As we march steadily into the cooler winter months, the expected seasonal slowdown is upon us. Interest rate increases have continued to influence a quieter-than-usual fall market. Higher mortgage rates reduce buying power, as well as the momentum of move-up buyers and sellers.

Fewer sellers mean lower inventory and a reduction in closed sales. Indeed, the supply of listed homes in our region has continued to decline. As compared to the same month last year, October experienced a 30% decrease in active King County property listings. If trends hold true to the past three years, the start of winter will bring rising home prices locally.

It is expected that median sold prices will rise between December and April, unless rates increase significantly. In King County, the median price for single-family homes dropped 2% from $903,000 in October 2022 to $882,997 last month. This was a slight bump up from September, and a 14% increase year-over-year.

Just like December temperature variations, our local real estate market continues to feel up and down. Interest rates, regional economic conditions and seasonal market shifts have meant rising home prices in some areas and drops in others. While the expected winter slowdown means overall lower inventory, buyers are still willing to compete for plum properties in a diminishing pool of available listings.

A slight decrease in interest rates has raised cautious optimism in our region. Interest rates fell to around 7.2% as of December 1, compared to 7.8% in October. A continued trend in this direction could signal some welcome positivity in the market as we move into the new year.

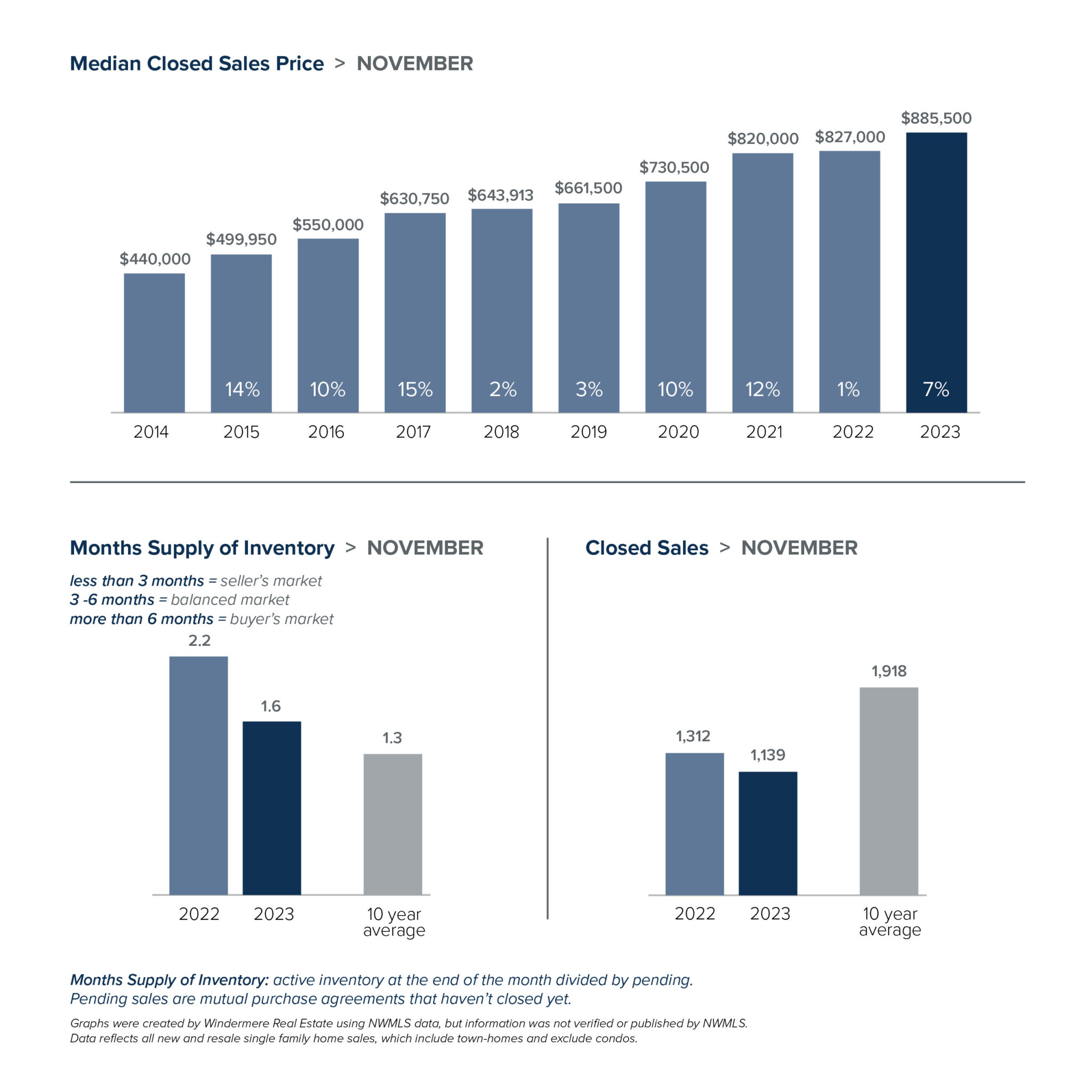

In King County, the expected decline in winter inventory is pushing up year-end home prices. The region saw a 7% year-over-year increase in the median residential sold price, from $827,000 in November 2022 to $885,500 last month. Buyers are still showing up: there’s steady demand and potential competition for each available home that’s in good condition and well-priced. King County condos also saw a year-over-year price increase, with the median sold price up 4% in November to $485,000.

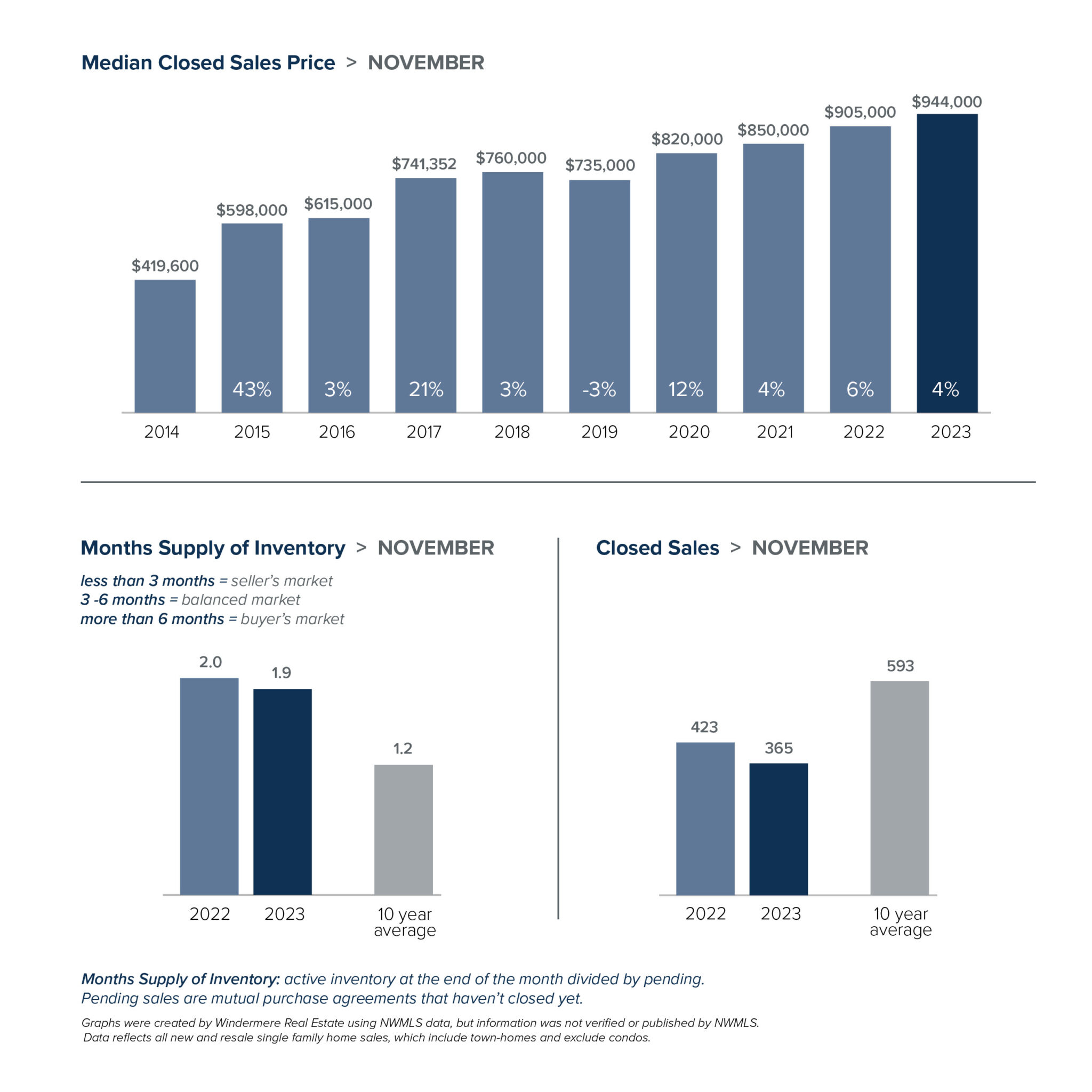

Seattle saw a 5% increase in the median sold price of a single-family home, up from October’s $900,000 to $944,000 last month. The market kept some momentum in November, with 48% of Seattle homes selling at or above asking price and 79% going under contract in 30 days or less. Condo prices saw a 21% year-over-year jump, from $480,500 in November 2022 to $582,750 last month. This price growth flew in the face of significant supply, at 3.4 months of inventory.

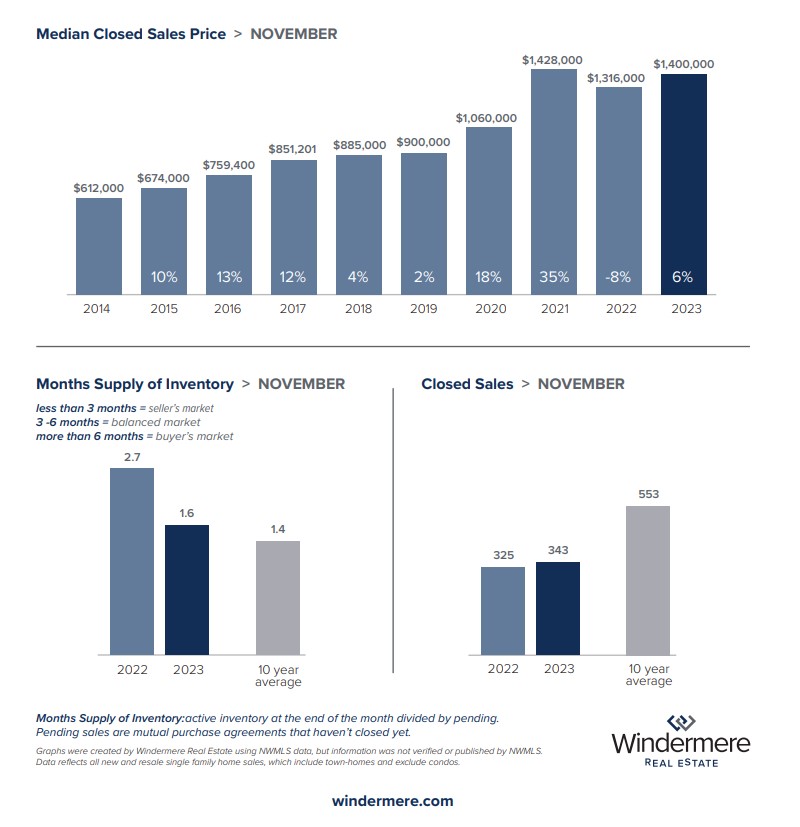

The Eastside median residential sold price experienced a modest decline in November, down 1% from October’s $1,420,000 to $1,400,000 last month. However, the November price was still up 6% from November 2022, while 75% of sold listings went under contract in 30 days or less. Residential inventory remained fairly flat on the Eastside, increasing slightly from 1.5 months in October to 1.6 months in November. Eastside condo prices increased last month, with a median sold price of $620,000, up from $569,500 in November 2022.

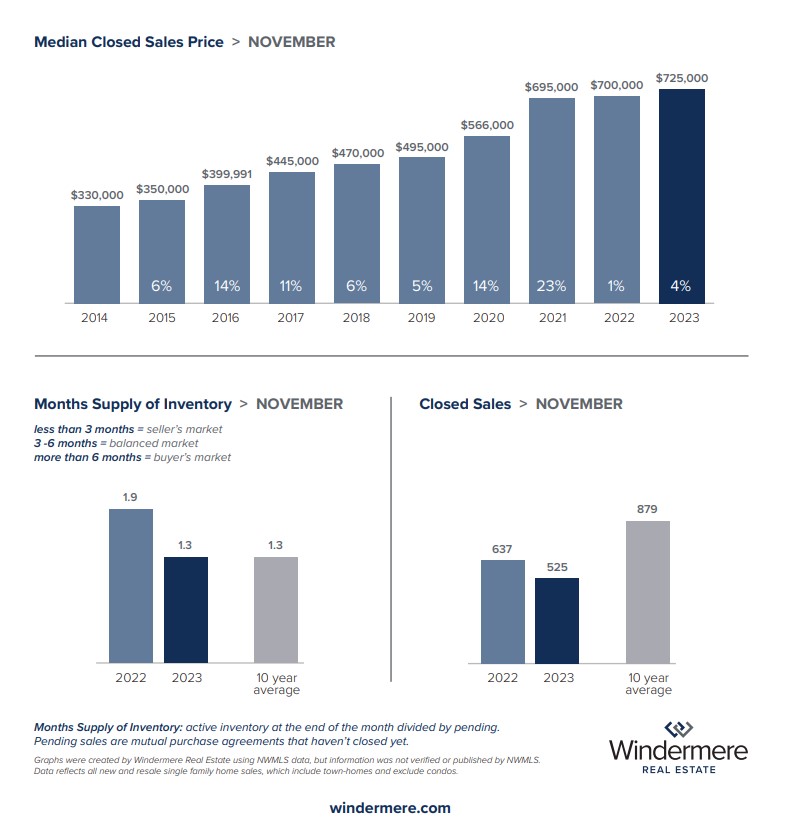

Snohomish County saw a year-over-year bump in prices last month. The median sold price for a single-family home rose from $700,000 last November to $725,000 this November. Supply stood at just 1.3 months at the end of the month, down 32% from this time last year. Condo prices also rose, from $507,500 in November 2022 to $521,209 last month.

As winter unfolds, it’s crucial for buyers and sellers to work with a knowledgeable broker to navigate this churning real estate market. Together you can create a strategy that best supports your real estate goals for the new year.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link