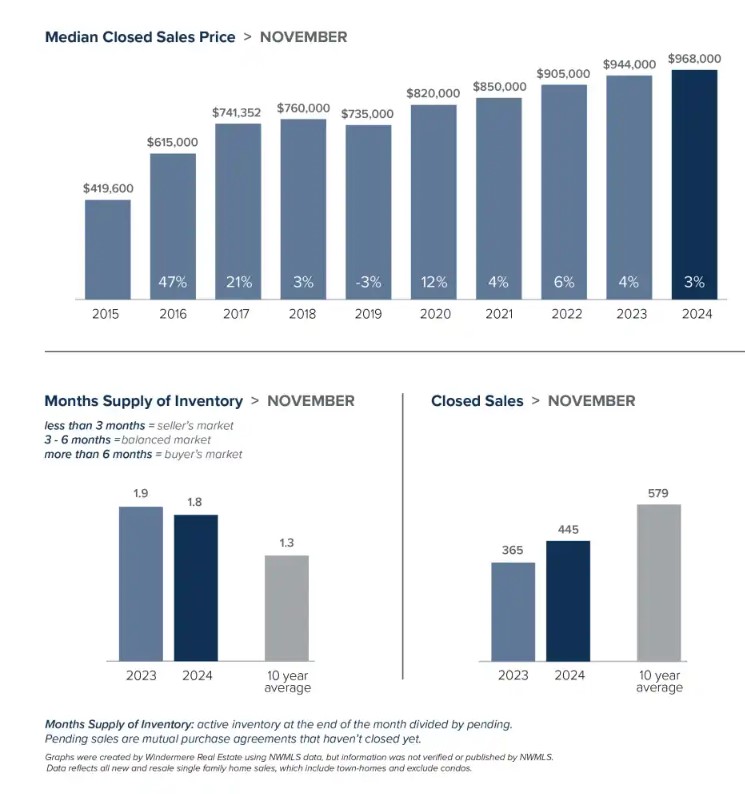

Seattle’s November median residential sold price inched up 3% year over year, reaching $968,000. However, this level remained roughly flat compared to last month. The number of closed residential sales jumped 22% from the same time last year, demonstrating a notable increase in buyer activity. Active residential listings rose 13% from a year prior, but dropped 26% from October, aligning with expected seasonal trends. Meanwhile, Seattle’s condo market experienced a significant boost in inventory this November, with 32% more active listings than at the same time last year. Perhaps due to buyers having more choices this year, the median sold price for condos slipped 1%, down to $574,950.

On the Eastside, the number of active residential listings dropped by 27% month over month but finished November 1% higher than a year ago. Single-family homes sold for a median price of $1,537,312, reflecting a 10% year-over-year increase. The number of closed residential sales jumped 23% compared to the same time last year but decreased 20% from October. Eastside condos also saw a 10% year-over-year price increase, with the median sold price reaching $685,000, though this was down from $740,000 in October. The month-over-month decline may reflect the significant 77% increase in the number of active condo listings compared to last year, giving buyers more options.

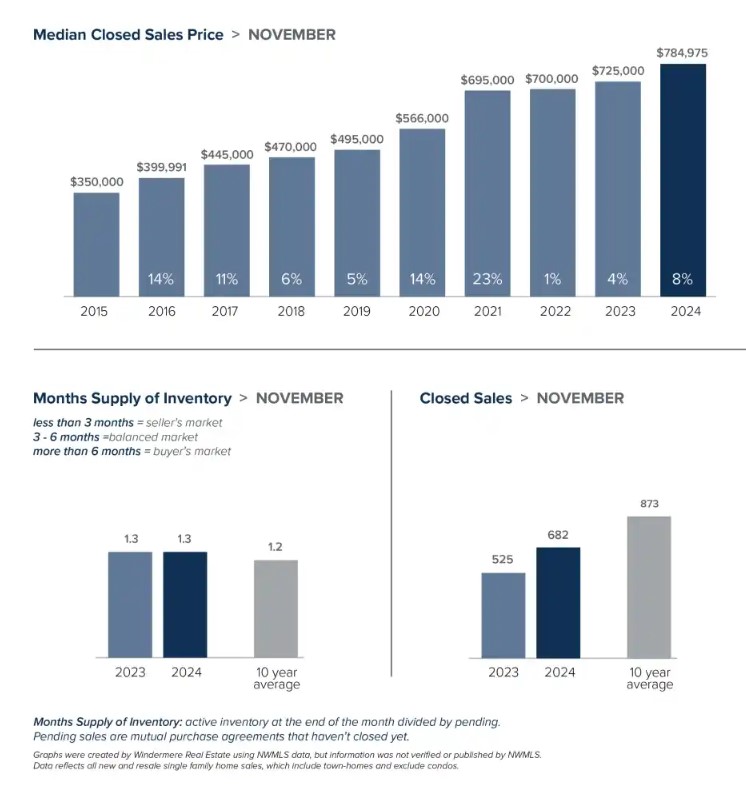

Snohomish County experienced an 8% year-over-year increase in the median sold price of a single-family home in November, rising from $725,000 to $784,976. The number of active residential listings declined 22% month over month, likely due to seasonal changes, but still finished the month 12% higher than a year ago. Closed residential sales surged 30% year over year, while pending sales climbed 16%, signaling increased buyer demand and a robust market. Snohomish County condos also posted gains, with the median sold price rising to $535,000, up 3% from last year. At the same time, active condo listings jumped 51% compared to a year prior, providing buyers with more opportunities.

November’s hot/cold market trends mirror patterns we saw a year ago, suggesting that Q1 of 2025 could once again bring rising prices. As we look ahead, it will be interesting to see how higher asking prices and shifting interest rates shape opportunities for buyers and sellers in the coming months. For help navigating these market fluctuations, connect with your Windermere broker for expert insights and up-to-the-minute advice.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – November 2024

Typically when fall rolls around, our local real estate market begins to cool. Last month, however, perhaps in response to lower mortgage rates, home buyers jumped excitedly into the market and sellers responded to the increased demand by listing their homes and pushing up the supply available to those buyers. Despite the addition of these homes to the market (the most in the Seattle area since pre-pandemic, according to The Seattle Times), residential prices have stayed steady or increased month over month, reflecting continued competition among buyers.

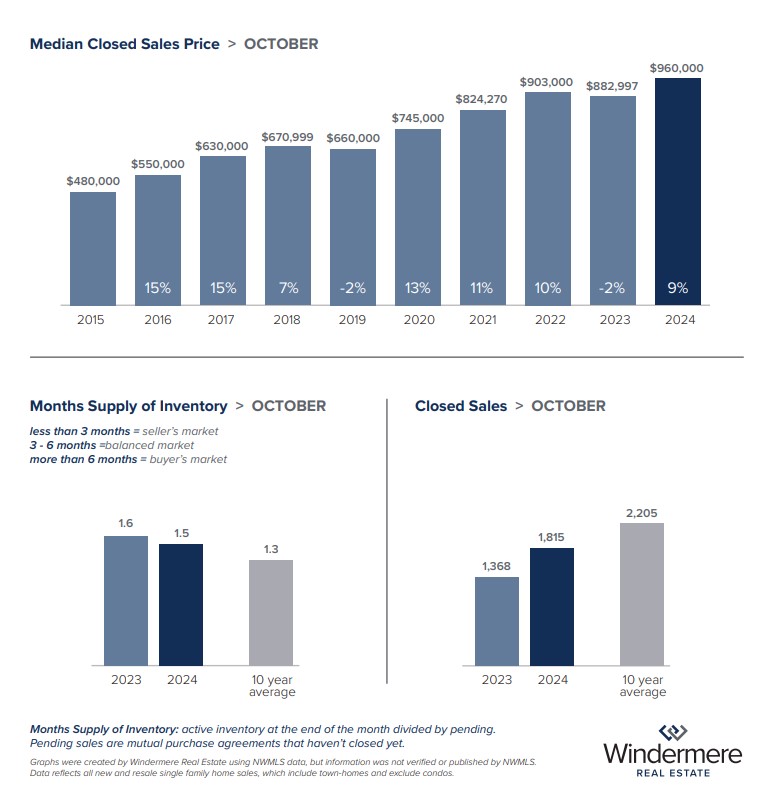

In October, the median sold price of a King County single-family home was up 9% from a year ago, from $882,997 to $960,000. Last month’s residential sales activity was remarkably strong, with the number of closed transactions up 26% from September and 33% from a year prior. October’s pending home sales were 33% higher than a year ago, a further marker of the month’s robust activity. The market for King County condos also experienced growth in October, with the number of closed sales rising 25% from September, and the median sold price rising 4% year over year, to $562,500.

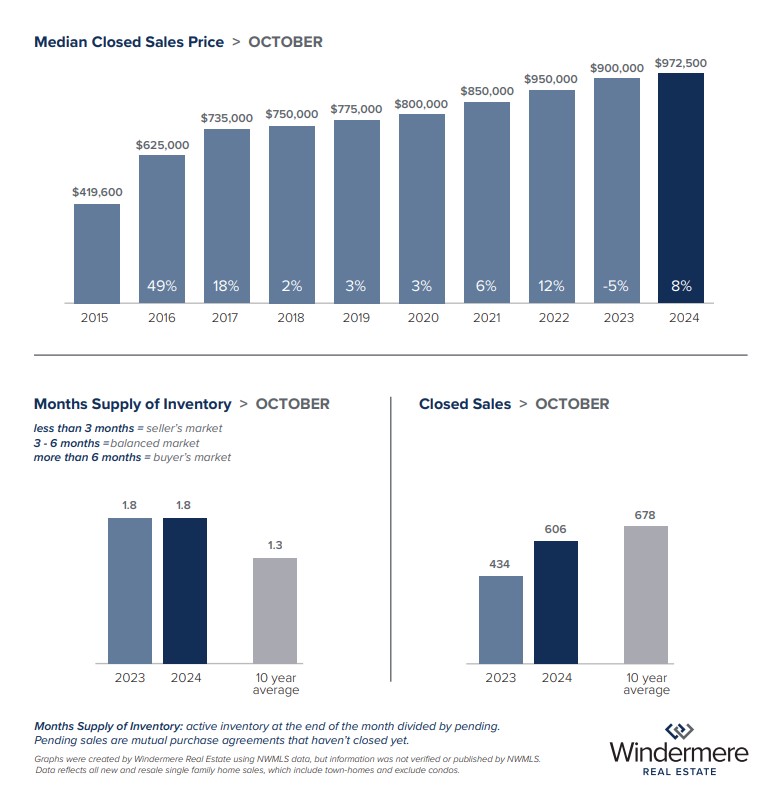

In Seattle, the median sold price for a single-family home was $972,500 in October, up 8% from a year ago and 4% from September’s median of $938,006. The number of closed residential sales last month was 49% higher than in September, revealing how much the late summer/early fall market was propelled by buyers trying to take advantage of declining mortgage rates. As for residential inventory, October ended with roughly the same number of active listings it started with, but 25% more than a year ago. The Seattle condo market is seeing the effects of a major (+40%) year-over-year supply increase: the number of closed sales grew by 56% between September and October, while the median purchase price dropped 4%, from $606,000 to $580,000.

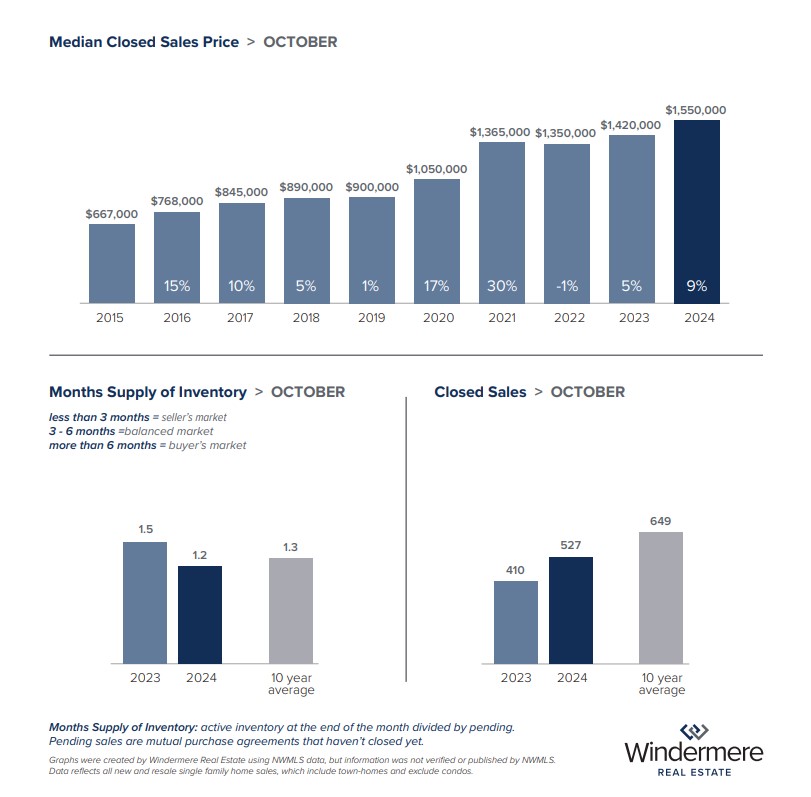

On the Eastside, the residential market kept churning despite declining inventory. Half of last month’s home sales closed at or above asking price, and the median purchase price for a home stood at $1,550,000 in October, up 9% from a year ago. Over the course of last month, the number of active Eastside listings dropped by 17%, a reflection of the busy pace of sales and a 21% year-over-year increase in the number of closed transactions. Eastside condo prices also rose in October — up 13% from a year ago and 7% from September — to a median of $740,000.

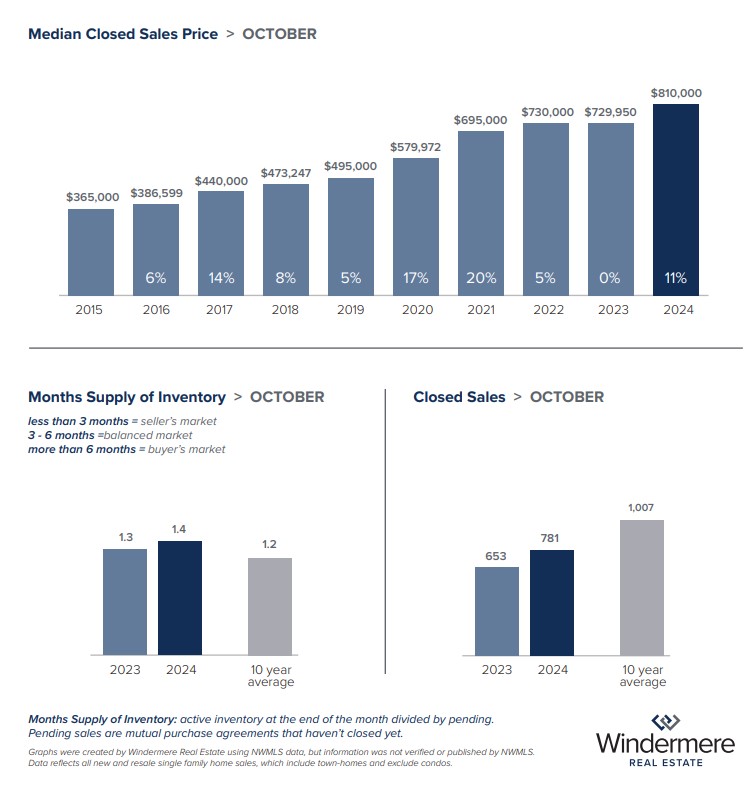

In Snohomish County last month, the median sold price of a single-family home was $810,000, up 5% from September and 11% from a year ago. The number of closed residential sales in October was 20% higher than it was for the same month last year. This surge in activity likely owes to two factors: declining interest rates drew more buyers into the late summer/early fall market just as a rising supply of Snohomish County homes provided greater selection (October ended with 22% more active listings than we saw a year ago). In the Snohomish County condo market, October’s median sold price of $509,500 was up 5% from a year ago but down 4% from September.

It will be interesting to see if either rising interest rates or a holiday season slowdown can cool the buzzy activity in our region. But tenacious buyers will continue to absorb smartly priced listings offered by sellers who stay alert to both their competition and a constantly shifting market. To navigate this real estate landscape, reach out to your Windermere broker for real-time insights and expert advice.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – October 2024

Our local real estate market has remained quite active so far this fall, with positive things happening for both buyers and sellers. Last month, every region in this report saw substantial year-over-year increases in the number of pending home sales. Residential inventory also rose in September, which is good news for buyers. And good for everyone was the continued decline of mortgage rates, which now hover about a point and a half below where they were last year. Meanwhile, sellers can take heart in September’s median sold prices, which held steady compared to August and were up compared to a year ago.

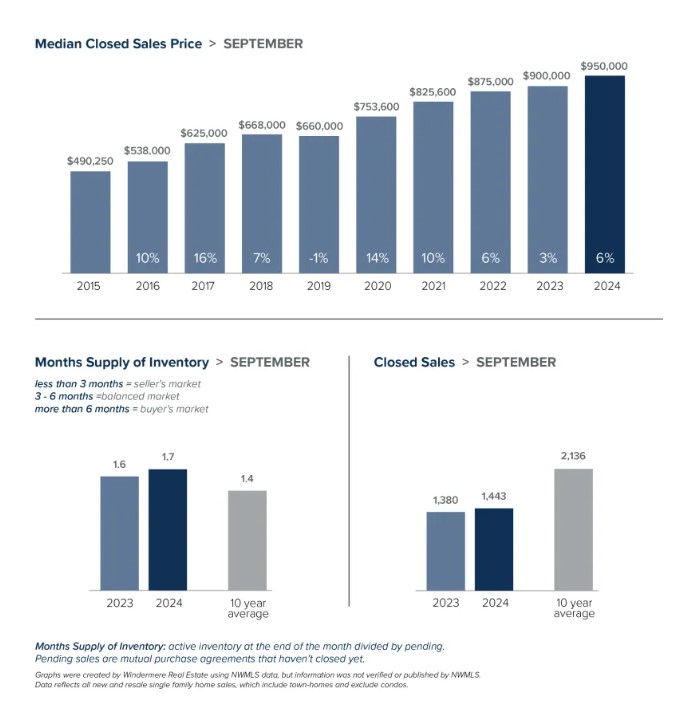

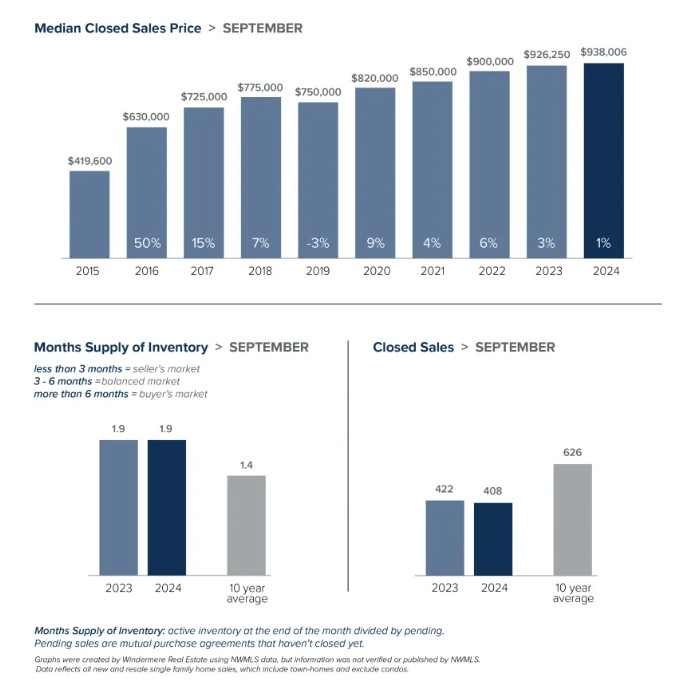

In King County, September’s median sold price for a single-family home was up 6% year over year, from $900,000 to $950,000, which is essentially flat with August’s median of $955,000. Sold prices seem to be holding steady even as the number of listings rises; September ended with 9% more residential listings than it began with and 28% more than a year ago. Pending sales were up 21% from the previous year, reflective of buyers taking full advantage of both growing supply and declining mortgage rates. The King County condo market saw increases in both median sold price – up 8% from $515,000 last September to $558,725 last month – and the number of active listings, which increased by 59% over the same span.

Seattle’s median sold price for a single-family home was $938,006 last month, up from $926,250 a year ago and $930,000 in August. September pending home sales grew by an impressive 28% year over year, still not enough to absorb the rising supply of residential listings, as the month ended with 18% more available single-family homes than it started with and 28% more than a year ago. Seattle condo prices were up 10% year over year, from $550,000 last September to $606,000 last month, even in the face of a 46% increase in the number of active condo listings over the same 12 months.

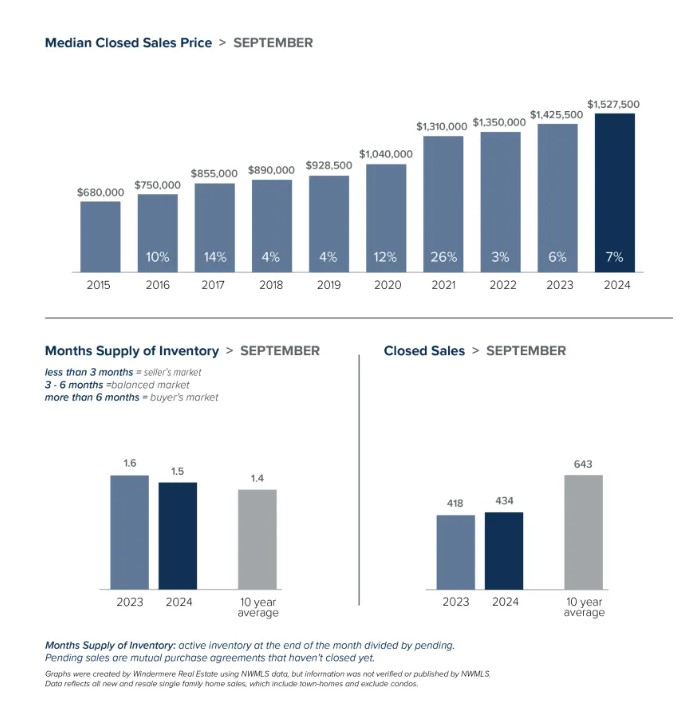

On the Eastside, the median sold price of a single-family home was $1,527,500 in September, up 7% year over year and down slightly from $1,550,000 in August. Pending home sales were up 16% from a year ago, while the number of active residential listings increased 7% from August and 10% from the same time last year. The Eastside condo market saw an interesting dynamic in September: median sold prices rose 11% year over year to $690,000, despite there being 93% more condos to choose from than there were a year ago.

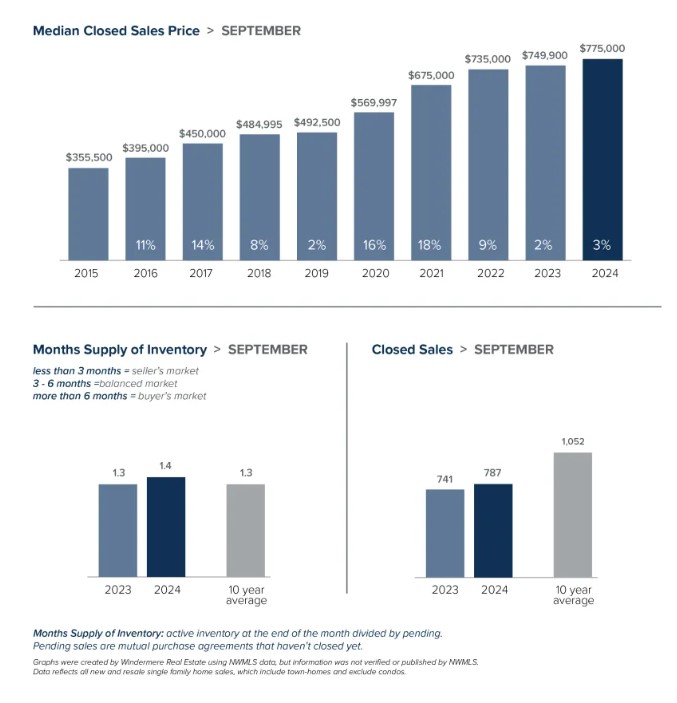

Snohomish County saw September’s pending home sales increase 15% from a year ago but dip 11% from August. Last month’s prices followed these same trend lines, with September’s median residential sold price of $775,000 up 3% from a year ago but down slightly from August’s median of $780,000. By the end of last month, the number of active residential listings in Snohomish County was 21% higher than a year ago, but this inventory still only accounted for a relatively low 1.4 months of supply. County condo prices rose 6% year over year, from $498,500 to $530,000 last month, despite there being 53% more active listings than a year ago.

As we head into the cooler months, our real estate market remains relatively warm. Better mortgage rates and greater supply are creating a tentative balance between the ongoing seller’s market and newfound buyer confidence. To understand how these dynamics align with your interests and goals, reach out to your Windermere broker for real-time insights and expert advice.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – September 2024

In the waning days of summer, the local real estate market saw rising sold prices, declining mortgage rates and rising inventory. The price trend shows that sellers are still seeing gains by listing their homes. The rate and supply trends are motivating buyers to be active in the market this fall.

As of the second week of September, mortgage rates were at their lowest level in 19 months, sitting at 6.2% for a 30-year fixed-rate loan. With at least one rate cut coming from the Federal Reserve this fall, buyers and investors are feeling bullish. It will be interesting to see how our region’s supply of homes – which is significantly higher than at this time last year – gets absorbed in the coming months by rate-motivated buyers.

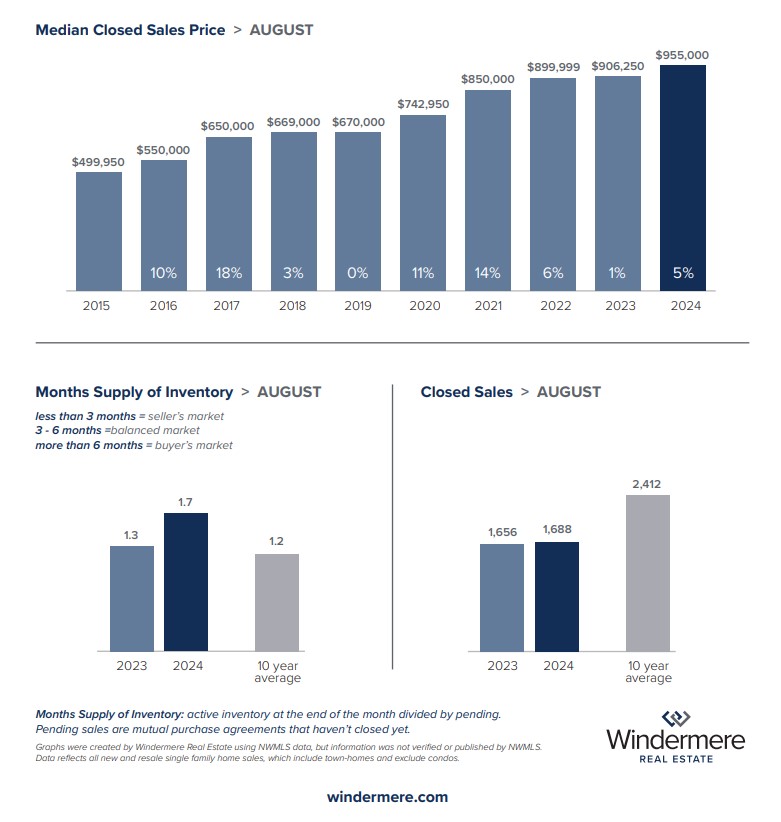

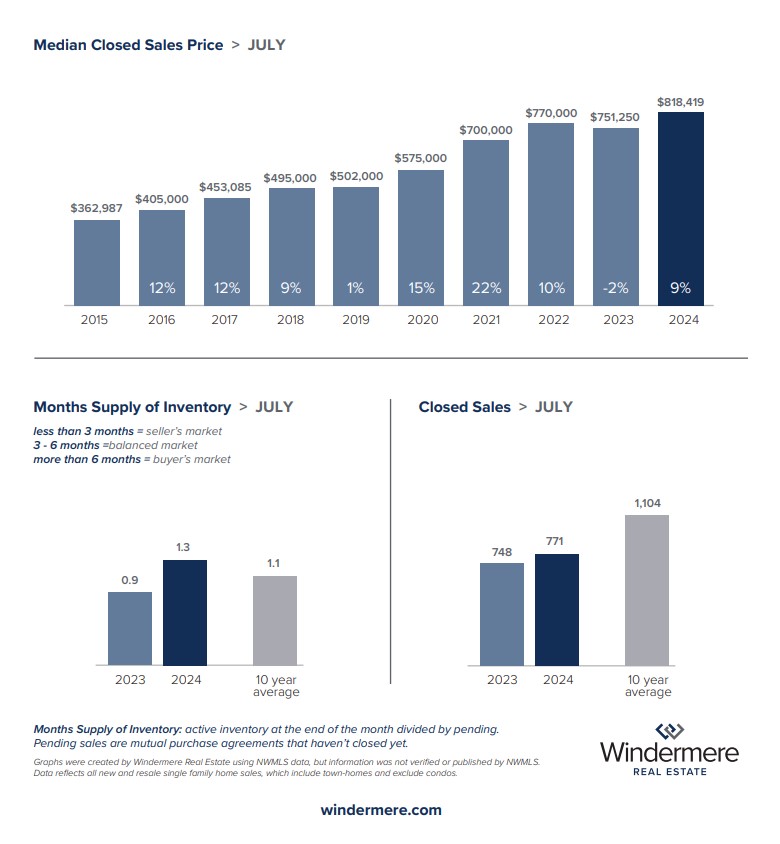

Last month the median sold price of a King County single-family home sold price rose 5.4% year over year, up to $955,000 from $906,250 in August 2023. The monthly trend was more encouraging to home buyers, however, as August’s median sold price dipped 4.4% from July’s $999,000. Also good for buyers: the number of single-family home listings at the end of August was 29% higher than it was a year ago. King County condo prices stayed static year-over-year at $525,000, despite a 69% jump in available supply.

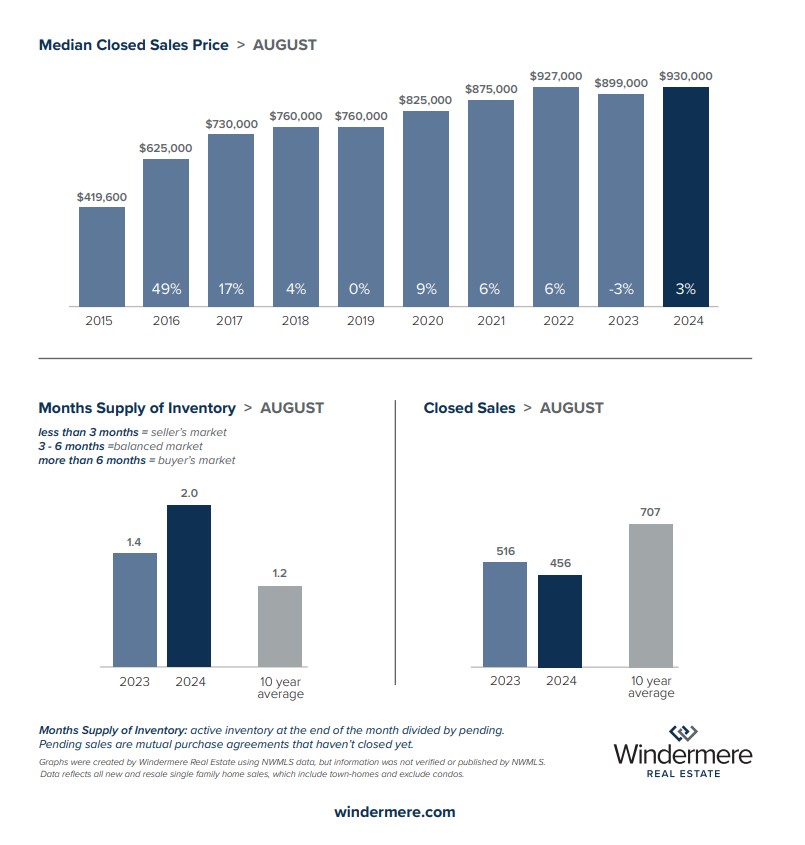

Seattle saw a 3.4% year-over-year increase in single-family home prices, up to $930,000 from $899,000 in August 2023. This represented a 4.4% monthly price drop from July’s median of $972,500. At the end of August, Seattle’s supply of single-family home listings was up 34% from the previous year, which is great news for buyers, but down 8% from July levels, which could benefit sellers. Seattle condo prices dropped 3.5% year over year, from $575,000 to $555,000, a more typical response to rising inventory, which was 39% higher than a year ago.

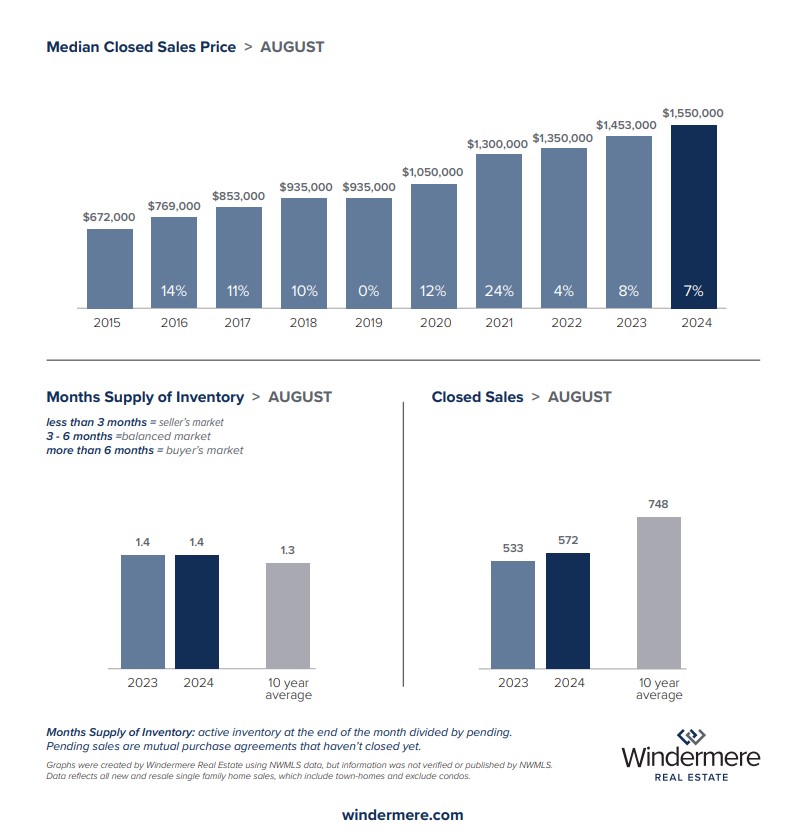

On the Eastside, the median sold price of a single-family home was $1,550,000 in August, up 6.7% year-over-year and down 4.3% from July. Pending sales dropped 16% from July, while inventory remained relatively flat between July and August. Eastside condo prices rose 2.3% year over year to $614,000, which was down 2.2% from July’s median of $627,500. At the end of August, the supply of listed condos was up 119% from the previous year and 18% from the end of July. Eastside buyers may be giving single-family homes another look as interest rates decline.

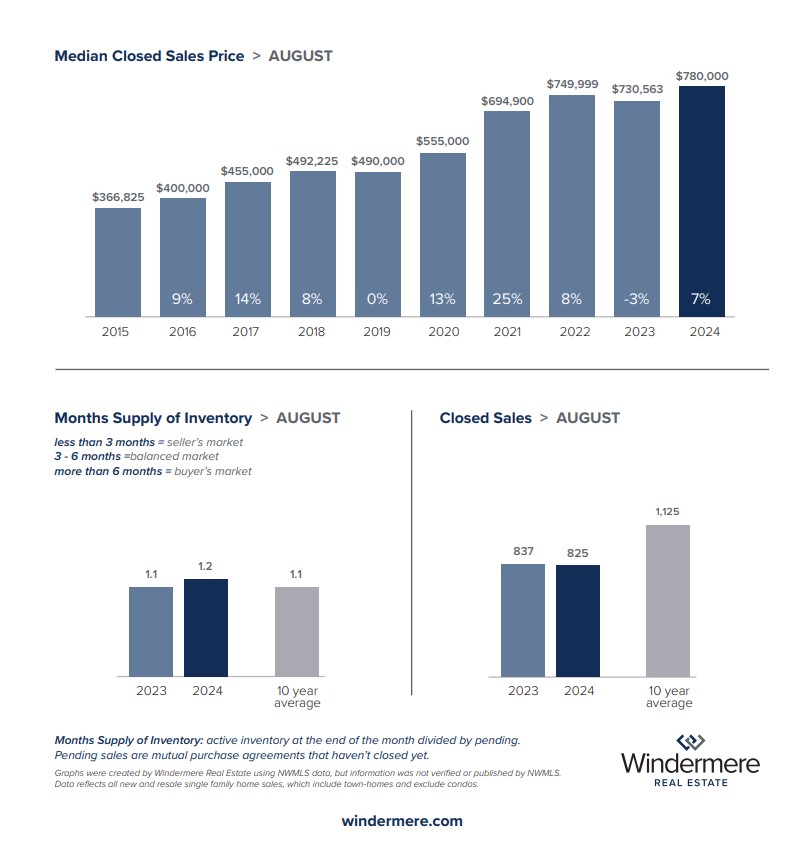

The Snohomish County market was quite active in August, with pending unit sales of single-family homes up 8% from July and 18% from the previous year. Median sold prices were up 6.8% year over year – to $780,000 from $730,563 in August 2023 – but down 4.7% from July’s median of $818,419. This month-over-month price dip occurred even in the face of continued low supply, at 1.2 months of inventory. Snohomish County condos saw August price gains, with the $589,975 median sold price up 24.2% from a year ago and 5.4% from July, despite inventory levels that were 76% higher than a year ago.

As fall begins, our local real estate market has positive markers, strong activity and relative balance. With hopes for further interest rate drops in the coming months, there should be opportunity ahead for both buyers and sellers.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – August 2024

The lazy days of summer are upon us, but home and condo sales are not the least bit idle. Just last month every area in this report saw more homes sell and for higher median prices than a year ago. And this month we’ve witnessed the year’s single biggest one-week drop in mortgage rates, which have fallen to the lowest level in 15 months. Paired with declining mortgage rates is rising inventory, with each of the areas below seeing a year-over-year increase in the supply of both homes and condos. These trends give late-summer hope to buyers who just a few months ago faced fierce market headwinds. Late summer typically sees a much slower market, but this year buyers might just be inspired and incentivized to make things hum more than usual.

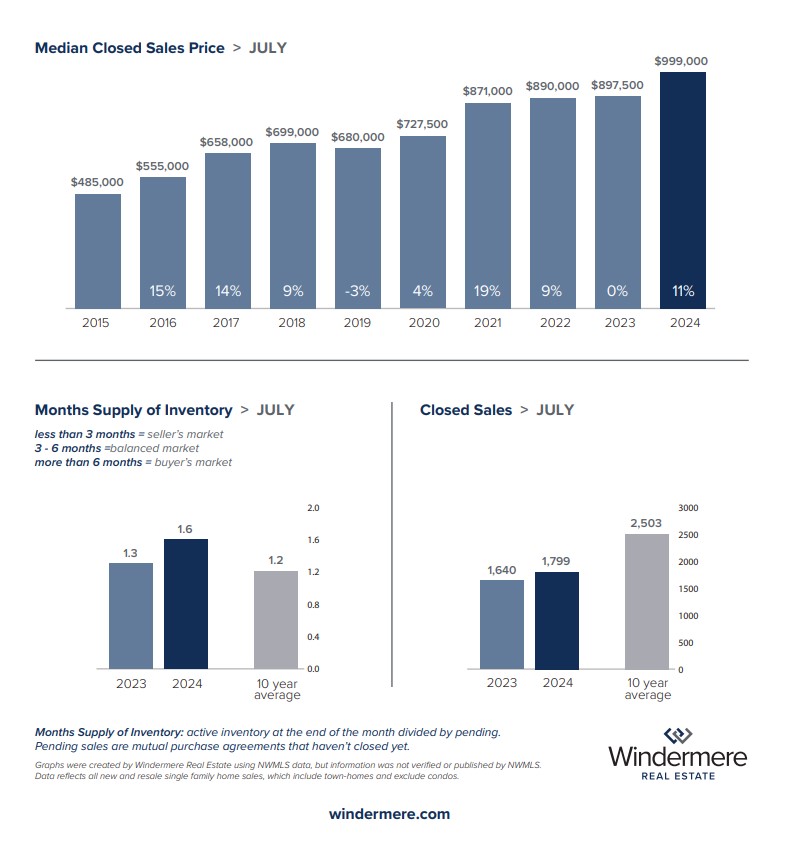

In King County, the median sold price for a single-family home increased 11% year over year, up from $897,500 in July 2023 to $999,000 last month. That reversed a price decline between May and June, after May’s record high of $1,001,000. Unit sales of single-family homes also increased in July, up 10% year over year. King County condo prices also rose last month, up 4% year over year from $510,000 last July to $530,000 last month. The number of active King County condo listings is up dramatically over last year, with a 64% jump between July 2023 and the end of last month.

Despite having the region’s highest supply of homes as measured in months of available inventory, Seattle saw the median sold price of a single-family home rise 8% year over year, from $957,000 in July 2023 to $972,500 last month. The number of Seattle homes sold in July was also up 8% from a year ago. Seattle condo prices rose 2% year over year from $550,000 to $559,000, while the number of active listings rose by 44% over a year ago. Unit sales of condos dipped by 14% last month versus July 2023.

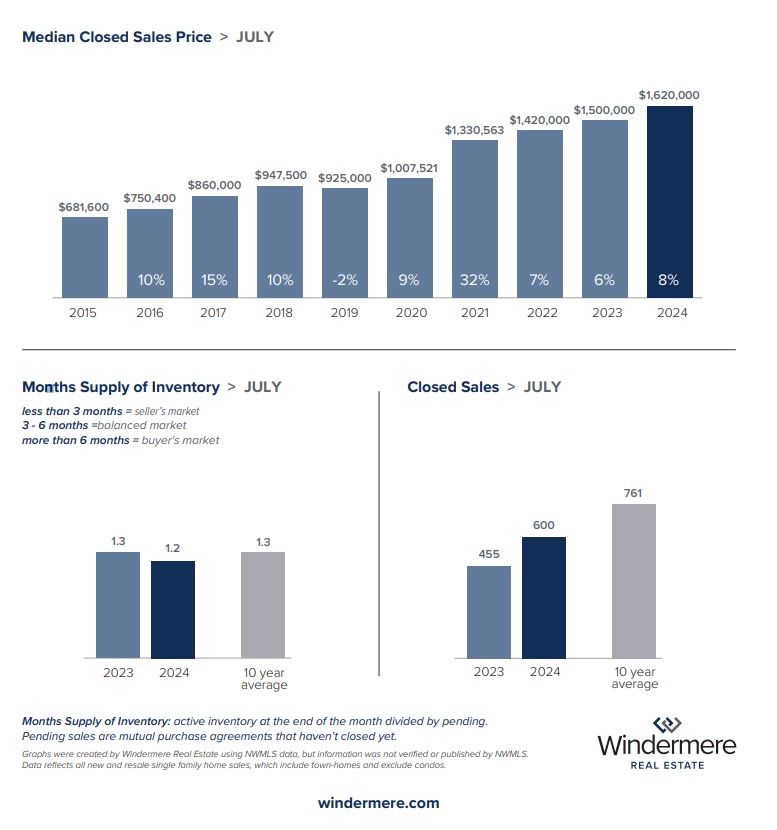

On the Eastside, home sales were robust last month, with 32% more homes changing hands than a year ago. This was accompanied by an 8% year-over-year price gain, as the median sold price of an Eastside single-family home stood at $1,620,000 last month, slightly down from June’s mark of $1,635,000. In July, 43% of home sales closed above asking price, compared to the year’s peak of 59% in April. And July’s condo prices rose 5% year over year to $627,500, despite an 83% increase in the number of actively listed Eastside condos.

By the end of July, the number of for-sale Snohomish County homes was up 38% year over year. Despite this, the median sold price of a single-family home rose 9% compared to July 2023. The Snohomish County condo market experienced a similar dynamic last month, with the median sold price rising 13% (from $495,000 a year ago to $560,000) despite a massive (137%) jump in the number of listed units. Last month, 21% more condos changed hands than in July 2023.

Similar stories are reflected throughout the markets reported above: growing supply meeting steady buyer activity leading to prices that are also holding steady. Some of these dynamics may seem counterintuitive, but they reflect a transitioning market and, combined with lower mortgage rates, a season of renewed opportunity for many buyers.

Whether you’re a buyer or seller, your Windermere advisor can shed more light on how best to navigate this market to your advantage.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – July 2024

As temperatures rise, so has the supply of for-sale homes in our area. Last month, active inventory continued its upward trajectory, which is leading to some summer price stabilization. Every region represented here saw a rise in the number of single-family homes and condos for sale in June. And while median sold prices did increase over last year in most cases, they dipped or were flat when compared to May.

Home buyers needing a little more time to find the right home can breathe a bit easier. With the rate of price increases slowing and the number of available single-family homes growing, there’s a little less pressure to act quite as fast as springtime bidding wars necessitated. While it’s still a seller’s market, buyers who’ve been sitting on the sidelines can now dip their toes back into a somewhat mellower market. That said, in hot areas like the Eastside, half of homes sold in June closed above list price and in an average of five days.

Let’s break it down by area to see what’s heating up and cooling down this summer.

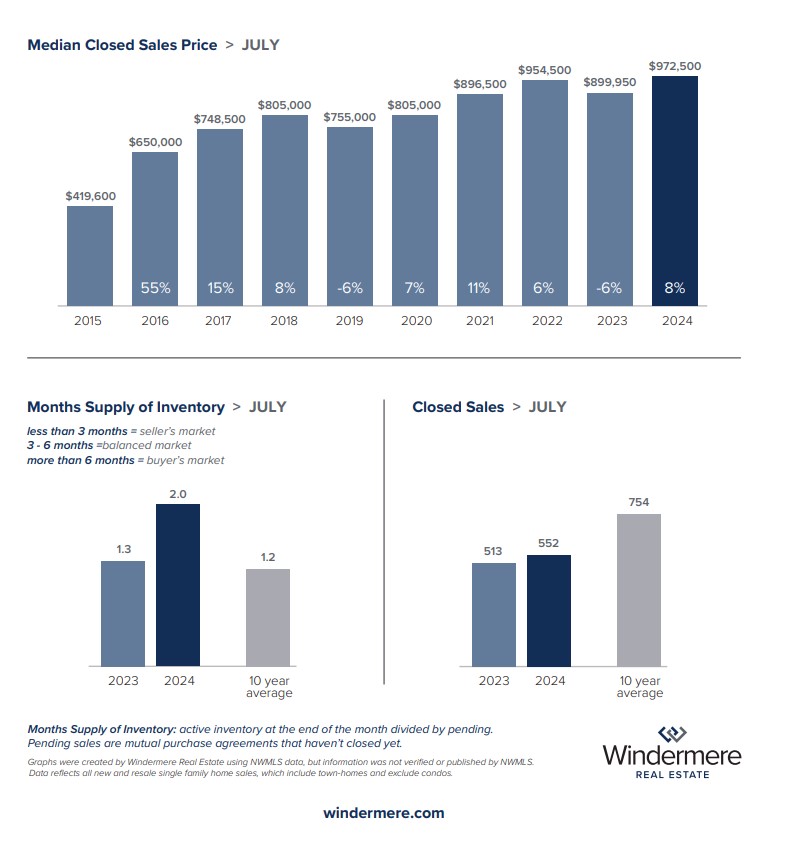

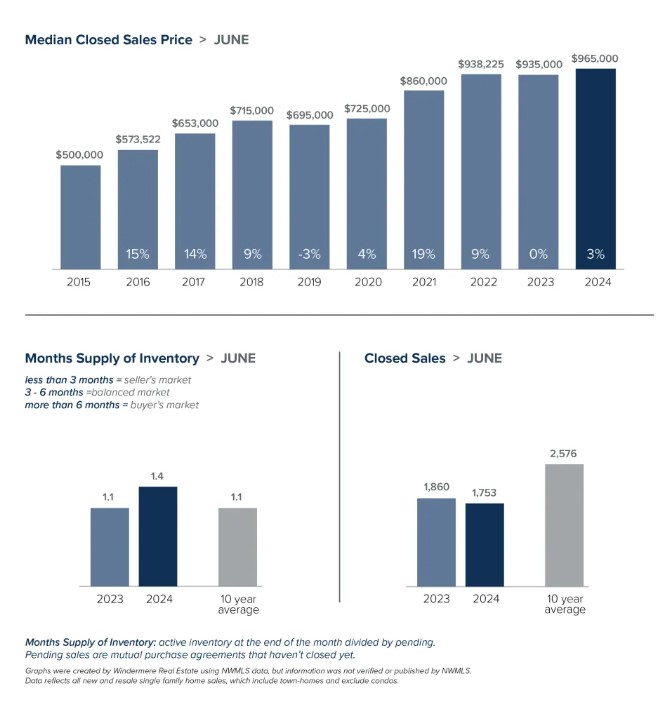

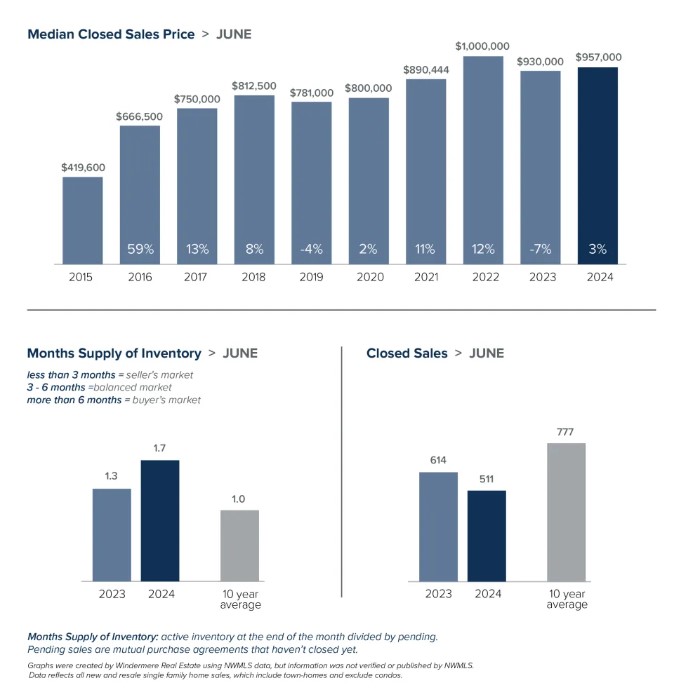

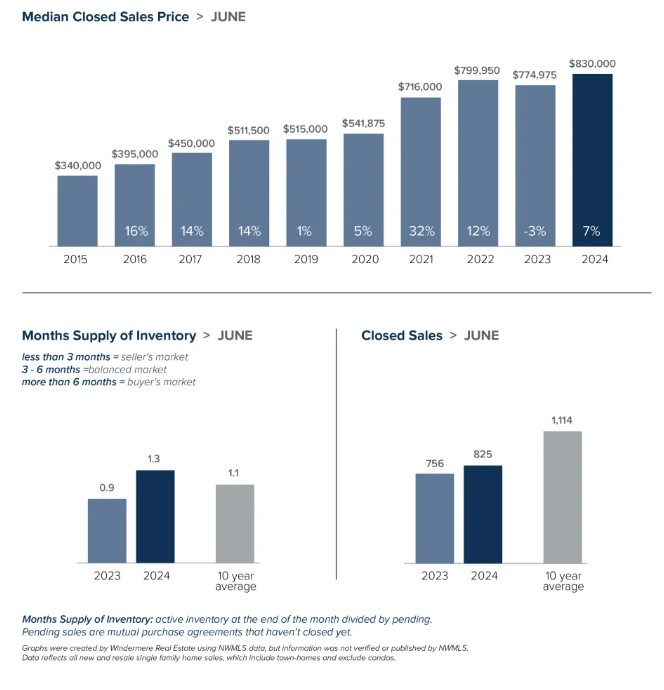

In King County, the median sold price for a single-family home increased from $935,000 in June 2023 to $965,000 last month. However, June sold prices decreased by 4% from May’s record-high price of $1,001,000. While these numbers likely reveal the effect of higher inventory, 43% of King County homes sold in June closed above list price. As of June 30, active residential listings were up 31% year over year and 12% month over month. King County condo prices rose 5% year over year from $529,975 last June to $555,090 last month. The increase is despite a 75% year-over-year jump in the number of active condo listings, up from 832 units on June 30, 2023, to 1,453 last month.

In Seattle, residential sold price increases are showing signs of slowing, with last month’s median of $957,000 up just 3% from a year ago and dropping 1% between May and June. This trend is likely a result of the healthy dose of new listings inventory over the past few months, as buyers now have more options and bidding wars have lessened. June saw many more residential listings hit the market, and by month’s end inventory was up 30% from the end of May and 27% year over year. Seattle condo prices stayed flat month to month at $550,000. Sensing calmer pricing on the horizon, it will be interesting to see if some potential condo buyers might be able to give the single-family housing market a second look.

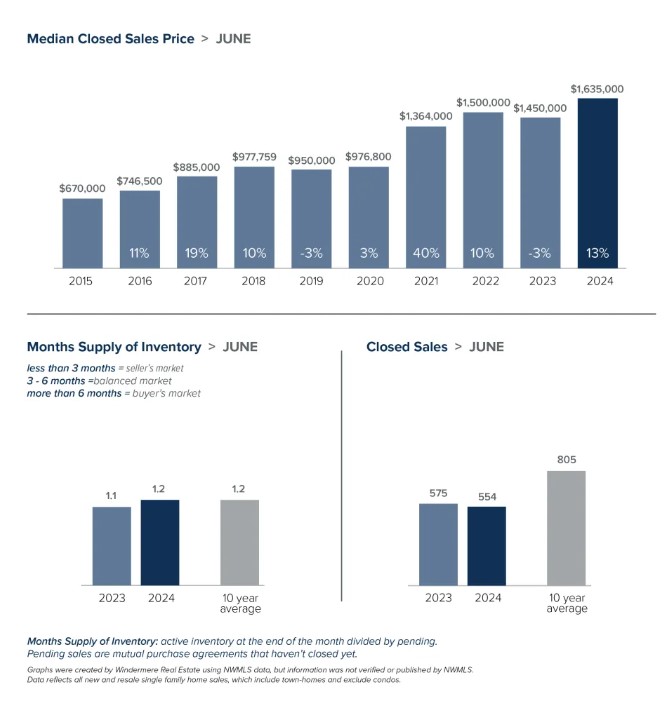

The June residential real estate market on the Eastside saw substantial year-over-year price gains but experienced a 4% decrease from May’s median sold price. Half of the homes sold in June received multiple offers, with the sales price exceeding the original asking price by a median of 7 percent. While these figures show a healthy seller’s market carrying over from May to June closings, the remaining summer months are likely to provide more balance for Eastside buyers, with fewer multiple offers and lengthening market times. June saw a growing supply of homes: the number of active residential listings rose 16% over the course of the month. Eastside condo prices dropped year over year from $650,000 last June to $637,500 last month, and the supply of listed condos grew by 19% during the month.

Snohomish County single-family home prices rose 7% year over year, up from $774,975 in June 2023 to $830,000 this June. Month-over-month prices, however, were flat: the median residential sold price was $830,000 in June versus $828,000 in May. The number of active listings was up 38% year over year and 21% higher at the end of June than at the end of May. Increasing inventory is happy news to home buyers and may help moderate prices in the coming months. The median sold price for a Snohomish County condo in June was up 5% against last year but down 5% from May. Between June 1 and June 30, there was a 26% increase in the number of active condo listings in Snohomish County.

In all markets reported above, the same trend lines have formed: price increases are slowing – or stopping altogether – and inventory is growing. The strong spring seller’s market has given way to a summer of more balance, with renewed opportunity for many buyers.

Your Windermere advisor can provide a clear, real-time picture of the market and its summertime trends, focusing on your priorities and presenting the best match for your real estate goals.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link