In the waning days of summer, the local real estate market reflected a mix of shifting prices, easing mortgage rates, and continued annual growth in inventory. Some areas still favored sellers benefiting from demand, while others gave buyers increasing leverage. Together, declining interest rates and higher supply could motivate cautious buyers to re-enter the market this fall.

As of the second week of September, mortgage rates reached their lowest point in 10 months, sitting at 6.35% for a 30-year-fixed-rate loan. Whether this is enough to draw more buyers into action remains to be seen, but it is welcome news for sellers contending with significantly higher inventory and tempered demand amid broader economic uncertainty. How this dynamic plays out in the coming months — particularly as the market enters a seasonal slowdown — will be important to watch.

KING COUNTY

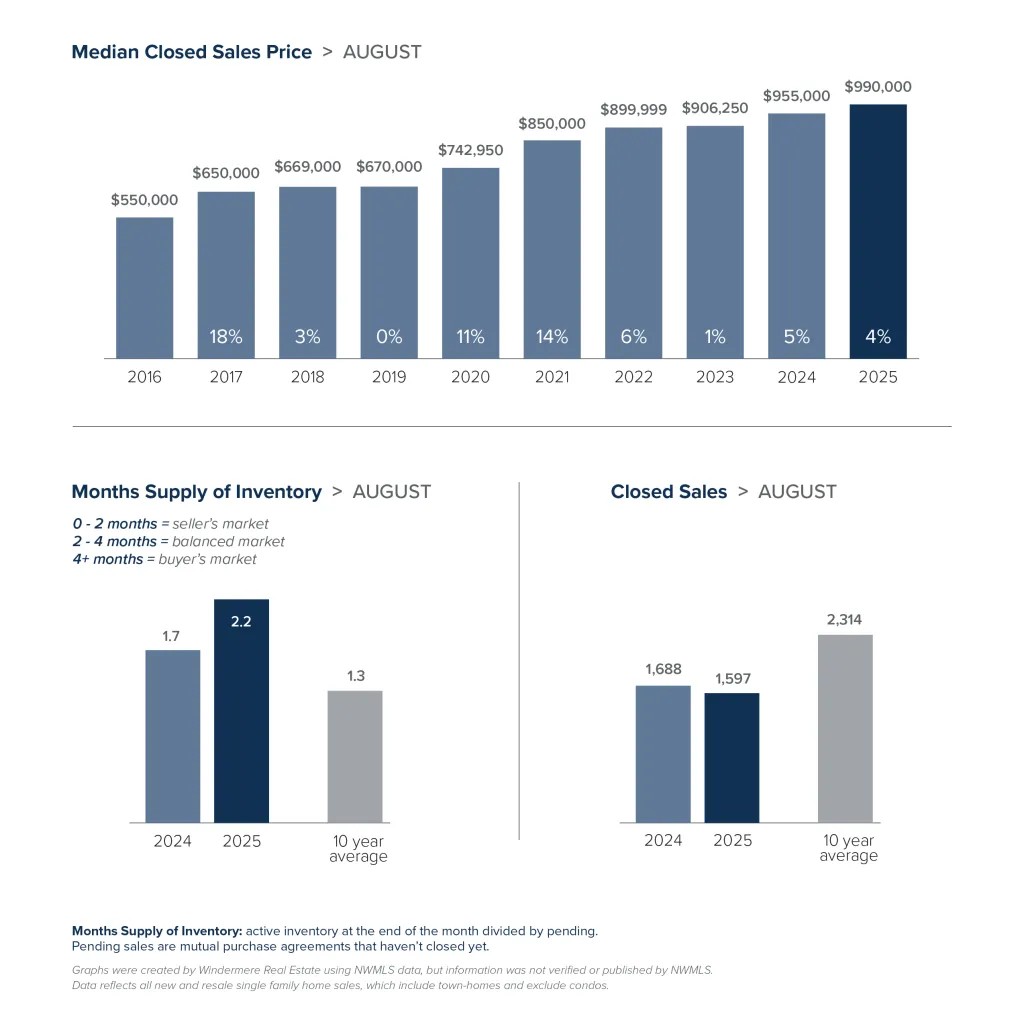

Last month, the median residential sold price in King County rose 4% year over year to $990,000, up from $955,000 in August 2024. The monthly trend was a bit more encouraging for buyers, however, as August’s median sold price dipped 1% from July’s $1,000,000. Active listings were 32% higher than a year ago, expanding options for buyers across the county. In the condo market, prices increased 4% year over year to $549,000, even as supply climbed 29%.

SEATTLE

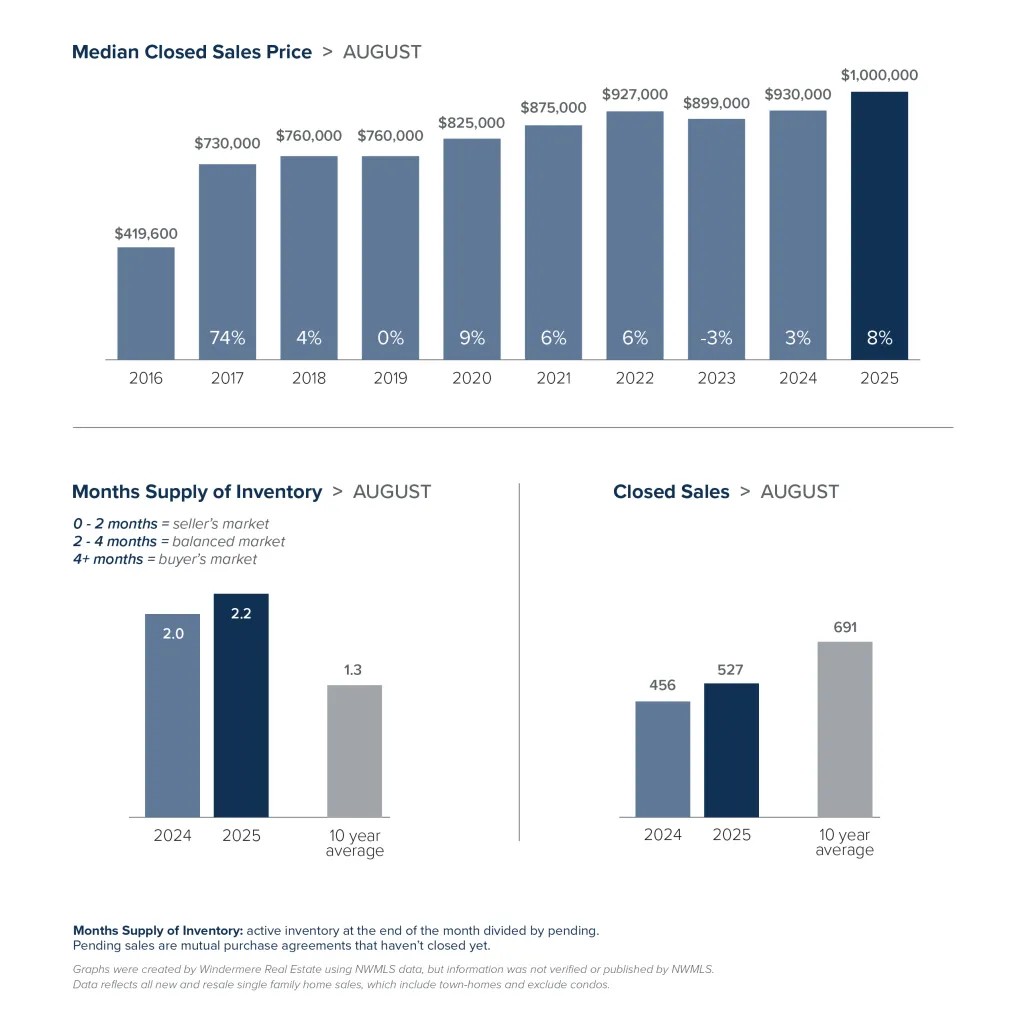

Seattle’s median single-family home price climbed 8% year over year to $1,000,000, though this marked a 1% dip from July’s $1,010,000. At the same time, inventory rose 17% compared to last August. Condo prices advanced 7% year over year from $555,000 to $595,000, with active listings up 24%. Throughout the summer, Seattle remained one of the more competitive markets in the region, with buyers and sellers adapting to higher prices and rising supply.

EASTSIDE

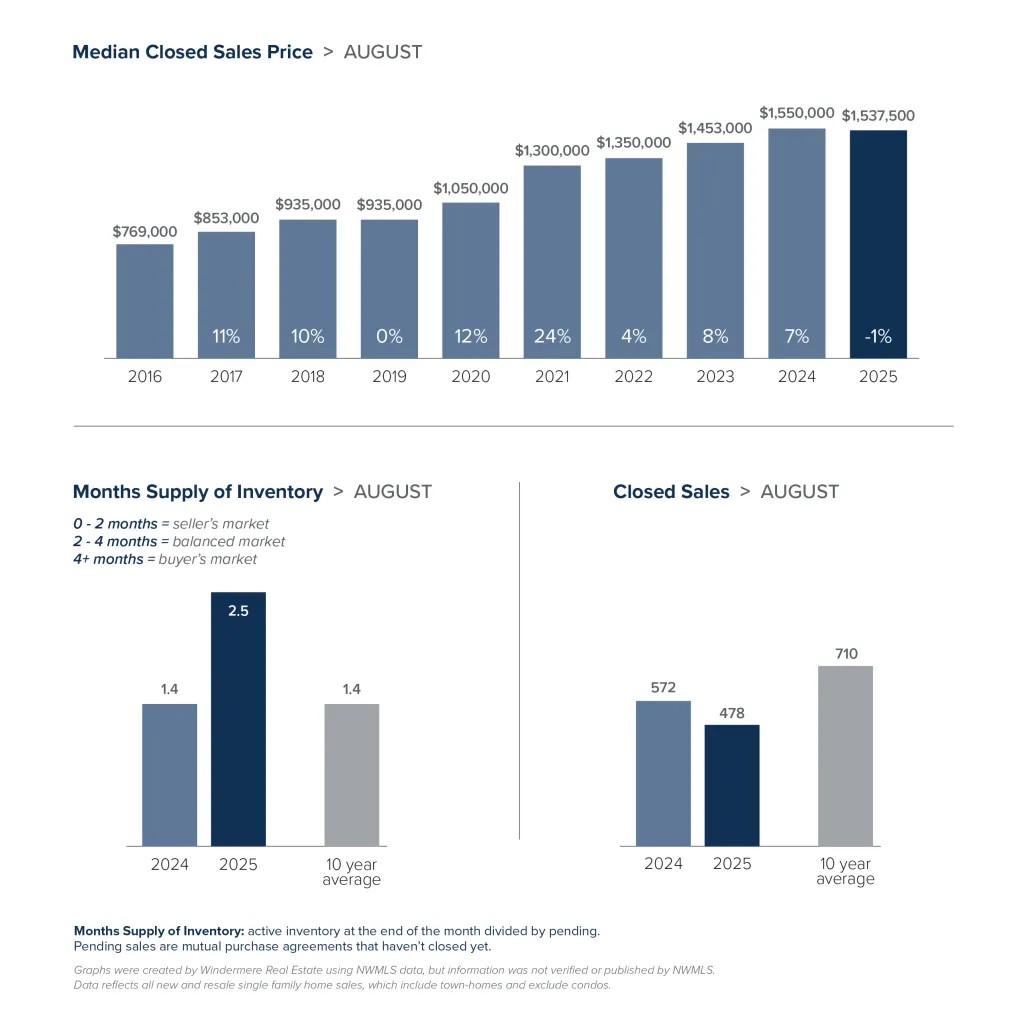

On the Eastside, the median sold price for a single-family home was $1,537,500 in August, down 1% year over year and 3% from July. Closed sales fell 16% annually, while inventory surged 69%. Motivated sellers had to be flexible to beat out competition last month as nearly 70% of homes sold under list or after a price reduction — a sharp contrast from 2024 when fewer than half did. Meanwhile, the Eastside condo market showed notable strength: median prices jumped 17% year over year to $717,500, with active listings up 48%.

SNOHOMISH COUNTY

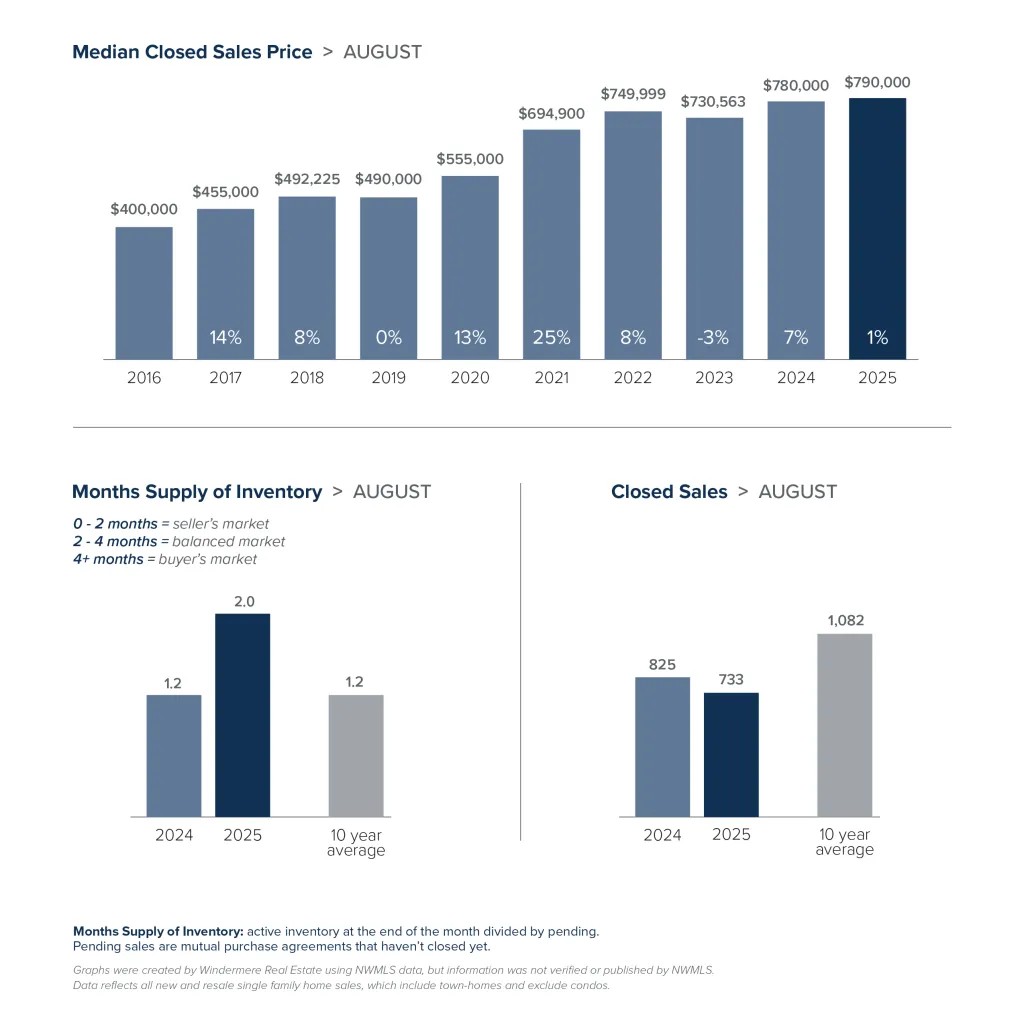

Snohomish County saw softer activity in August. Pending sales of single-family homes declined 12% and closed sales dropped 11% compared to last year, while active listings increased 47%. Median sold prices inched up 1% year over year to $790,000 but slipped 2% from July’s $805,000. This month-over-month price dip aligns with the county’s shift toward a balanced market. The median sold price for a Snohomish County condo fell to $500,000, a 15% annual drop and a typical market response to rising inventory — which was 64% higher than a year ago.

As fall begins, our local real estate market is showing signs of equilibrium, with opportunities for both buyers and sellers. Inventory growth and easing rates suggest buyers may gain ground, but how supply responds this season remains an open question. In such a rapidly evolving landscape, expert guidance is essential. Partnering with an experienced Windermere agent can help you build a strategy tailored to today’s conditions and tomorrow’s opportunities.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link