Local Market Update – April 2024

It’s the time of year when for-sale signs typically start popping up like tulips and daffodils. Houses show well in the spring, just as the number of homebuyers peaks and sellers feel more ready to list. While we are seeing the market thaw this spring, challenges remain, especially for buyers. There remain more buyers in the market than available homes, an imbalance that’s driving up prices despite mortgage rates that still hover in the upper six-percent range.

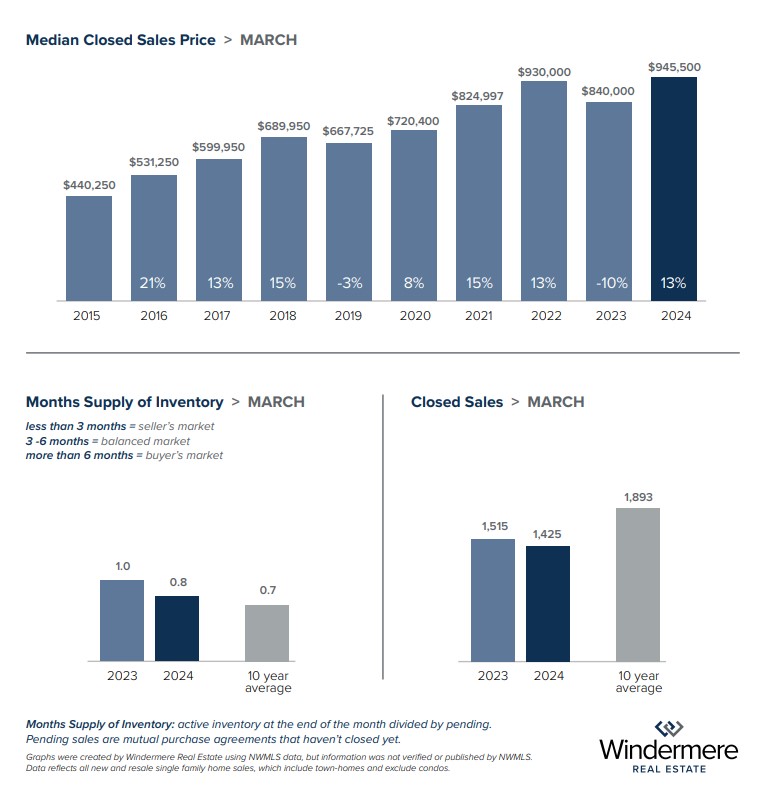

Following suit from the prior two months, King County home and condo prices rose again in March. The median residential sold price of a single-family home was $945,000, up 13% from a year ago. The percent of homes selling above asking price increased by 14% year over year, with those properties selling in less than a week. Supply dropped to just 0.8 months of inventory, feeding the competition for single-family homes. King County condo prices also jumped last month, with the median sold price up 7% from a year ago, to $540,000.

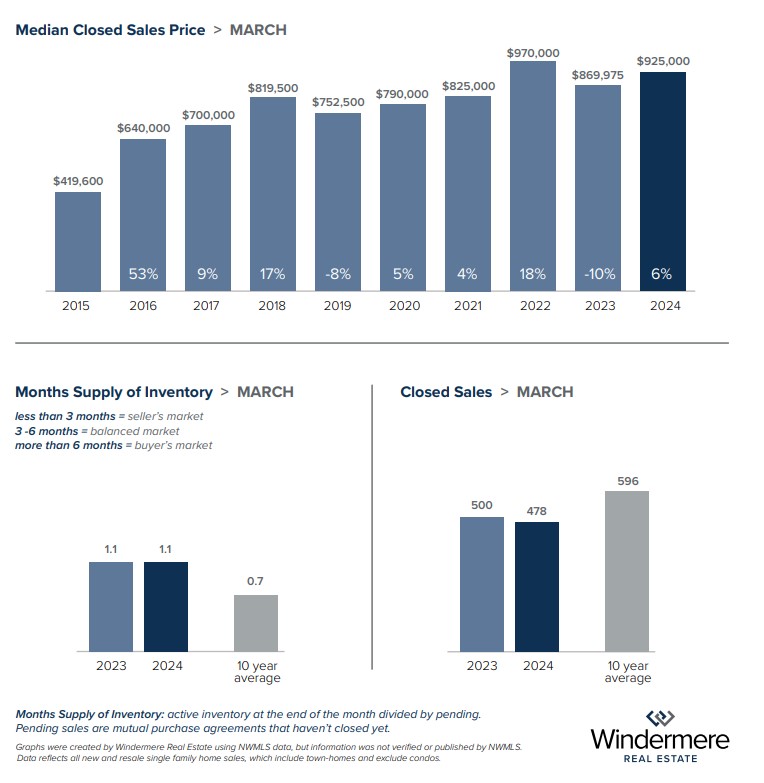

Seattle’s supply of available homes – as measured in months of inventory – remained stable month to month. The median sold price for a Seattle single-family home landed at $925,000 in March, up 10% from a year ago. Conversely there was a 4% month-over-month drop in the portion of homes selling above asking price, yet nearly 60% of sold homes still closed at or above asking price. Seattle condo prices leapt by 10% year over year, up to $587,500, despite there being 19% more active listings than there were a year ago.

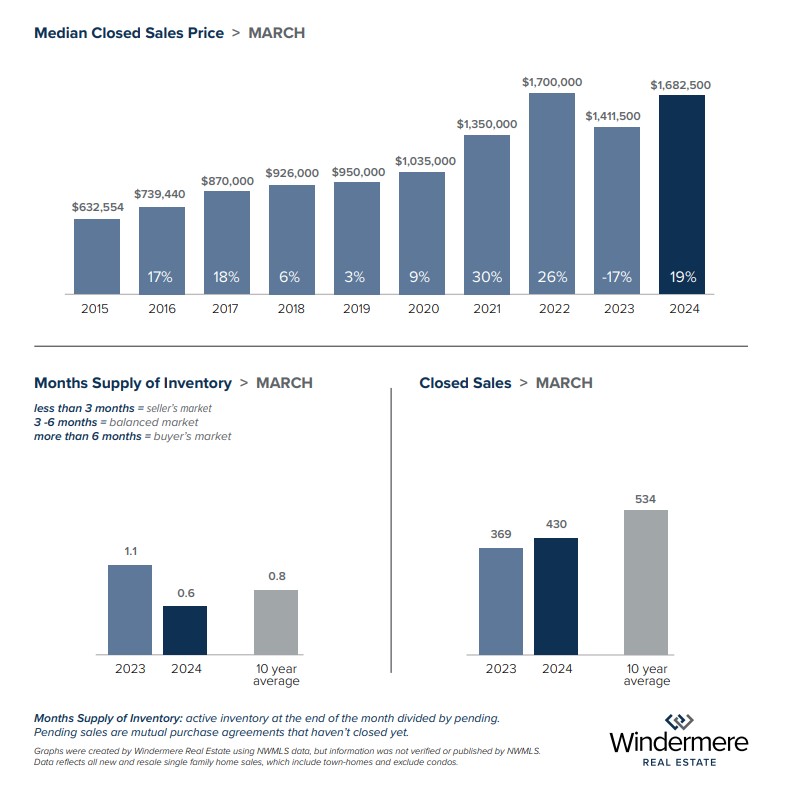

Eastside single-family home prices jumped 19% in March compared to a year ago, up from $1,411,500 last year to $1,682,500 this year. Competition remains fierce among Eastside buyers, with more than half of all sold homes closing above asking price, and 85% going under contract in 30 days or fewer. At 0.6 months of supply, inventory is very low, having decreased by 46% year over year. Eastside condo prices increased at a more modest pace last month, up 4% year over year, from a median of $585,000 to $610,000.

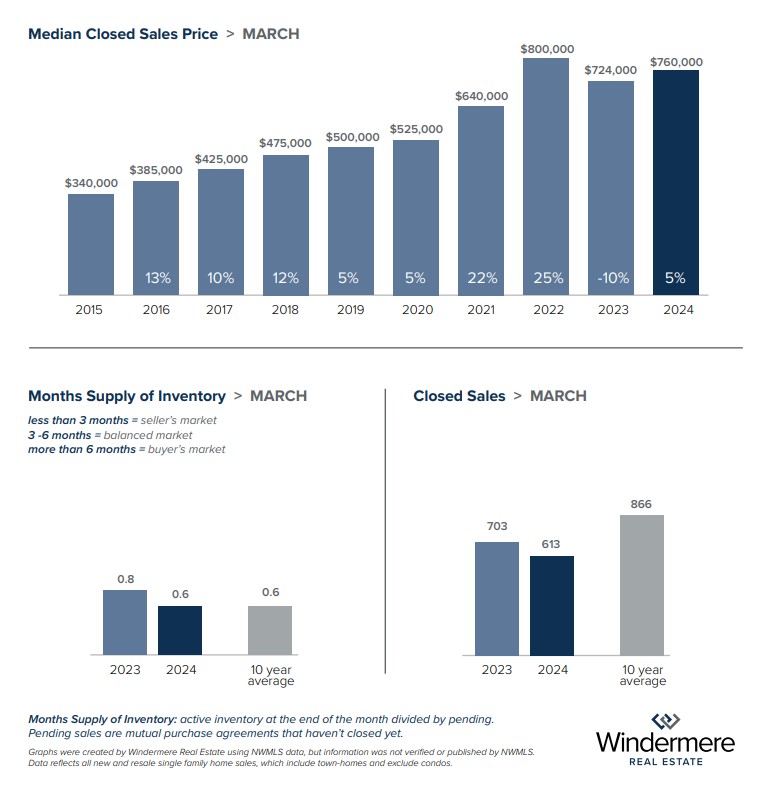

The median sold price of a Snohomish County single-family home rose to $760,000 in February, up 5% from a year prior. Supply – as measured in months of inventory – remained low at 0.6, resulting in almost half of all sold homes closing above list price and 83% going under contract in 30 days or fewer. Snohomish condo prices also rose, up 4% year over year, from $495,000 to $515,000 last month.

In this spring market, buyers who find a home they love will typically need to be prepared to act fast and compete against multiple offers. The current market’s dynamics are fueled by low supply, with not enough new listings coming on the market to offset the number of listings going under contract each month. Prospective home and condo sellers may be motivated by the multiple offers, fast market times and higher sold prices being generated by so much buyer competition. But many still wait on the sidelines, watching to see when mortgage rates drop so they can feel better about giving up their current lower rate in order to jump back into the market.

When faced with a fast-moving and shifting market, it’s important to have a knowledgeable expert by your side. Your Windermere broker is ready to provide the insight you need regarding your local market, as well as the context and direction to help you make the best decisions as either buyer or seller.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – March 2024

Seasonal changes are starting to take shape across the region and the local real estate market is experiencing cautious optimism. As we transition from winter to spring, home and condo sales are increasing, in both units and price. Low inventory means motivated sellers are finding success in about a week’s time, while buyers thread the needle between needing to present enticing offers and having to adjust their price ceilings due to recent mortgage rate increases.

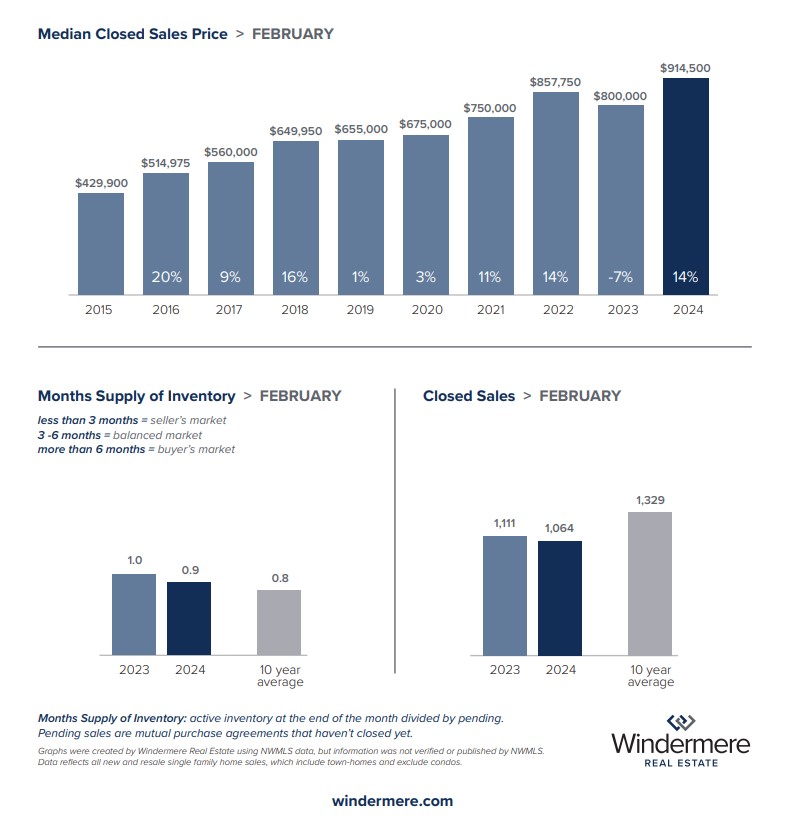

Last month was the second month in a row that King County home and condo prices rose. February’s median residential sold price increased to $914,500, up 14% from a year prior, while the number of homes selling over list price rose by 16 percent. These homes averaged just under a week on the market, likely due to the continued low inventory of available properties. King County condo prices jumped 17% year over year, from $468,500 in February 2023 to $550,000 last month.

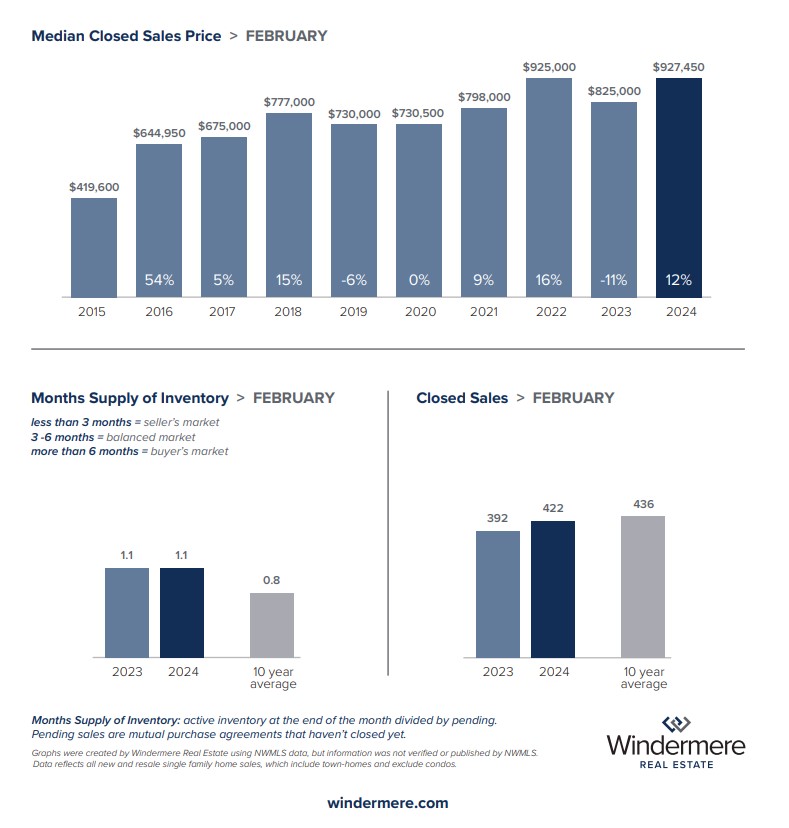

In Seattle, the median sold price for a single-family home increased 12% year over year, from $825,000 in February 2023 to $927,450 last month. The market pace picked up in February, with 41% of homes selling above list price and in just over a week. Inventory still sits around one month’s supply, benefiting sellers who are ready to list. Seattle condo prices also are on the rise, with an 8% year-over-year jump to $558,000, up from $515,000 in February 2023. Condo inventory in the city was up 16% between February 2023 and 2024, from 1.7 to 2.0 months of supply.

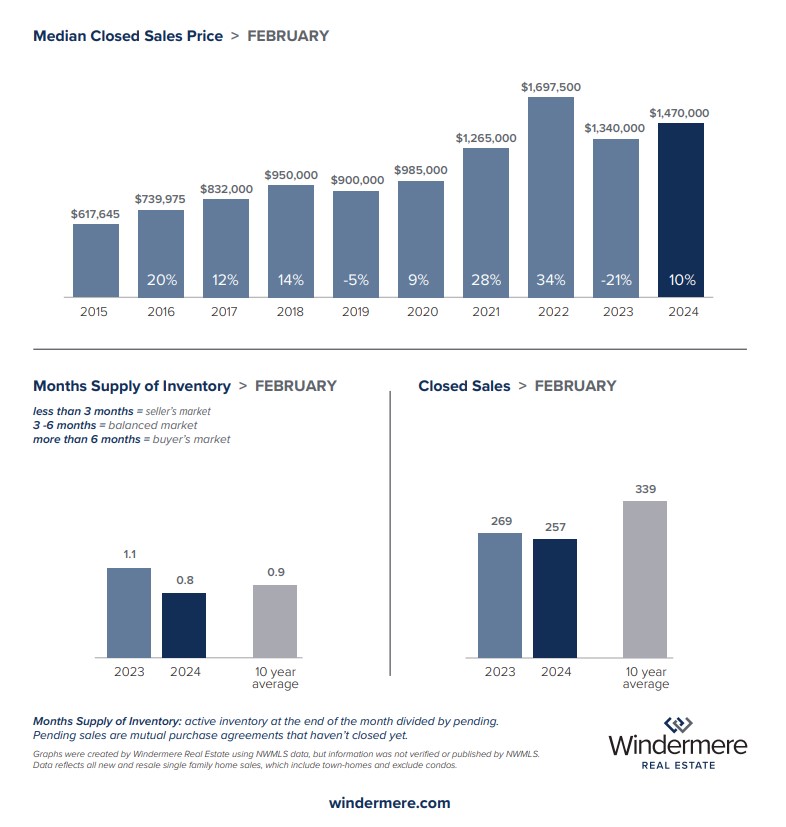

The median sold price for a single-family home on the Eastside experienced a 10% jump year over year, from $1,340,000 in February 2023 to $1,470,000 last month. In that time, supply (as measured in months of inventory) dropped from 1.1 to 0.8, spurring competition among buyers – 42% of homes sold above list price and in an average of 5 days. Eastside condo prices leapt by 23%, from $540,000 in February 2023 to $665,000 last month.

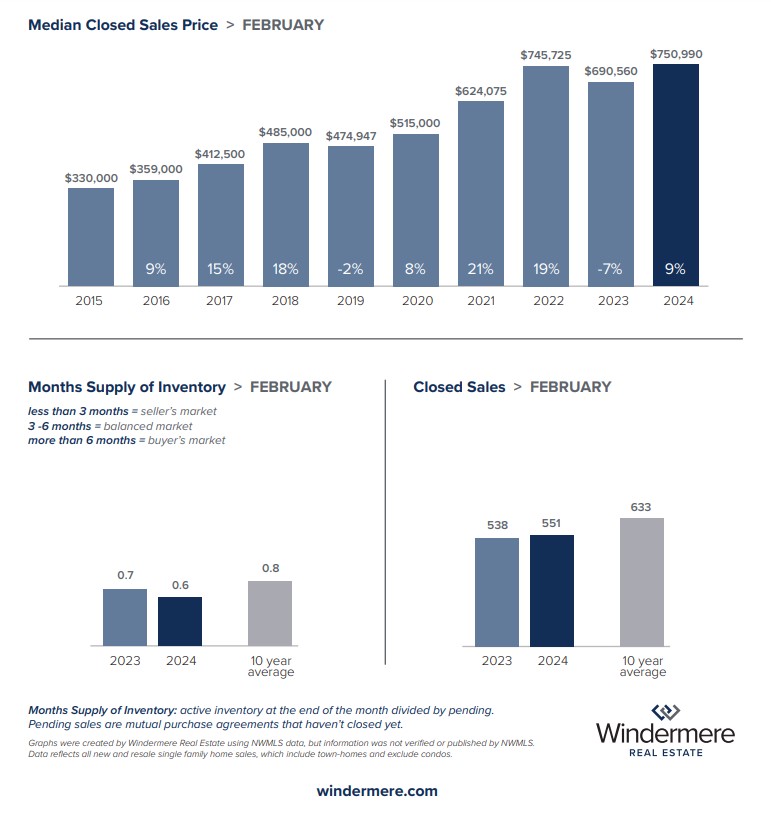

The median sold price of a Snohomish County home rose again last month, to $750,990 in February, up 9% from a year prior. Inventory remained the lowest of any area reported here, at just 0.6 months of supply. Homes are moving quickly, with 35% selling above the asking price and in an average of six days. Snohomish County condo prices jumped by 14% last month compared to February 2024, up from $437,725 to $500,000.

Homes are selling faster and with more offers, benefiting sellers ready to enter the market while spurring competition among buyers. Despite a quarter-percent interest rate increase over the past month, prospective buyers have strong motivation to get under contract in the face of rising prices. And on-the-fence sellers – of both condos and single-family homes – also have price motivation to engage with this market.

When faced with a rapidly moving market, it’s vital to have a knowledgeable expert by your side. Your Windermere broker is ready to provide invaluable insight regarding the evolving dynamics of your local market and can guide you to make the right move at the right time to achieve your real estate goals.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – February 2024

Like some plants and trees, the local real estate market is starting to bloom. Last month, median residential sold prices increased in each of the four geographic areas covered below. That’s welcome news for intending home sellers, who are also benefitting from continued low inventory region-wide. At the same time, local buyers are seeing stabilizing interest rates (currently in the mid-6-percent range) while confronting hefty competition for available properties. With residential supply shrinking last month, compelling offers continue to be the key to buyers securing a home.

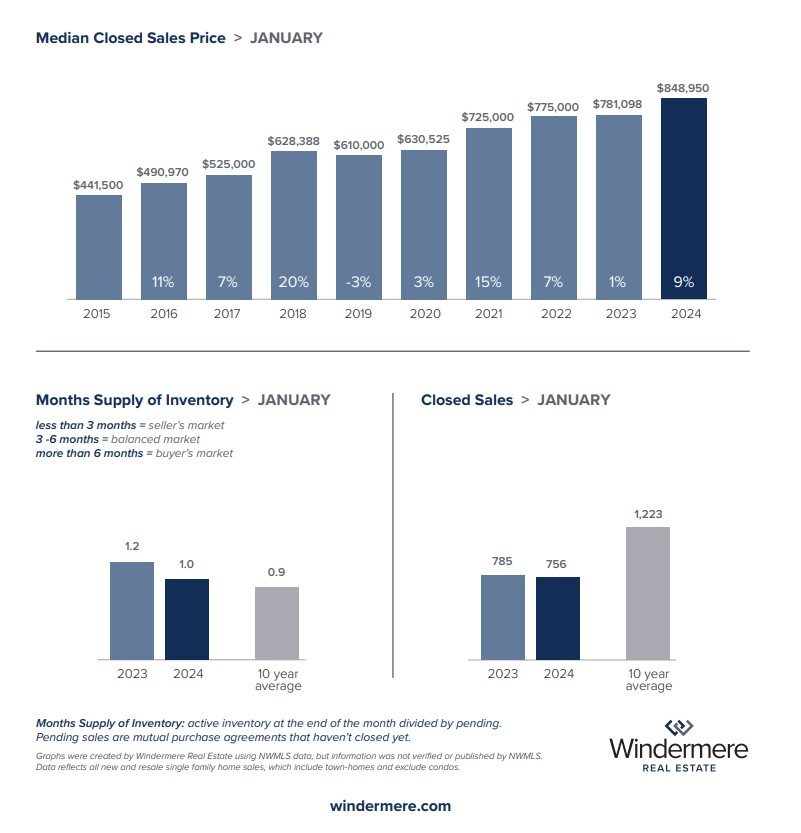

In King County last month, single-family home prices rose by 9% year over year, to $849,850. Condo prices gained momentum as well, rising to $495,000 last month, up 10% from $450,000 a year ago. With limited new listings coming on the market in January, the inventory of available King County single-family homes dropped to 1.0 months of supply, down from 1.3 months at the end of December 2023.

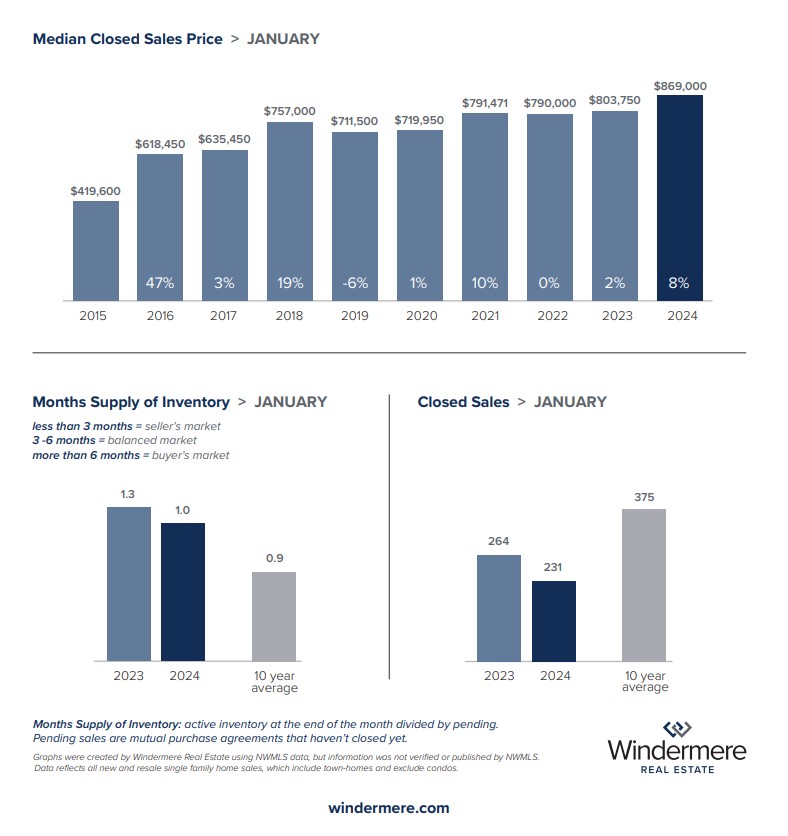

Seattle also saw an increase in home prices last month, with an 8% year-over-year jump to $869,000, up from $803,750 in January 2023. The supply of homes in Seattle dropped from 1.7 months to 1.0 months, spurring buyer competition. Seattle condo prices also rose year over year, from $487,500 in January 2023 to $537,500 last month, while supply dipped to 2.1 months of inventory, having started the year at 2.5 months.

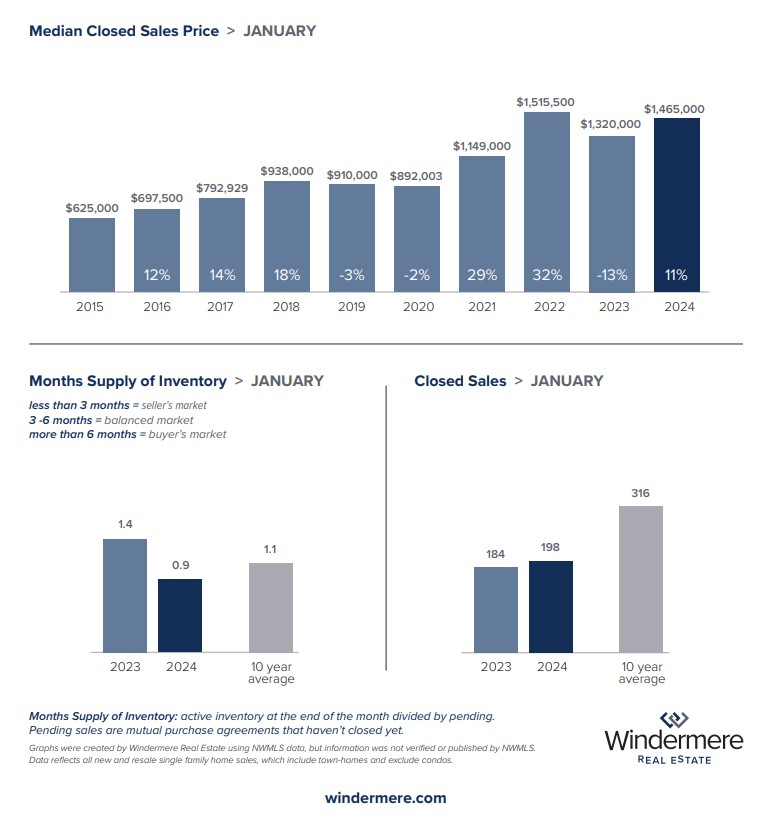

On the Eastside, the median sold price for a single-family home was $1,465,000 in January, up 11% from $1,320,000 the year prior. The supply of Eastside homes dropped from 1.2 months of inventory at the beginning of January to just 0.9 months by February 1, and more than half of the area’s available homes sold in under 30 days. Condo prices also rose last month, though at a slower rate. The median sold price for an Eastside condo increased 5% to $570,000, up from $543,000 in January 2023.

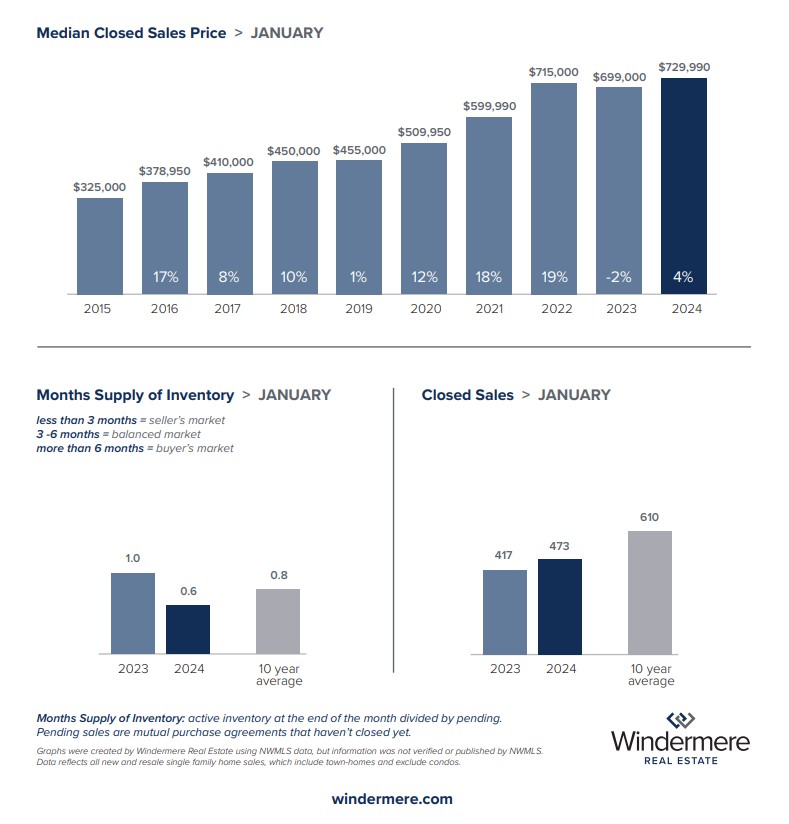

Snohomish County home prices rebounded last month, perhaps feeling the effects of a continued drop in inventory. The median residential sold price increased by 4% year over year, up from $699,000 in January 2023 to $729,990 last month. By the end of January, the supply of Snohomish County single-family homes stood at just 0.6 months of inventory. Perhaps reflecting these supply constraints, the median sold price for a Snohomish County condo jumped by 13% last month compared to January 2023.

While real estate market activity has remained slow in accordance with seasonal buying patterns and low inventory, residential prices have been on the rise. The regional condo market, despite its comparatively greater supply (as measured in months of inventory), has seen its share of recent price gains as well.

In the face of a rapidly evolving market, it’s more important than ever to connect with your Windermere broker. They can provide insight into the changing dynamics of regional submarkets, offer nuanced expertise and move quickly when the time is right for you to attain your real estate goals.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – January 2024

Despite moments of snow in Western Washington, the local real estate market is slowly warming, as new opportunities arise for both home buyers and sellers. Lower mortgage rates are welcome news for buyers, and low inventory means sellers are starting the year with minimal competition.

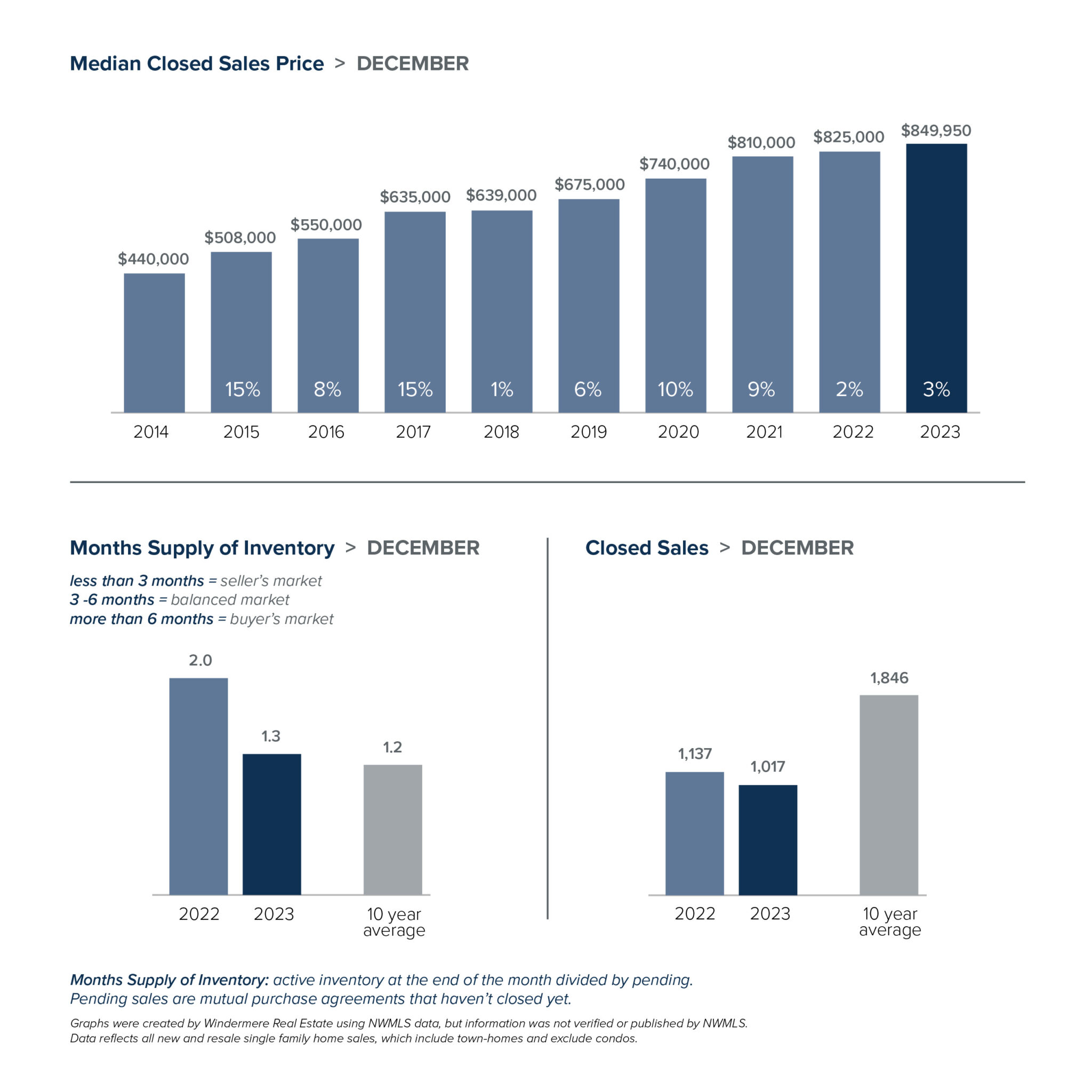

King County continues to see residential price gains, with last month’s median sold price of $849,950 up from $825,000 a year ago. Condo prices also rose, up 15% from $465,000 in December 2022 to $537,000 last month. King County is also experiencing a reduced supply of available single-family homes. At the end of last month, inventory stood at 1.3 months, down from 1.6 months at the end of November and 2.0 months a year prior.

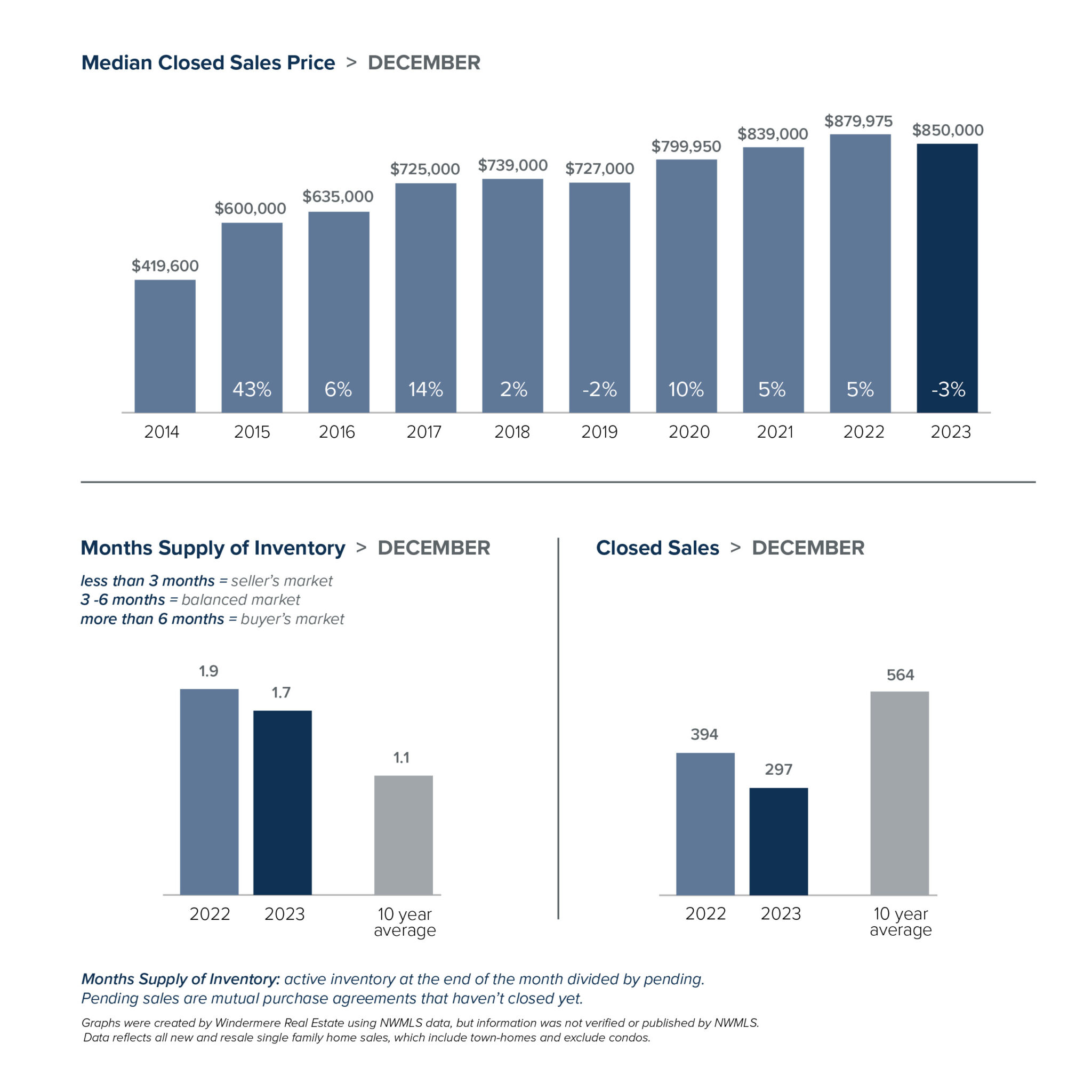

In a slightly different dynamic, Seattle experienced a decrease in both inventory and home prices last month. The median residential sold price was down from $879,975 in December 2022 to $850,000 last month. And December ended with 1.7 months of inventory, down from 1.9 months the previous month. While 16% of homes sold above list price in December, that was significantly lower than November, when 29% sold above asking. Seattle condo prices rose year-over-year, from $512,500 in December 2022 to $585,000 last month, with supply dropping 22 percent.

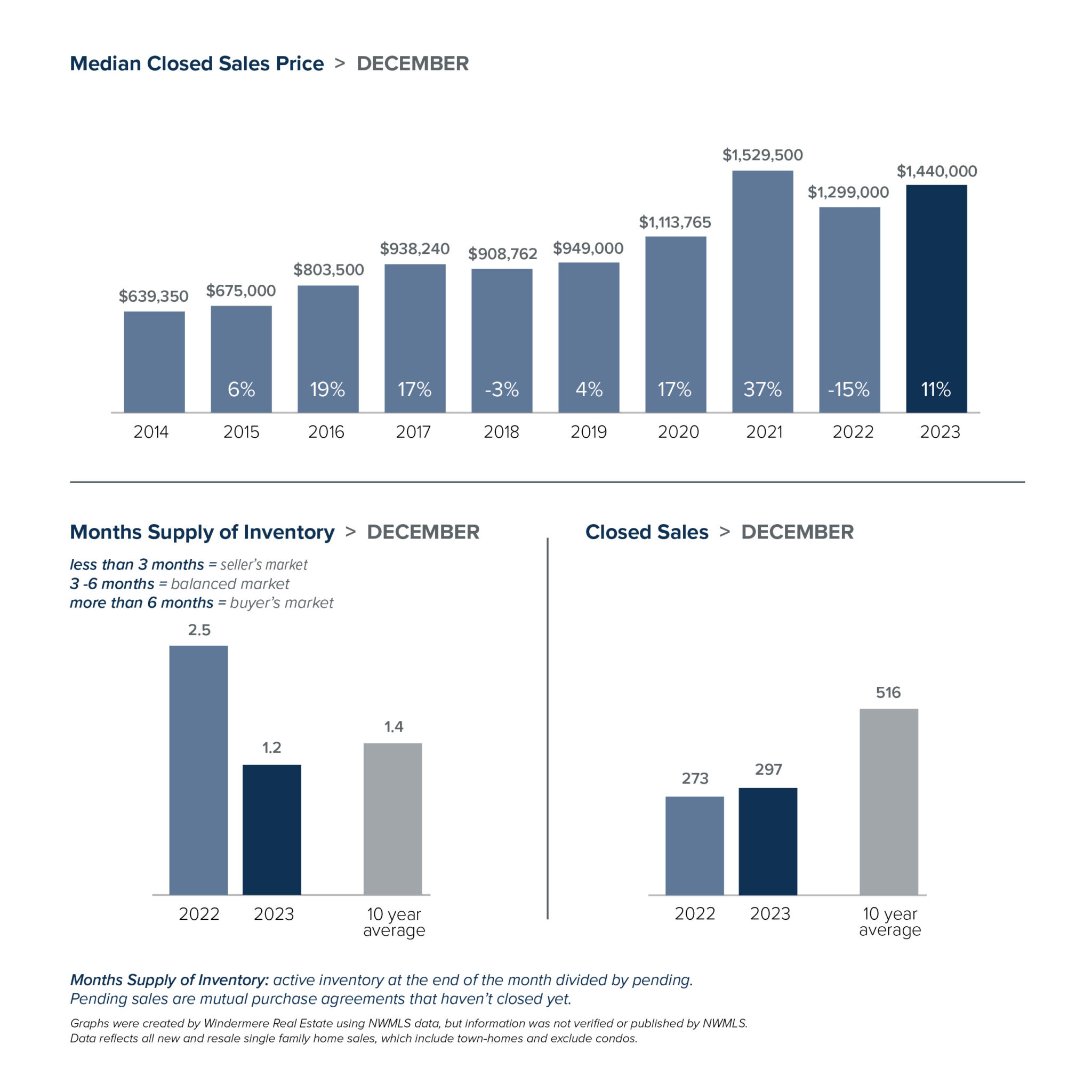

Following a modest decline in November, the Eastside rallied with an 11% bump in the median residential sold price, up from $1,400,000 last year to $1,440,000 last month. Further proof of a warming Eastside market: residential inventory is less than half of what it was last year, down from 2.5 months at the end of 2022 to just 1.2 months at the end of 2023. Mirroring the residential market, Eastside condominiums experienced a healthy 12% price increase last month, up from a median of $565,000 a year ago to $630,000.

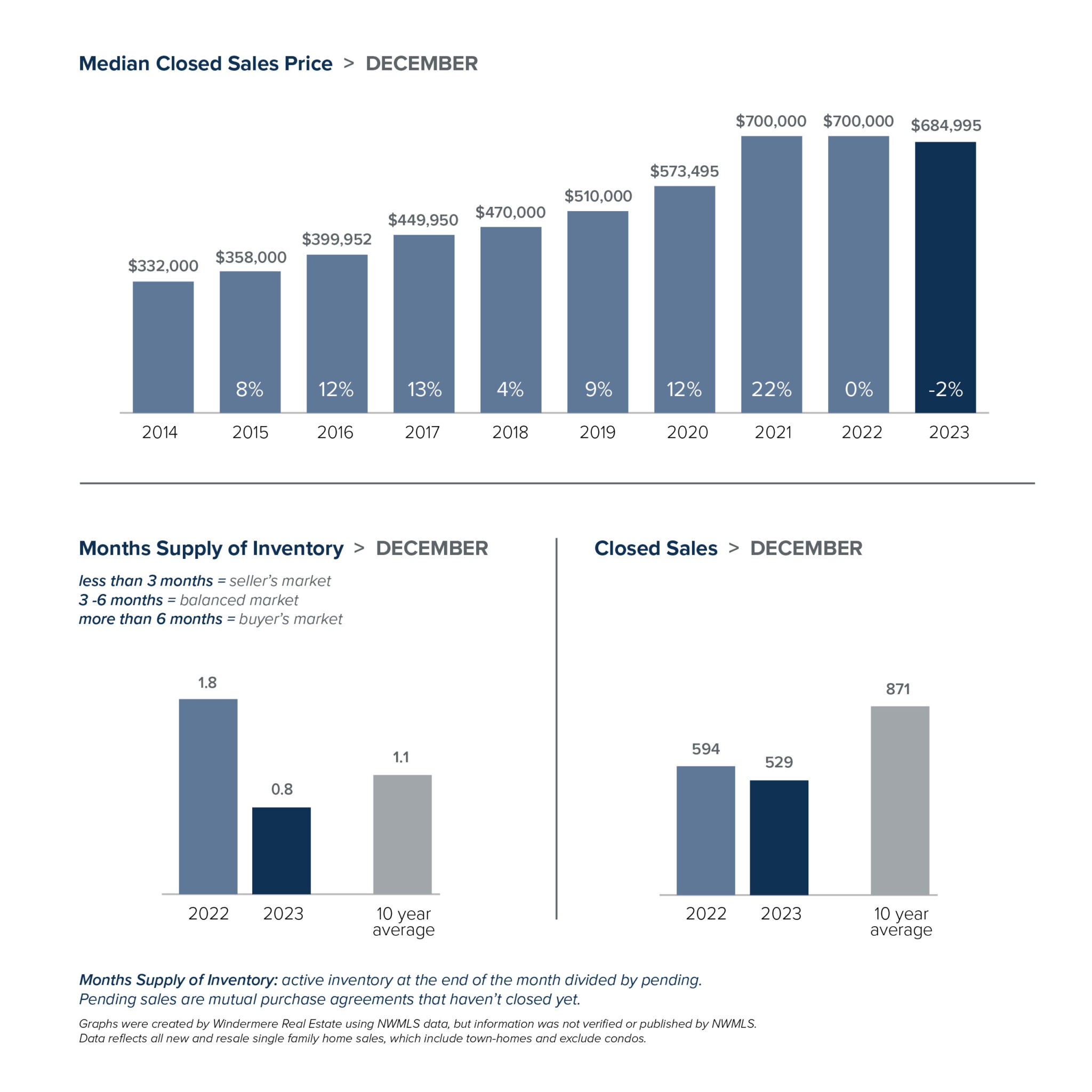

Snohomish County was an interesting tangle of contradicting sales data. Median residential sold prices saw a slight year-over-year decrease last month, down from $700,000 to $684,995. This price decrease occurred despite a dramatic drop in inventory. The supply of Snohomish County single-family homes stood at just 0.8 months at the end of December, down from 1.8 months the year prior. Of the four areas reported in this market update, Snohomish County saw the lowest percentage of sold homes that had experienced a price reduction, at 41%, perhaps a reflection of the drastically reduced supply. Another possible outcome of the limited supply of single-family homes: the median sold price for Snohomish County condos jumped 11% year over year, from $469,950 in December 2022 to $523,500 last month.

As we move further into the new year, buyers remain hopeful that interest rates will continue to drop. The inventory of homes on the market has declined from a year ago in most markets, prompting price gains during what’s normally a slower time of year. Overall, the regional condo market has seen sustained activity, with unit sales experiencing only a modest decrease in the face of lower inventory and higher prices.

With regional submarkets exhibiting varying dynamics, it’s more important than ever for buyers and sellers to have a knowledgeable expert at their side. So connect with your Windermere broker to co-create a strategy that’s best for your buying or selling journey.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – December 2023

As we march steadily into the cooler winter months, the expected seasonal slowdown is upon us. Interest rate increases have continued to influence a quieter-than-usual fall market. Higher mortgage rates reduce buying power, as well as the momentum of move-up buyers and sellers.

Fewer sellers mean lower inventory and a reduction in closed sales. Indeed, the supply of listed homes in our region has continued to decline. As compared to the same month last year, October experienced a 30% decrease in active King County property listings. If trends hold true to the past three years, the start of winter will bring rising home prices locally.

It is expected that median sold prices will rise between December and April, unless rates increase significantly. In King County, the median price for single-family homes dropped 2% from $903,000 in October 2022 to $882,997 last month. This was a slight bump up from September, and a 14% increase year-over-year.

Just like December temperature variations, our local real estate market continues to feel up and down. Interest rates, regional economic conditions and seasonal market shifts have meant rising home prices in some areas and drops in others. While the expected winter slowdown means overall lower inventory, buyers are still willing to compete for plum properties in a diminishing pool of available listings.

A slight decrease in interest rates has raised cautious optimism in our region. Interest rates fell to around 7.2% as of December 1, compared to 7.8% in October. A continued trend in this direction could signal some welcome positivity in the market as we move into the new year.

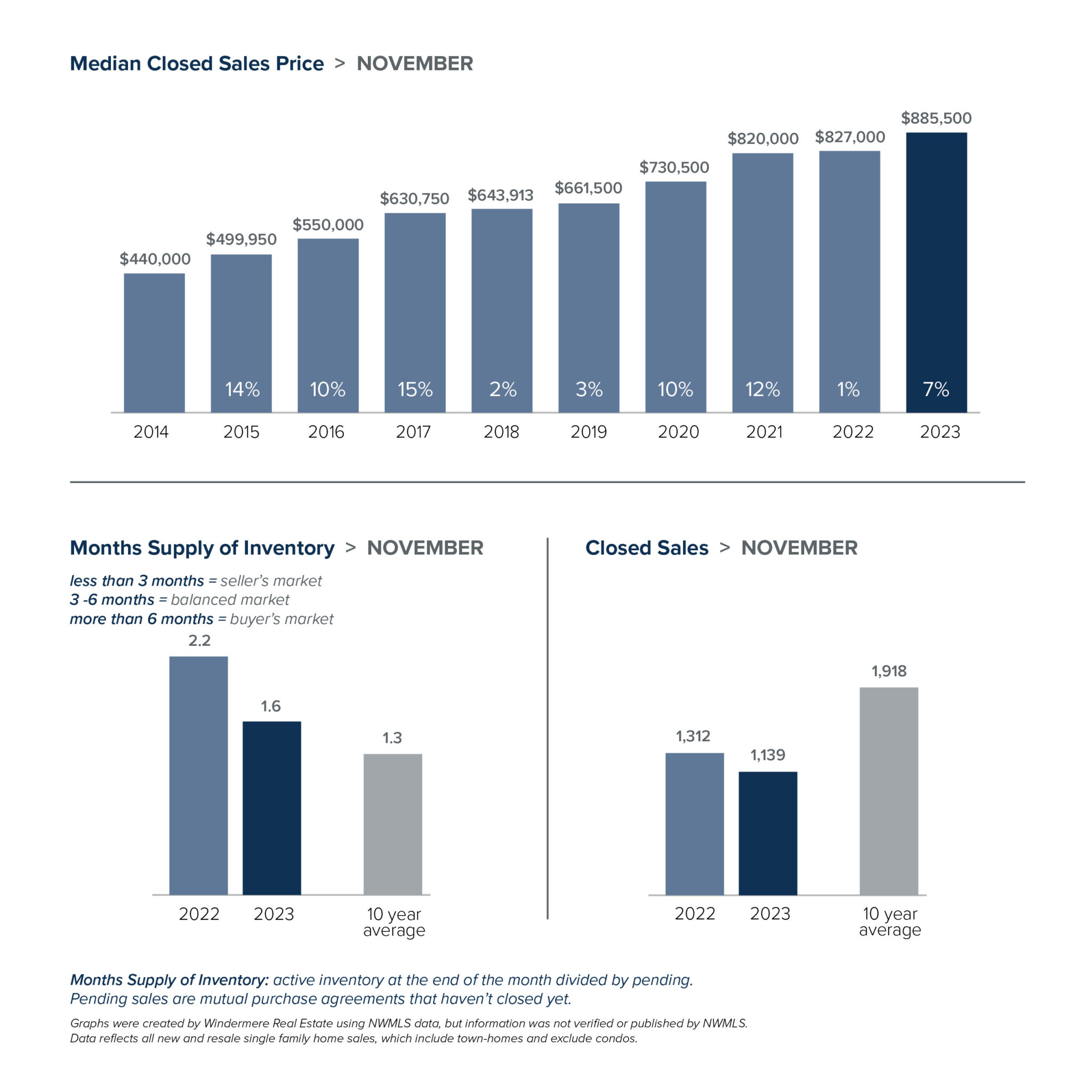

In King County, the expected decline in winter inventory is pushing up year-end home prices. The region saw a 7% year-over-year increase in the median residential sold price, from $827,000 in November 2022 to $885,500 last month. Buyers are still showing up: there’s steady demand and potential competition for each available home that’s in good condition and well-priced. King County condos also saw a year-over-year price increase, with the median sold price up 4% in November to $485,000.

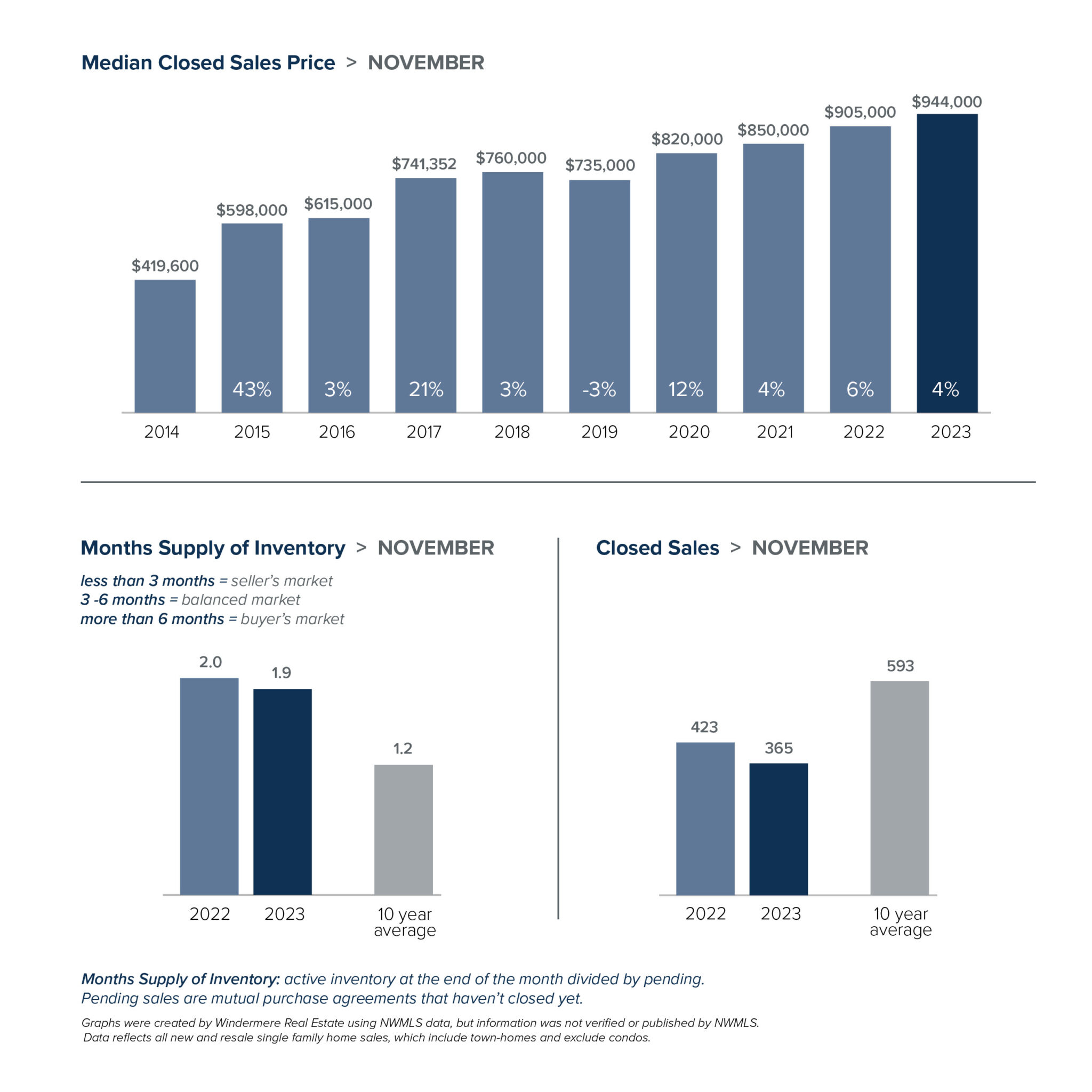

Seattle saw a 5% increase in the median sold price of a single-family home, up from October’s $900,000 to $944,000 last month. The market kept some momentum in November, with 48% of Seattle homes selling at or above asking price and 79% going under contract in 30 days or less. Condo prices saw a 21% year-over-year jump, from $480,500 in November 2022 to $582,750 last month. This price growth flew in the face of significant supply, at 3.4 months of inventory.

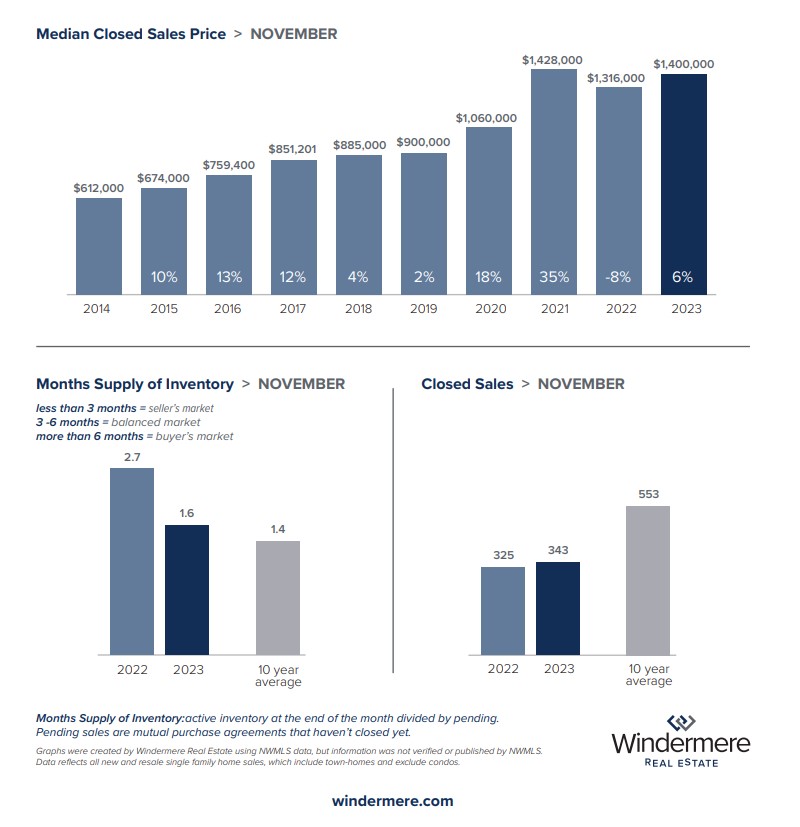

The Eastside median residential sold price experienced a modest decline in November, down 1% from October’s $1,420,000 to $1,400,000 last month. However, the November price was still up 6% from November 2022, while 75% of sold listings went under contract in 30 days or less. Residential inventory remained fairly flat on the Eastside, increasing slightly from 1.5 months in October to 1.6 months in November. Eastside condo prices increased last month, with a median sold price of $620,000, up from $569,500 in November 2022.

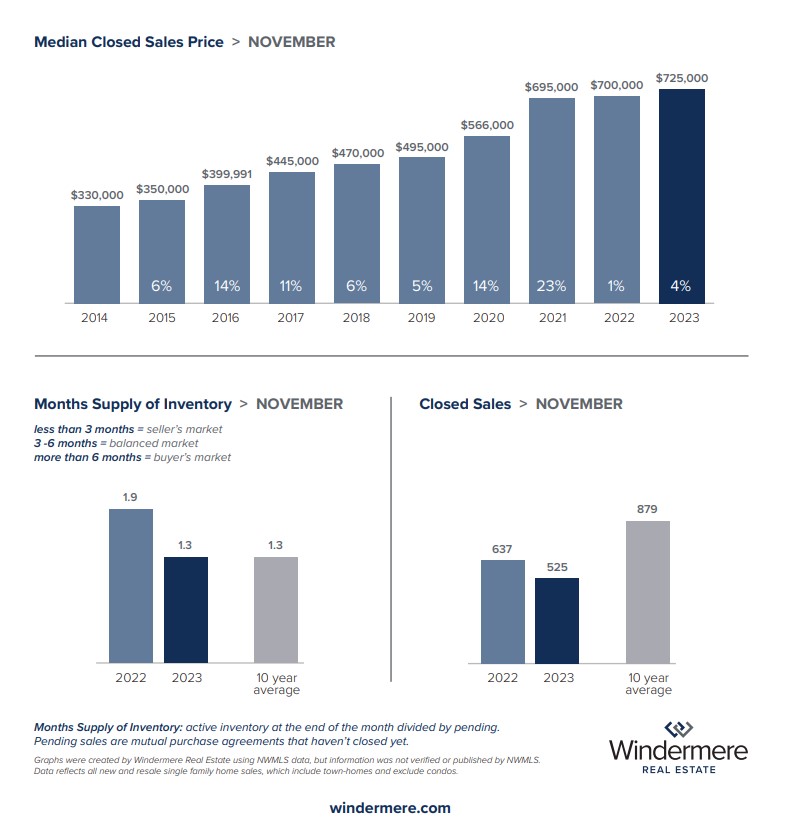

Snohomish County saw a year-over-year bump in prices last month. The median sold price for a single-family home rose from $700,000 last November to $725,000 this November. Supply stood at just 1.3 months at the end of the month, down 32% from this time last year. Condo prices also rose, from $507,500 in November 2022 to $521,209 last month.

As winter unfolds, it’s crucial for buyers and sellers to work with a knowledgeable broker to navigate this churning real estate market. Together you can create a strategy that best supports your real estate goals for the new year.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – November 2023

As we march steadily into the cooler winter months, the expected seasonal slowdown is upon us. Interest rate increases have continued to influence a quieter-than-usual fall market. Higher mortgage rates reduce buying power, as well as the momentum of move-up buyers and sellers.

Fewer sellers mean lower inventory and a reduction in closed sales. Indeed, the supply of listed homes in our region has continued to decline. As compared to the same month last year, October experienced a 30% decrease in active King County property listings. If trends hold true to the past three years, the start of winter will bring rising home prices locally.

It is expected that median sold prices will rise between December and April, unless rates increase significantly. In King County, the median price for single-family homes dropped 2% from $903,000 in October 2022 to $882,997 last month. This was a slight bump up from September, and a 14% increase year-over-year.

Despite the expected seasonal lull, 33% of homes are selling above list price in an average of just 6 days. This demonstrates a willingness for buyers to compete for the most desirable properties. Condo prices rose 9% year-over-year to $540,000, versus $494,975. Following modest price gains from August to September, the Seattle residential market saw a 5% decrease in the median sold price for single-family homes between September and October, from $926,000 to $900,000.

Inventory dropped slightly, spurring an increase in the number of homes selling over list price by 5% compared to September. Homes sold, on average, in 6 days. Sold condo prices were 10% higher year-over-year, rising from $522,500 in October 2022 to $573,750 last month. By the end of October, Seattle condo inventory was at 3.6 months’ supply, double the amount for single-family homes.

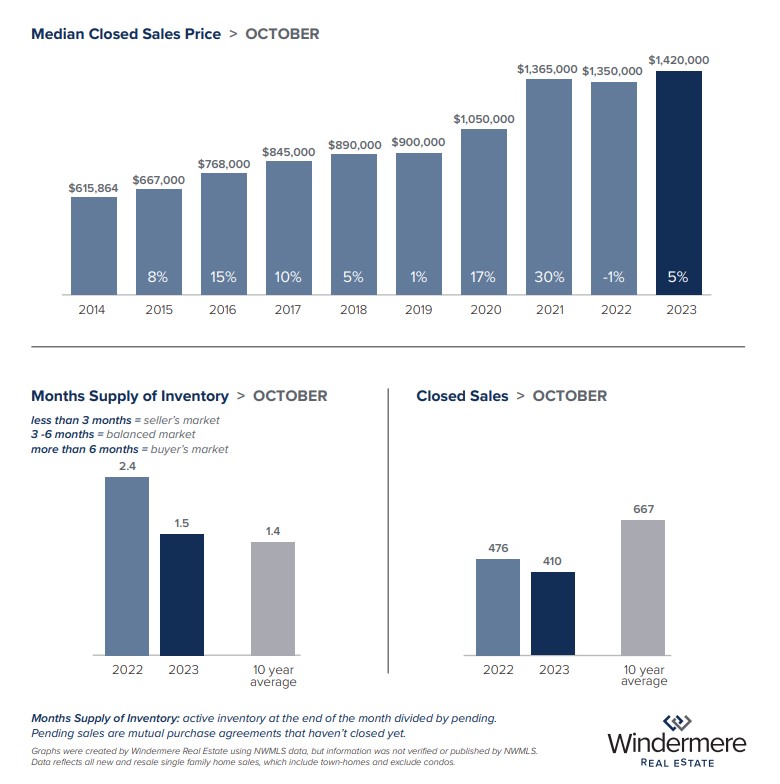

On the Eastside, median sold prices dropped slightly from $1,427,500 in September to $1,420,000 last month, though demand remained high. The portion of homes selling above list price increased to 34% in October, which is more than double the percentage selling over list price at the same time last year.

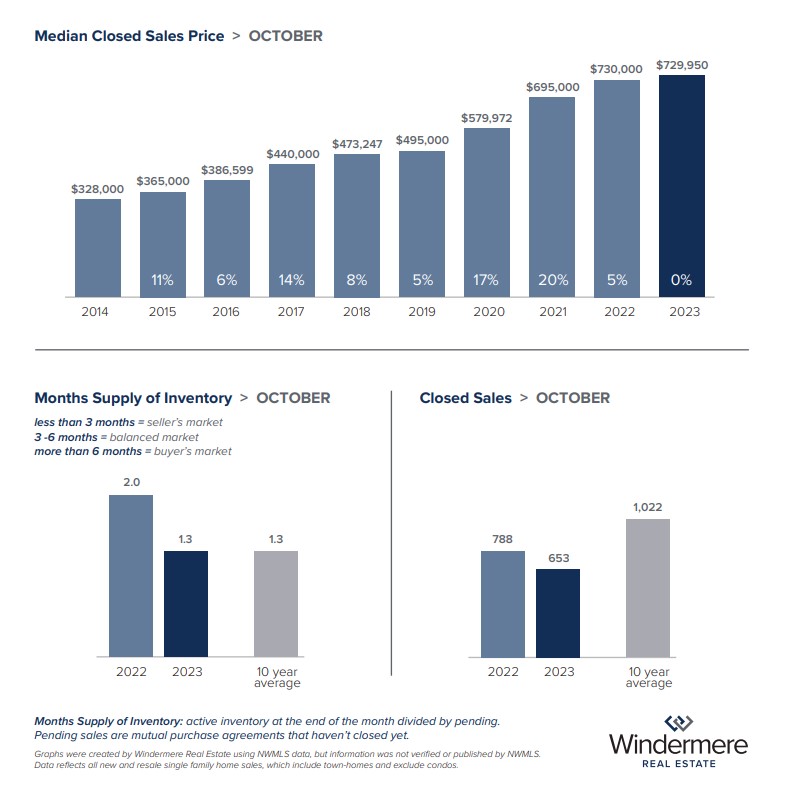

There was also a notable year-over-year difference in months of inventory: 1.5 last month, versus 2.4 in October 2022. Condos on the Eastside sold for about 8% more year-over-year, increasing from a median sold price of $607,500 last year to $657,000 last month. The October median sold price of a Snohomish County single-family home remained flat year-over-year, at $729,950.

Homes selling above list price dropped from 31% in September to 26% last month, the only region covered here with a drop in this metric. That’s still a large increase from October 2022, when 13% of closed sales were over list price. Residential inventory dropped by 38% from October 2022, while the number of listed Snohomish County condos dropped by 23% year-over-year.

The early part of the calendar year typically sees an increase in multiple offers, driven by sellers listing properties in the spring and by a seasonal influx of motivated buyers. With the new year on the horizon and an expected increase in both inventory and buyer activity, now’s the perfect time to chat with your Windermere broker about how to navigate the current market to match your goals.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – October 2023

With the fall season finally upon us, the behavior of the housing market is like the range in outdoor temperatures: somewhere between warm to cool. There’s a lower overall volume of home sales than in recent years, but at the same times buyers are moving quickly and assertively on highly desired properties, despite higher interest rates.

Although these interest rates could make it more difficult for sellers to see significant price gains in the near future, the high demand for homes after a prolonged inventory drought in our region is likely to keep buyer activity on accurately priced listings unseasonably warm.

Overall, buyers and sellers are likely to experience this fall as something of a transitional period. The market has slowed considerably after the frenzy of the pandemic, and interest rates have yet to stabilize. It’s most likely that the market will remain slow until sometime in the new year, at which point either interest rates will have dropped slightly, buyers will be better equipped to manage them, or sidelined sellers will grow tired of waiting.

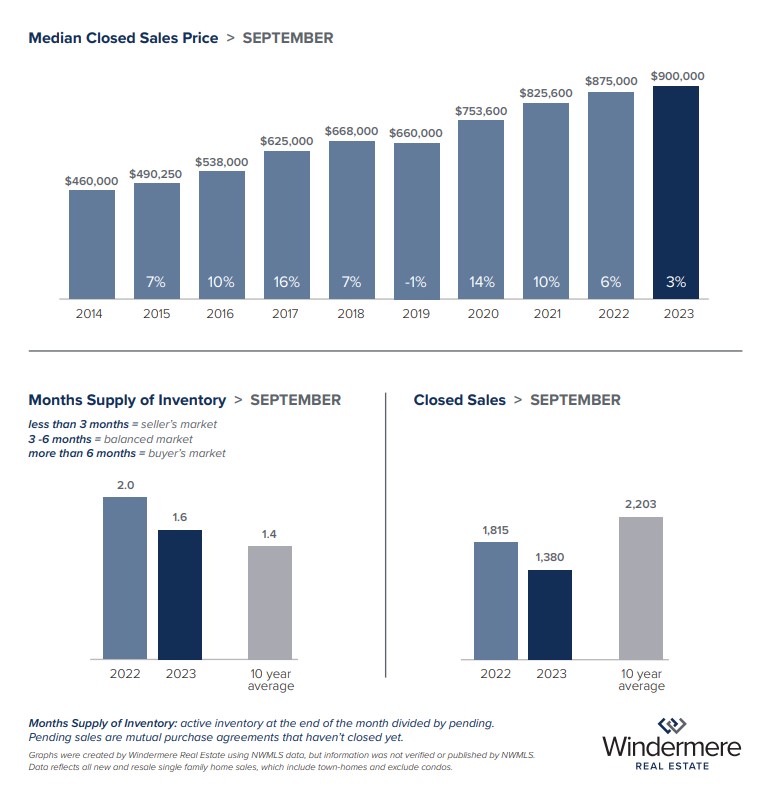

Despite a September slowdown in home sales, King County did see price gains for residential listings and condos. The median price for single-family homes increased about 3% year-over-year, from $875,000 in September 2022 to $900,000 last month. Around one-third of listings in the county sold over list price last month, in an average of just 6 days. Properties that sold at list price spent around 10 days on the market. Condos rose a more noticeable 7% in September, from $483,000 to $515,000.

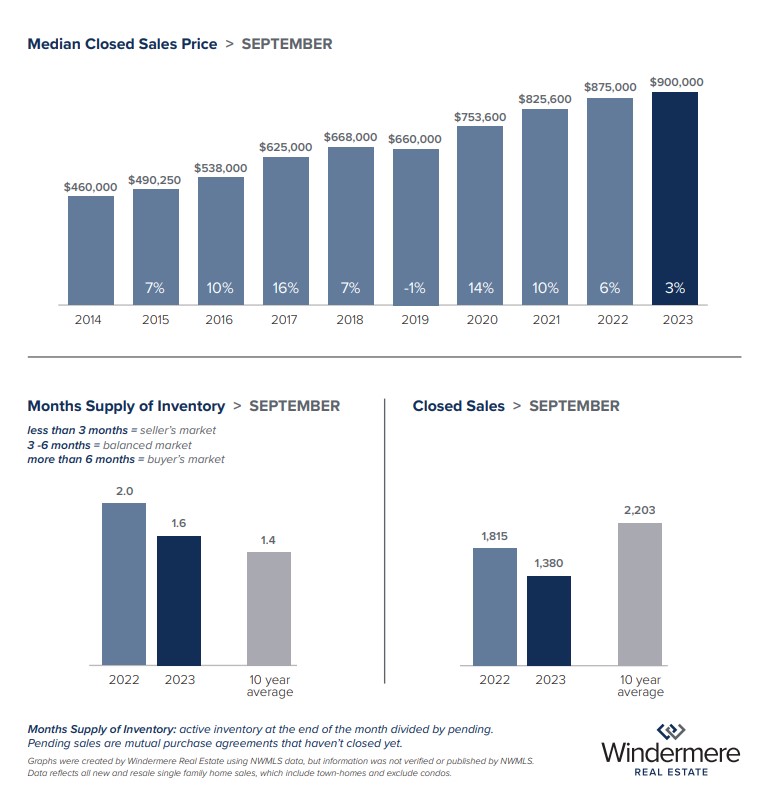

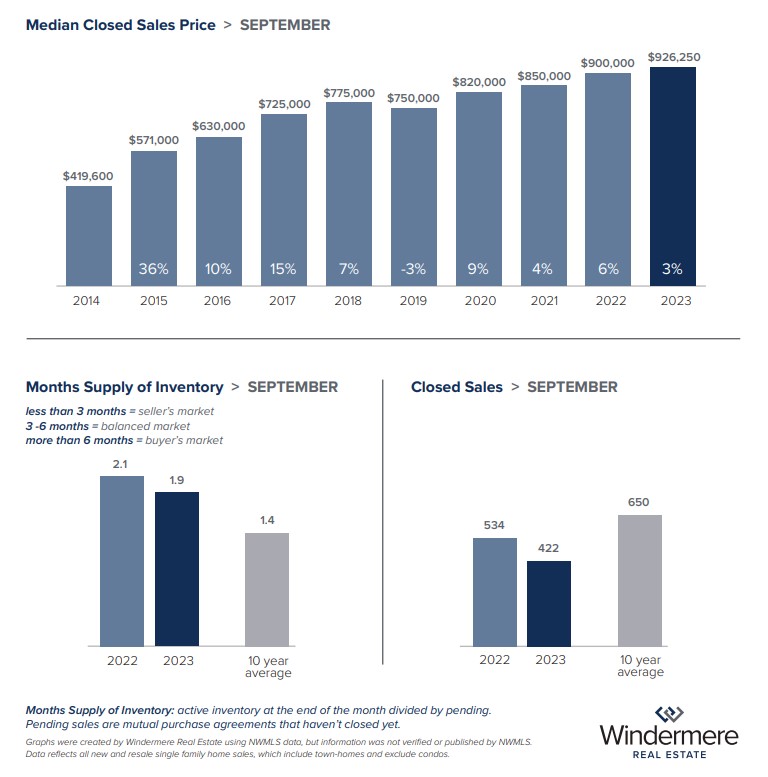

The Seattle residential market also saw modest price gains, with the median sold price of single-family homes increasing from $900,000 last September to $926,000 this September. Around 29% of listings sold over list price, in an average of 5 days. Those that sold at list price spent a slightly longer 11 days on market, however this still indicates that buyers are prepared to move quickly on properties that are accurately priced. Condos in the city also saw a respectable 10% price increase year-over-year, rising from $499,000 in September 2022 to $550,000 last month. With nearly 3 month’s inventory, the Seattle condo market may have the highest inventory rate and be the most balanced market in the region at this time.

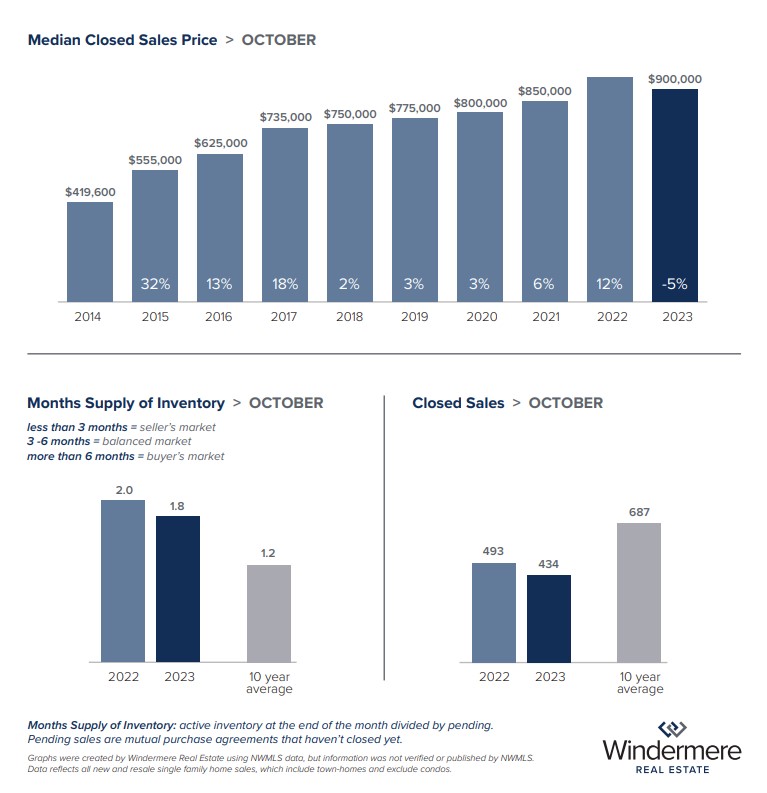

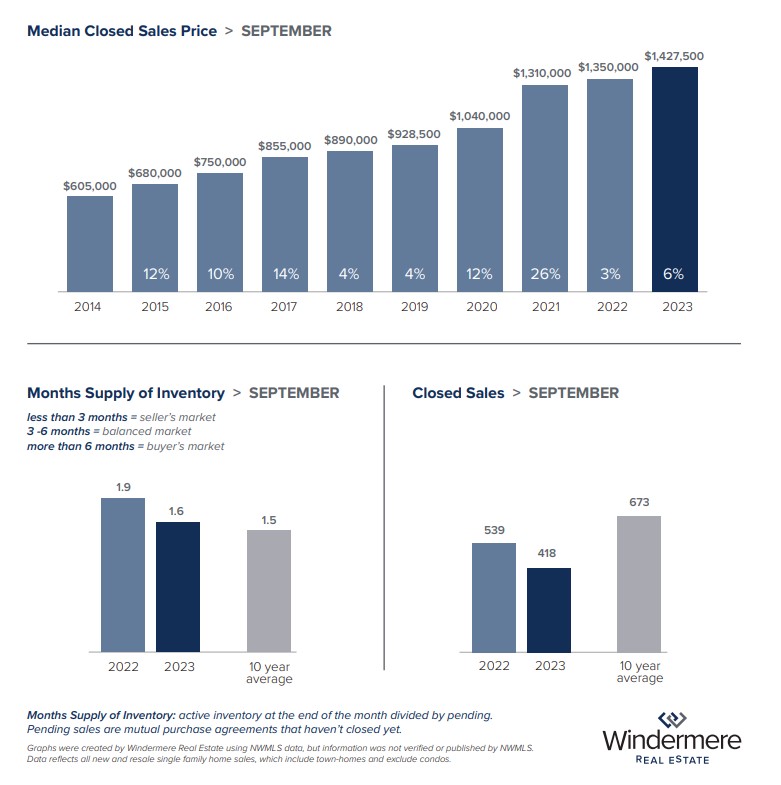

On the Eastside, prices crept up around 6% from $1,350,000 in September 2022 to $1,427,500 last month. Demand is still high in the area, with 32% of listings selling above list price, averaging just 5 days on market. Those that sold at their list price were purchased within 6 days. Condos on the Eastside saw decent year-over-year price growth, increasing 7% from $580,000 last year to $620,000 last month.

Homes in Snohomish County saw the smallest yearly price increase, rising just 2% from $735,000 in September 2022 to $749,900 last month. Despite this lower rate of price growth, about 31% of homes sold above listing price, averaging only 6 days on the market. Those that sold at listing price spent a bit longer on the market, averaging 13 days. The condo market in Snohomish is the only niche market in the region that saw a price decrease compared to last year. In September 2022, the median price was $539,500. Last month, prices decreased about 8%, landing at a median of $498,500.

It’s likely that we will continue to see fewer unit sales in our region through the end of the year. However, if you need to buy or sell a home before then, there are opportunities to make the most of current conditions. Ask your Windermere broker for more information about how this market might align with your goals.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – September 2023

As summer draws to a close, the local housing market remains somewhat unsettled. This is due to persistently high interest rates that have caused buyers to pause and sellers to hold onto their pandemic-era mortgage rates, as well as low inventory increasing competition for the available listings. Sold home prices in some areas have begun to see year-over-year price increases in relation to the slowdown that hit the market at the end of last year.

Windermere’s Chief Economist Matthew Gardner remarked on this trend. “Historically, the number of homes for sale slows in August,” he said. “Where sales did occur, prices rose between July and August in King and Pierce counties.” Gardner also described these conditions as “very unique times” in the housing market.

While these conditions may be challenging to navigate, sellers are still finding success with correctly-priced listings. New listings are attracting multiple offers and often sell over list price. Buyers who come prepared with strategic offers and a willingness to waive contingencies can break into the market with the guidance of a savvy broker.

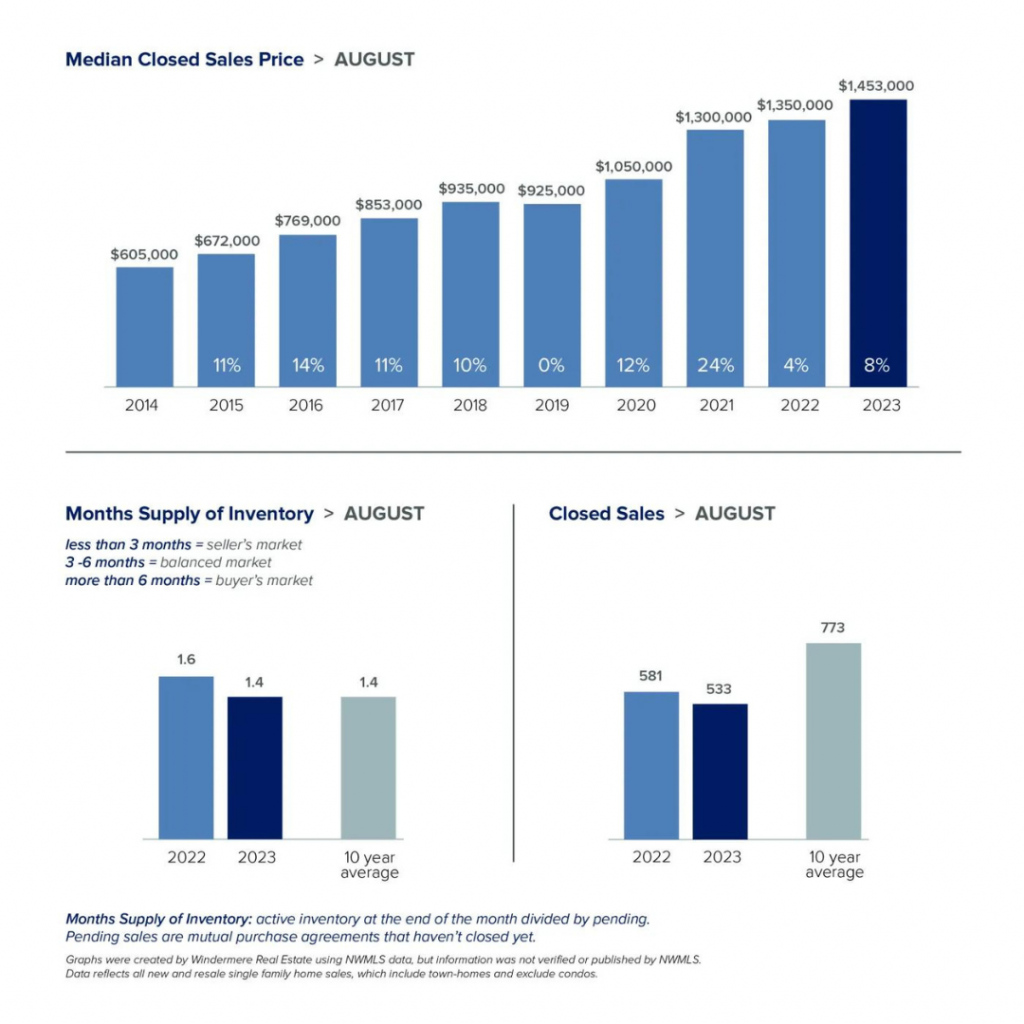

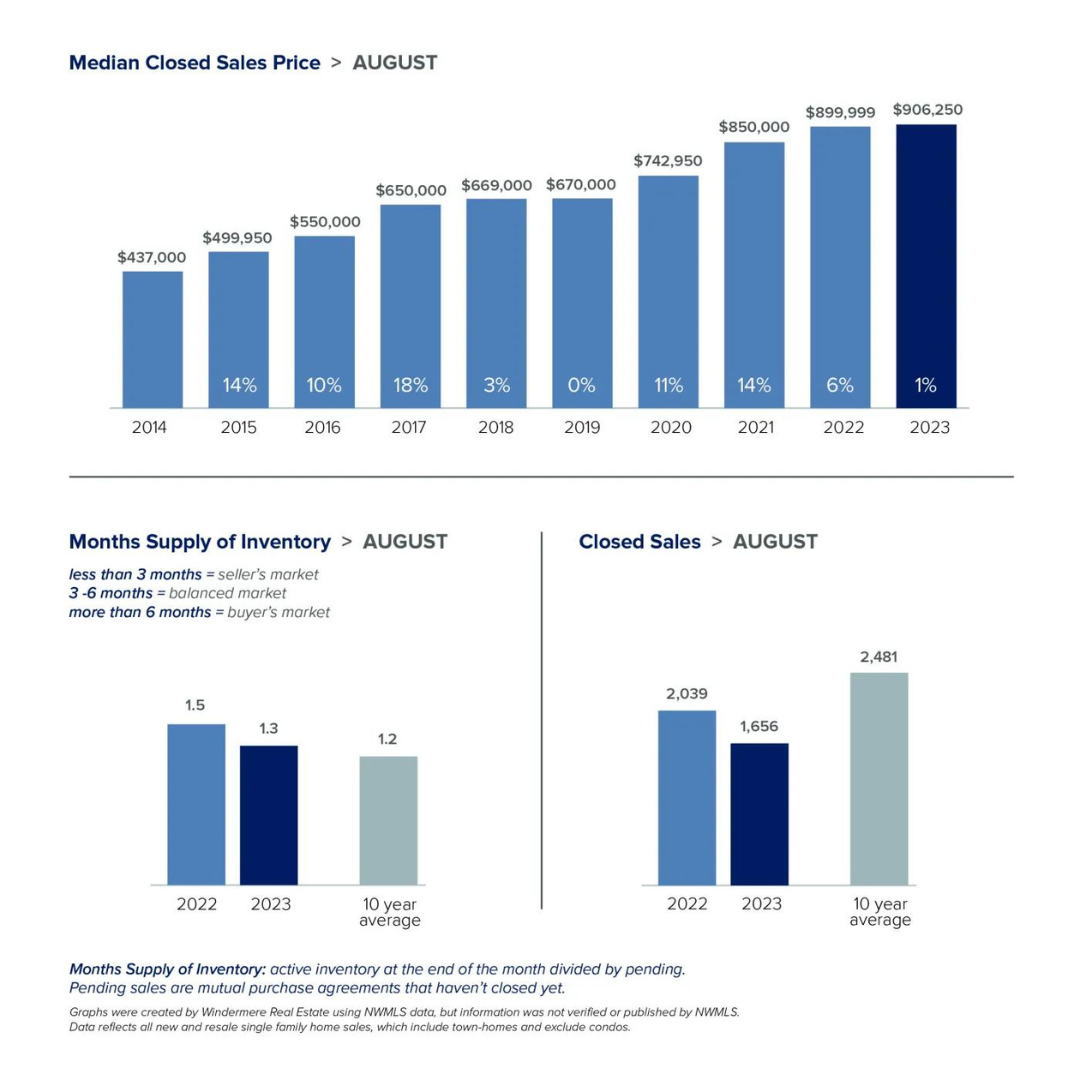

King County was one of the regions that saw year-over-year price gains. The median price for a single-family home rose 0.7% from $899,999 in August 2022 to $906,250 last month. Condos saw even bigger gains, likely due to their better affordability for new homebuyers. The median price for condos in August was $525,000, up 8.25% from $485,000 the same time a year ago.

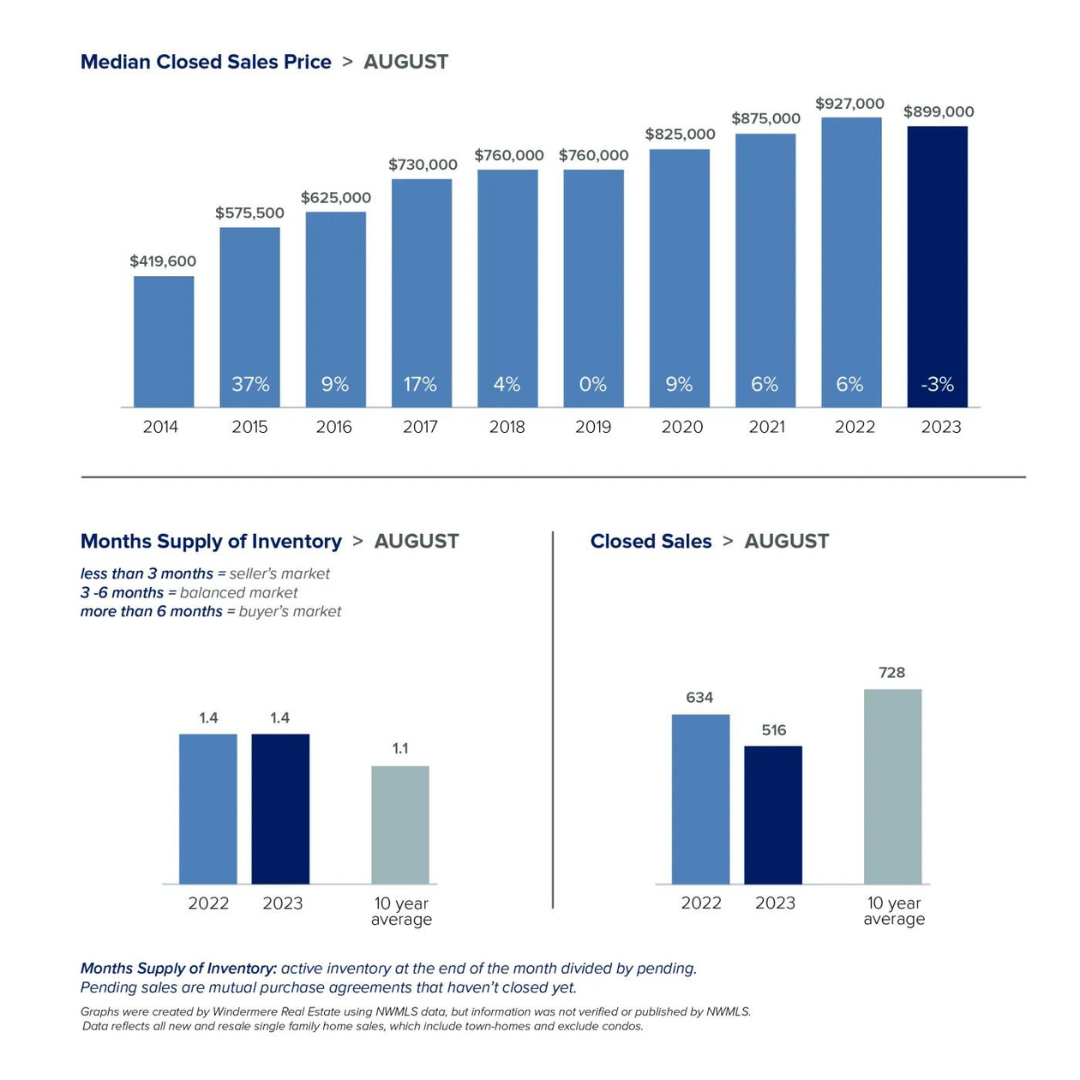

The Seattle market hasn’t quite caught up to its pricing from this time last year. There, the median price for single-family homes in August was $899,000, down about 3% from $927,000 in August 2022. On the other hand, the condo market saw a 10.5% price increase year-over-year, rising from $520,000 in 2022 to $575,000 last month.

Eastside median sold prices fared better. After a somewhat sluggish summer in terms of pricing, last month the median price for single-family homes rose to $1,453,000. That’s an increase of 7.6% from $1,350,000 in August 2022. Condos in the area also saw price growth, with median sold prices increasing 5.4% from $569,000 last year to $600,475 in August.

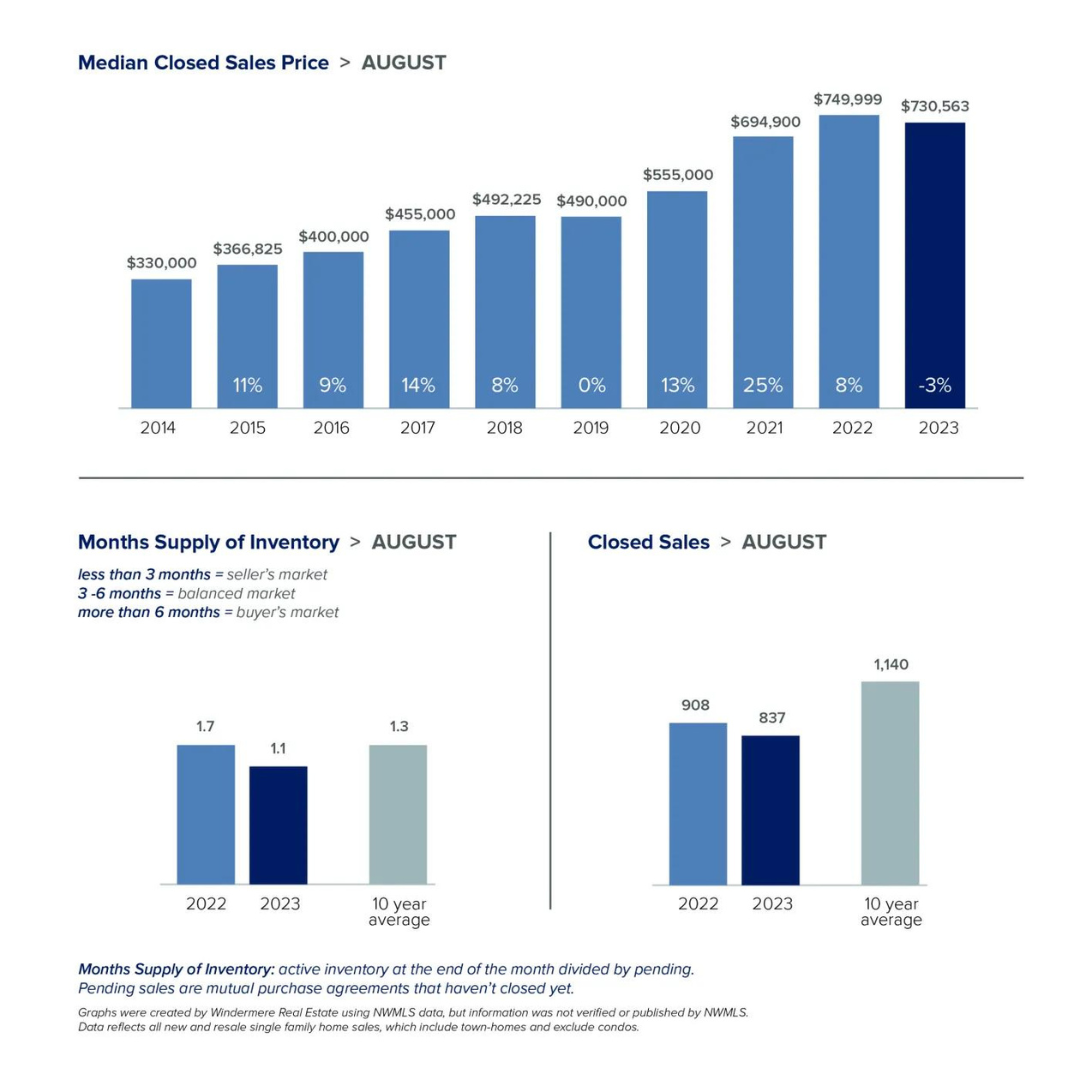

Like Seattle, Snohomish County also hasn’t caught up to its 2022 prices, though this is likely because the county had fewer fluctuations in the last year and may be experiencing the typical end-of-summer slowdown that is common in the housing market. There, the median price for single-family homes was down 2.6% from $749,999 last August to $730,563 this year. The condo market was virtually unchanged in pricing, increasing from $474,999 in August 2022 to an even $475,000 last month.

In all the areas mentioned above, condos generally saw the most notable price gains. This is likely due to their greater affordability for first-time homebuyers and those in the median price-bracket. With interest rates still fluctuating, many buyers are rethinking their plans and may be pivoting to the condo market, thus driving up demand and prices.

Matthew Gardner sees the current real estate market as still “lack[ing] direction,” due to the ongoing interest rate issues. He says “it likely won’t find its footing until mortgage rates start to pull back, which I expect to see as we enter the fall months – and assuming the U.S. economy continues to moderate.”

The remainder of the year will set the tone for how the market looks in 2024. Until then, your Windermere broker can help you navigate these changing conditions and find a strategy that’s best for your buying or selling journey.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – August 2023

The dog days of summer are upon us, and along with stifling heat comes a sluggish market. High interest rates and a dearth of available inventory are driving prices up and slowing sales across the region.

One major contributor to the low supply of homes is the phenomenon of homeowners protecting their sweet pandemic-era mortgage rates of 3-4%. Rather than selling and having to manage interest rates that are currently in 7% range, they are choosing to stay put. This means homes that otherwise might have been on the market this time of year are also staying put, and would-be buyers are competing for very limited inventory.

According to Windermere Chief Economist Matthew Gardner, July’s active listings in the tri-county market were fewer than in any July on record, excepting the pandemic year of July, 2021.

Gardner also noted that “With mortgage rates unlikely to move tangibly lower during the balance of the summer, I don’t expect the market to move much over the coming months, both in terms of sales and prices.” But he did add that “If the economy starts to soften this fall, rates could start to fall and this could revitalize the market.”

The key now seems to be accurately pricing the listings that are available. While there’s limited inventory, mortgage rates are putting a damper on buying power. Buyers may already be forced to compromise on lifestyle and location for mid-tier properties. They won’t want to compromise on price as well.

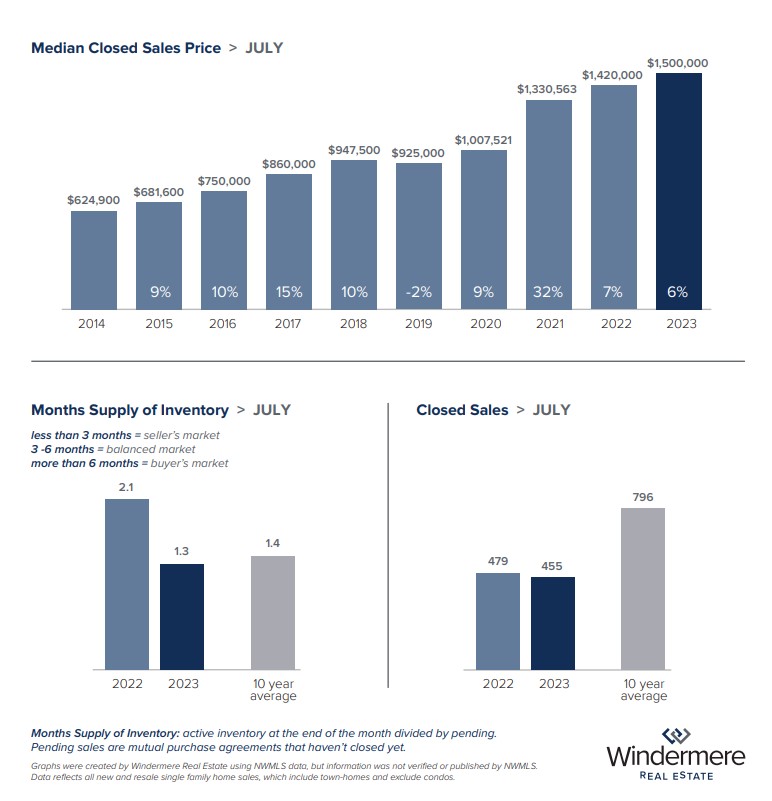

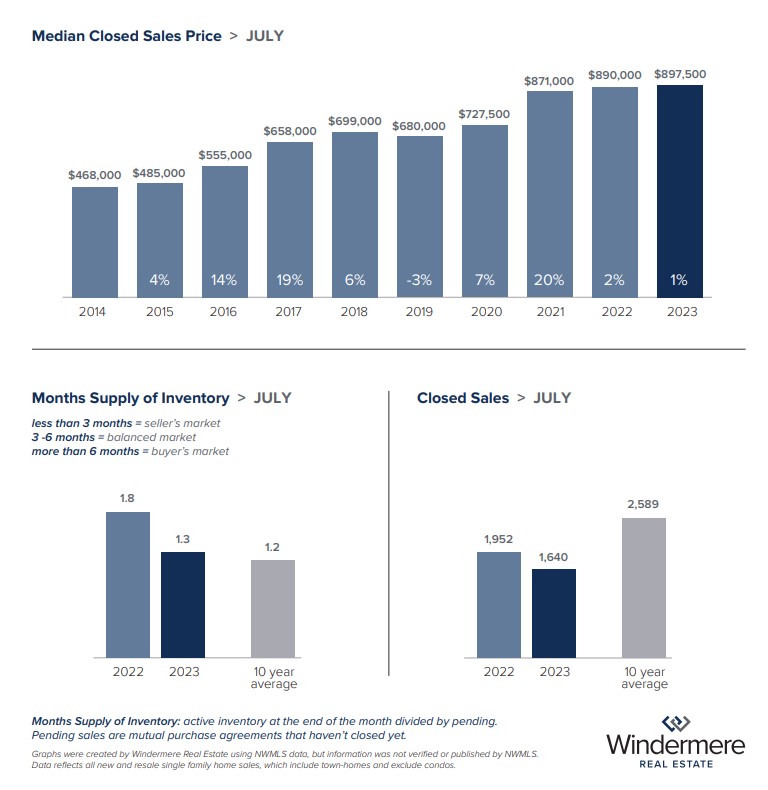

In King County, the median sold price for a single-family home was $897,500 in July, up from $890,000 in July, 2022. Condos also saw a boost, landing at a median of $510,000 last month—up from $490,000 a year ago. This is likely due to high demand and strong competition from buyers in the area.

In Seattle, the necessity of pricing homes accurately is clear. As an example, 69% of Seattle single family homes sold in under 15 days in July, and these generated sold prices that were 100.1% of their list price. Those that took longer than two weeks to sell, however, closed at 97.5% of list price.

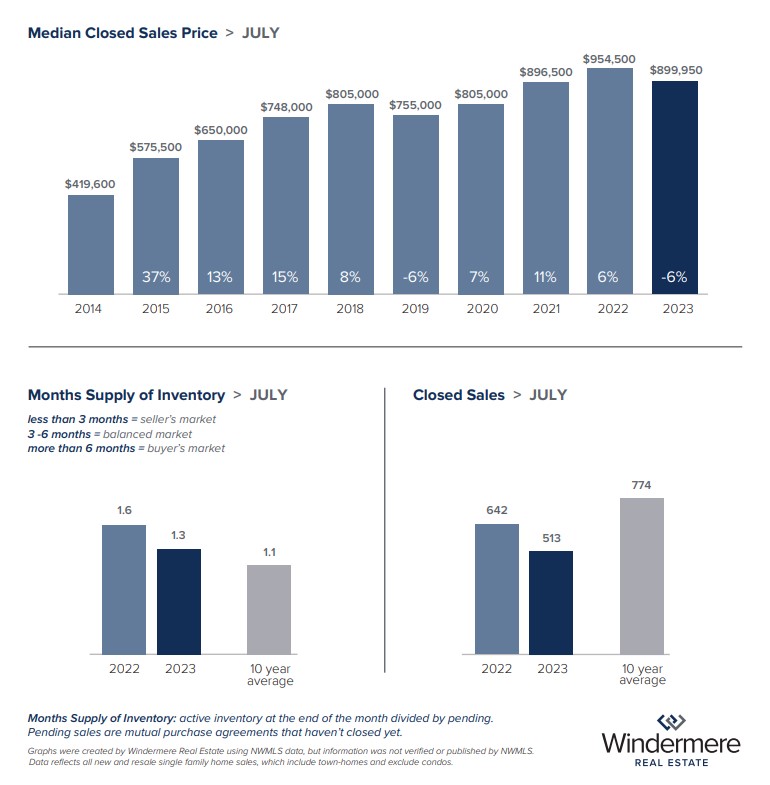

Seattle sold prices softened a bit in July. The median price for a single-family home in the city was $899,950, down from $954,500 a year ago. On the other hand, condo prices rose to $550,000 last month, up from $537,000 a year ago.

Low inventory on the Eastside had the effect of pushing up home prices in July, when the median sold price of a single-family home was $1,500,000. That’s an increase from $1,420,000 in July 2022. It’s also the first month since September of last year that Eastside median prices have increased from the year prior, so the mid-summer market has shown some heat. Eastside condo prices also increased last month, with a median sold price of $600,000, up from $575,000 a year ago.

Snohomish County saw prices soften slightly last month. The median sold price for a single-family home dropped from $770,000 last July to $751,250 this July. Even with less than one month’s inventory, interest rates are slowing sales and causing prices to drop. Condo prices also dipped slightly, from $500,000 in July 2022 to $495,000 last month. The county’s condo market had only .7 months of inventory, but this supply squeeze couldn’t completely counter high interest rates when it came to the impact on sold prices.

Looking ahead, it’s clear that now more than ever, sellers and buyers need to tether their real estate interests to a knowledgeable broker who will help them navigate these fluctuating market dynamics. If you have questions about what current market conditions mean for you, reach out to your Windermere broker.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Local Market Update – July 2023

This summer’s local housing market is seeing low inventory feed higher prices, putting the squeeze on would-be buyers. June is typically the month where home prices reach their apex, and last month was no exception as King and Snohomish counties’ prices neared the peaks seen during the sugar high of the pandemic market.

Approximately 80% of recent transactions have been in the more affordable and mid-price ranges, which are nearly sold-out at the moment. Because of this, multiple offers and offers over list price were more prevalent in June’s closed home sales than at any other point this year.

Windermere’s Chief Economist Matthew Gardner addressed the inventory shortfall. “The number of homes for sale in the Central Puget Sound area in June was down 48% from the same month in 2019 (pre-pandemic),” he said. “I believe much of the reason for this is that almost 33% of in-state homeowners have mortgage rates at or below 3%, and 87% of owners have rates below 5%. There is little incentive to list your home for sale if you don’t have to.”

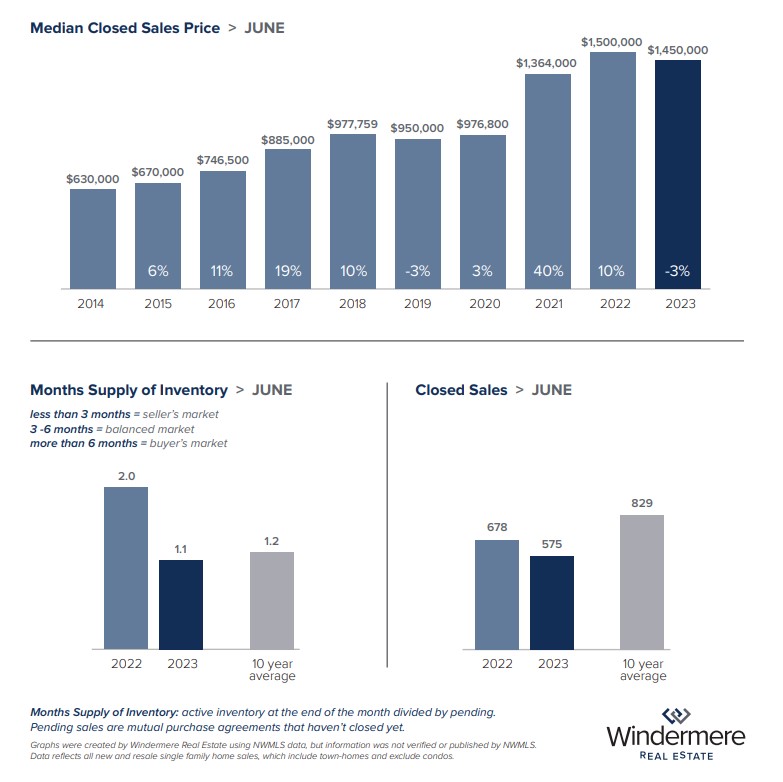

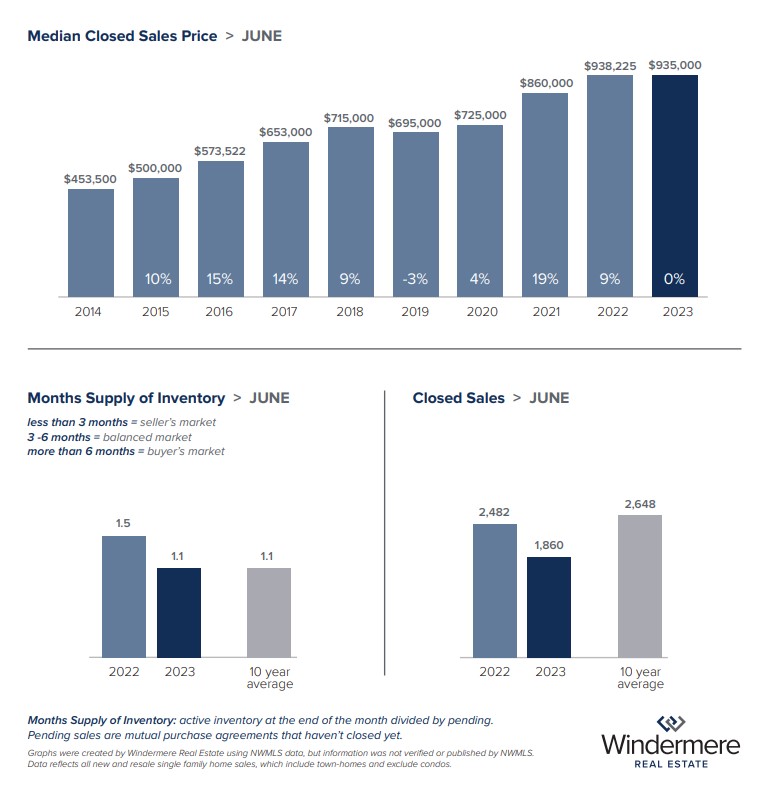

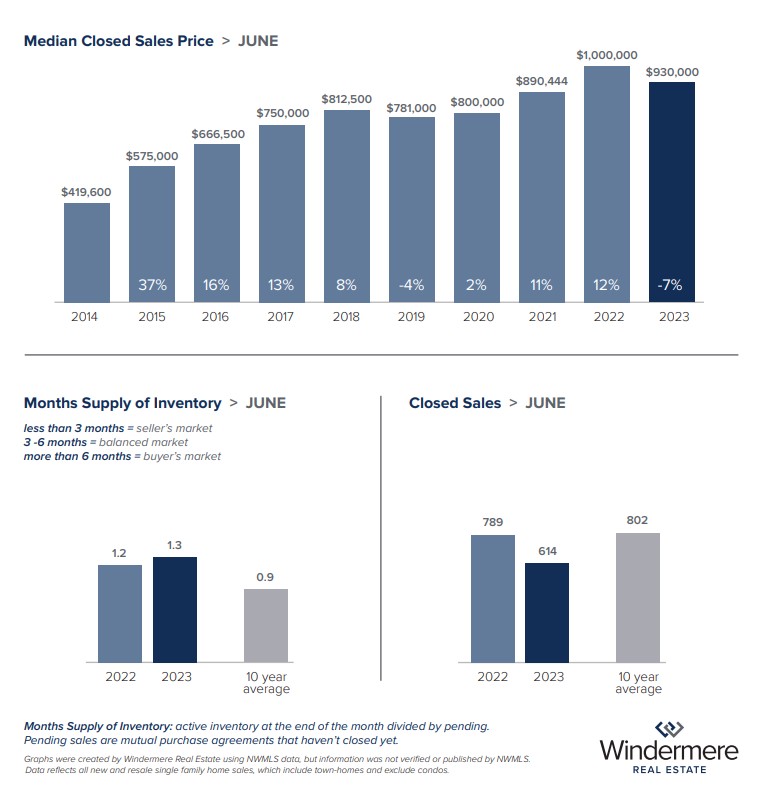

In King County, the median sold price for a single-family home landed at $935,000 in June. This is just a notch below the median price of $938,225 in June 2022. The scarce inventory has caused buyers to compete more aggressively and sellers to list higher, thus leading to comparable peaks as the pandemic market in summer 2022. Likewise, condos were up from $525,000 June 2022 to a median of $529,975 last month.

In Seattle, June’s median sold price for a single-family home was $930,000, down 7% from June 2022. Condo prices in the city were up year-over-year, with a median price of $550,000—an increase from $538,700 last June. This jump could be due in part to rising residential prices pushing some buyers into the more affordable condo market.

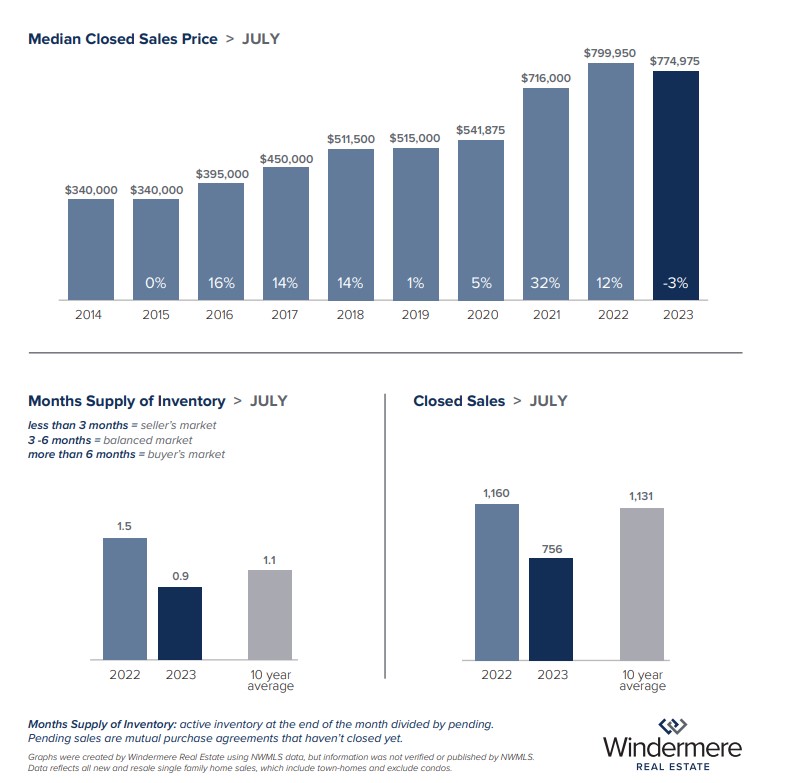

The Eastside, meanwhile, is seeing sales activity slow because of extremely limited supply. The level of new inventory coming onto the market is just 44% of the 10-year average. As a result, median prices have held strong. In June, the median sold price for an Eastside single-family home was $1,450,000, barely off last June’s mark of $1,500,000.

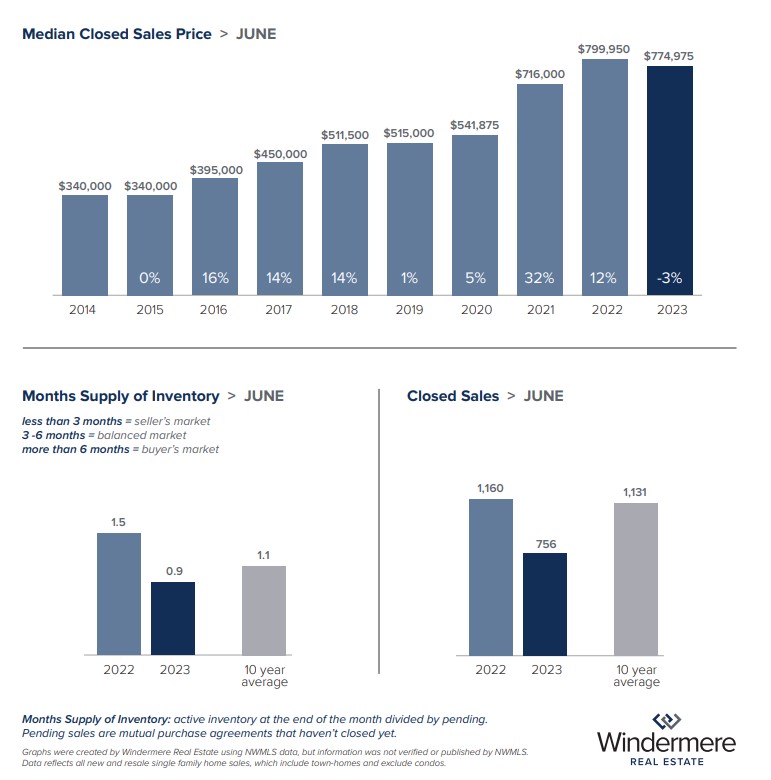

In Snohomish County, the median price for a single-family home last month was $774,975, down from $799,950 in June 2022. Condos actually saw a year-over-year price increase, from $500,000 last June to a median of $506,000 last month. The strength of Snohomish County condo prices is likely tethered to low inventory—there is just over a two week-supply of condo units in the area.

Economist Matthew Gardner notes that “Sale prices in King and Snohomish counties rose for the fifth consecutive month and are only modestly lower than a year ago. It will be interesting to see if this trend can continue given the stubbornly high mortgage rates.”

Despite the high interest rates and scant supply, buyers who are educated on the market and working with a trusted broker should be able to navigate these changing market conditions. For more information on how you can make the most of your real estate endeavors, reach out to your Windermere broker.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link